Monetary policy involves influencing and controlling the money supply/interest rates to target inflation and economic growth.

Monetary policy primarily involves changing interest rates, though it can include other tools such as quantitative easing and open market operations.

In recent decades there has been a trend to making Central Banks independent and responsible for setting interest rates (as opposed to interest rates set by the government)

Central Banks were often created out of a desire to help the government finance wars.

Inflation targets of Monetary Policy

The primary target of monetary policy is low inflation. e.g.

- The UK – The target is CPI inflation 2% +/-1 (i.e. between 1% and 3%)

- EU – less than 2% The primary objective of the European Central Bank (ECB) is – price stability – is HCIP inflation of less than 2% (ECB)

- The US – The Fed target inflation of 2%.

- India – 4% (2-6%) In India the government’s latest inflation target for The Reserve Bank of India is 4% – keeping inflation between 2% and 6%)

- Japan – 2%

- China – 3%

- Brazil – 4.5% (+/-1)

- Egypt – 9.0% +/-3%

- (Central Bank inflation targets)

Dual targets

As well as targetting inflation, Central Banks usually also have objectives to maintain economic growth. For example:

- In the UK, the inflation target is combined with – “We also support the Government’s other economic aims for growth and employment. (Bank of England)

- “In the US the Federal Reserve’s target is

- “Maximum employment, stable prices, and moderate long-term interest rates.” (The Fed)

- The EU is known for placing greater emphasis only on the control of inflation. The ECB mandate states

- “The primary objective of the ECB’s monetary policy is to maintain price stability. This is the best contribution monetary policy can make to economic growth and job creation. ” (link)

- India. The objective for the Reserve Bank of India is

- “The primary objective of monetary policy is to maintain price stability while keeping in mind the objective of growth. Price stability is a necessary precondition to sustainable growth.” Reserve Bank of India

- Japan: Monetary policy should be “aimed at achieving price stability [2%], thereby contributing to the sound development of the national economy. (Bank of Japan)

- China. In China, there is an inflation target of 3% but of perhaps greater importance is the target placed on economic growth and the value of the currency (RMB

- The People’s Bank of China states the aim of monetary policy is to “keep the value of the RMB stable and contribute to economic growth. ” [1]

Tools Central Banks use to influence money supply and demand for credit

- Discount rate. A Central Bank typically sets the discount rate – the rate at which commercial banks borrow from the Central bank. If this discount rate is increased, commercial banks will usually pass this rate increase on to their consumers. In the UK, the Bank of England set the repo rate. In the US, it is called the discount rate.

- Open market operations. When a Central Bank buys or sells government bonds to manipuate short-term interest rates and the money supply. If the Central Bank creates money and buys government bonds on the open market, this will increase the money supply and reduce interest rates. If the Central Bank sells government bonds, then it takes liquidity from the market and reduces money supply – thereby increasing interest rates.

- Reserve requirements. The % of funds a bank must hold against liabilities. If the reserve ratio rose from 1% to 2%, the bank would have to keep more cash and reduce lending.

Interest rates

Why do interest rates have such a big impact on the economy?

Higher interest rates –

- Increase the cost of borrowing – making investment more expensive

- Increases the return from saving money in banks – encouraging saving rather than consumption

- Increase debt interest payments – leaving firms and households less disposable income

- Increase mortgage interest payments – leaving households less disposable income and makes buying house less attractive.

- Cause hot money flows. Higher interest rates in the UK, lead to more demand for saving money in the UK – thereby causing higher demand for sterling, appreciation in sterling and making exports less competitive.

Creation of Central Banks around the world

- 1668 Sveriges Riksbank – Sweden. The world’s first Central Bank.

- 1694 Bank of England – in response to King William III’s shortage of funds in financing the nine years war with France. The Bank gained the right to print money in return for lending the government money.

- 1800 Banque de France – Created by Napoleon to help finance his wars.

- 1913 United States created the Federal Reserve through the passing of The Federal Reserve Act. The US had two previous Central Banks Second Bank of the United States (1816–1836) and the First Bank of the US (1791-1811)

Central Bank Independence

- 1957 – The Deutsche Bundesbank was established and given independence in setting monetary policy. The ‘Bundesbank model’ was admired for the low rates of inflation and impressive rates of economic growth in post-war Germany. The basic model of the Bundesbank has been incorporated into the European Central Bank (ECB)

- 1989 – New Zealand

- 1997 – Bank of England given independence to set interest rates with an inflation target of 2% +/-1

- 1998 – European Central Bank (ECB) independent from date of creation.

Is the US Federal Reserve independent?

- The US Federal Reserve is part of the US government but has an operational independence. Its objectives from Congress are maximizing employment, stabilizing prices, and moderating long-term interest rates. Its decisions do not have to be approved by the President, so it has operational independence to set interest rates. However, presidents can appoint sympathetic economists and also put political pressure on the Fed.

- During the 1950s and the ongoing Korean War, President Truman pressed the Fed chair William McChesney Martin to keep interest rates low – despite the inflationary effects of the war. Martin refused Truman, creating bad blood between the two. Truman is said to have called Martin a traitor for keeping interest rates high.

- In the 1960s, Lyndon Johnson was more successful in brow beating the Fed to keep interest rates low. Johnson leaked a false story that Martin was getting a 50% pay rise. The resulting bad publicity dissuaded Martin from raising rates. Richard Nixon also tried to put pressure on the Fed to keep interest rates low.

- In the 1970s, the cost-push inflation of the decade led to the rise of new monetarist policies. With Monetarists like Milton Friedman arguing Central Banks should make control of inflation their primary goal. In 1979, Fed chair Volcler raised interest rates from 11.2% in 1979 to 20% in June 1981. It brought inflation under control, but at the cost of the 1980-82 recession.

- In the 1990s and 2000s, Fed Chair Alan Greenspan was seen as the ‘maestro’ attaining the dual-mandate of low inflation and economic growth. Presidents sought approval of Greenspan rather than trying to influence him. However, the financial crisis of 2006-09 led to a revaluation of Greenspan’s legacy.

- In 2019, President Trump is nominating political advisor and partisan economist Stephen Moore to a vacancy in the Fed. CNBC

Does Central Bank independence help reduce inflation?

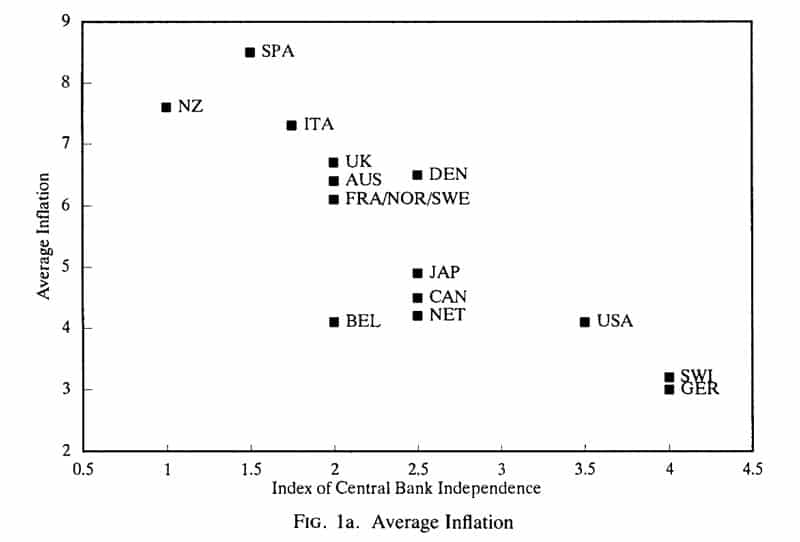

A paper by Alesina, A and Summers, (1993) on Central Bank Independence and comparative inflation performance, suggested there is a link between Central Bank independence and lower inflation.

Criticism of Central Bank Independence

However, Joseph Stiglitz has criticised Central Bank Independence arguing that in the financial crisis, Central Banks felt a greater responsibility to bailing out the finance sector and the banks they were supposed to be regulating than the wider economy. He argues less independent Central Banks did a better job.

“Countries with less independent central banks-China, India, and Brazil-did far, far better than countries with more independent central banks, Europe and the United States.” (Stiglitz, 2013)

Lender of last resort

- An important function of a Central Bank was the concept that it should act as ‘lender of last resort’ to maintain liquidity in the banking system.

- In 1825, a financial crisis left Britain close to financial collapse. In the aftermath, it was decided that a new convention should allow the Bank of England to intervene and lend to banks in distress.

- In the 1930s, the US lacked any real lender of last resort, and thousands of medium-sized banks went bankrupt causing widespread financial panic and loss

- In 2007, during the credit crisis, the Bank of England offered emergency liquidity to struggling banks like Northern Rock to avoid their collapse

Related pages

External links