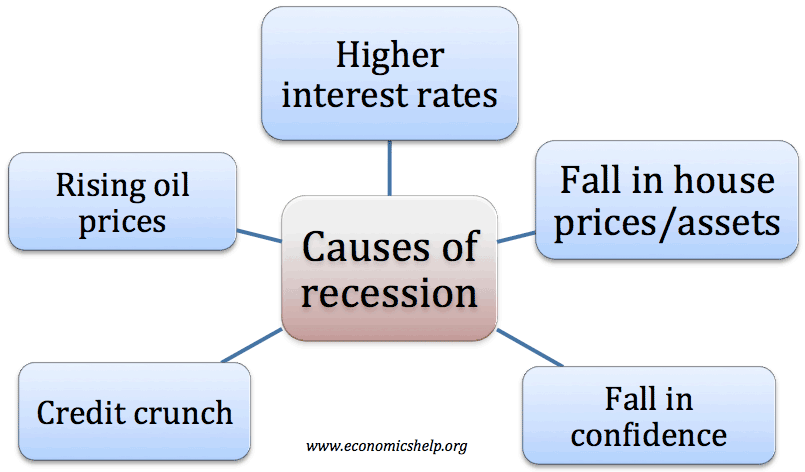

Recessions (a fall in real GDP) are primarily caused by a fall in aggregate demand (AD). A demand-side shock could occur due to several factors, such as

- A financial crisis. If banks have a shortage of liquidity, they reduce lending and this reduces investment.

- A rise in interest rates – increases the cost of borrowing and reduces demand.

- Fall in asset prices – negative wealth effect leads to less spending.

- Fall in real wages – e.g. inflation outstripping nominal wage increases.

- Fall in consumer/business confidence also exacerbated by the negative multiplier effect.

- Appreciation in the exchange rate – exports less competitive.

- Fiscal austerity – when government cuts spending.

- Trade war – Global economic downturn.

Recessions can also be caused by

- Supply-side shock, e.g. rise in oil prices cause inflation and lower spending power. (e.g. in 1970s)

- Black swan event – this is an unexpected event that is very hard to predict. For example, Covid-19 flu pandemic which disrupts travel, supply chains and normal business activity. A pandemic affects both supply and demand.

Causes of recession

1. Demand Side Shock

Factors that can cause a fall in aggregate demand include:

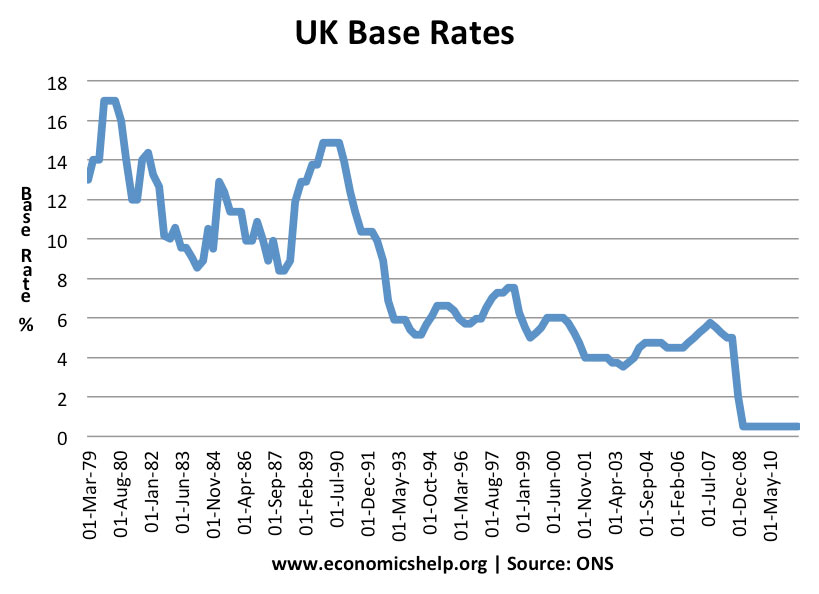

- Higher interest rates which reduce borrowing and investment. For example, in the early 1990s, the UK increased interest rates to 15%, this caused mortgage payments to rise and consumers had to cut back spending.

- Falling real wages. For example, firms cutting wages (or freezing wages) but inflation erodes the real value of wages.

- Falling consumer confidence, (e.g. negative series of events causes consumers to delay spending). Lower confidence also reduces business investment. Confidence can cause a knock-on effect, with low confidence affecting other consumers and business. Fall in confidence was a big factor in 2008/09 when bank crisis affected consumer behaviour.

- Credit crunch which causes a decline in bank lending and therefore lower investment.

- A period of deflation. Falling prices often encourage people to delay spending. Also, deflation increases the real value of debt causing debtors to be worse off and less disposable income.

- Appreciation in the exchange rate which makes exports expensive and reduces demand for exports. In 1981, the UK had a sharp appreciation in the Pound Sterling (partly due to North Sea Oil) – this caused a sharp fall in exports.

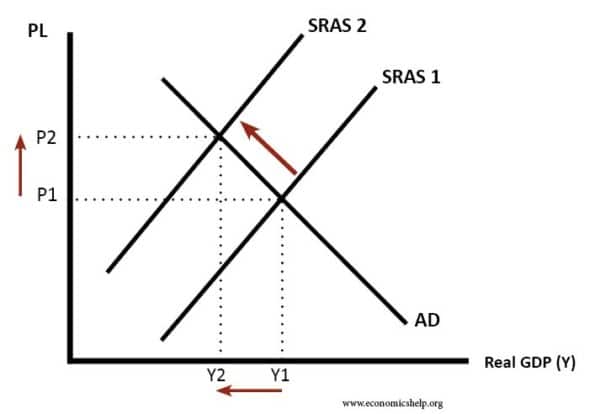

2. Supply Side Shock

Higher oil prices would increase the cost of production and causes the short-run aggregate supply curve to shift to the left.

This supply-side shock causes lower real GDP and higher inflation. This is difficult to solve with monetary policy – because we have both inflation and lower output to try and solve. (Changing interest rates can’t do both at once.)

- Confidence. A fall in confidence can precipitate a recession. See: Can we talk ourselves into recession?

Examples of recessions in the US

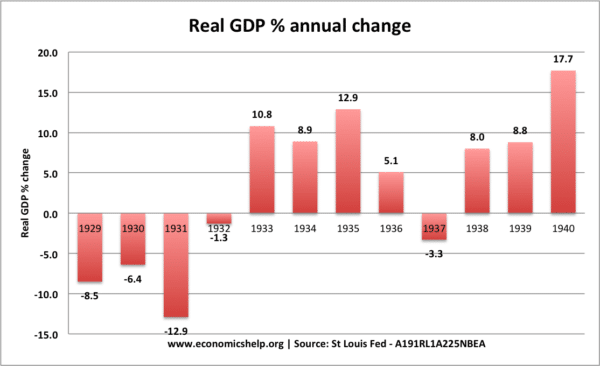

1. Great Depression 1929-32

US economy experienced an unprecedented downturn 1929-32

- Stock market crash in 1929 caused financial turmoil and decline in confidence. Many investors had bought shares on the margin (basically borrowing to buy). This caused people to lose significant sums.

- In US, bank failures led to a fall in the money supply and deflationary pressures. Bank failures also caused lost confidence and discouraged investment

- Negative multiplier effect – initial fall in spending caused a knock-on effect throughout the economy. There were no automatic stabilisers. People were made unemployed and so started spending less themselves.

- Fall in trade due to the global nature of downturn.

- Up until 1932, deflationary fiscal policy (higher taxes, lower spending) worsened the situation. The belief that budgets must be balanced caused governments to put up taxes and reduce spending – when the opposite needed to occur.

- More detail at causes of the great depression

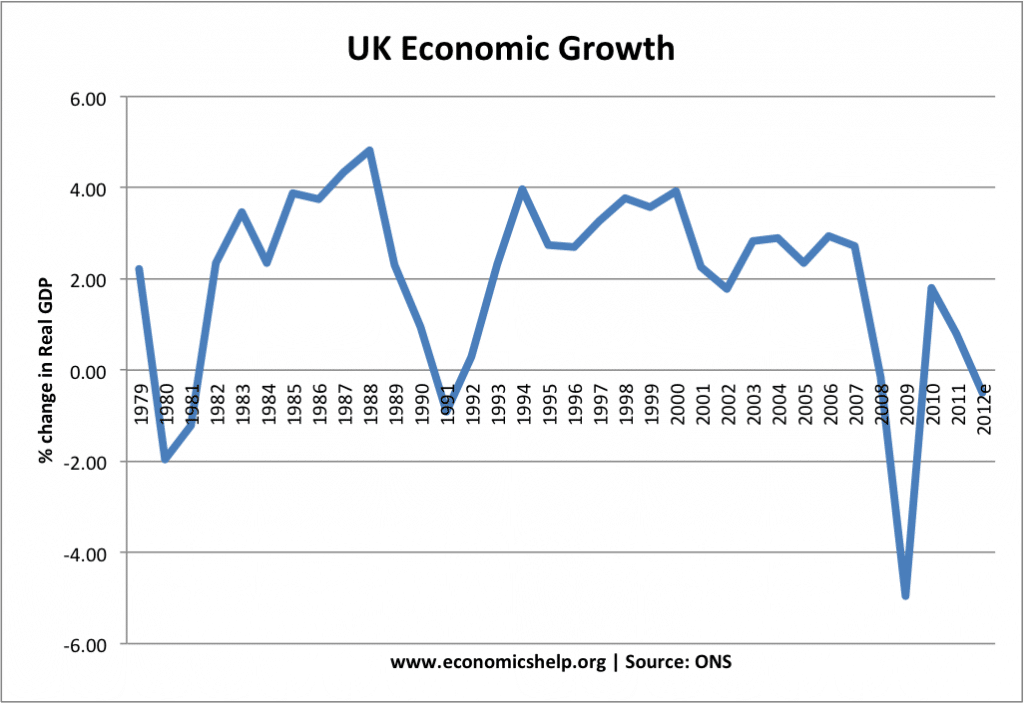

Causes of UK recessions

1981 Recession

1981 recession was caused by:

- High value of the pound which made exports more expensive and reduced demand for exports. This recession particularly impacted on British manufacturing. The Pound soared due to the discovery of North Sea Oil but also the high-interest rates.

- High-interest rates. In 1979, inflation in the UK was over 15%. The new Conservative government was committed to reducing high inflation they inherited. They pursued a tight monetary policy (higher interest rates) and tight fiscal policy (higher taxes, lower government spending. This reduced inflation but at the cost of falling spending, investment and output.

- Tight Fiscal Policy. To control inflation, the government were committed to reducing the levels of Government borrowing. This was influenced by Monetarist beliefs that controlling excess government borrowing was essential to the economy. Therefore the government increased taxes which reduced the disposable income of consumers and therefore reduced consumer spending.

more on 1981 recession

1991 Recession

- BOOM and BUST. In the 1980s economic growth was too fast and unsustainable therefore inflation increased to over 10% (see: Lawson boom). To reduce this inflation the government increased interest rates which lowered spending.

- Joining the exchange rate mechanism. The government became committed to maintaining a high value of the Pound. This required high-interest rates of up to 15%, which caused a big fall in aggregate demand. Also, because the pound was overvalued, exports were expensive causing less demand for UK exports.

- High-interest rates increased the cost of mortgage interest payments. Many were forced to sell. This caused a fall in house prices. Falling house prices caused a decline in consumer wealth and lower confidence. This also caused lower spending.

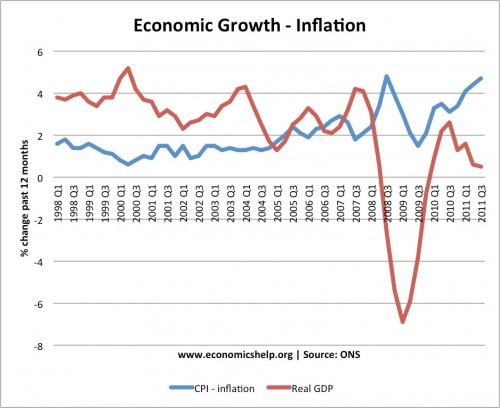

Causes of the recession of 2008/09

- Credit crunch – shortage of finance (Credit Crunch explained)

- Falling house prices – related to shortage of mortgages and credit crunch

- Cost-push inflation from rising oil prices squeezing incomes and reducing disposable income

- Collapse in confidence of finance sector causing lower confidence amongst the ‘real economy.’

- Fall in real wages due to inflation, but squeezed nominal wages.

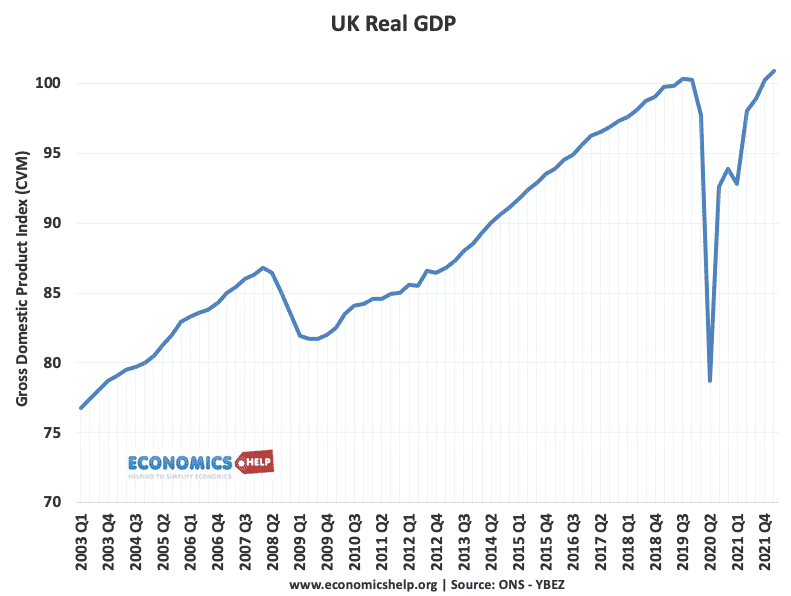

The unique recession of 2020/21

In 2020/21, the Covid-19 flu pandemic caused a major disruption to trade, manufacturing, travel and business confidence. Economies were virtually shut down, with the government setting restrictions on normal economic activity. This caused an unprecedented fall in GDP

(See: economic effects of pandemic)

Recession of 2022/23

Unfortunately, many signs are pointing to recession in UK and Europe for the end of 2022/23

- Geopolitical uncertainty discouraging investment

- Unexpectedly high cost-push inflation causing a fall in living standards and lower consumer spending but also pressuring Central Banks to increase interest rates.

- The likelihood that higher interest rates will cause a housing market crash as price to income ratios are at record levels. Falling house prices have a major effect on consumer wealth and spending.

- Negative real wage growth as inflation outstrips nominal wage growth.

- No-deal Brexit in the UK could lead to major disruption and fall in trading between the UK and EU would push the EU into recession.

- Higher oil and gas prices prices from Russian/Ukraine conflict.

- General weakness in global economy post great financial crash.- weak productivity growth – see: Tortoise economy

- Limited room for monetary/fiscal policy. Central Banks can’t loosen monetary policy because of the danger of inflationary expectations becoming embedded.

Further reading

Essay on causes of recession

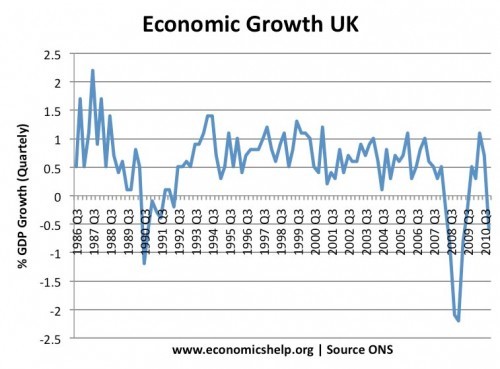

A recession occurs when there is a fall in economic growth for two consecutive quarters. However, if growth is very low there will be increased spare capacity and increased unemployment; people will feel there is a recession. This is sometimes known as a growth recession. see also: Definition of Recessions

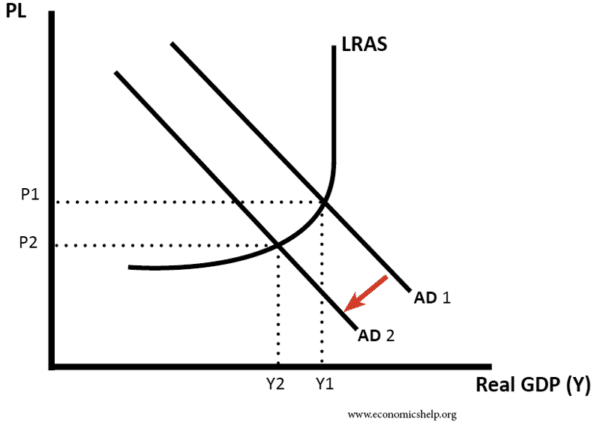

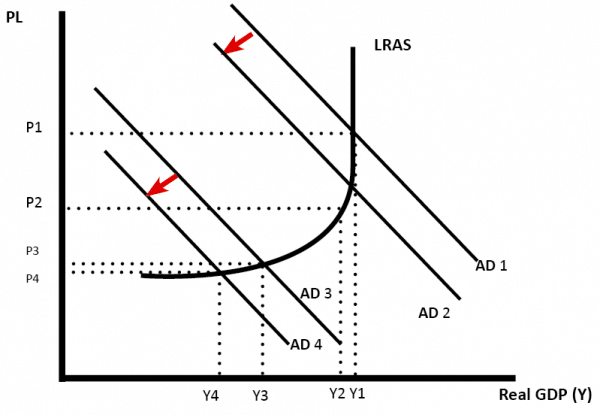

If there is a fall in aggregate demand (AD) then according to Keynesian analysis there will be a fall in Real GDP. The effect on Real GDP depends upon the slope of the AS curve if the economy is close to full capacity lower AD would only cause a small fall in Real GDP.

AD is composed of C+I+G+X-M, therefore a fall in any of these components could cause a recession. For example, if the MPC increased interest rates sharply this would cause the cost of borrowing to increase and make saving more attractive. This would have the effect of reducing consumer spending. AD could also fall due to deflationary fiscal policy, for example, higher taxes and lower government spending would also cause a fall in AD.

If there was a fall in AD the multiplier effect might magnify the initial fall in AD. For example, if there was a fall in output, workers would be made unemployed. These workers would then spend less causing a secondary fall in AD. This would make the fall in Real GDP greater.

A key feature in determining the rate of economic growth is the level of consumer and business confidence. If confidence was high then higher interest rates may not reduce demand. However if confidence is low and people fear they may be made unemployed, then they will start spending less, causing AD to fall (or increase at a slower rate). Therefore this shows that expectations are very important and it is possible for “people to talk themselves into a recession”

An important feature of the UK economy is international trade. Therefore the UK would be affected by a global recession. For example, a recession in the EU would cause a fall in demand for UK exports reducing our AD (EU accounts for 60% of our trade, therefore, is important). Also, a recession in other countries would affect economic confidence if people see the US in a recession they are worried and will spend less. However, a global recession may not cause a recession in the UK if domestic demand remains high.

Classical economists believe that any fall in Real GDP will be temporary and will end when labour markets adjust to the new price level. Classical economists argue that if there is a fall in AD then, in the short term, there will be a fall in real GDP. However with a lower price level wages will fall therefore the SRAS will shift to the right and the economy will return to the original level at Yf and the recession will be over.

However in the great depression of 1930s, Keynes was very critical of this classical view he said that the long period of negative growth showed that markets do not automatically clear he argued that this was for various reasons.

- Wages are sticky downwards. Firms should cut wages to reflect lower prices but in reality, workers are very resistant to cuts in nominal wages

- If wages were cut in response to unemployment, workers would have less spending power, therefore AD would continue to fall.

- In a recession, people have low confidence and therefore spend less. Keynes said this was the “Paradox of Thrift”