Readers Question: How does the MPC predict future inflation?

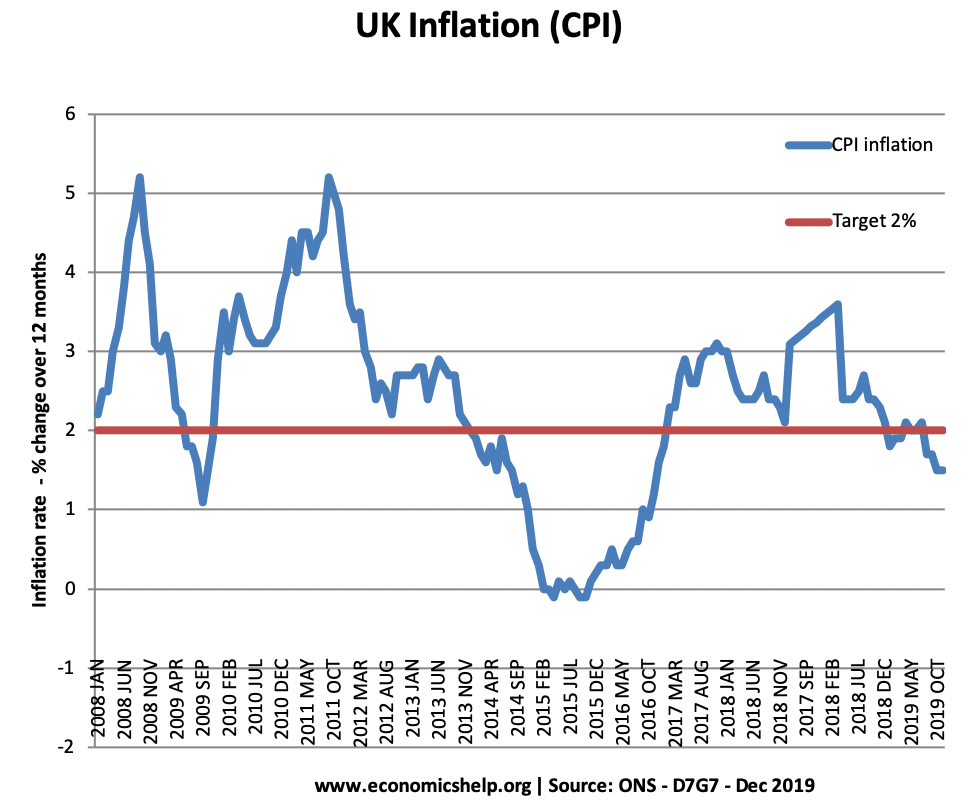

Inflation is caused by a mixture of demand-pull and cost-push factors. Therefore, the MPC will look at many statistics which give an indication of whether the economy is reaching full employment and causing inflationary pressures. This will include rate of economic growth, unemployment and the amount of spare capacity (output gap) in the economy. Inflation could also come from supply-side factors such as rising oil prices and rising wages.

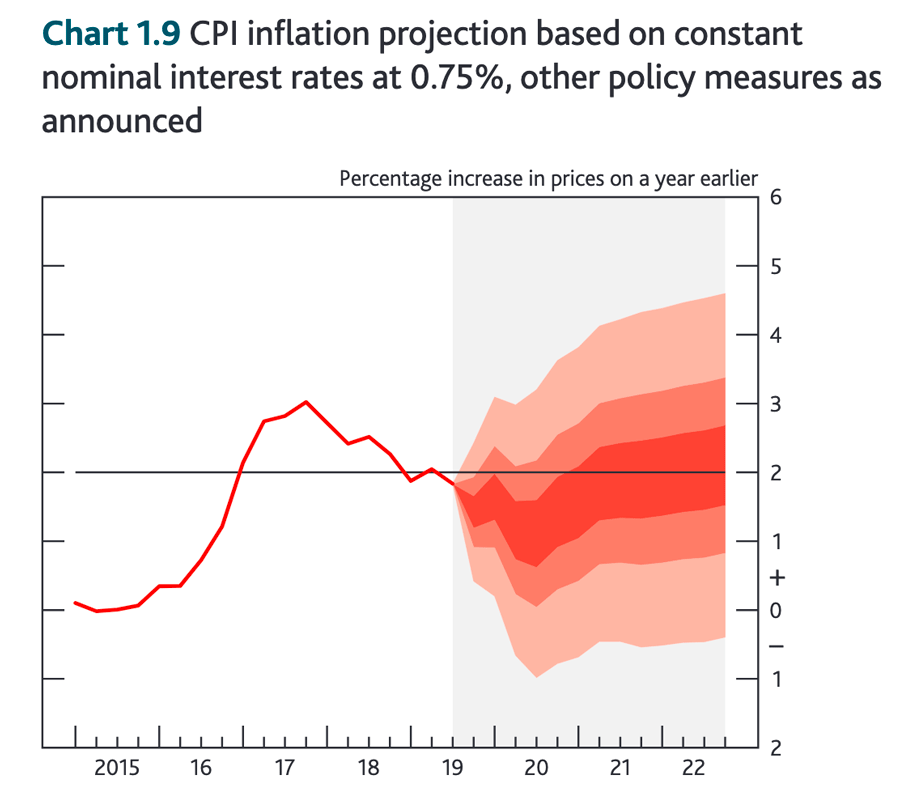

This shows inflation forecasts for the next three years. The dark red shows most likely inflation rate, The lighter red shows the range of possible inflation forecasts. This shows that forecasting inflation is far from an exact science. There are many factors affecting inflation and many of these are uncertain. For example, an unexpected shock could cause inflationary pressures to rise (e.g. higher oil prices)

Factors that help to predict inflation

Full employment

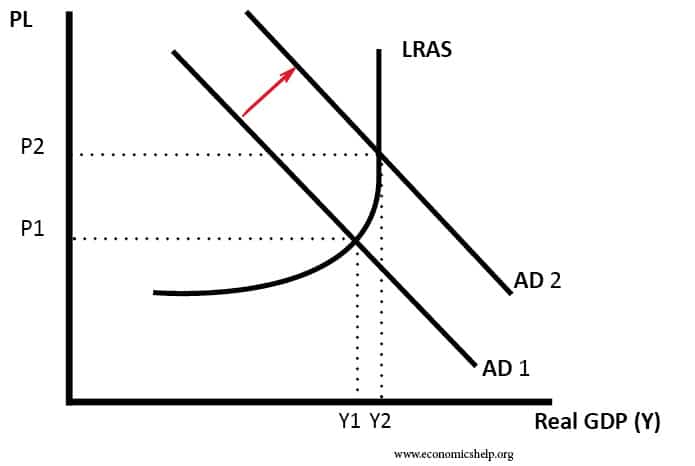

A key factor in predicting inflation is the amount of spare capacity and the rate of economic growth.

Suppose an economy, such as the UK, has a long-run trend rate of 2.5%. This means growth of 2.5% or less is unlikely to cause inflation. If however, growth is above – e.g. 3 -4 % then the economy will quickly approach full capacity and therefore inflation is likely to occur.

Inflationary pressure from rising AD. For example, in the late 1980s, the UK had growth of 4% a year, but this caused rising inflation.

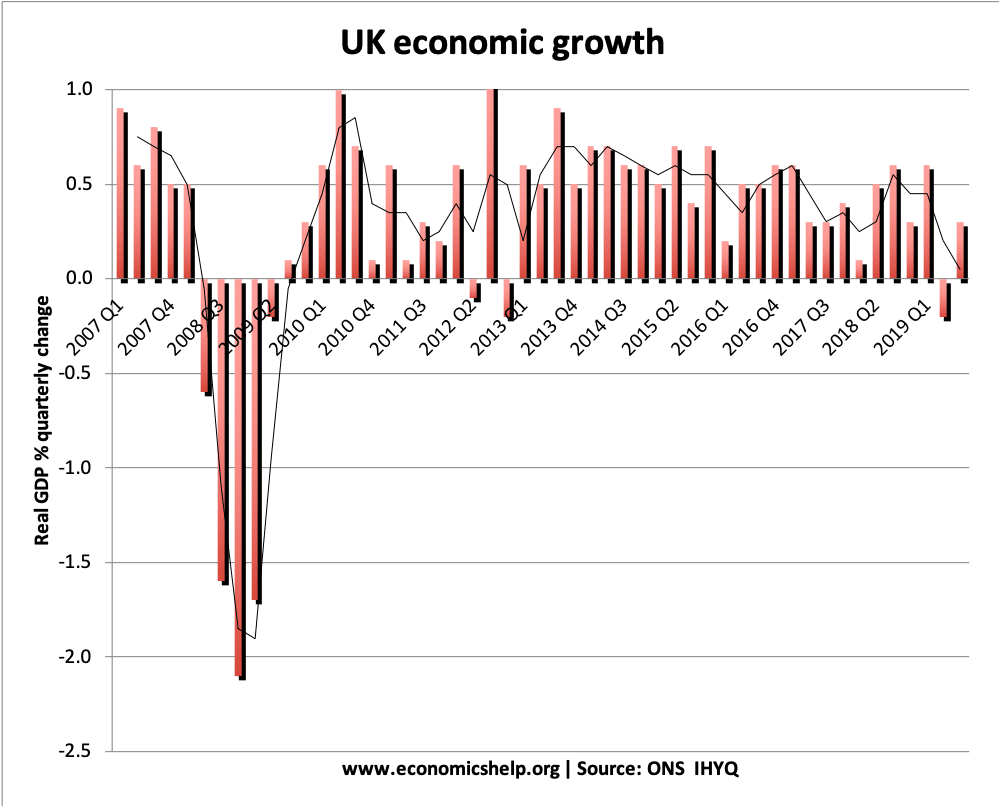

UK Economic Growth

The long-run trend rate of economic growth in the UK is roughly 2.5%. If growth is below 2.5% (or the equivalent of 0.6% a quarter) then demand-pull inflation will be very low. This shows that in the past four quarters, the UK is currently experiencing below-trend rate of growth causing low inflationary pressures.

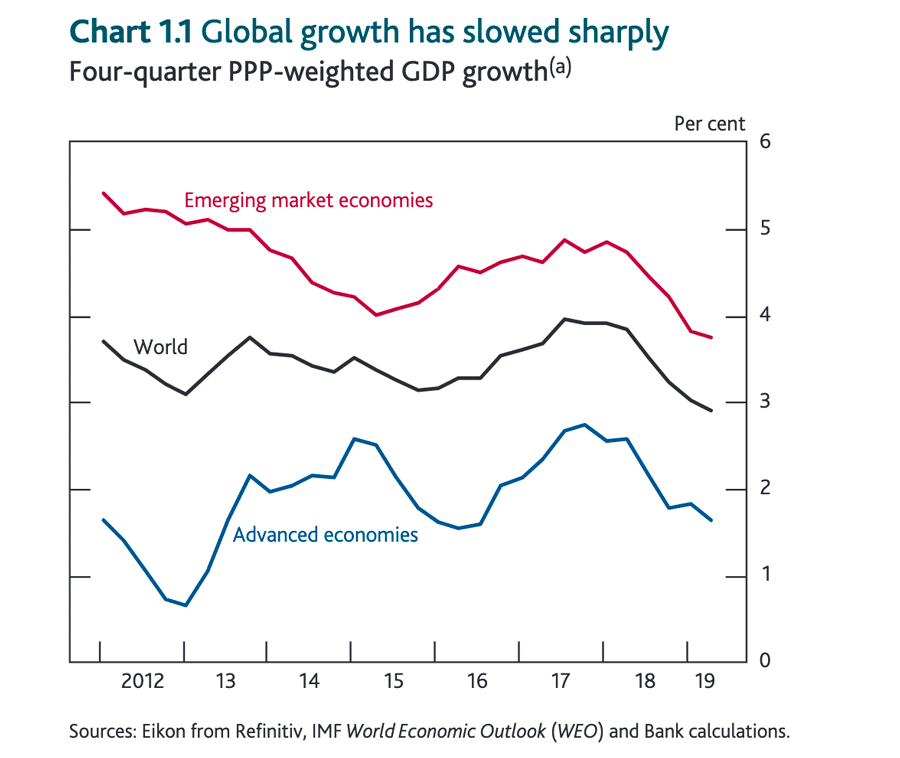

Global growth

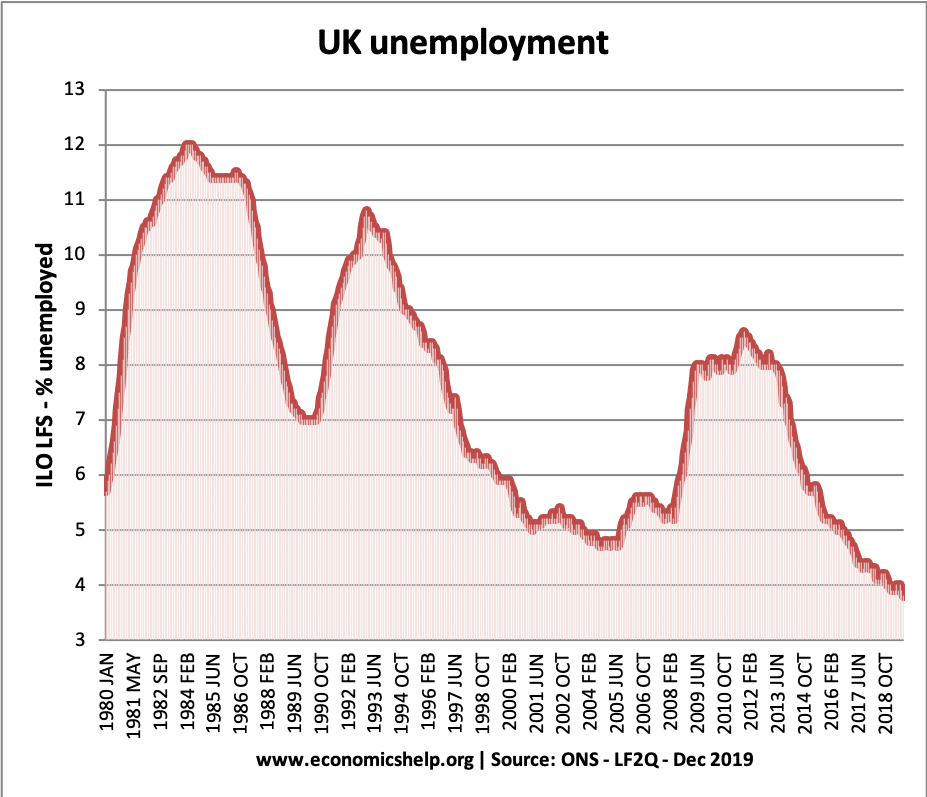

Unemployment and Inflation Predictions

Some economists believe there is a trade-off between unemployment and inflation. If unemployment falls it could be a sign that inflationary pressures will increase.

House Prices and Future Inflation

It is often assumed that house price inflation will cause actual inflation. There is a good economic reason for this. If house prices are rising it creates a wealth effect. Rising wealth encourages consumer spending (equity withdrawal and higher confidence) this spending can then cause inflation. However, it doesn’t necessarily cause inflation. In the early 2000s, the UK had house price inflation of over 20%, but it didn’t cause actual inflation. There are many factors that affect inflation, not just house prices.

Money Supply and Inflation

The quantity theory of money states that increased money supply will lead to inflation. This is because of the relationship between money supply and inflation, shown in the equation MV=PT where V and T are independent of the Money Supply. However, in practise empirical evidence has shown that increased money supply doesn’t necessarily cause inflation, as there are other factors determining money supply and inflation.

Hysteresis – What Happened in the Past?

Sometimes the best way to predict inflation is to look at what happened in the past

It is argued that if you want the best prediction for inflation, ignore all the economist’s predictions and just state what happened last year. Of course, inflation does change from year to year, but it shows the difficulty of predicting inflation that it is often best to just use last years data.

However, there is an important point here and that is the role of expectations. If inflation is low, people will expect low inflation in the next year, workers will not demand big pay rises, firms will not try to increase prices. Therefore, low inflation becomes easier to maintain. If inflation is high then people will be expecting inflation in the next year. Therefore, it becomes difficult to remove inflation from the system (without pain like a recession)

Supply-Side Shocks and Inflation

When predicting inflation you can never take into account unexpected supply-side shocks. For example, a rapid increase in oil price inflation would cause a significant rise in inflation, as they did in the 1970s and 2008. In 2020, recent events such as fears over the virus have caused a substantial fall in oil prices and commodities, which will make economists revise down their inflation forecasts.

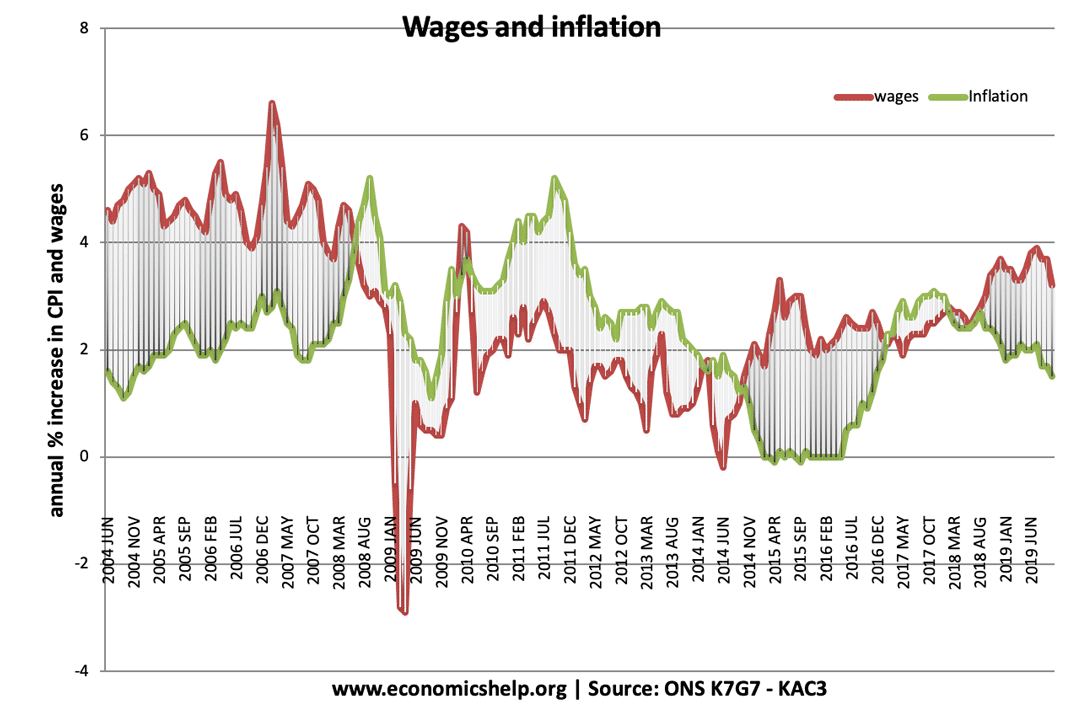

Wage growth

Other factors the MPC may look includ

- Exchange rate. A rapid devaluation in the exchange rate is likely to cause inflation from higher imported inflation. however, to complicate matters, this kind of inflation is likely to be temporary. The spikes in inflation in 2008 and 2011 were cost-push inflation.

- Balance of Payments – A deterioration in the current account may indicate an unbalanced economy and inflationary pressures leading to higher demand for imports.

- Consumer Confidence

- Level of Investment and business confidence

- Amount of spare capacity surveys.

- Input prices – prices of raw commodities.

Difficulties of predicting inflation

Long-term economic forecasting can be very difficult. A well known joke by John Kenneth Galbraith is:

“The only function of economic forecasting is to make astrology look respectable.”

Some difficulties include

- Data can change in importance. Falling unemployment used to be a good guide to predicting inflation, but recently the labour market has changed – with low wage growth despite falling employment

- Unexpected shocks in the global economy.

- Global economies are too complex to include all factors in models.

- Track record of predicting inflation is not particularly good. Forecasters tend to go for conservative predictions and miss the big swings.

- Hard to know impact of monetary policy. If interest rates rise, will consumers respond by cutting spending.

Related

1 thought on “How do economists try to predict inflation?”

Comments are closed.