The optimal inflation rate is often considered to be around 2%. For example:

- The UK target inflation of 2% +/-1

- The ECB target inflation of less than 2%

- US Federal Reserve target inflation of less than 2% (But from 2020 are likely to make inflation target symmetrical like the UK)

Why Central Banks wish to keep inflation at 2%

A higher inflation rate has various costs to the economy

- High inflation can create uncertainty and confusion for firms. With rising prices and raw material costs, it becomes less attractive to invest and this can lead to lower growth in the long-term.

- When inflation is above 2%, inflation expectations will rise and it will be harder to reduce inflation in the future. Keeping inflation less than 2% will keep long-term expectations low.

- Inflation of over 2% may indicate the economy is over-heating and this can lead to a boom and bust type of economic cycle.

- If inflation is higher than your competitors, then it will make the economies exports less competitive and will lead to depreciation in the exchange rate.

- Menu costs of changing prices.

Why do we target inflation of 2% rather than 0%?

Inflation of 0% is close to deflation, and deflation imposes a different type of cost on the economy. Therefore inflation of 2% has certain benefits:

- It allows prices and wages to adjust

- It avoids the risk of deflation. Deflation is potentially damaging because

- Increases the real value of debt.

- It can discourage spending because consumers expect prices to keep falling

- It can make monetary policy ineffective as you can’t have negative interest rates.

The case for a higher inflation rate target

The optimal inflation rate is a subjective concept. Some economists believe there are occasions when Central Banks may need to allow higher inflation (e.g. up to 4%).

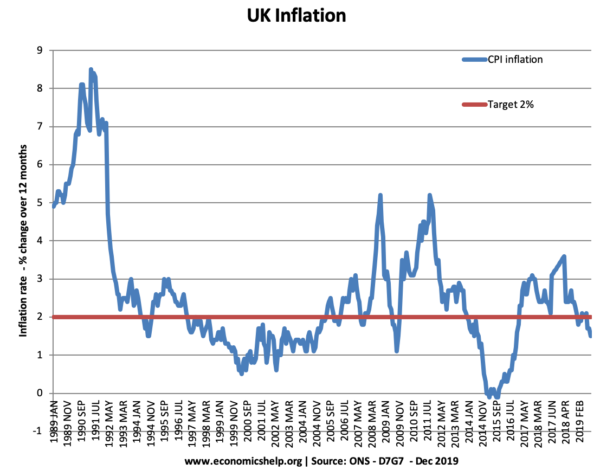

graph source: ONS

Reasons higher inflation (3 or 4%) may be necessary

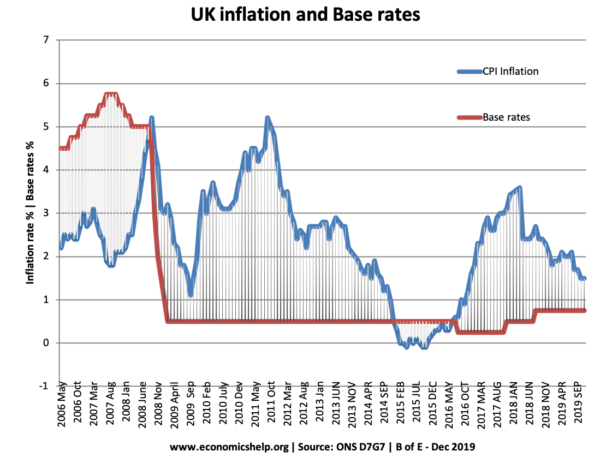

- Inflation can spike due to temporary cost-push factors. Inflation is influenced by volatile commodities like oil. Just before the 2009 recession, the UK had inflation of 5% – which discouraged the Central Banks from cutting interest rates. But, this inflation is temporary and not evidence of excess demand in the economy. In other words, monetary policy needs to distinguish between temporary rises in inflation and a permanent rise in excess demand.

- Higher inflation rate gives more room for manoeuvre. Some economists argue that a target of 2% gives monetary policy too little room for manoeuvre. E.g. during the slow economic recovery from the 2009 recession – inflation fell below the 2% target, but cuts in interest rates were ineffective in boosting demand. If we had a higher inflation target of 3 or 4%, we could have had more expansionary monetray policy – leaving central banks more room for manoeuvre and therefore less need to rely on large budget deficits. See: Interview with Oliver Blanchard from the IMF

- Cost of unemployment. Inflexible targeting inflation of 2% could lead to a trade-off of lower economic growth and higher unemployment. Higher unemployment has a higher welfare cost than moderate inflation. High unemployment leads to poverty, wasted resources and higher government borrowing.

This shows that UK inflation was above target – despite interest rates of 0.5% – because economic recovery was very weak. If the UK had been inflexible about inflation, interest rates would have been increased in a period of economic stagnation.

- Low inflation expectations make monetary policy ineffective. Prolonged periods of low inflation anchor inflation expectations at a very low level (for example, Japan 90s and 00s, Europe in 10s). This leads to a prolonged period of low nominal interest rates. But, given the state of spare capacity, estimates of the desirable real interest rate are as low as -4%. But, Central Banks do not go for negative interest rates. Therefore nominal interest rates o.5% are too high causing slow recovery. Guido Tabellini of the ECB forum on Central Banking states

“First, recent estimates suggest that the natural real rate of interest in the US economy was below -4% in the last three recessions” ECB

- Prolonged low interest rates distort borrowing/saving. Low nominal interest rates can cause distortions in the market because it makes borrowing very cheap and saving unattractive. A higher inflation rate would enable interest rates to rise above rock-bottom levels and to a more ‘normal’ interest rates. There is a danger with interest rates close to 0%, ‘zombie firms’ are able to keep borrowing to stay afloat.

- Changed circumstances. When the US Federal Reserve set an inflation target of less than 2% in the 2000s, nominal interest rates were 6%. Now nominal interest rates are 1.75% – despite low unemployment. Interest rates in Europe are even lower – suggesting a prolonged liquidity trap. With these changed circumstances, the FED sees the desirability of avoiding this low inflation, low-interest rate scenario. (US Federal Reserve considers letting inflation run above target)

- Are the costs of inflation overestimated? Larry Ball quotes Paul Krugman arguing that the costs of moderate inflation are often overestimated.

“one of the dirty little secrets of economic analysis is that even though inflation is universally regarded as a terrible scourge, efforts to measure its costs come up with embarrassingly small numbers”. Krugman (1997)

- Larry Ball (2013) makes the case for an inflation target of 4%. His main reasons are

- 4% target would ease constraints on monetary policy during a liquidity trap and make economic downturns less severe.

- The cost of 4% inflation is quite minimal, e.g. 4% inflation does not discourage investment, a bigger discouragement to investment is low growth.

Related

Interesting and informative article. I would like to add few point related to the topic. I write about CPI and RPI, A biggest jump in Consumer Price Index (CPI) measure of inflation had risen to 2.9%, up from an annual rate of 1.9% in November and on the other hand Retail Price Index (RPI), which includes housing costs, rose to 2.4%, its highest level since November 2008. On result, Increase in the supply of money. In future A possibility of increase in interest rate. I think accurate forecast require to stable economy.

Guess it’s a double edge thing. We need more jobs and low inflation is possibly better for economic growth.