Readers Question: Can inflation cause a recession?

Inflation is not the main cause of recessions. Usually, recessions are caused by factors such as high-interest rates, fall in confidence, fall in bank lending and decline in investment. However, it is possible that cost-push inflation can contribute to a recession, especially if inflation is above nominal wage growth.

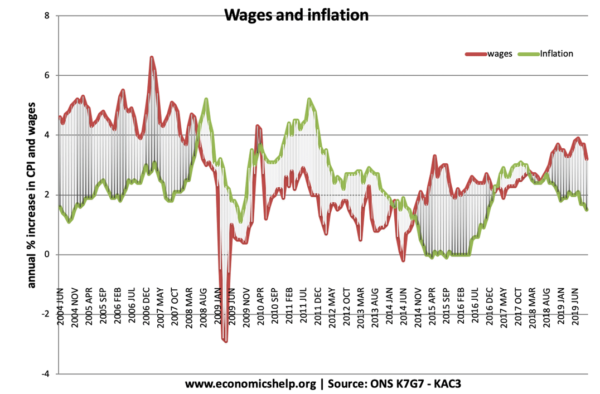

- For example, in 2008, inflation was higher than nominal wages (leading to a fall in real wages) and this contributed to lower consumer spending and was a contributing factor to the 2008 recession.

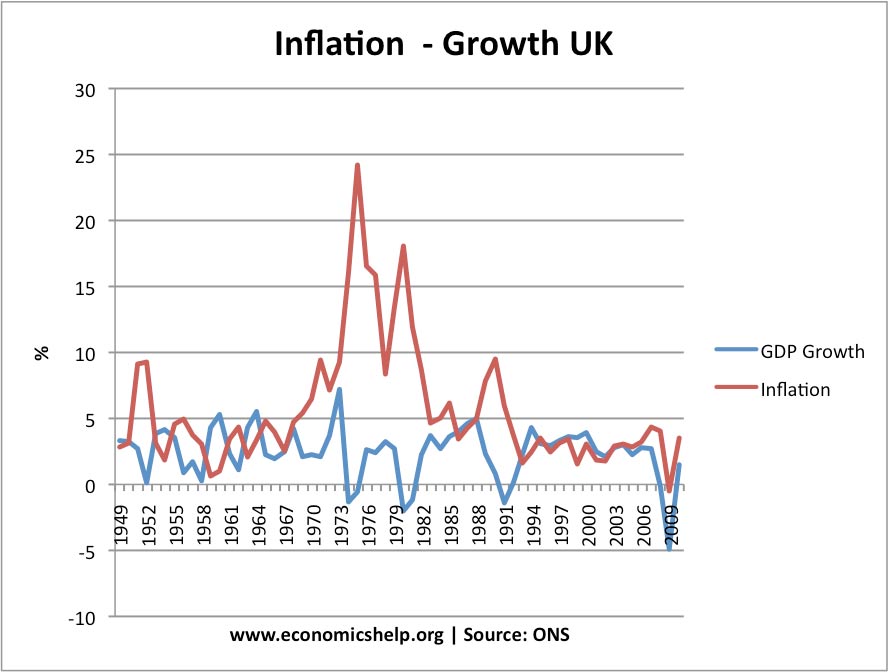

- It is also possible inflation can indirectly cause a recession. If economic growth is too high, this can cause higher inflation and the growth can prove unsustainable and lead to a ‘boom and bust’ economic cycle. In other words, inflationary growth is often followed by a recession.

- Also, if inflation is too high, the Central Bank and/or government may respond by tightening monetary or fiscal policy. This reduces inflation but also causes a fall in aggregate demand and lower economic growth. Therefore, a recession is often caused by policies to reduce inflation.

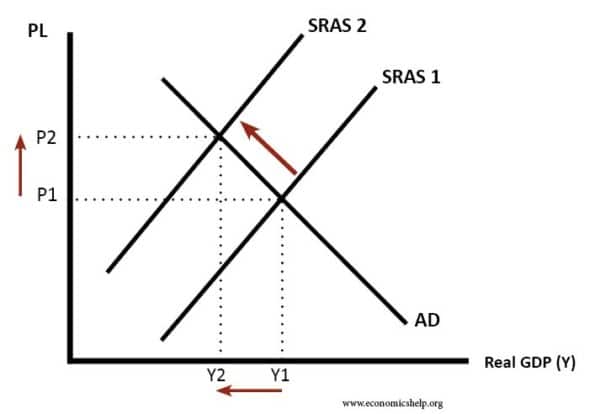

Cost-Push Inflation and Recession

If there is a rapid rise in commodity prices, then consumers will see a fall in disposable income (aggregate supply will shift to the left). This squeeze on living standards can lead to lower growth and aggregate demand. Firms will also face rising transport costs, they may respond by cutting down on investment. This is another factor that may push the economy into recession.

In 1974, the trebling of oil prices was definitely one factor in causing a short-lived but deep recession in the UK.

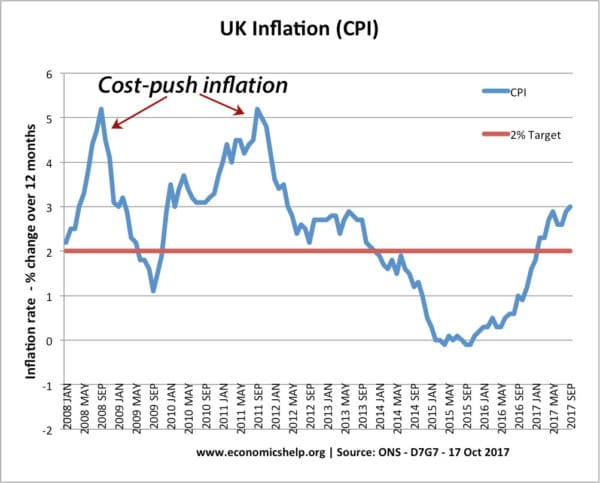

2008 Recession

In 2008, rising oil prices was one factor in causing a fall in consumer spending. Also, cost-push inflation encouraged Central Banks to keep interest rates higher than they should; this can contribute to the decline in aggregate demand.

In 2008 – inflation was above nominal wage growth – causing a fall in real wages – a factor leading to the recession.

In 2008 – inflation was above nominal wage growth – causing a fall in real wages – a factor leading to the recession.

However, cost-push inflation wasn’t the main cause of the 2008-11 recession. More important factors in pushing the economy into recession were:

- Credit crunch – Boom and Bust in credit markets led to a shortage of finance and therefore less investment.

- Falling house prices – falling house prices cause lower wealth and consumer spending

- Loss of confidence – bank collapses, falling stock markets and falling house prices have all changed consumer and business expectations meaning people are more willing to save than spend.

- Decline in world trade.

Boom and Bust Cycles

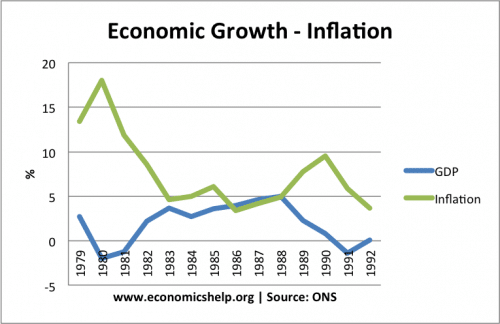

In the late 1980s, the UK experienced an economic boom, economic growth was above the long-run trend rate of economic growth. This caused inflation to increase to 10%.

But, then the boom ran out of steam. Also, the government decided they need to tackle this inflation of 10%, and so pursued tight monetary policy (high-interest rates). This increase in interest rates (combined with the strong exchange rate, UK were in ERM) caused a fall in aggregate demand and recession.

Indirectly, we can say inflation contributed to a recession.

Inflation does not mean demand falls

It would be a mistake to just sa .- Inflation means prices go up, therefore, people can’t afford goods. Therefore demand falls and we get a recession. A level students often write this, but this analysis is at best incomplete. It is more likely inflation is caused by rising demand.

- Inflation in the 1980s was caused by the rapid rise in consumer spending. The recession was caused by efforts to reduce the inflation rate.

- It was a similar situation in the 1981 recession. The Conservatives were determined to reduce the high UK inflation of late 1970s. They successfully reduced inflation through pursuing monetarist policies, but it caused a recession.

Related

Good summary of the causes of the recession. Seems to me that most governments’ have tackled the cause in that they have rescued banks. However, they have not done much about the deterioration in household balance sheets (item No 2 above). The US monetary base has doubled in the last quarter (which is unprecedented). I got this from an article in the Wall Street Journal. But I suspect most of this new money has gone to banks. Indeed too much of it has gone there, since banks are busy doing precious little with the money other than buying government stock. The US government has dished out about $1,000 worth of tax rebates or reductions per household, as I understand it, but this is chicken feed compared to the drop in value of the average house.

That was a well composed piece of answer.Stock market crashes, sharp increase in oil prices and globalization can also be added to the list..I guess…

Australia is causing the world recession, World economics is interwined and Australia has breached its code of ethics, In the year 2000 a taxed called GST passed through legislation, this tax is not recognized by the Australian and World Economies.

As Australia’s Inflation is now out of control, the world will suffer, take the formula of world economics not even the economist know what is causing the problems of today,

the question is why?

The Answer is Economics is basic and here is how it works, Divided each population by the amount we all earn, the only difference between countries is population sizes.

A string theory of percentages based on the 100% total average will formulate the basics of each country.

Now study the introduction of GST in Economics in Australia, thier was no adjustments made, the question is should thier have been? the Answer is Yes

Our Constitution suggest a Tax cannot be incuded which may place burdens on the people, that is GST, we now demand massive wages to compensate us, whilst each wage increases the 100% total.

How much is to much whilst companies are now going over sees for cheap labour.

And how does this effect you