Core Inflation. This is a measure of inflation which excludes certain volatile and seasonal prices.

It will be based on the Consumer price index but exclude prices such as

- Petrol (subject to oil price variations)

- Food (subject to seasonal variations)

Core inflation will also exclude the impact of government excise duties.

Core inflation is seen as an important guide to long term inflation trends. however, if fuel price increases last for a while they can affect core inflation by raising price expectations.

However, core inflation can be misleading for consumers, who will mistrust figures which exclude many prices they have to pay for.

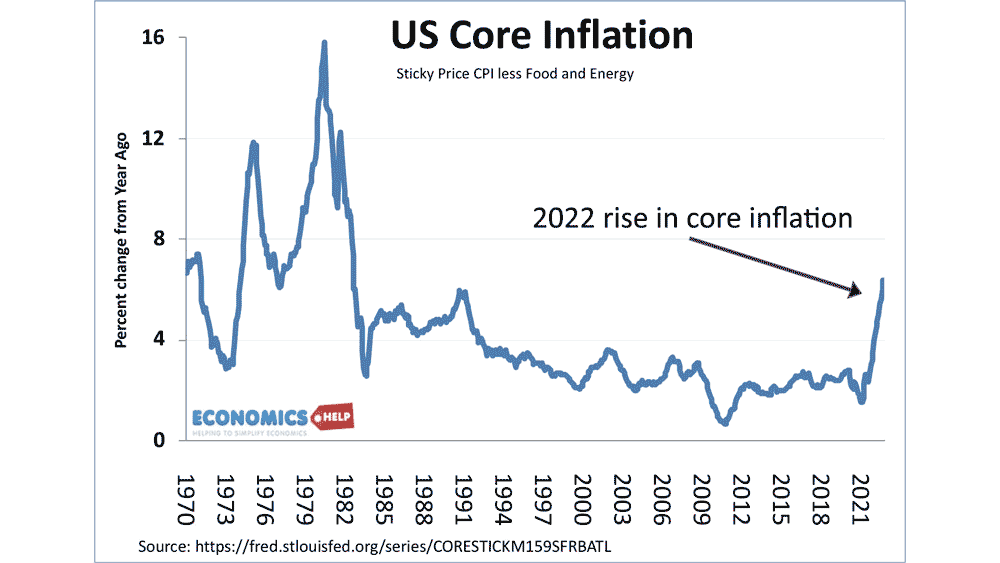

US Core Inflation

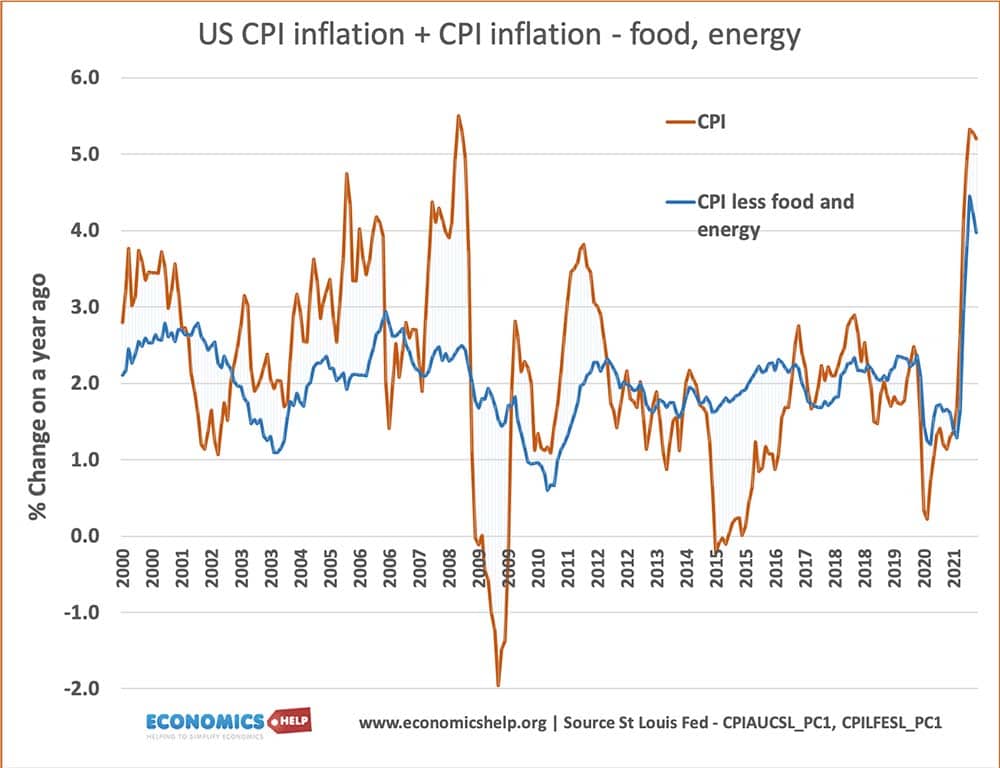

In the US, there is a measure of inflation CPI less energy and food prices. These are prices which tend to be quite volatile.

For example, in 2008, headline CPI inflation rose to 5%. But the measure which excludes food and energy remained unaffected at just over 2%.

This graph shows core inflation in the Eurozone compared to the ‘headline’ HICP (Harmonised consumer price index)

Example Core EU Inflation

Source: Eurostat

Useful addition for: ECB v Bank of England post

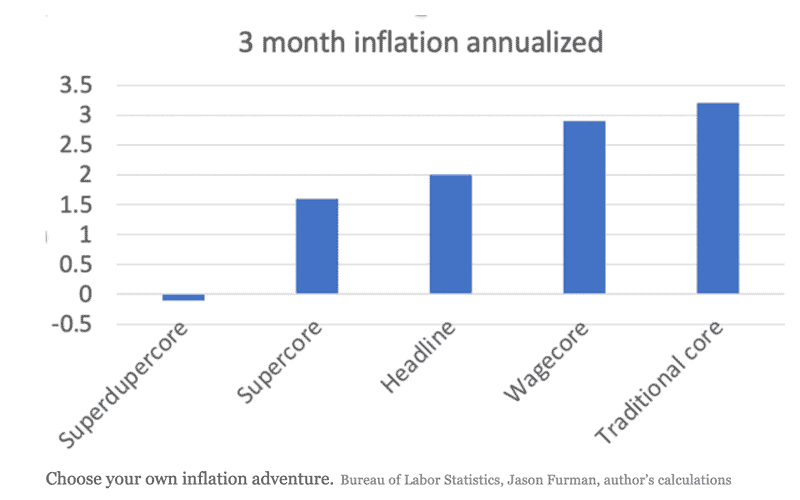

Different types of Core Inflation

Jan 2023.

Covid made measuring core inflation more difficult because covid supply chain problems caused a surge in the price of some hardware goods like furniture and used cars. It led to a variety of core inflation measures, as mentioned above. But, this dilutes the usefulness of core inflation, when it’s possible to pick and choose measures.

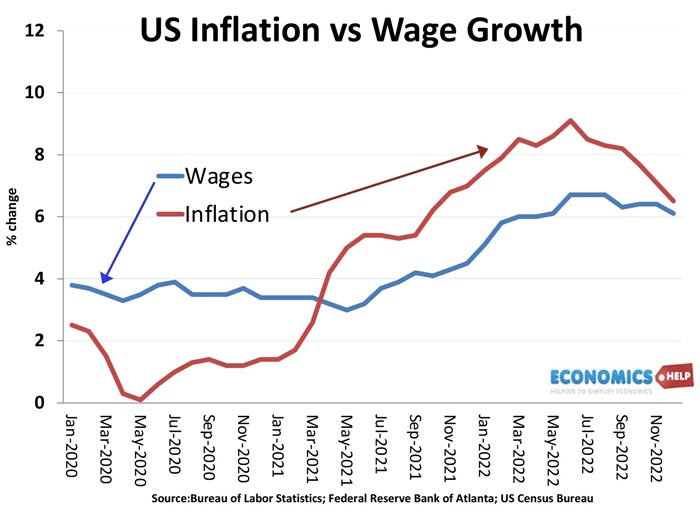

Wage inflation usually remains a fairly good yardstick for underlying inflationary pressures.

Related