A recession is a fall in real GDP/ negative economic growth. To avoid a recession, the government and monetary authorities need to try and increase aggregate demand (consumer spending, investment, exports). There is no guarantee that they will work. It will depend on the policies and also the causes of the recession.

The primary policies will be

- Loosening of monetary policy – cutting interest rates to reduce cost of borrowing and encourage investment

- Expansionary fiscal policy – increased government spending financed by borrowing will enable an injection of investment into circular flow

- Ensure financial stability – in a credit crunch, government intervention to guarantee bank deposits and major financial institutions can maintain credibility in the banking system.

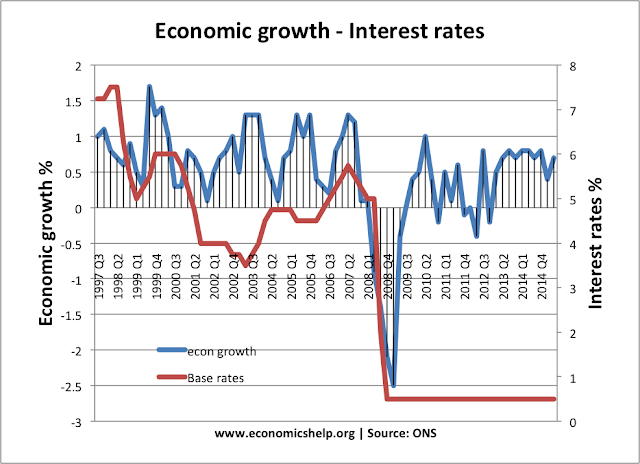

If the recession is caused by very high-interest rates, then cutting interest rates may help avoid a recession. But, if you have a large fall in asset prices/bank losses (often called balance sheet recession) it is more difficult because even if you cut interest rates, banks may still not lend.

Policies to avoid a Recession

1. Expansionary monetary policy – cutting interest rates. Cutting interest rates should help to boost aggregate demand. Amongst other things, lower interest rates reduce mortgage interest payments, giving consumers more disposable income. Lower interest rates also encourage firms and consumers to spend rather than save. (effect of lower interest rates)

As well as cutting base rates, the monetary authorities could try and reduce other interest rates in the economy. e.g. the Central Bank could buy government bonds or mortgage securities. Buying these bonds causes lower interest rates and helps to boost spending in the economy.

However, lower interest rates don’t always work. In 2008- 09, interest rates were cut to 0.5% in the UK, yet it didn’t avoid a recession. This was because:

- Banks didn’t pass the base rate cut onto consumers

- Although interest rates were low, banks were reluctant to lend and consumers reluctant to spend.

- This is known as a liquidity trap

2. Quantitative easing If interest rates are already zero, then the Central Bank may have to pursue unconventional monetary policies. Quantitative easing involves the Central Bank electronically creating money and using this money to buy long-dated securities. This increases bank reserves and should help encourage bank lending. Also, it reduces interest rates on bonds which should help encourage spending and investment. See: Quantitative Easing Explained

3. Helicopter money. Helicopter money is a policy to increase the money supply and give money directly to consumers. This is effective in a period of deflation – where consumers are reluctant to spend and banks are reluctant to lend money. See: Helicopter money

4. Expansionary fiscal policy

Expansionary fiscal policy involves increasing government spending and/or cutting taxes. This injection into the circular flow is financed by government borrowing. If the government cut income tax or VAT, it increases disposable income and therefore increases spending.

If effective expansionary fiscal and monetary policy will increase AD and lead to increase in real GDP.

- There is no guarantee tax cuts will boost spending if confidence is very low. Some economists are concerned higher government borrowing will cause crowding out – where private sector lend to the government and then spend less themselves. However, Keynes argued in recession, there are surplus savings, so there will be no crowding out and fiscal policy will be effective in boost demand and preventing a recession. Can tax cuts avoid a recession?

- Expansionary fiscal policy is less practical for countries in the Euro, who have less flexibility over borrowing levels in the Eurozone.

5. Ensure financial stability. In the credit crunch of 2008, there was a danger that savers would lose confidence in bank deposits. Customers were queuing up to withdraw savings. If people lose confidence in the banking system, it could cause bank closures, rapid fall in confidence and decline in money supply (like the US in 1932). Therefore, Central Bank/government act as lender of last resort – guaranteeing savings. Home repossessions can cause bank losses and fall in consumer spending.

The government may try to freeze mortgage rates to preventing house repossession or give subsidies to homeowners facing repossession.

6. Devaluation. A devaluation in the exchange rate can cause a boost in aggregate demand. A fall in the value of the dollar makes exports cheaper and imports more expensive increasing domestic demand. (see: effects of devaluation)

In the great depression, when the UK left the Gold Standard in 1932, the Pound devalued and this helped the UK economy recover more quickly than other countries.

However, in a global recession, demand for exports may be quite inelastic. Also, in a global recession, countries may begin competitive devaluation. This is when several countries try to gain a competitive advantage by devaluing currency against others, but it proves self-defeating.

7. Higher Inflation Target. This is a conscious decision to target growth rather than inflation. The argument is that if the economy gets stuck in a period of low inflation, this causes lower economic growth. Targetting higher inflation rate helps to break out of a deflationary spiral. See: Optimal inflation target

8. A government bailout of major firms. In 2009, the Obama administration agreed to bail out the US car industry as it was undergoing financial difficulties. The argument was that if car industry closed down, it would exacerbate the recession, cause more unemployment and a big negative multiplier effect. The bailout saved jobs and minimised the economic downturn.

Evaluation

In practice, it is very difficult for a government/Central bank to always avoid recessions. If the global economic climate is very dim, then monetary and fiscal policy may not be enough. Also, the policies have significant time lags. However, the right combination of fiscal and monetary policy can at least minimise the downturn and speed up the economic recovery. Depending on the economic circumstances other policies may be appropriate too, such as

- Devaluation

- Targetting higher inflation rate

- Financial stability

Related

- A look at policies to avoid recession the UK could try implement.

these are some great points!

How can you give tax cuts but increase government spending? I dont get that.

Increased government borrowing – selling bonds to private sector

TAX CUTS SHOULD BE IBCREASED

People aren’t spending because they’ve seen their dollars lose almost 30% of it’s value by old methodologies of inflation calculation, and wages are stagnant. Printing money and extending credit aren’t going to do much good here. Even lowering taxes won’t be enough relief to get people spending. To restore confidence, we need a currency that doesn’t constantly bleed it’s value, and time to allow people to save. We’re seeing the fate of all fiat currencies unfold before us. Sensible policies will come back when the currency collapses. Pity we don’t allow alternative currencies now, so that the transition will have a framework in place.

the govt to reduce much borrowing and fully employ its resources to cater for deficit budgets