George Osborne has recently stated that leaving the EU could leave a black hole in public finances of £30bn and this would lead to sharp budget cuts – tax rises and spending cuts.

This raises the interesting question of whether you can talk yourself into a recession. Do predictions of recession become self-fulfilling?

How can you talk yourself into recession?

- If influential people talk about an upcoming recession, it makes people nervous about their economic future. Therefore, they cut back on spending and increase saving.

- Due to lower spending, firms see a fall in demand. As firms see fall in demand, they cut back on employment and also cut back on investment.

- Both these factors of lower employment and lower investment cause an additional fall in aggregate demand.

- We can start to see a negative multiplier effect, where an initial fall in spending causes further rounds of lower spending.

- Confidence is very important to an economy. If confidence is low, firms will cut back on investment due to lower demand.

- If government fears recession will harm finances and pre-emptively cuts back on spending and raises taxes.

Long-term finances of Brexit

If the UK votes to leave the EU, there will be two factors at work

- Short term uncertainty, which could discourages investment / spending and could cause a demand side shock (and therefore recession)

- Long term impact on finances of lower economic growth rate. If UK gains worse trade deals after Brexit it could impact the long-run trend rate of economic growth when we leave the EU – a few years after the vote. Post Brexit, we will also most likely lose the net fiscal contribution of young migrants. Therefore in the long-term, lower GDP will lead to lower relative tax rates and it may lead to lower spending (or lower growth in public spending)

However, in the case of Brexit, is it a good idea to pre-emptively raise taxes and cut spending in anticipation of future lower economic growth?

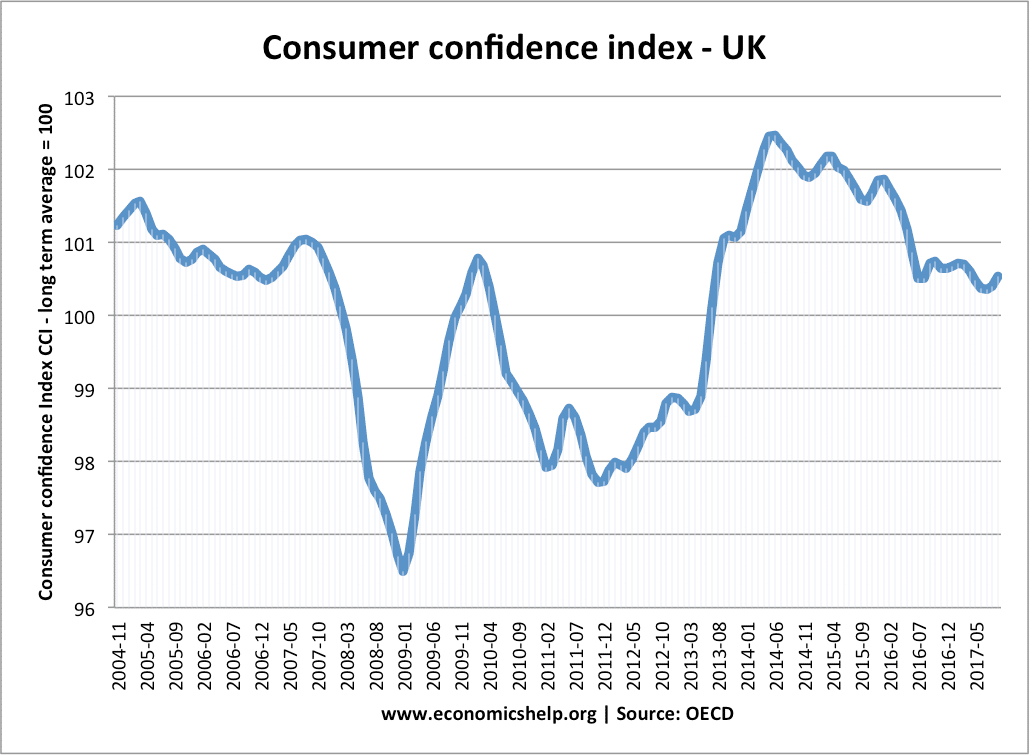

UK consumer confidence dropped sharply in 2008.

Fiscal contraction during a period of uncertainty

If you do cut public spending and raise taxes, you will almost guarantee that you will have a recession. Even the threat of future tax rises and spending cuts maybe enough to alter consumer spending habits.

Combined with the uncertainty of Brexit, fiscal contraction or even threat of fiscal contraction, would be damaging to the economy, and almost certainly cause a fall in aggregate demand.

In addition, all the talk of Brexit causing recession will lower confidence and encourage people to save rather than spend and invest.

Policies for short term uncertainty of Brexit

After a vote for Brexit, in theory nothing substantial should change for a few years. The process of withdrawal from the EU takes time. But, any chancellor will have to deal with the short-term problem of a demand side shock from the uncertainty effect.

In this case, the best policy response would be to try and deal with this ‘uncertainty shock’ and avoid recession. This could involve:

- Expansionary fiscal policy to shore up aggregate demand (Keynesian demand management) – or at least avoiding shot term contraction.

- Strong leadership from government, that we are committed to avoiding recession and there is no reason for UK to enter recession. The confidence effect maybe hard after making such a strong commitment to economic costs of Brexit.

- Possibly expansionary monetary policy, though Bank of England already has interest rates at 0.5%

To some extent the chancellor will be helped by the fall in the value of the Pound – which is expansionary and will help exports. But, on the other hand, we could see a fall in inward investment as companies avoid investing in the UK.

However, as chancellor, you have to be careful in setting the tone. The concern is that people who have predicted economic disaster from a Brexit vote have, ironically, the influence to make it happen.

Whatever happens to the EU vote, the UK should take all necessary steps to avoid recession, and remember ‘careless talk can cause recessions’.

Long-term finances

If the UK leaves EU, and if this reduces the long-run growth rate – then the UK may have to re-evaluate spending choices and taxes in the long-term, especially, if we see a rapidly ageing population. However, these spending and tax choices are long-term, and it should be left until we start to see what actually happens.

Evaluation of ‘talking yourself into recession’

I should mention briefly that there is no guarantee that talking about a recession will make it happen.

- Maybe firms and consumers don’t pay too much attention to politicians / economists and continue to spend anyway.

- The economy has self-correcting mechanisms. E.g. Loss of confidence could cause Pound to fall in value, which helps boost domestic demand.

- It depends on whether talk of recession is based on economic realities, e.g. after global credit crunch, it would be expected people fear and talk about recession. But, here the recession was not so much caused by the talk of recession, but the actual economic reality of banks running out of money.

Related