What are the problems of high government borrowing?

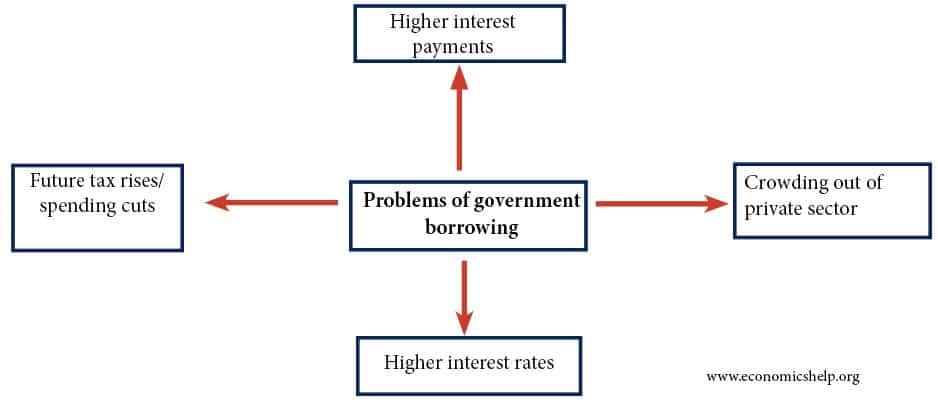

The potential problems of government borrowing include; higher debt interest payments, a need to raise taxes in the future, crowding out of the private sector and – in some cases – inflationary pressures.

Potential problems of high government borrowing

Higher debt interest payments. As borrowing increases, the government have to pay more interest rate payments on those who hold bonds. This can lead to a greater percentage of tax revenue going to debt interest payments.

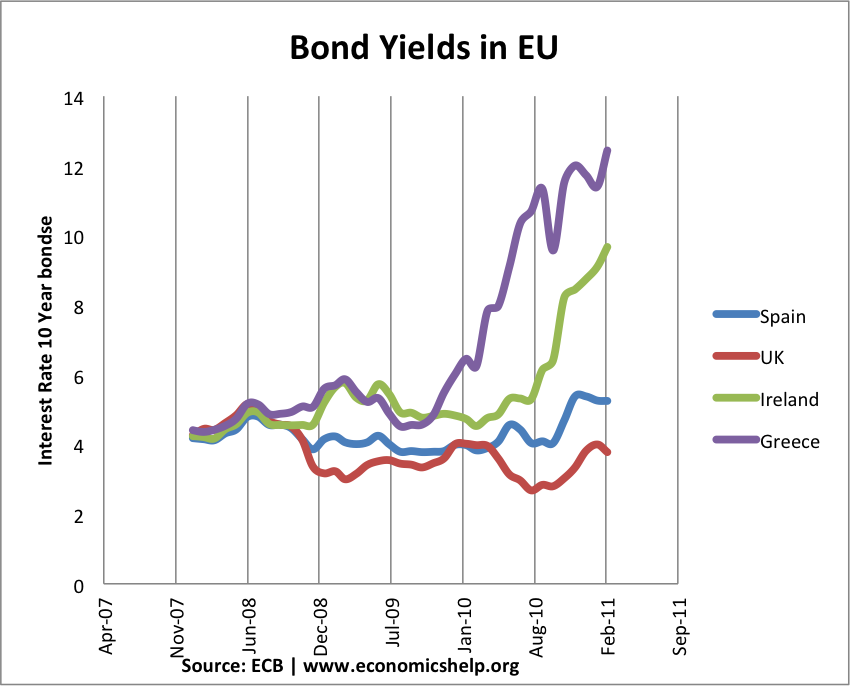

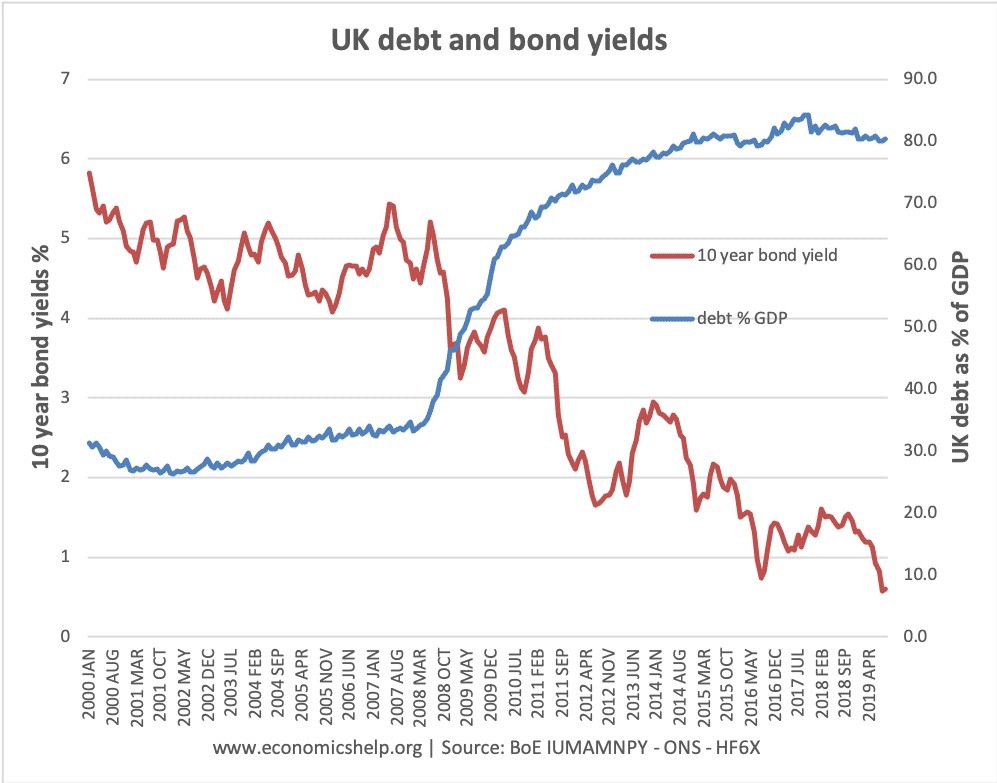

Higher interest rates. In some circumstances, higher borrowing can push up interest rates because markets are nervous about governments ability to repay and they demand higher bond yields in return for perceived risk. This was particularly a problem for countries in the Eurozone because in 2011/12 there was no real lender of last resort. In periods of high inflation, investors will also demand higher bond yields – e.g. in the 1970s, high government borrowing caused an increase in bond yields.

In 2010/11 – countries in the Eurozone with high deficits experienced rapidly rising interest rates because of markets fears over their ability to repay. (see: bond yields on EU debt)

Higher interest rates on government bonds tend to push up other interest rates in the economy and reduce spending and investment. (This impact of higher interest rates in reducing private sector spending is known as financial crowding out)

Crowding out A classical monetarist argument is that high levels of government borrowing cause ‘crowding out’. What they mean is that the government borrow from the private sector by selling bonds. Therefore, because the private sector lends money to the government, they have less money to spend and invest. Therefore, although government spending increases, private sector spending falls. Also, it is possible government spending may be more inefficient than the private sector and so we get a decline in output.

- However, crowding out is unlikely to apply in a recession because in a recession private sector saving is rising and there are surplus savings. If the government borrows, they are making use of surplus savings and so do not ‘crowd out’ the private sector. The government are spending to offset the rise in private sector saving.

Higher taxes in the future. If the debt to GDP rises rapidly, the government may need to reduce debt levels in the future. It means future budgets will need to increase taxes and/or limit spending. The danger is that if taxes are increased too early too quickly, it could snuff out the recovery and cause a further downturn. But, if they don’t raise taxes, markets may be alarmed at the size of borrowing. High government borrowing can cause difficult choices for future chancellors; it is a difficult situation to be in.

Vulnerable to capital flight. If a government finances its deficit by borrowing from abroad, then there is potential for the economy to suffer from capital flight in the future. For example, if investors feared a country like Greece would be forced out of the Euro and devalue, investors would lose out from the devaluation. Therefore, this would encourage foreign investors to sell – causing more pressure on the economy.

Inflationary pressures. It is rare for government borrowing to cause inflation. But, some governments may be tempted to deal with high levels of debt by printing more money. This increase in the money supply can cause inflationary pressures to increase.

Suppose markets fail to buy enough gilts to finance the deficit, the deficit can always be financed through ‘monetisation’. i.e. creating money. This creation of money creates inflation, reduces the value of the exchange rate and makes foreign investors less willing to hold that countries debt.

However, in the period 2010-16 in the UK and US, quantitative easing did not cause inflation because of the falling velocity of circulation (and depressed economy). But, if the economy was close to full capacity, printing money to ‘monetize the debt’ would lead to inflation. In the case of Zimbabwe, high government debt and printing money led to a severe case of hyperinflation.

Evaluation of government borrowing

It depends on the state of the economy. In a recession, Keynes argued borrowing can be beneficial in creating economic stimulus and shortening the recession. A growing deficit when the economy is close to full capacity will be more damaging. For example, see: irresponsible tax cuts

It depends on levels of domestic saving. In 2016, Japan has a national debt over 225% of GDP, but bond yields are low because there is strong domestic demand for buying government borrowing.

It depends on levels of government debt. If bond yields are low and borrowing relatively low, a government can finance debt by a relatively small share of tax revenues. This debt is manageable.

In this case, higher public sector debt in the UK did not lead to higher interest rates – but lower interest rates.

However, if debt increases beyond a certain level and a growing share of GDP needs to go on debt repayments, debt can start to take tax revenue that is needed for public sector investment. Many developing countries suffered from a growing debt burden, which meant they struggled to meet even the debt interest payments

Related

Hello Tejvan,

It is very interesting to read your analyses learnt of the meanings accredited to the circumstances the population of a country bears when times are hard so to say!

Being of an unqualified background my right to freedom of speech still remains therefore with the experiences collected whilst in personal and economical turmoil it has become blatantly obvious to me that the old blame game can easily be attributed to each others policies of whether using borrowed funds to keep a harminious society or should i say community in the countries we live is either appropriate or unappropriate.

Though in reading the teachings which are applied to all students of economics I do feel you do actually have to use the art of sitting on the fence with your opinions whilst relaying the information into ledgable knowledge that every individual can decide which way they believe to be correct the same way we choose our own religious beliefs non-doctrinated.The format you have offered us to access is obviously the one you have been taught therefore the question arises in my head whether certain schools of thought universities in this case ,actually define their currculms along the line of political views and in my cities case would the offering of termination of academic contracts mean that this university is about to change the way it teaches?Sommoning up an example of this thought may be the alighning of views to political parties with say Cambridge for Labour and Oxford for conservative would i be correct in assuming this affilation ot these think tanks are alreadfy in place in the U.K.similar to the lines of thought where certain Universities specialise in subjects?

Regarding unemployment it is also obvious to those who have or are experiencing this process in the majority feel a change is good , though the underlying fear of taking away the options of being able to do limited hours should be retained and maybe an idea i have mentioned of a time bank accrued in the job centre working with agencies/training providers may be a fairer way forward to stop corruption and even idleness.

Most in the unemployed/public sector of the population do not wish to become the scape goats of those fortunate to be able to apply themselves to continous employment and to be fair the secret of this lies in the ability to either serve your country in the forces/public sector for a period that allows you to accumilate a pension fund allowing you to accept lower wages when leaving as in the case of the people who were actually taught the knowledge at a very young age which parents and teachers today must not forget as this encouragement in the younger years allows a person to have a more expansive life experience .

This also gives us in economic terms the reason to justify good pensions as these are the accrued funds aligned with prosperity and depression of funds set aside for slow release at certain stages of a countries population and as you say funds which a country may lend funds from in lean periods at low fix rate bonds.I realise now the prerequisite of the theory of a job for life exists for those who toe the line so to say and do not experience any social variences that require the assistance of the public sector and do not forget this includes the N.H.S.Differentiating experiences in the wealth of the population could be ilminated if we were all non-problematic humans then we would have the answer to a debt free Utopia where no-one got paid and life became sterile.

This could also relate to where the G.D.P Is at lower levels where the population is affodable in terms of revenues coming into the country from natural resources,the breaking up of oversized countries such as the U.S.S.R ,India and maybe in time China the main reason for this action is either the country not having the infrastructure and public sector to service a growing population hence the desire of the minority in wealth control will want to be cost effective as a nation provider.These facts allow a person to choose how they would wish to perceive the management of a countries population should be carried out.

Summing up this information we may assume that economics can be seen to be going through a stage of reform with us as Westerners being infactuated by blaming ourselves through the use of information providers in the form of goverments using facts and figures to prove our inadequacies as unworthy citzens of established nations who have built infrastructure on fairness with morals rather than the failings of the past where we to were ascociated with being the profiteers , polluters and non-social harmony providers we now have to label the reforming nations of our time.

thank you for such a good information.my question is what could be the factors affecting PED?

After reading your article my mind went back to accounting I learned where if profit could be lowered by capital investment then tax was less or even nil. Clearly it was sole trader. Don’t know about large companies.

Is there anyway Government can steer businesses towards investment that will improve productivity, diversification, exports or whatever is needed to increase G.D.P. Trouble is gap between rich and poor is too large. Austerity hits the poor.

Hands up if anyone understood the above clap-trap and also if they think it attempts to find a solution to our current woes. Does it just perpetuate the need for “experts” to sort out these complex issues for us mere mortals? I cite 2008 as an example of their value in a crisis. Now can we replace our heads firmly in the sand?

Hello. I am new here. Can I ask a question? If the government borrows money to increase its(government) spending does it help promote recovery from recession? Hopefully you can answer it. Thanks 🙂

Milton Friedman argued that government should borrow nothing. See the 2nd para of his 2nd section – starting “Under the proposal….” here:

https://miltonfriedman.hoover.org/friedman_images/Collections/2016c21/AEA-AER_06_01_1948.pdf

Warren Mosler (founder of Modern Monetary Theory) argued likewise. See his 2nd last para here.

http://www.huffingtonpost.com/warren-mosler/proposals-for-the-banking_b_432105.html

I’ve examined the various alleged reasons or “lame excuses” for government borrowing, and demolished them here:

https://mpra.ub.uni-muenchen.de/87111/

Thank you all for the educative articles.

I have really enjoyed the article although very complex for my level.

But I would like to ask a question is borrowing good or bad? Explaining the why to both debatably.