A tortoise economy refers to an economy that is barely growing – either economic growth is stagnant or growth is very slow. In particular, it has been used to describe a sluggish recovery from recession.

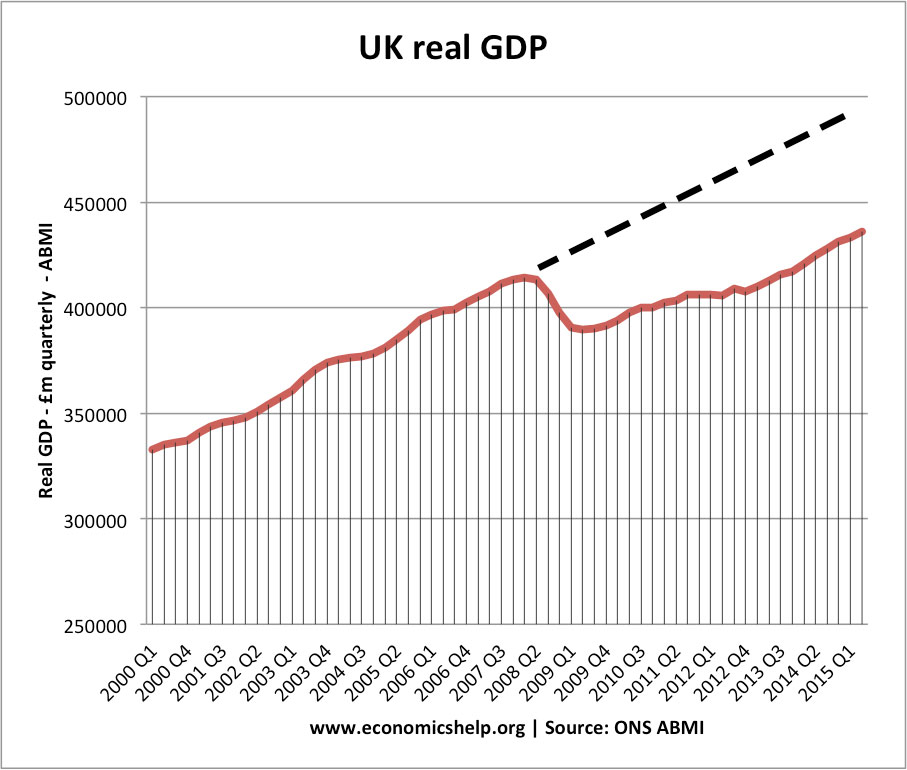

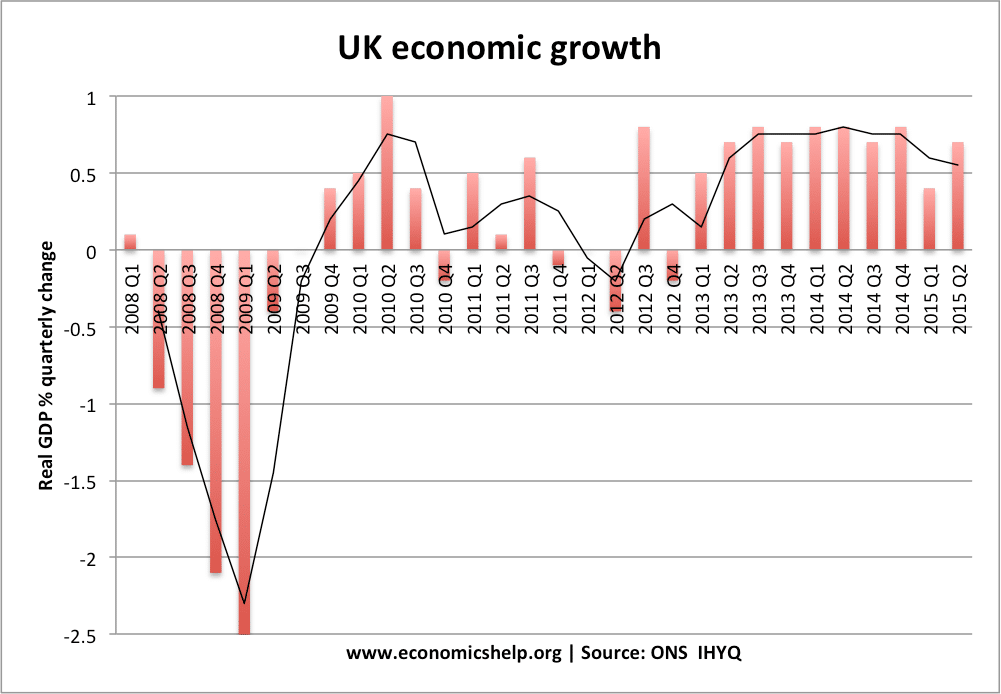

In the aftermath of the great recession – 2007/08, many western economies experienced a very slow economic recovery. GDP was increasing, but it was an unusually slow economic recovery, and this reflected a weak economy (some argue artificially propped up by quantitative easing/loose fiscal policy)

Economist Robert Reich used the analogy of a tortoise falling in a big hole and struggling to get out.

“We may or may not fall into another hole, but a so-called “double dip” isn’t really the worry. The worry is we’re not getting out of the giant hole we fell into. Growth is slowing when it should be surging. Think of a tortoise trying to get out of a deep ravine, who’s just begun to scale the wall when he gets tired and goes to sleep.”

The Tortoise Economy, Robert Reich 2010

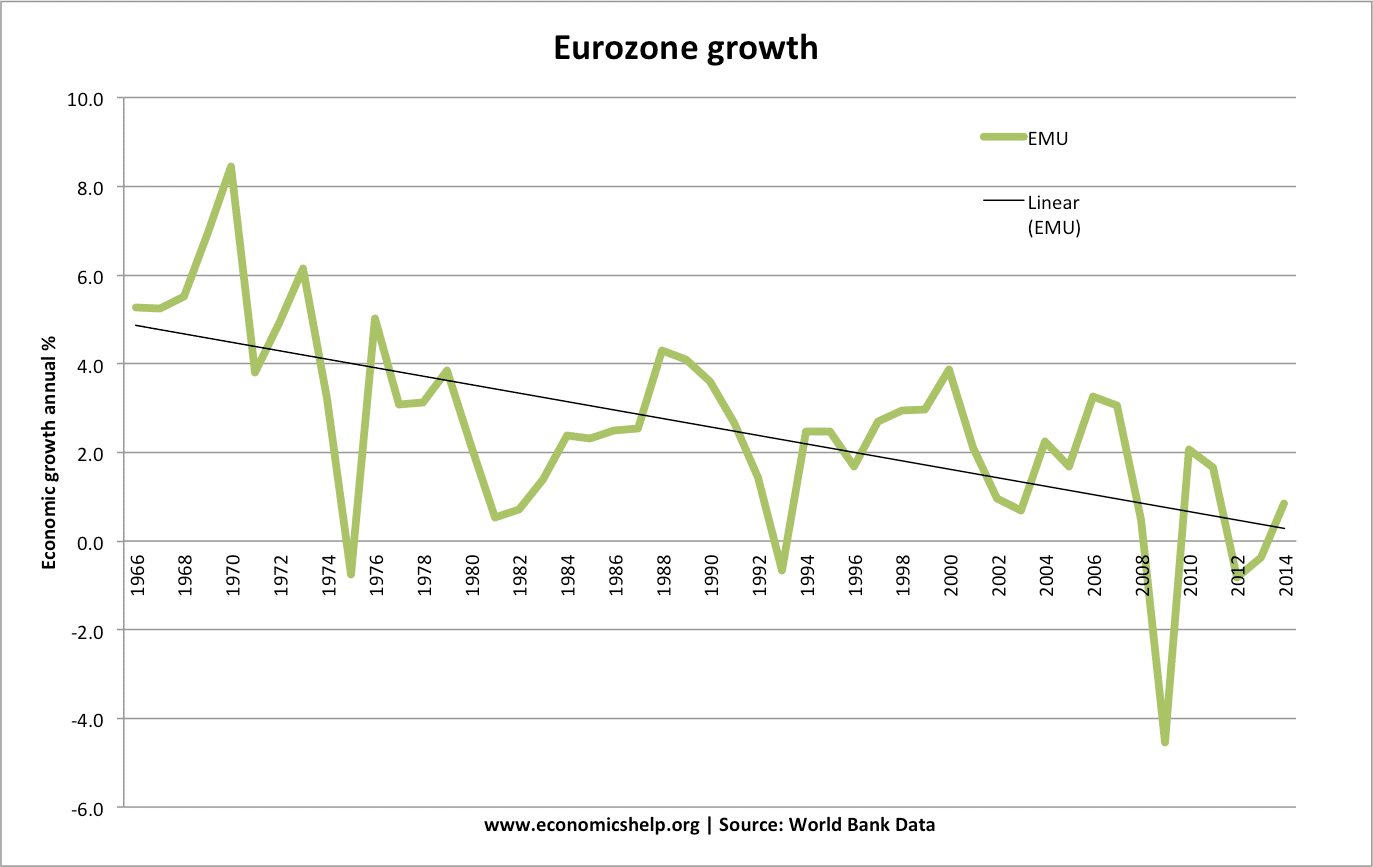

After 2010, the US economy started to grow at a quicker rate. The US has been one of the few economies to raise interest rates from its historic lows of 0.5%. However, this description of sluggish growth could definitely be applied to the Eurozone where economy growth was well below the trend rate for a considerable time.

Slow economic recovery

Usually, when an economy enters into recession, the economy ‘bounces back.’

This is because in a recession – there is a fall in demand, people save and cut back on big expenditure. Similarly, firms hold back on investment decisions. However when confidence returns (or interest rates are cut) this allows individuals to spend again and this causes rapid recovery (catch up with lost potential) When firms see an economic recovery, the accelerator theory suggests there will be a significant rise in investment in response to the improvement in growth rates.

Example of strong bounce-back

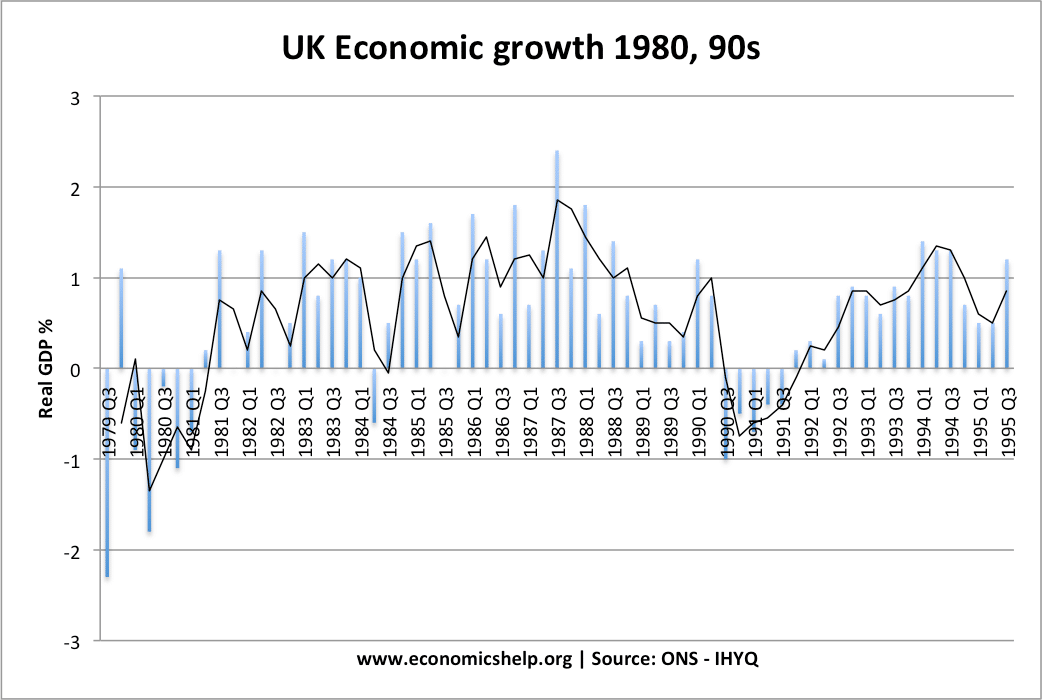

In 1990, the UK increased interest rates to 15% – this caused the recession of 1990 and 1991. However, when the UK left the ERM and cut interest rates, this caused the economy to recover strongly, from 1992 to 1994, the economy had quarterly growth of close to 1% (an annualised rate of 4%)

However, in certain circumstances, this doesn’t occur.

Why we got a slow recover post-2010

- Confidence was slow to recover

- Interest rates were low before the crisis. There wasn’t any more interest rates could be cut

- Balance sheet recession. The great recession of 2008/09 was partly caused by bad loans in the banking system. Therefore, even with low-interest rates, banks were not willing to lend – they didn’t have the liquidity. Therefore, recovery was held back because banks were not lending and firms struggled to borrow for investment.

- Fall in asset prices. The sustained fall in house prices in Europe and the US caused a prolonged fall in wealth of households and balance sheets of banks. Therefore, consumers and firms were more nervous about investing again. (the UK did experience a stronger recovery in house prices, though this didn’t lead to much of a positive wealth effect)

- Secular stagnation. Since the 1960s, we have seen falling growth rates across the western world. This is due to a number of factors, such as demographics (ageing population) and a possible decline in the growth of productivity improvements.

- Biflation – rising commodity prices, but deflation of goods. Rising commodity prices increases the cost of living, but general deflation of other prices discourages consumption, investment and increases the real value of debt in the economy. In the post-recession period, the UK’s period of cost-push inflation caused stagnant real wages and therefore, consumer spending was held back.

Related

thank you , nice article