An inflation target means the Central Bank has the objective to use monetary policy in order to keep inflation close to an agreed level (e.g. 2%)

If inflation is forecast to rise above the target, they are likely to increase interest rates to moderate demand and slow down inflationary pressures.

If the Central Bank is only given an inflation target, they should ignore other variables, such as economic growth and unemployment. However, in practice, most Central Banks are given a dual-target – a target for inflation, but also consideration for economic growth.

An inflation target means they will not target inflation indirectly. e.g. fixing currency or targeting money supply. But, look at prospects for inflation and change interest rates accordingly.

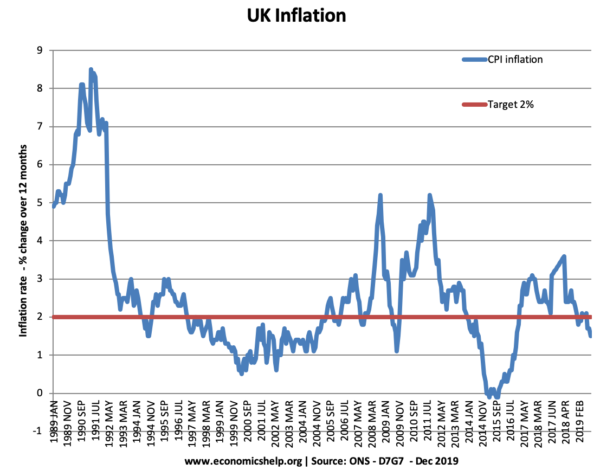

Inflation Target in the UK

Since 1997, the UK has been a good example of inflation targeting.

The government set the inflation target of CPI 2% +/-1. This means the bank is committed to keeping inflation within the range of 1-3%.

Monetary policy is operated by the Monetary Policy Committee (MPC) which is part of an independent Bank of England. This means the government cannot interfere in Monetary policy decisions.

The MPC use interest rates to try and achieve this goal. In exceptional circumstances, they may also use unorthodox monetary policies such as quantitative easing.

It is hoped that having an inflation target will reduce inflation expectations and therefore make it easier to maintain low inflation.

The Bank’s monetary policy objective is to deliver price stability – low inflation – and, subject to that, to support the Government’s economic objectives including those for growth and employment.

Bank of England Monetary policy framework

How Monetary Policy Works

If inflation is above the government’s target, the MPC will probably decide to increase interest rates. Higher interest rates increase the cost of borrowing and reduce consumer spending and investment. This should lead to slower growth in AD and lower inflation.

If inflation was below target and the rate of economic growth very low, the MPC would be likely to cut interest rates to try and stimulate AD.

Inflation Target in the US

In the US, the policy is slightly different because the Federal Reserve has two objectives. One is to target low inflation, the other is to maintain full employment. At the moment the Fed is cutting interest rates to try and avoid recession, they are not too worried if inflation increases.

ECB Inflation target

The ECB’s main target is low inflation and price stability – unlike the Bank of England and Federal Reserve

“The primary objective of the ECB’s monetary policy is to maintain price stability. The ECB aims at inflation rates of below, but close to, 2% over the medium term.”

From: ECB Monetary Policy

Which target is more important inflation or economic growth?

This is an interesting question. The ECB emphasises low inflation. The logic for this is

- Low inflation is important for the long term success of the economy. Low inflation encourages investment and stable growth in the long term. If the authorities allow inflation to get out of control, it will only require a more painful readjustment in the future.

- Keeping inflation low may lead to low economic growth in the short term, but, the economy should recover and the negative growth temporary.

- Being strict about inflation will help reduce inflation expectations and make it easier to reduce inflation.

It could be a mistake to only target inflation

- Other economists argue in a recession it may be better to relax inflation target and focus on economic growth. A recession has very high costs in terms of unemployment and closed businesses.

- If inflation is caused by cost-push factors (rising oil and energy prices) the monetary authorities are more likely to agree to higher inflation. This is because with cost-push inflation, we are faced with a worse trade-off (aggregate supply shifts to the left). Also, cost-push inflation is more likely to be temporary.

- However, if the inflation is caused by demand-pull factors, if economic growth is too fast, then the MPC may be more willing to raise rates and prevent the economy overheating. For example, in the Lawson boom, the economy grew rapidly allowing inflation to reach double figures. This boom then caused a bust.

Related