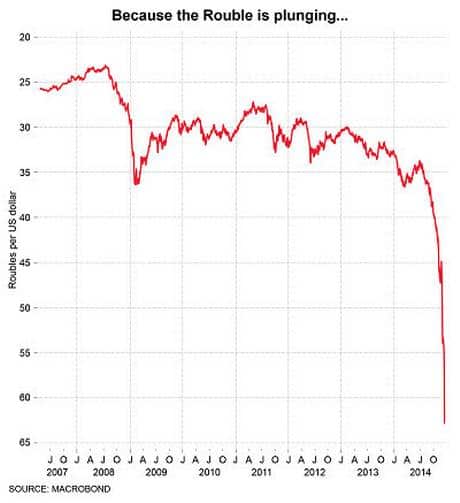

With economic sanctions and a plummeting price of oil, the Russian economy is seeing a real economic crisis. The value of the rouble is falling – causing inflation and a decline in living standards. Government tax revenues are falling as oil tax revenues decline. On top of a falling Rouble, the economy faces recession due to declining export revenues, falling real incomes, a collapse in confidence and higher interest rates.

Causes of Russian economic crisis

Oil dependent economy. The Russian economy has done well in recent years from high oil and gas prices. This has led to strong export revenues and government tax revenues. In 2012, the oil and gas sector accounted for 52% of federal tax funds and 70% of exports But, the near 50% in oil prices have caused the economy to suffer. Unfortunately, the strength of the oil industry has meant alternative manufacturing industries remain undeveloped – and unable to benefit from more competitive export prices. The Russian oil economy is an example of the Dutch disease.

Falling oil prices. The oil price has collapsed from $115 a barrel in June 2014 to just above $60 in Dec 2014. Falling oil prices have caused a big fall in export revenue, a fall in real GDP and a fall in government tax revenues.

Economic sanctions. Sanctions imposed by the EU and US since the issues around the Ukraine have damaged the ability of some Russian firms to raise finance. On their own, the sanctions are quite limited in effect, but combined with the timing, they are a big blow to confidence in the Russian economy.

Recession. Due to the 50% devaluation in the Rouble, the price of imported goods has increased, leading to imported inflation. With inflation running at 9%, consumers are seeing a fall in real wages. Wages, pensions and benefits are not keeping up with rising cost of living. This is causing lower spending. The Central Bank faces a difficult dilemma – because of the recession it needs to cut interest rates, but the falling Rouble has caused it to increase interest rates to 17% – to try and protect the value of the Rouble – but, this will further reduce spending and lower growth. (See: effect of higher interest rates). With the oil and gas sector hit, big firms are likely to lay off workers, due to the fall in demand and revenue. This rise in unemployment will exacerbate the recession. It’s a tough combination of factors, which give the government and Central Bank little room for manoeuvre.

Source: Independent

Falling Rouble. Despite high foreign currency reserves, the Rouble has fallen in value, suggesting investors have lost confidence in the Russian Central Bank, the Russian economy and the Rouble. The problem of the falling confidence in the Rouble, is that it is encouraging capital flight – where Russians seek to protect the value of their wealth by transferring it into other currencies outside Russia. This is a toxic mix – a self-reinforcing cycle of falling Rouble, causing more people to give up on the Rouble.

- Usually a fall in the value of a currency could cause a boost to export demand and help economic growth. But, the economy has become reliant on the oil and gas industries and so the manufacturing export industry is quite weak and unable to benefit

Is the crisis likely to end?

- Russia had a very large $200bn trade surplus for 2014. This surplus is shrinking, but still it is better than the situation might suggest.

- The boom years did allow Russia to build up more than $400bn in foreign reserves.

- Russian manufacturing has received a boost – both from sanctions hitting import spending, and falling Rouble making exports cheaper. It will take time, but the crisis may help rebalance the Russian economy. It may also help the proceeds of economic growth to be distributed more equally. The gas and oil dependent economy lead to the creation of many billionaires. In 2014, 110 individuals owned 35% of Russian financial wealth. One of the highest levels of wealth inequality in the world.

- Do the West really want to see the Russian economy enter free fall? Putin may not be liked, but the uncertainty of any alternative may encourage them to prevent any real crisis which could destabilise the region further.

- The fall in the Rouble suggests it is not so much economic fundamentals as the ‘animal spirits’ of investors. If this negative cycle can be broken, the Rouble could stabilise on the economic fundamentals which have some positive benefits.

- The oil price has collapsed from $115 to $60, but it remains to be seen whether this is a permanent fall; the history of oil prices suggest it is notoriously volatile and could increase again.

Related pages

- Types of economic crisis

- Shock therapy economics

- UK ERM crisis of 1992 – a parallel in the sense that the UK responded to falling value of Pound by pushing up interest rates, but these rates proved unsustainable.