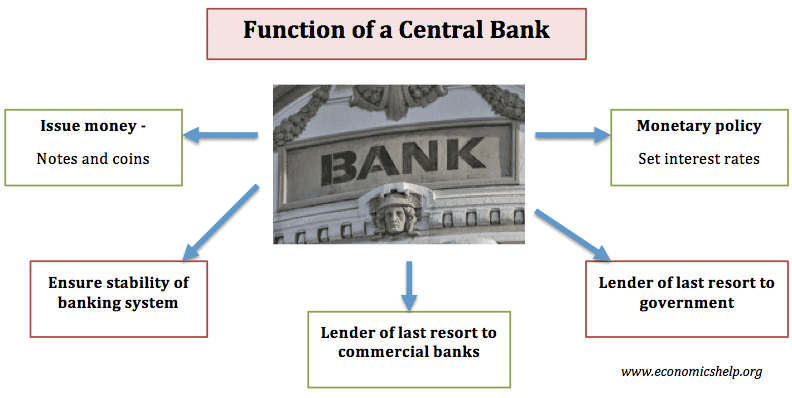

A Central Bank is an integral part of the financial and economic system. They are usually owned by the government and given certain functions to fulfil. These include printing money, operating monetary policy, the lender of last resort and ensuring the stability of financial system. Examples of Central Banks include

- Federal Reserve – US

- Bank of England – UK

- European Central Bank (ECB) – EU

- Reserve Bank of India

Functions of Central Bank

- Issue money. The Central Bank will have responsibility for issuing notes and coins and ensure people have faith in notes which are printed, e.g. protect against forgery. Printing money is also an important responsibility because printing too much can cause inflation.

- Lender of Last Resort to Commercial banks. If banks get into liquidity shortages then the Central Bank is able to lend the commercial bank sufficient funds to avoid the bank running short. This is a very important function as it helps maintain confidence in the banking system. If a bank ran out of money, people would lose confidence and want to withdraw their money from the bank. Having a lender of last resort means that we don’t expect a liquidity crisis with our banks, therefore people have high confidence in keeping our savings in banks. For example, the US Federal Reserve was created in 1907 after a bank panic was averted by intervention from J.P.Morgan; this led to the creation of a Central Bank who would have this function.

- Lender of Last Resort to Government. Government borrowing is financed by selling bonds on the open market. There may be some months where the government fails to sell sufficient bonds and so has a shortfall. This would cause panic amongst bond investors and they would be more likely to sell their government bonds and demand higher interest rates. However, if the Bank of England intervene and buy some government bonds then they can avoid these ‘liquidity shortages’. This gives bond investors more confidence and helps the government to borrow at lower interest rates. A problem in the Eurozone in 2011, is that the ECB was not willing to act as lender of last resort – causing higher bond yields.

- Target low inflation. Many governments give the Central Bank a target for inflation, e.g. the Bank of England has an inflation target of 2% +/- 1. See: Bank of England inflation target. Low inflation helps to create greater economic stability and preserves the value of money and savings.

- Target growth and unemployment. As well as low inflation a Central Bank will consider other macroeconomic objectives such as economic growth and unemployment. For example, in a period of temporary cost-push inflation, the Central Bank may accept a higher rate of inflation because it doesn’t want to push the economy into a recession.

- Operate monetary policy/interest rates. The Central Bank set interest rates to target low inflation and maintain economic growth. Every month the MPC will meet and evaluate whether inflationary pressures in the economy justify a rate increase. To make a judgement on inflationary pressures they will examine every aspect of the economic situation and look at a variety of economic statistics to get a picture of the whole economy. See: how the Bank of England set interest rates.

- Unconventional monetary policy. The Central Bank may also need to use other monetary instruments to achieve macroeconomic targets. For example, in a liquidity trap, lower interest rates may be insufficient to boost spending and economic growth. In this situation, the Central Bank may resort to more unconventional monetary policies such as quantitative easing. This involves creating money and using this money to buy bonds; the aim of quantitative easing is to reduce interest rates and boost bank lending

- Ensure stability of the financial system. For example, regulate bank lending and financial derivatives.

Central Bank Independence

In some countries government’s take responsibility for Monetary policy. However, recently there has been a trend towards giving Central Banks independence for setting interest rates and controlling monetary policy. For example, the Bank of England was made independent in 1997.

However, the government often retains some control over monetary policy. For example, the UK government still set the inflation target CPI = 2% +/-1.

Related

- What does the Bank of England do? (Bank of England)

- ECB v Bank of England

1 thought on “What is the function of a Central Bank?”

Comments are closed.