To what extent does an increase in profit lead to an increase in economic welfare?

In summary. Higher profit enables firms to invest in more research and development, leading to better products in the long-term. Higher profit also acts as a signal to other entrepreneurs to increase investment in that industry. However, others are concerned higher profitability reflect monopoly power and an unfair transfer of income from consumers to shareholders.

Benefits of Profit

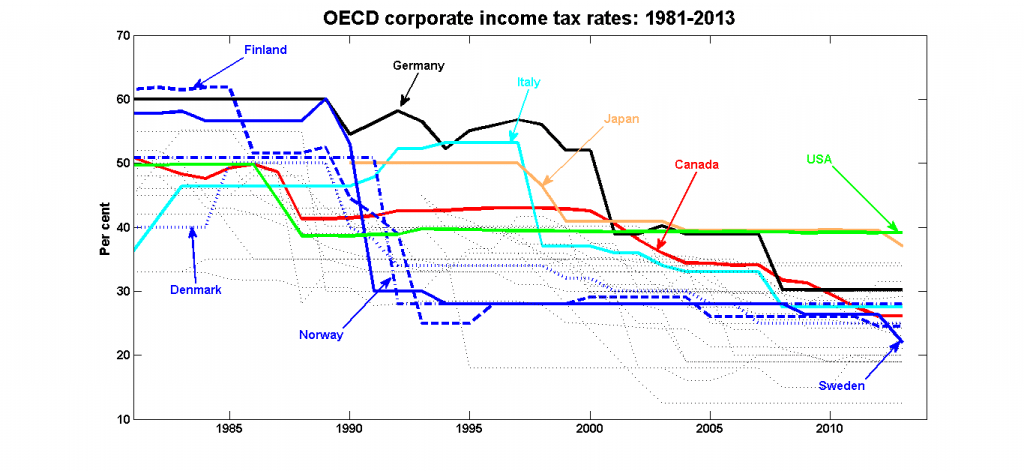

1. Increased tax revenues. Higher company profit will lead to a rise in corporation tax revenues. This enables the government to spend more on public services, such as health care, education and welfare payments. Therefore, indirectly, the general taxpayer benefits from a rise in company profit.

- However, corporation tax rates have been falling in recent years. In the UK corporation tax rates have fallen to 19%. So only one-fifth of company profit is shared with the general taxpayer.

- Also, large multinationals have become adept at avoiding corporation tax through channelling profit through countries with the lowest tax regime. For example, Google, Microsoft and Apple have set up in Ireland to gain from low tax rates. Amazon has a high turnover in many EU countries, but it has used registration in Luxembourg to reduce tax rates.

2. Research and development Higher company profit enables firms to invest more in research and development. This can lead to better products in the long-term, which benefit consumers. This investment in improvements enables greater dynamic efficiency. It is important for industries which require significant investment and research. For example, when record companies make a profit, they can afford to invest in scouting new music groups and artists. Drug companies claim they need to make a high profit to enable the development of new drugs.

- However, it is debatable what percentage of profit is reinvested in research and development. If companies make more profit, they may just use it to pay higher salaries to managers and higher dividends to shareholders. In this respect, firms are not providing a social benefit but redistributing income from the rich to the poor.

3. Higher dividends for shareholders. Higher profit is good news for shareholders who will gain more dividends. Indirectly workers with private pensions will see some benefit. As pension funds will own shares in profitable companies.

- However, it is a very indirect benefit and those who benefit the most will be those who are wealthy.

4. Incentive effects. Profit is an important incentive to encourage people to invest, innovate and take risks. A rise in profitability will encourage more entrepreneurs to take risks and invest. This can lead to increased economic opportunities, new employment and higher growth.

5. Signal effect. Profit helps signal where rising demand is. Industries which are very profitable should attract new firms to enter the market and increase their investment. For example, the profitability of mobile phones attracted more firms to enter and expand their operations. This has led to rapid improvements in the quality of technology.

6. Savings. Profit can be used to create savings for a cyclical downturn and avoid firms going bankrupt.

Costs of higher profit

Profit at the expense of other objectives. Firms who maximise profits for shareholders may ignore long term objectives such as investing in better infrastructure. Or they may seek to maximise profit by cutting corners – e.g. not following environmental legislation. Higher profit doesn’t necessarily reflect increase economic and social welfare. For example, it is more profitable to use artificial chemicals to grow food, but this has had high costs to the environment and long-term effects on human and animal health.

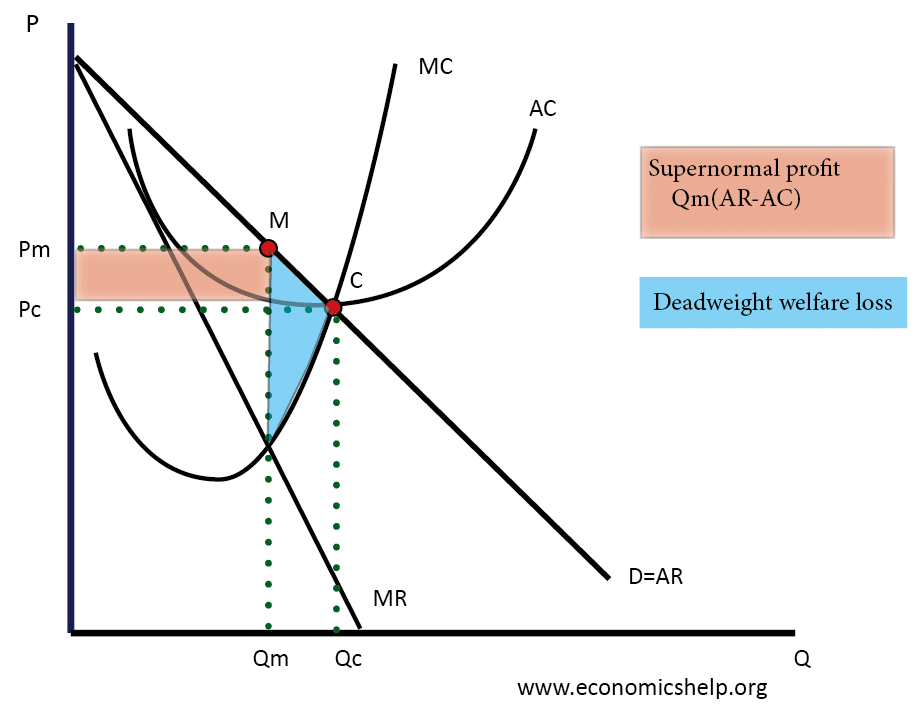

Monopoly power. Profit is often the result of monopoly power. Monopolies can create bigger profits by charging high prices. However, this is allocatively inefficient (price greater than marginal cost) leading to a deadweight welfare loss. Furthermore, those who lose out will be those on low incomes. The most profitable companies of this decade – Apple, Google, Microsoft, Facebook all have a degree of monopoly power.

Unused cash reserves. It is not true firms use profit to reinvest, some large tech firms have been so profitable they have struggled to make use of their profit and they have seen large rises in cash reserves which represent an unproductive use of money. According to Moody – a rating agency, US non-financial companies held a total of $1.7tn held on their balance sheets.

- Apple’s cash reserves are the largest with total cash reserves of $216bn, 93% of which is overseas.

- The top five companies Apple, Microsoft, Alphabet, Cisco and Oracle had a total of $504bn of cash by the end of 2015.

- Microsoft has $90 billion of cash reserves – 91% overseas (Forbes)

- Google’s $64.4 billion

Profit can be used to create barriers to entry With very high levels of profit, firms can invest in extra capacity (limit pricing) or buy up suppliers and key reselling points.

Increased inequality. Higher profitability will benefit a smaller share of the population who own shares. Higher profit often represents a transfer from the consumer to the shareholder.

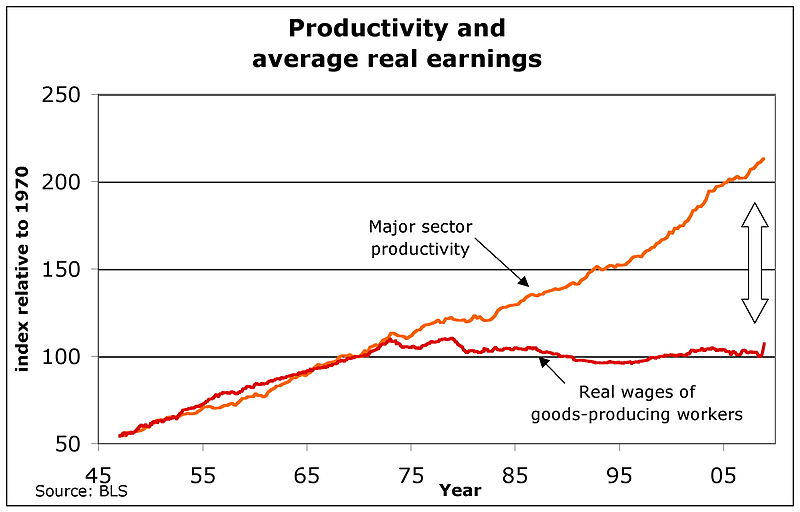

Profit a result of monopsony power. HIgher profit doesn’t necessarily translate into higher wages. Firms with monopsony power are able to pay wages below the competitive equilibrium. In fact, profit may increase due to falling real wages.

US productivity and average real earnings.

In the US since the early 1980s, the profitability of firms has increased, but real wages of goods-producing workers has flatlined. Firms are benefitting from rise in productivity more than workers.

Other factors to consider

How is the profit made? If firms make profit from selling desirable goods, then consumers are gaining welfare from purchasing the goods that they want. If a firm is making profit because it has monopoly power, then consumers may be unhappy with the goods on offer. For example, if a firm has monopoly from selling gas or electricity but it is also inefficient and there is power cut, the consumers get the worst of both worlds high prices and low quality of service.

Diminishing marginal utility of wealth. If large companies become more profitable and take a bigger share of national income, then it is likely to cause an increase in income and wealth inequality. This is because company profit benefits a few rich shareholders more than average workers. However, if a millionaire gains 10% extra income, the increase in living standards may be quite low. If a worker pays high prices to a profitable firm, it may significantly eat into living standards. (diminishing marginal utility)

Ownership of the company. If a company is a co-operative, then an increase in profit will be shared by all the workers, consumers and stakeholders. However, if it is a multinational plc, profit will go to a small number of shareholders. For example, a developing economy may be very poor, but a multinational company may invest in oil extraction. In this case, even if the firm is very profitable, local people may see little return and increase in economic welfare. If a company is nationalised and it makes more profit, then the profit will go to government revenues. This enables the government to cut taxes or spend more on public services.

Related

See also: Role of profit in economy

Great article. I agree.

Bigger profits does not necessarily mean a bigger benefits for all (i.e. society). What matters is productivity and return on investment. If, due to the size of its profits and demand for investment, Firm A is crowding out investment in other more productive assets then society is actually at a disadvantage due to Firm A’s size.

Third,