Definition of Capital Flight – When a large number of people in a country move capital and assets from one country to another. Usually in response to a political and/or economic crisis.

For example, on news that the banks of Iceland were bankrupt, many investors took their savings out of Iceland and into other countries. This sale of Icelandic assets led to a sharp depreciation in the value of the Icelandic Krona. (Iceland and IMF)

Causes of Capital Flight

- The threat of hyperinflation which could wipe out the value of assets.

- The threat of compulsory nationalisation.

- Fear of rising income and capital gains tax

- Uncertainty and fears over the future of the economy.

- Devaluation of the currency – which makes it more attractive to hold foreign currencies which are holding their value.

- A balance of Payments crisis – a large current account deficit can cause a depreciation in the exchange rate and create a motive for capital flight

- Loss of confidence in the economy.

- Fall in price of an important commodity. If an economy relies on oil exports for export revenue and tax revenue. If oil prices fall, then the economy could suffer and prices fall significantly.

Capital flight can create a bandwagon effect. If influential people start removing their capital, the economic crisis is often exacerbated and so it encourages others to withdraw capital.

Capital flight often involves a certain sector of society. Many of the poorer members do not have the means to withdraw their capital.

Examples of Capital Flight

- French tax on Wealth [1]

- Capital flight can also involve people leaving certain areas of a country. For example, post-apartheid many white businesses left central Johannesburg.

- Russian economic crisis – 2007

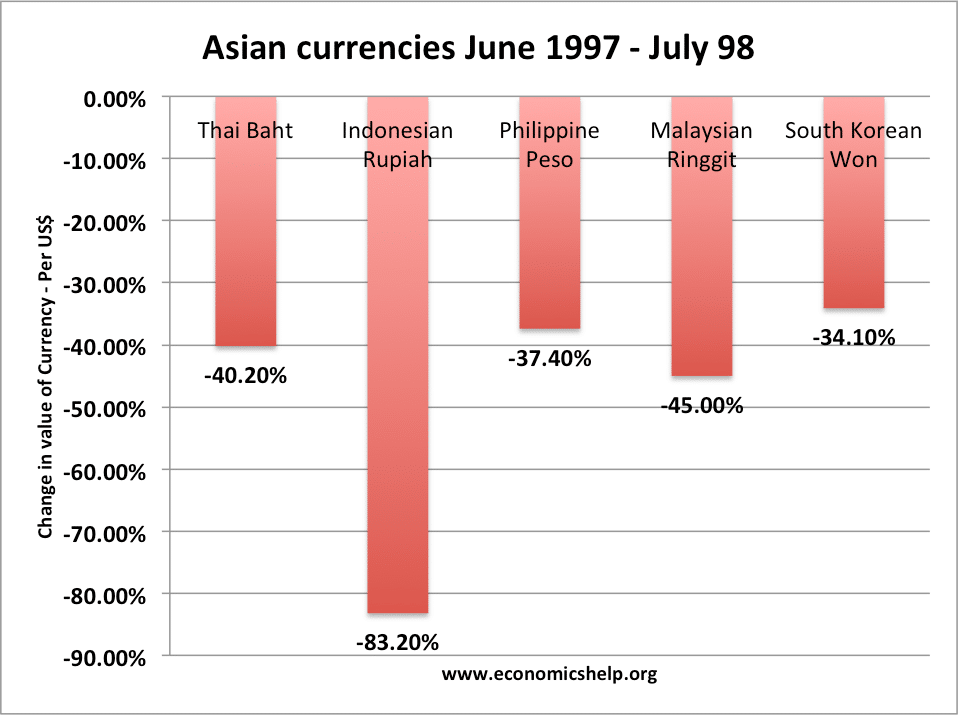

- Asian financial crisis – 1997

- Venezuela economy and oil dependency

Debt Default and Capital Flight

If investors feared that a country might default on its government debt, investors would sell those government bonds. This would cause a fall in the value of government bonds and an increase in interest rates. This would increase the cost for the government to service the debt. It would also cause a devaluation in the exchange rate leading to a decline in competitiveness.

Taxes and Capital Flight

High taxes on wealth and assets may encourage wealthy investors to move their savings abroad to avoid taxes. This kind of capital flight may or may not be legal. For example, in France, the wealth tax has led to an outflow of money to avoid the tax.

Recovery from Capital Flight

Capital flight causes a loss of capital and wealth for a country. However, sometimes, the devaluation in the exchange rate may be necessary to restore the competitiveness of the economy. For example, Iceland’s devaluation helped rebalance the economy. (see: Iceland v Ireland)

Capital Controls and Capital Flight

To stem or prevent capital flight, a government may impose capital controls to limit the amount of money people can take out of a country. However, in a modern global economy, it can be difficult to fully regulate these capital flows.