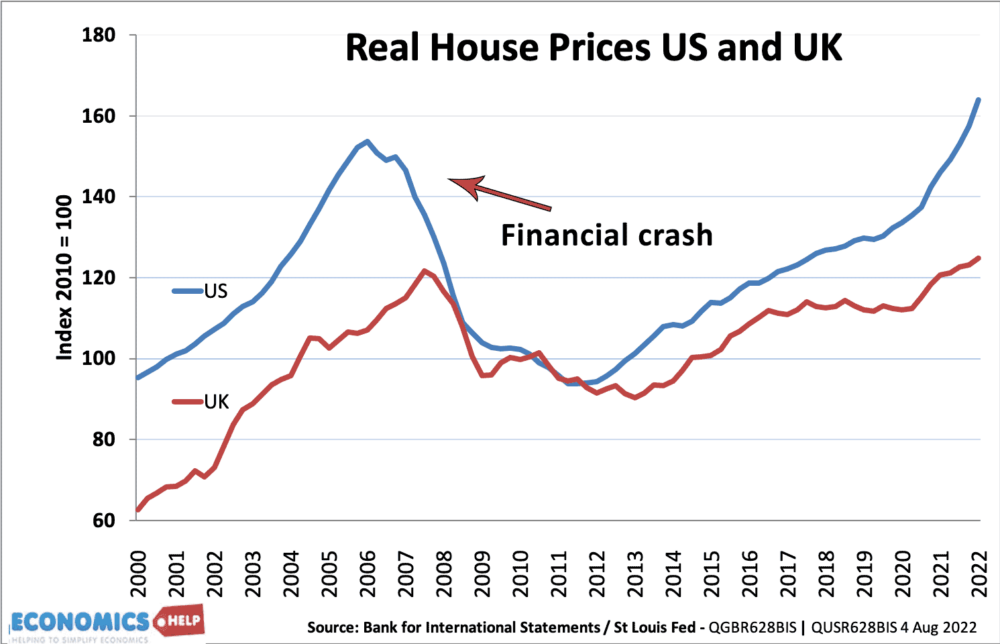

When I started teaching economics in the early 2000s, I remember quite a few commentators predicting imminent house price falls because house prices were overvalued by historical trends, I used to occasional dip into house price crash forums to see a debate about when prices would fall. Yet, since 2000, even accounting for the financial crash, UK and US house prices have witnessed a remarkable, above-inflation rise. However, despite the housing market often defying gravity and long-term affordability measures, there are good reasons to believe this time is different as a combination of factors look set to cause a fall in house prices. The main factors are a very high price-to-income ratios, combined with rising interest rates, economic slowdown and cost of living pressures.

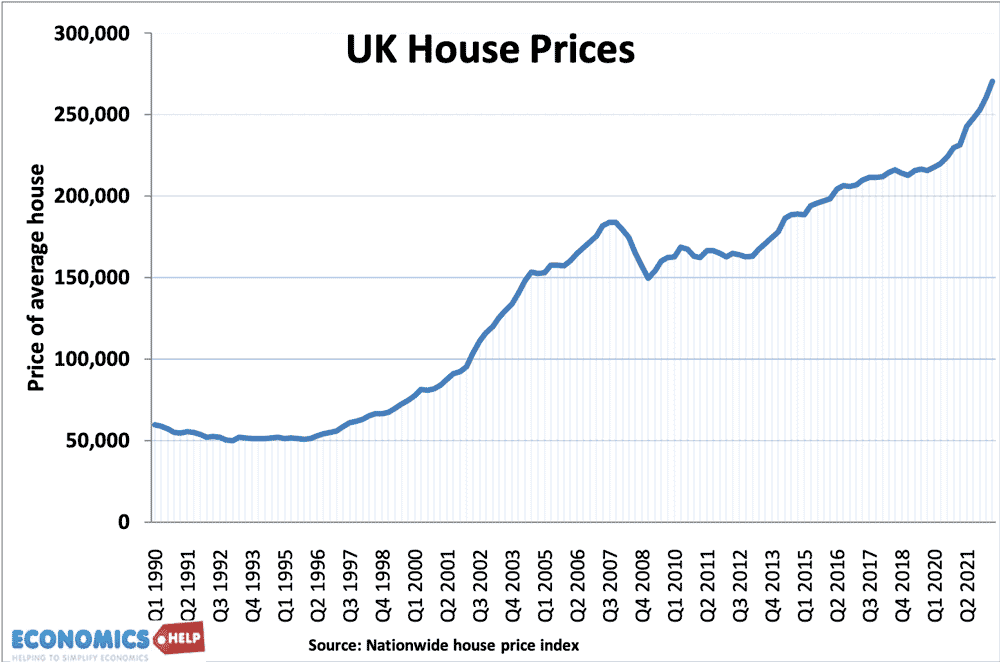

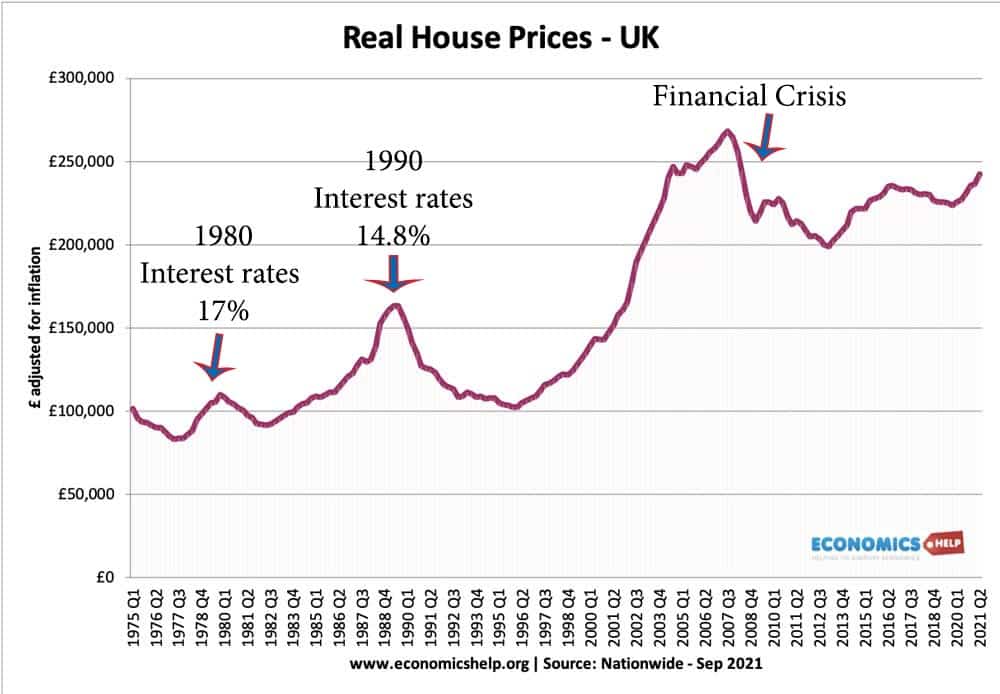

UK house prices have risen from £77,000 (2000) to £270,000 (Q2 2022) Even adjusted for inflation, house prices have risen considerably. There has been a 150% real increase since 1996.

UK house prices have risen from £77,000 (2000) to £270,000 (Q2 2022) Even adjusted for inflation, house prices have risen considerably. There has been a 150% real increase since 1996.

Video version

If there is one lesson I learnt about the UK property market is don’t underestimate the capacity of house prices to keep rising. True, we had the correction of house prices in 2008/09, but this was relatively minor and prices continued to rise sooner than many expected.

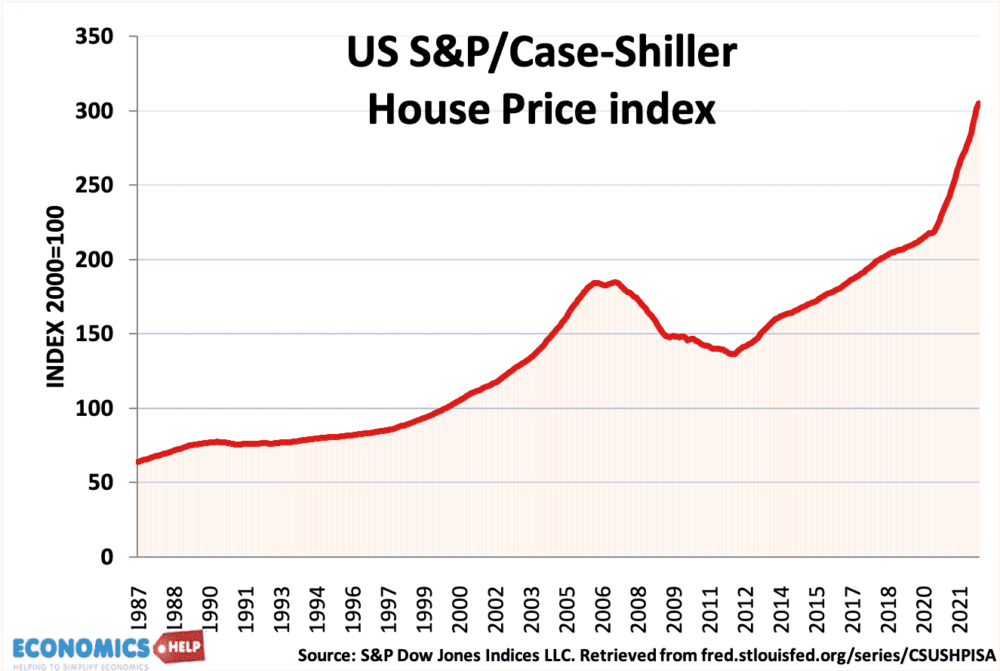

US House prices

Although the US had a more significant fall in house prices during the credit crunch, house prices have shot up in recent years.

Why have house prices risen so much?

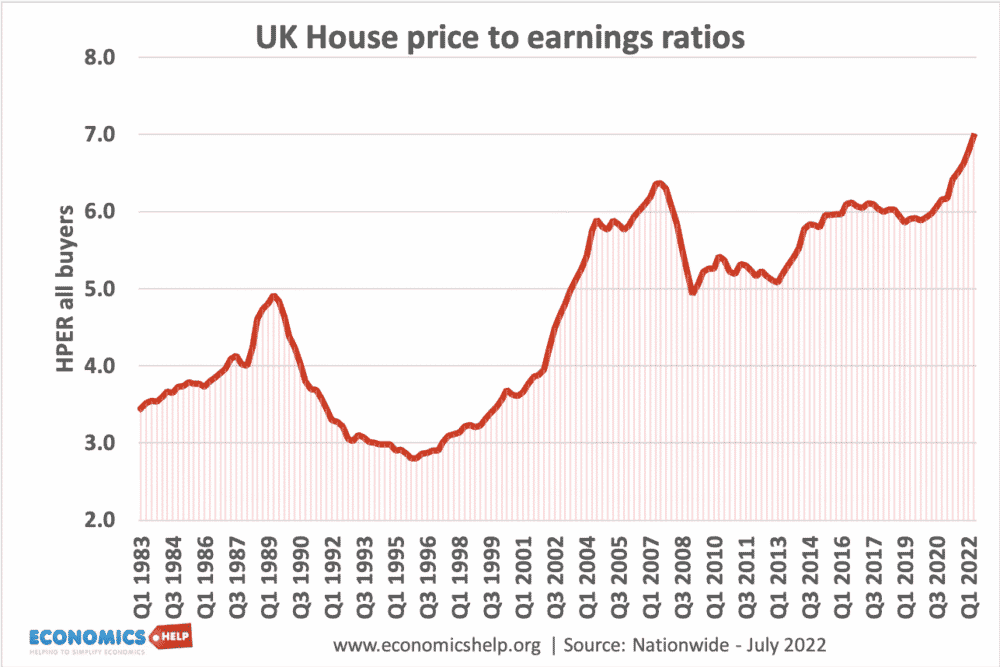

Despite weak wage growth and a cost of living crisis, it seems that the demand for housing is very strong. And combined with weak supply growth, market forces have pushed up prices beyond the reach of the majority of young people (at least those who cannot access their parents for a large deposit.) The result is that the ratio of house prices to incomes has increased very significantly, showing how house prices have risen faster than not just inflation but earnings as well.

According to the Nationwide, UK house prices to earning ratios reached a record of 7.0 in Q1 2022, this compares to less than 3.0 – in the mid-1990s.

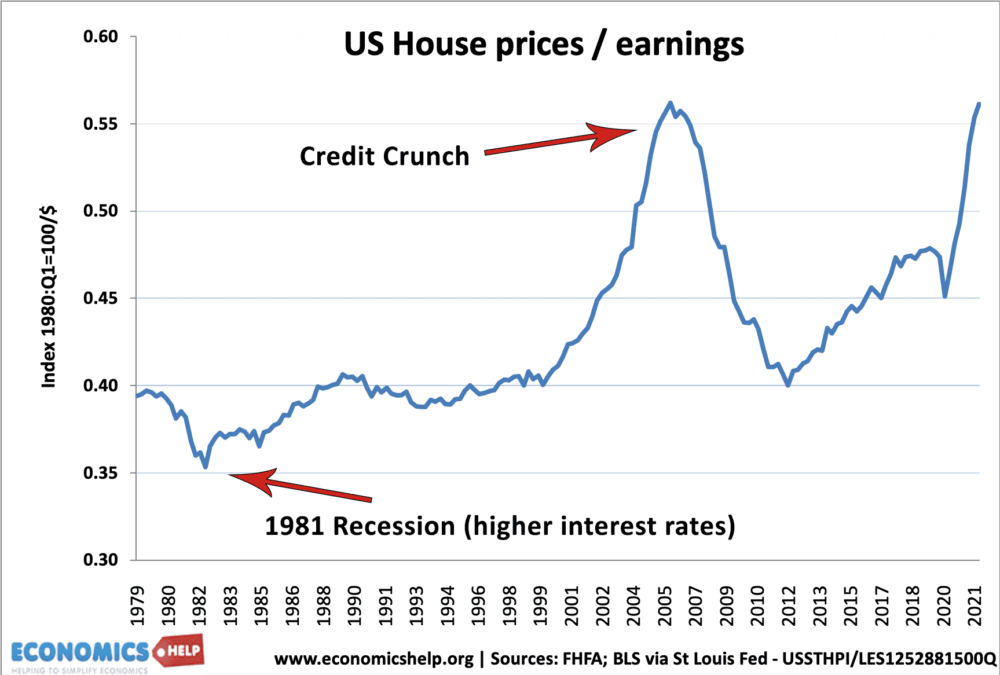

It is a similar situation in the US, with house price to income ratios reaching record levels.

There has also been a Covid effect with working from home encouraging people to buy better property.

So why are house prices so expensive and why are they set to fall?

Firstly, we have to understand why house prices have been increasing. There are two main factors underpinning the rise in house prices.

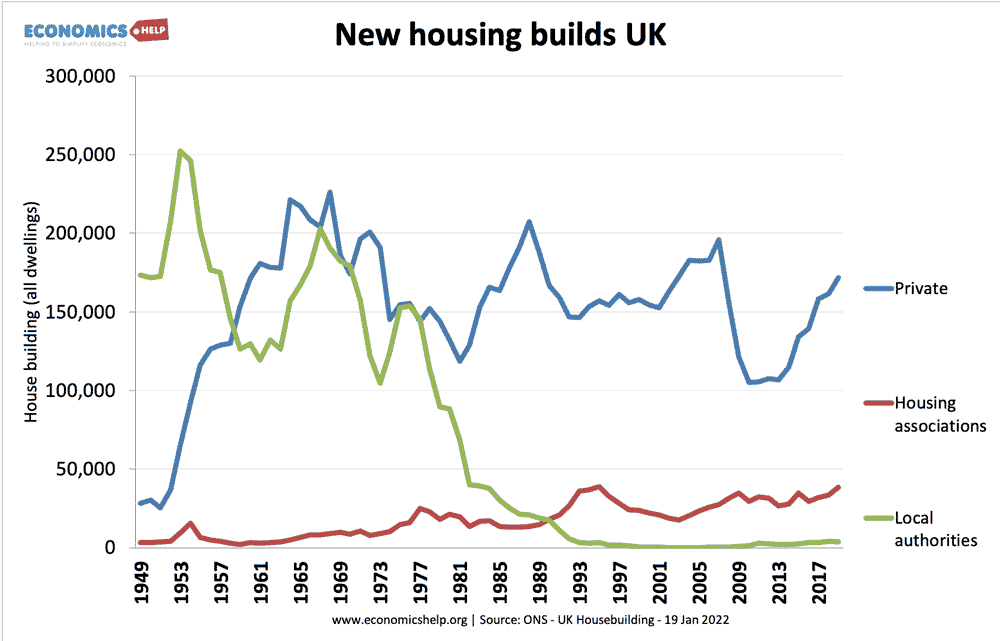

- Imbalance between demand and supply (we are not building enough homes to keep up with growing demand)

- Ultra low-interest rates, which have distorted the market and made buying a house more attractive than other investments.

Interest rates

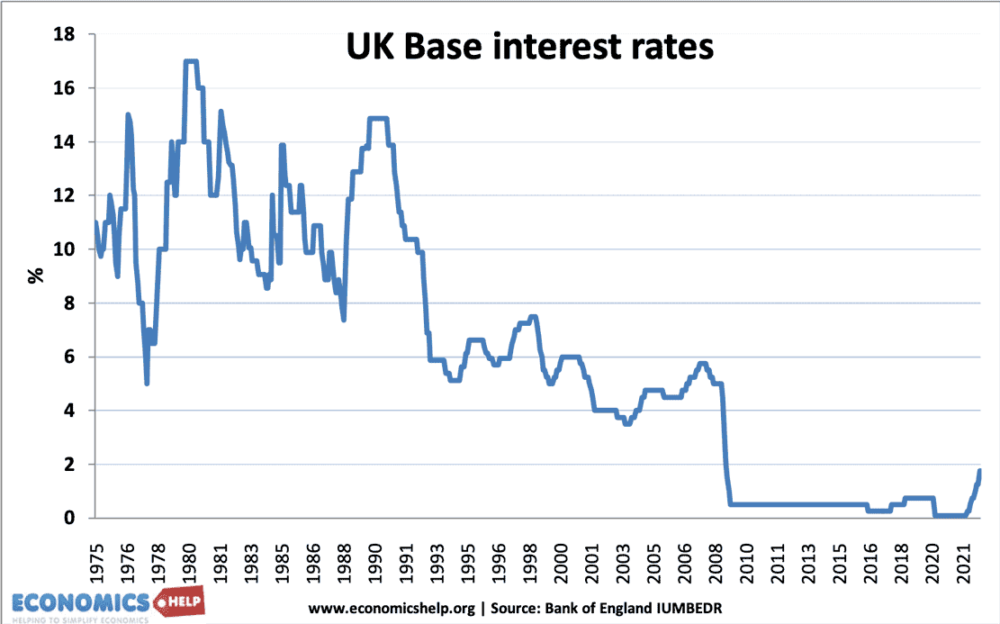

If we look at interest rates, this is the one factor that is changing. For a long-time, households, buy-to-let investors and the economy have gotten used to interest rates close to 0%. This is a real anomaly by historical standards. It means that saving in a bank or in bonds gives a very poor return. (real interest rates have been negative for many years). Therefore, investors with spare savings have a big incentive to buy property. This gives them a real dividend (rentable income) and also the prospect of equity gains from rising house prices. Investing in the housing market has vastly outperformed keeping money in a bank. In the UK, we have seen the proportion of homeowners fall because first-time buyers are being priced out of the market by buy-to-let investors.

Interest rate changes.

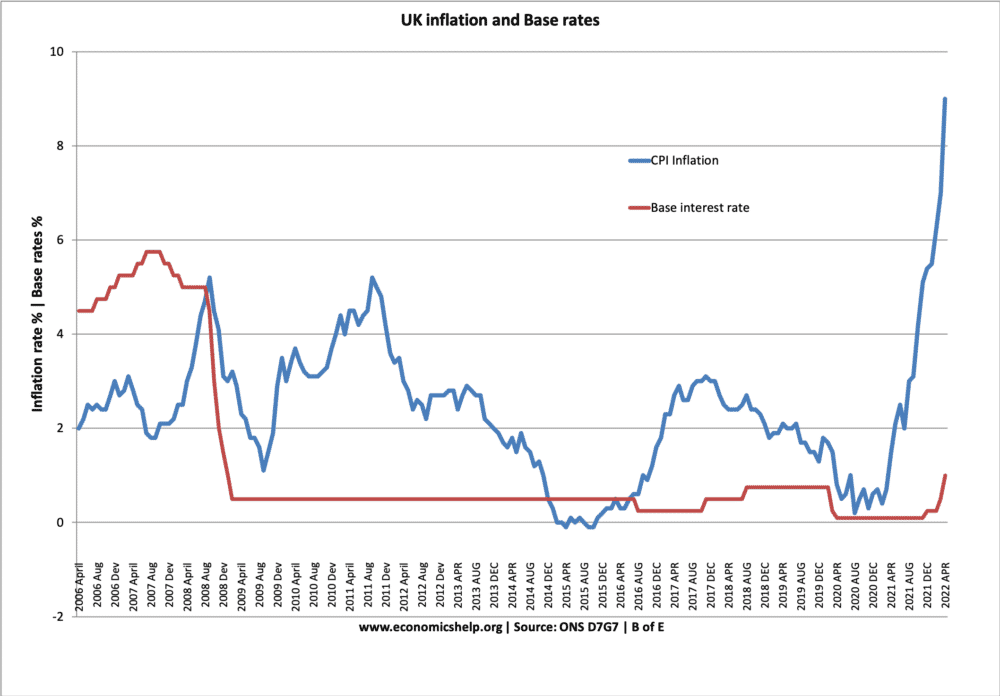

However, this dynamic changes now that interest rates are rising. In the UK, the Bank of England made a stark commitment that they are willing to raise interest rates to tackle high inflation – even if it means causing a recession. For a long time, the Bank has tried to dismiss inflation as temporary, cost-push inflation they hope would fall away (as it did in 2009) But, it hasn’t and forecasts for inflation are that it could keep rising in the winter as oil and gas prices continue to rise. The Bank predict inflation of 13% in winter, and some economists warn this may be too optimistic if Russia cuts of gas supplies and causes a potentially devastating rise in gas prices.

The interest rates of 0.5% are historically low, and with an inflation forecast of 13%, rates could have a long way to go up.

To bring inflation under control, the Bank may have to increase interest rates quite significantly.

Increasing interest rates will increase the cost of mortgage payments and reduce the affordability of owning a home. Combined with the current cost of living crisis (high inflation, energy prices) this may push many hard-pressed households into difficulties meeting mortgage payments. This may cause some households to sell. But, more significantly, higher interest rates reduce the desirability of buy to let as the return from buying on a mortgage will fall. Already, UK house prices have started to fall in July 2022 – a significant turning point. And given the ratio of house price to income is at a record low, it is time for a correction.

Recession

The rise in interest rates will cause lower demand for buying a home. But, other factors will reduce demand too. Firstly there is the unprecedented cost of living crisis with real wages falling by 2% – their biggest drop in two decades.

In every major recession – 1980, 1991/21 and 2008, we saw a rapid fall in house prices. A recession in 2022/23 would see another fall in house prices. This is due to the combination of higher interest rates, lower incomes and also negative confidence.

Also, we shouldn’t underestimate the role of market sentiment in the housing market. The past two decades have mostly been very optimistic (with exception of 2009/10) But, the dark clouds over the global economy and the stagflation we are experiencing will cause this market sentiment to change. As prices start to fall, buy to let investors may look to cash in on their equity gains and sell before prices fall further.

Houses will remain expensive

Despite many good reasons for a fall in house prices, we shouldn’t get carried away in expecting a complete collapse.

The lack of supply is not going to change. Renting will remain quite expensive and so buying a house will always be attractive if people can afford it. House prices will continue to be expensive, but they will still fall from current peaks. A comparison is the housing market in Spain. In the 2000s, there was a property bubble in demand and supply. When the crash hit in 2007, demand fell but also there was a large oversupply, so prices fell up to 50%. In the UK, demand fell in 2007, but there was no surplus of housing, so the fall was more moderate (around 20%).

In a time of high inflation, houses as a physical asset do have an attraction as a way to secure your wealth. The fall in nominal house prices may be quite limited, but with inflation running at close to 10%, even house price falls of 1%, mean real house prices would be falling by 11%.

US housing market

The US housing market has quite a few similarities, though it also has huge geographical differences with coastal cities like New York and San Francisco reporting the highest price to incomes ratios of 9.0. The above graph shows US house prices have risen faster than UK prices since 2011, though this partly reflects the bigger fall in US house prices during the credit crunch.

Another difference is that the US economy is doing slightly better than the UK because

- The dollar is strong than the pound causing a bigger fall in oil and imported prices. (the UK have barely noticed falling oil prices because of the weakness of the Pound)

- The US is insulated from European-wide rises in natural gas.

- The UK is struggling with low productivity and Brexit-related issues.

- The result is that US inflation is likely to fall in the coming months, whereas in the UK, inflation is still set to rise. This will reduce pressure on US to raise interest rates too much.

But, still, there is a similar phenomenon of the Federal Reserve finally increasing interest rates to more normal levels, which will have a similar effect on reducing the incentive to buy a property through borrowing. The poor returns in banks and the bond market are one reason why the US house price to income ratio has accelerated so much in the past year. Also, the rise in house prices in the US in the past two years has been quite dramatic suggesting market sentiment is getting carried away in a similar vein to 2007.

- In 2006, landlords only bought 10% of housing, in 2022, that ratio is 21%. The importance of this is that as the market turns, it is much easier for investors to sell than for families living in them. It shows how the market has been fuelled by buy-to-let. (Forbes)

- Another difference with 2006, is that it is much easier to see what is happening to house prices due to the internet and house price websites. Therefore, as prices fall, it will immediately influence people’s expectations and knowledge of the housing market.

- Having double the landlord purchases should make house prices less sticky on the downside than in 2006 because it’s easier for landlords to sell when prices start falling.

- The US is already experiencing a big fall in home sales with 17.4% fewer homes sold in June 2022 than in June 2021.

Further reading

Dont neglect the effect of government interventions to stimulate demand. Measures such as stamp duty holidays and backstopping the lenders have an impact on demand.

Great blog. A Corinthian Endeavour even 😉

Yes. The solutions have often been a sticking plaster of trying to make buying affordable, which only artificially inflates.