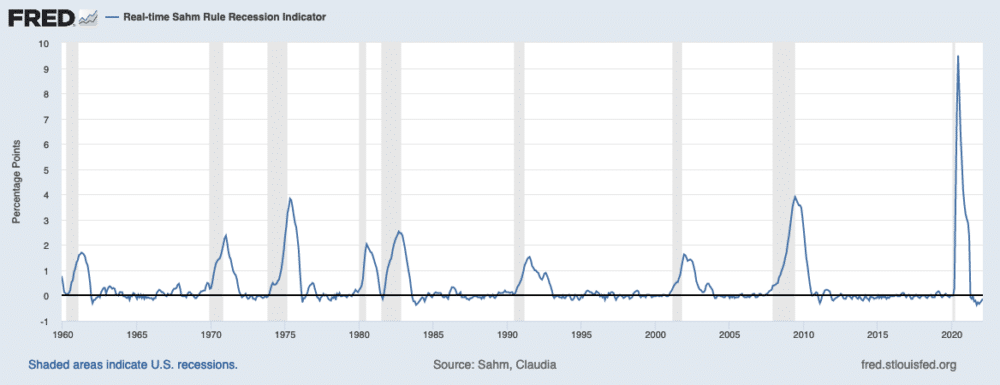

The Sahm rule is a way of predicting a recession from changes in the unemployment rate.

“(The) Sahm Recession Indicator signals the start of a recession when the three-month moving average of the national unemployment rate (U3) rises by 0.50 percentage points or more relative to its low during the previous 12 months.” (Sahm Rule)

This clearly shows that in a recession there is a strong correlation with an increase in the three months moving average unemployment rate.

Why is Sahm Rule important?

Recessions are typically defined as a fall in gross domestic product. However, data on GDP is not measured in real time – there is a time lag between what is happening in the economy and producing data. Also, even after the first publication, GDP can also be subject to revisions as more accurate data comes in. Therefore, it can take economists up to 12 months to actually state that the economy is in recession.

However, these 12 months is wasted time. To reduce the impact of the recession, the Central bank may want to cut interest rates and the government pursue the expansionary fiscal policy. If you can have early warnings signs of a recession, you can start pursuing expansionary and fiscal policy early rather than later.

One suggestion of economist Claudia Sahm is that a rise in the Sahm Rule recession indicator could be automatically linked to fiscal policy so, at early signs of recession, automatic benefits are paid, to provide a fiscal stimulus rather than relying on governments to react (usually takes time).

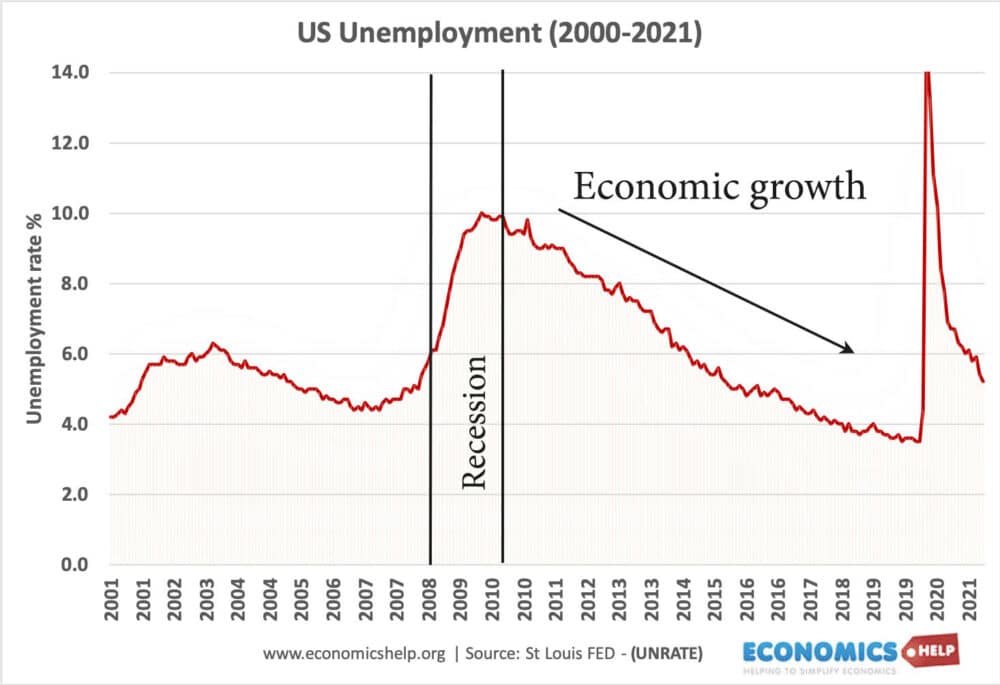

Example of 2008/09 recession

The great recession began in December 2007, but the NBER was only able to formally announce the recession in December 2008 – a full 12 months after the recession began.

The Sahm indicator began to identify a recession in April 2008 – a lag of only four months.

On 17 February 2009, the Obama administration implement a set of expansionary fiscal policy the “American Recovery and Reinvestment Act of 2009” 15 months after the start of the recession. It is also worth noting fiscal policy itself has a time lag before it is implemented and has an effect on the economy.

Advantages of Sahm Rule

- Historically it has a good track record of predicting recession in the US.

- It is a relatively simple measure relying on a widely available statistic from the BLS. It is does not require any complex econometric analysis.

- It is quicker than traditional methods of identifying recession.

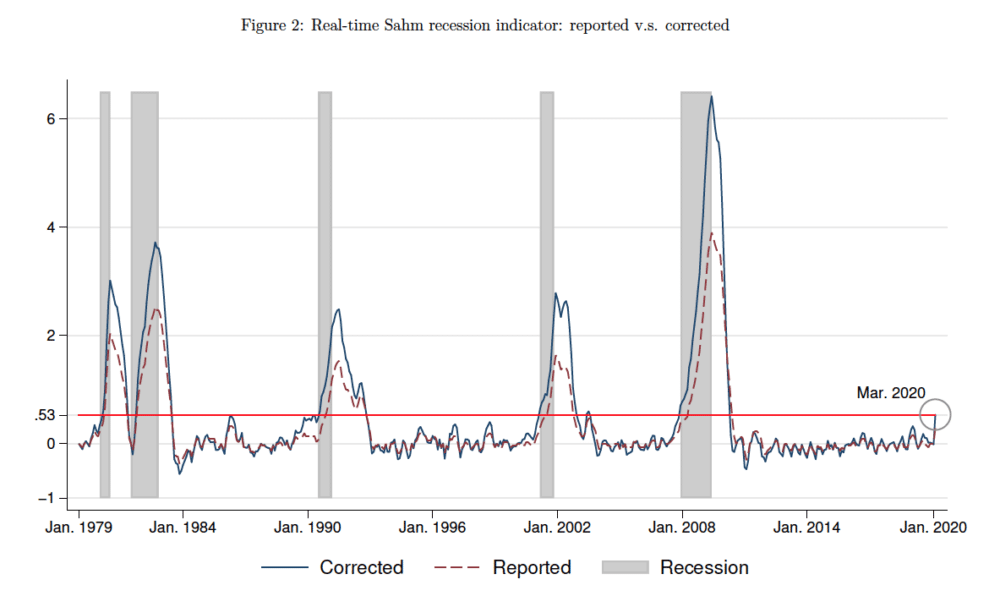

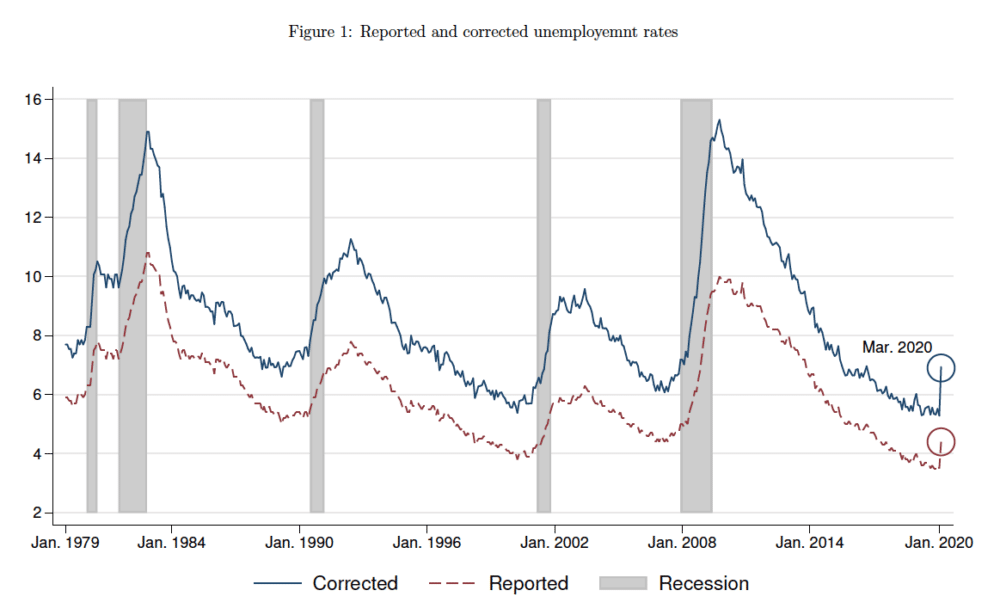

Improved Sahm Rule

In a paper ( I Z A Institute of Labor Economics No. 13167, April 2020), Feng and Sun suggest that the Sahm rule can be improved by taking into account misclassification errors of measuring unemployment at the start of a recession.

Pointing to studies by Zellner 1985; Poterba and Summers 1986). Feng and Hu (2013) there is often under-reporting of unemployment at high levels of unemployment.

This is because a rise in unemployment may be misidentifying as leaving the labour force and becoming economically inactive.

Therefore the rise in the official unemployment rate is in practice less than the actual rise in real-life unemployment. If we adjust for this measuring error, there is a shaper increase in unemployment and we are able to predict recessions much earlier.

Source: I Z A Institute of Labor Economics No. 13167, April 2020

Source: I Z A Institute of Labor Economics No. 13167, April 2020

Therefore, with the adjusted Sahm rule, we see the great recession identified in December 2007, as soon as employment data was released.

Another study by Blanchflower & Alex Bryson (2021) NBER 29300 suggested a very useful indicator of recession was the survey of whether workers feared unemployment.

Limitations of Sahm Rule

There are many economic rules which were true for past historical data, but then proved to be less reliable for the future. Examples include

- Taylor rule on setting interest rates – became ineffective in a period of zero interest rates

- Phillips Curve – showed trade off between nominal wage growth and unemployment, but then became less reliable in 1970s and 80s.

- Friedman’s Rule for growth of the money supply – lost relevance in the 1980s.

However, despite these caveats, there is good reason to believe the Sahm Rule will be quite robust as there is a very strong and obvious link between recession and a rise in unemployment.