Readers Question: What credit can the adoption of central bank independence take for the relative stability of the UK business cycle since 1997?

The MPC, Bank of England, are responsible for setting interest rates and determining UK monetary policy. They seek to keep inflation close to the government’s target of CPI 2% +/-1 %

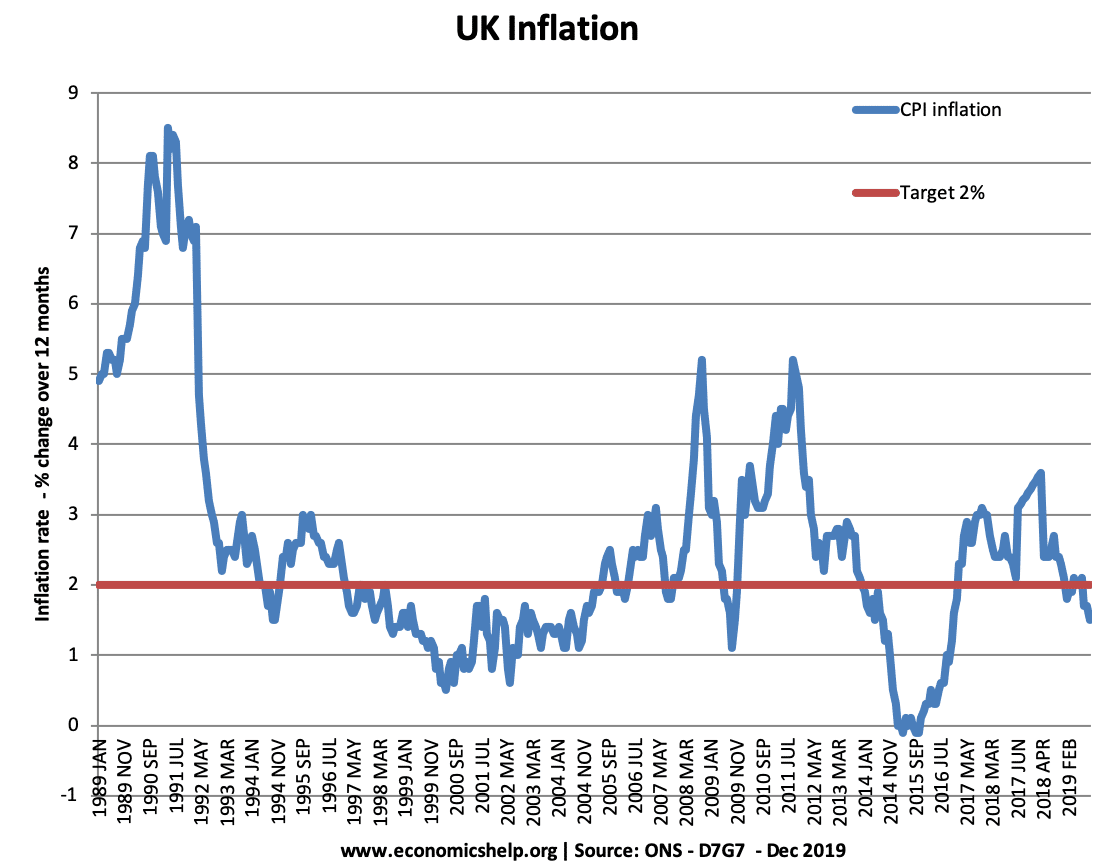

Between 1997 and 2007, the UK enjoyed a period of unbroken economic growth and low inflation. It appears that the UK has been able to avoid the ‘boom and bust‘ economic cycles that characterised the boost way period – most notably the Lawson boom of the late 80s and following recession.

The statistics on inflation and economic growth were impressive, especially when put in historical context. It is a good question to ask how much we can credit the independence of the Bank of England?

Why the MPC has helped keep inflation on target

1. They are independent. They are not subject to political pressures. E.g. they are not tempted to cut interest rates just before an election. This used to be a problem for UK economy, with many experiences of boom and bust economic cycles.

2. Monetary Policy is pre-emptive. They try to prevent inflation before it occurs. They predict future inflation trends. If inflation looks to be increasing above the target of 2%+/-1 then they can increase interest rates to reduce consumer spending and keep inflation on track.

3. MPC have reduced inflation expectations. Because the Bank is independent and has developed a good track record, people have confidence that inflation will remain low. Therefore wage demands are lower and it becomes easier to keep inflation low.

4. By targeting inflation directly they get the best overall picture of the economy rather than focusing on small aspects like the money supply.

5. Since 1997 UK inflation has remained close to the government’s target of 2%. This is much lower than UK inflation in the 1980s which reached 10%

Limitations of the MPC’s Effectiveness

1. Inflation is low but this has partly been due to global pressures keeping inflation low. E.g. globalisation, low prices of raw materials (up to 2006) and better technology. If these factors were to increase it would be much more difficult for the MPC to keep inflation low.

2. Economic Stability had occurred before 1997. After the recession of 1991, the UK embarked on a period of low inflation and stable growth. The MPC had the good fortune to take over Monetary policy when economic circumstances were more favourable.

3. Future Stagflation? It remains to be seen how the MPC will cope with rising cost push inflation and falling growth. Some are criticising the MPC for giving too much importance to controlling inflation and ignoring the dangers of an economic downturn.

4. Some might criticise the MPC for not doing more to prevent a housing boom which has created an unbalanced economy.

Conclusion

The MPC have done a good job so far. It helps that they are independent of political pressures. But, their job has been made easier by the relatively benign economic conditions of recent years. As global economic conditions deteriorate it may be more difficult to achieve low inflation and stable growth.

Why is the Government’s Inflation Target 2%?

Why is the Bank of England Inflation target 2%? Why not 0% or 5%? Central Banks around the world have tended to converge on this figure of 2% as being the ideal inflation rate. This is because

Inflation has various costs

- Uncertainty. When inflation is high firms are more reluctant to invest because they are uncertain about future prices. Low inflation creates more stability and confidence to invest.

- Less Competitive. If UK inflation is higher than elsewhere, then our exports become less competitive leading to lower exports and depreciation in exchange rate.

- Menu costs. This is the costs involved in changing price lists.

- Boom and Bust Cycles. High inflation accompanies unsustainable economic growth; this invariably leads to a boom followed by bust. e.g Lawson Boom was followed by recession of 1991. Low inflation enables stable growth.

Deflation also has various costs

- When prices are falling consumers delay purchasing goods because they will be cheaper in the future. This delay in spending can cause a fall in aggregate demand.

- Real interest rates become too high. Interest rates can’t fall below 0%. therefore if prices are falling, real interest rates may be too high and this will cause a further fall in AD.

- Real Wages may be too high. Workers are very resistant to nominal wage cuts. So if prices are falling, real wages will be rising and this could cause real wage unemployment

Inflation is harmful; but deflation is also very harmful This is why governments do not aim for inflation of 0%. Governments tend to aim for an inflation rate of 2%; this enables prices and wages to adjust without causing the uncertainty of higher inflation rates.

Low inflation is also closely linked to the goal of stable economic growth.

Related

Related Essays

8 thoughts on “To what extent is Bank of England responsible for low inflation?”

Comments are closed.