Readers Question: What are the similarities and differences between the Bank of England and the ECB? Thank you

- They are both responsible for controlling inflation. However, this year, the Bank of England have shown much greater flexibility and willingness to consider other objectives such as full employment and preventing recession. The ECB has been much more rigid in targeting low inflation.

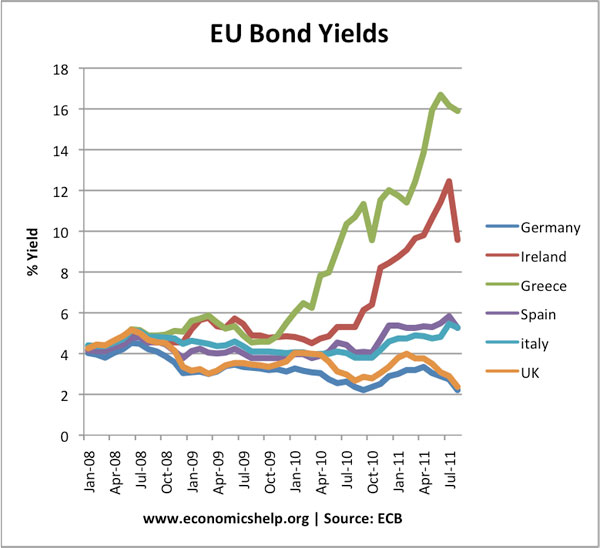

- The Bank of England is also willing to pursue quantitative easing and increase the money supply where necessary. The ECB has promised to avoid creating money and not to get involved in buying government bonds (in any significant quantity).

Inflation Target of ECB and Bank Of England

Both have an inflation target as the primary objective.

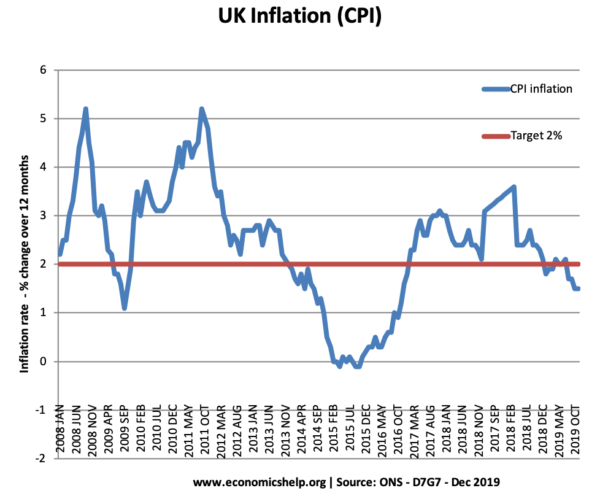

- The Bank of England have a target of inflation of CPI = 2% + / – 1

- The ECB have an inflation target of below, but close to, 2%. Therefore, the ECB is less tolerant of inflation going above the inflation target. Evidence suggests the ECB is less willing to cut interest rates than say the Fed or MPC of Bank of England. Some have criticised the ECB of having an anti-inflationary bias at the expense of unemployment.

- A further difficulty for the ECB is that they have to consider the inflation rate for the whole Eurozone. There could be simultaneously inflationary pressures in Germany, but deflation in southern Europe.

Other Objectives of ECB and Bank of England

The Bank of England has a target of low inflation, but, they are also asked to consider wider macroeconomic implications

Low inflation is not an end in itself. It is however an important factor in helping to encourage long-term stability in the economy. Price stability is a precondition for achieving a wider economic goal of sustainable growth and employment. High inflation can be damaging to the functioning of the economy. Low inflation can help to foster sustainable long-term economic growth.

From: Monetary Policy at Bank of England

Also, we have:

The Bank’s monetary policy objective is to deliver price stability – low inflation – and, subject to that, to support the Government’s economic objectives including those for growth and employment.

By Contrast, the ECB targets just inflation

“The primary objective of the ECB’s monetary policy is to maintain price stability. The ECB aims at inflation rates of below, but close to, 2% over the medium term.”

From: ECB Monetary Policy

The ECB is, of course, responsible for 11 countries in the Eurozone, whereas the Bank of England is responsible for just the UK economy.

Bank of England Response in 2011.

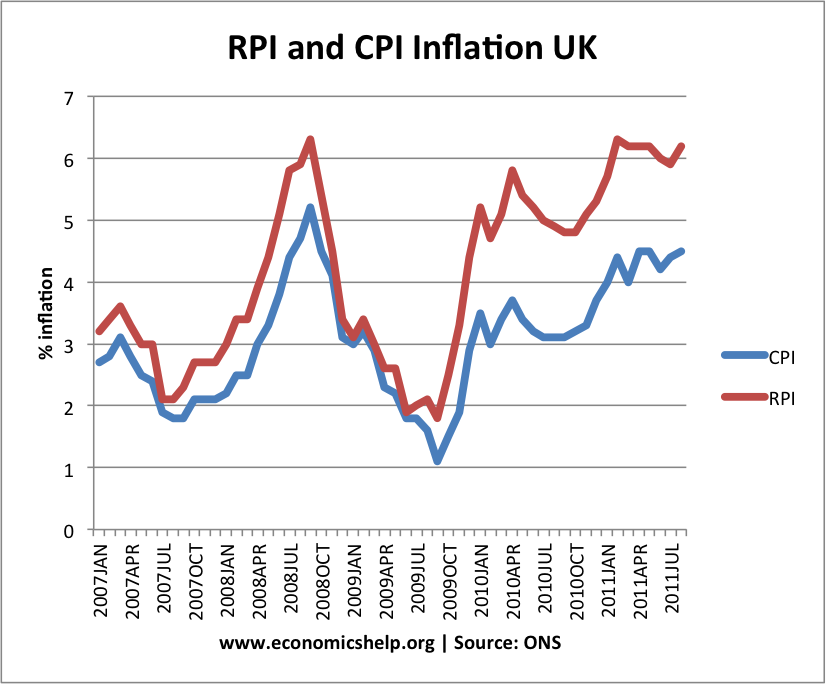

In 2011, UK CPI inflation reached 5.2% – way above the government’s inflation target. However, the Bank of England didn’t increase interest rates. They argued that inflation was due to temporary cost-push factors.

Source: ONS

- Impact of devaluation

- Rising taxes

- Rising commodity prices.

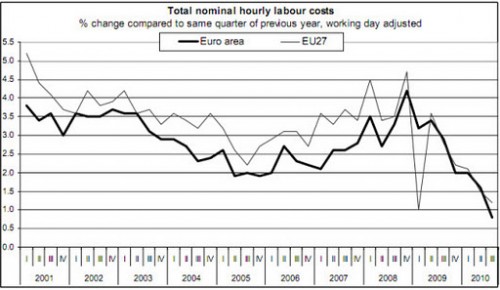

The Bank of England argued that underlying inflation was low (e.g. wage inflation was low).

The Bank of England were more concerned about the prospect of a double dip recession and so contemplated another round of quantitative easing.

ECB Response in 2011

In 2011, EU inflation increased just above the inflation target. The ECB also felt that it was caused by cost push inflation. However, the ECB increased interest rates because they were concerned about these inflationary pressures becoming permanent and influencing future inflation expectations. This was despite the fall in wage growth and lack of underlying inflationary pressures.

source: Krugman, NYT

source: Krugman, NYT

Lender of Last Resort

More on Lender of Last Resort

- Should Low inflation be the primary objective of Monetary policy?

- Inflation targeting pros and cons

- UK Monetary Policy

- An evaluation of MPC in controlling inflation

Pls explain to me, how the Bank of England can electronically create ” gilt ” currency to prop up the UK economy, and print more pounds, whereas,the European conglomerate are struggling to balance their National Budgets ?

2. Explain to me, how the USA, since 1775, can similarly create dollars with total impunity, to pay for their Wars, and their massive debts, and continue to pursue this course without having to account for their spendthrift ways & credit cards interminably ?

3. Explain to me, how the ” Reserve currency ” can corner the World’s Financial sector, without any assets or Gold bullion and not have to balance their budgets, and the Fed’s can with Congressional approval, and the US Constitution( 14 Amendment ) print greenbacks, whereas the rest of the World struggle to make ends meet ?

4. Explain to me, how the World’s Economist can continue to teach this subject in Universities, and perpetuate the myths.

5. There are much more ” facts ” which go unanswered, but I will await your illustrious response to my queries ?

Fantastic post, the argument of the ECB v Bank of England is a great case study, it is so relevant in so many aspects of the problems in so many areas. Though it is important to note as to why the ECB comes to conclusion, could be fair to say that it does not factor in the ‘real’ UK environment