Rising petrol, food and energy prices have pushed many households in the UK and around the world into an unprecedented cost of living crisis. In the UK, in March 2022 the ONS reports that 23% of households found it difficult to pay their monthly bills.

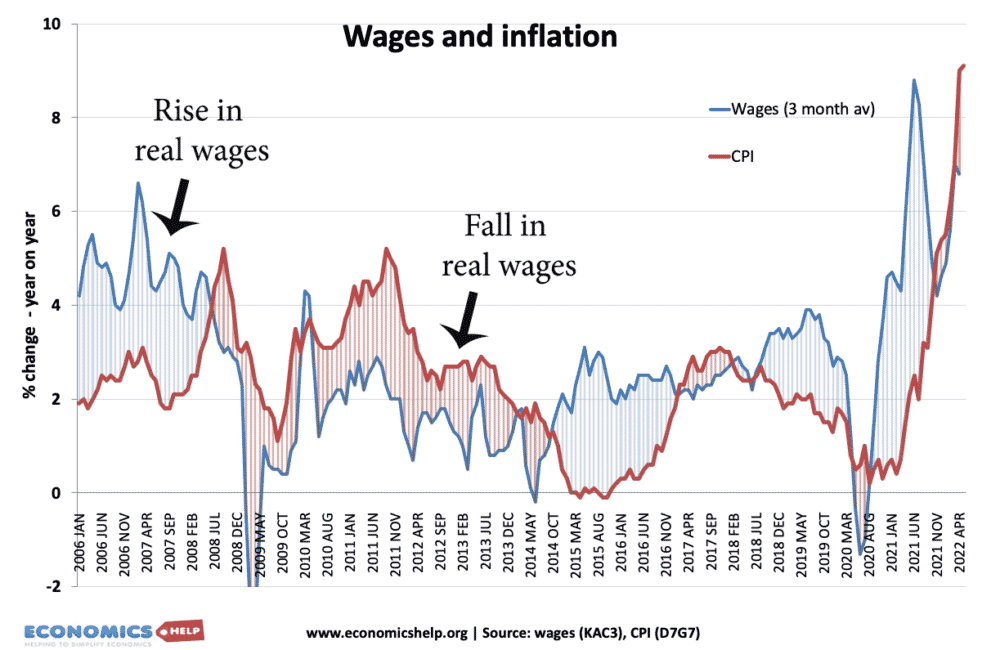

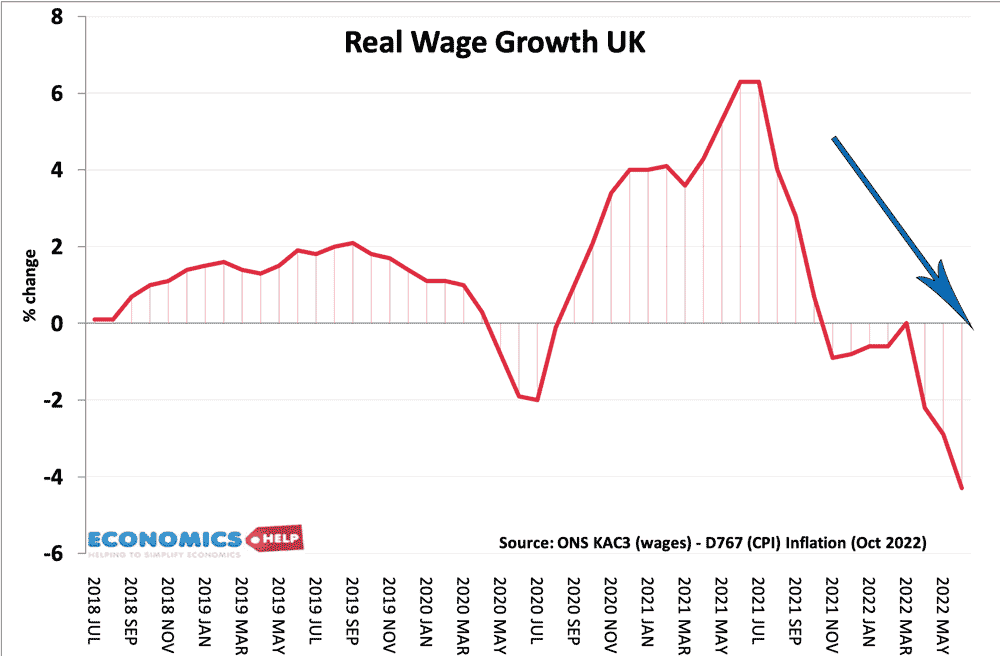

The cost of living crisis is fundamentally caused by higher inflation, and low wage growth Leaving many households worse off in real terms. The crisis has been exacerbated by short-term factors, such as the Ukraine war, but the pressure on living standards has long-term trends, such as low productivity growth and increased market power of firms.

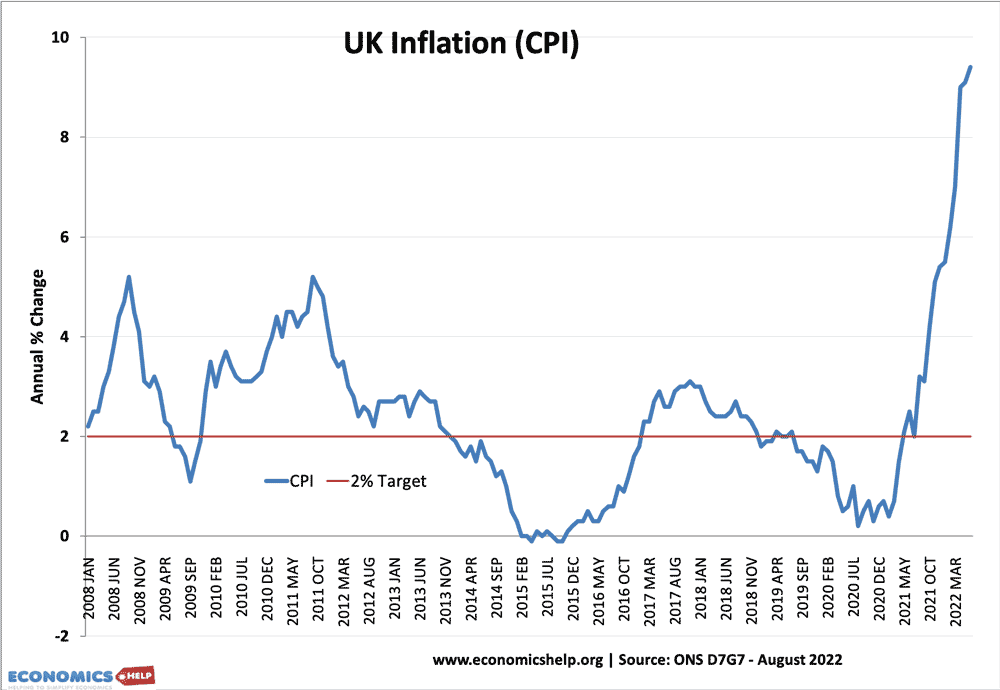

Why inflation of 10%

During the Covid pandemic, inflation fell as households cut back on spending. When restrictions were lifted in 2021, two things happened. Households were free to spend accumulated savings from the pandemic, leading to a significant rise in aggregate demand. But, firms were not ready to deal with the surge in demand. Firms had laid off staff and cut back on investment. Also, there were global supply chain issues, from continued lockdowns in China (e.g. severe shortage of containers) Therefore, when we saw a rise in demand in 2021/22, there were also supply shortages, causing rising prices. The inflation of late 2021 was a combination of excess demand (demand-pull inflation) and cost-push (rising costs).

Russian invasion of Ukraine

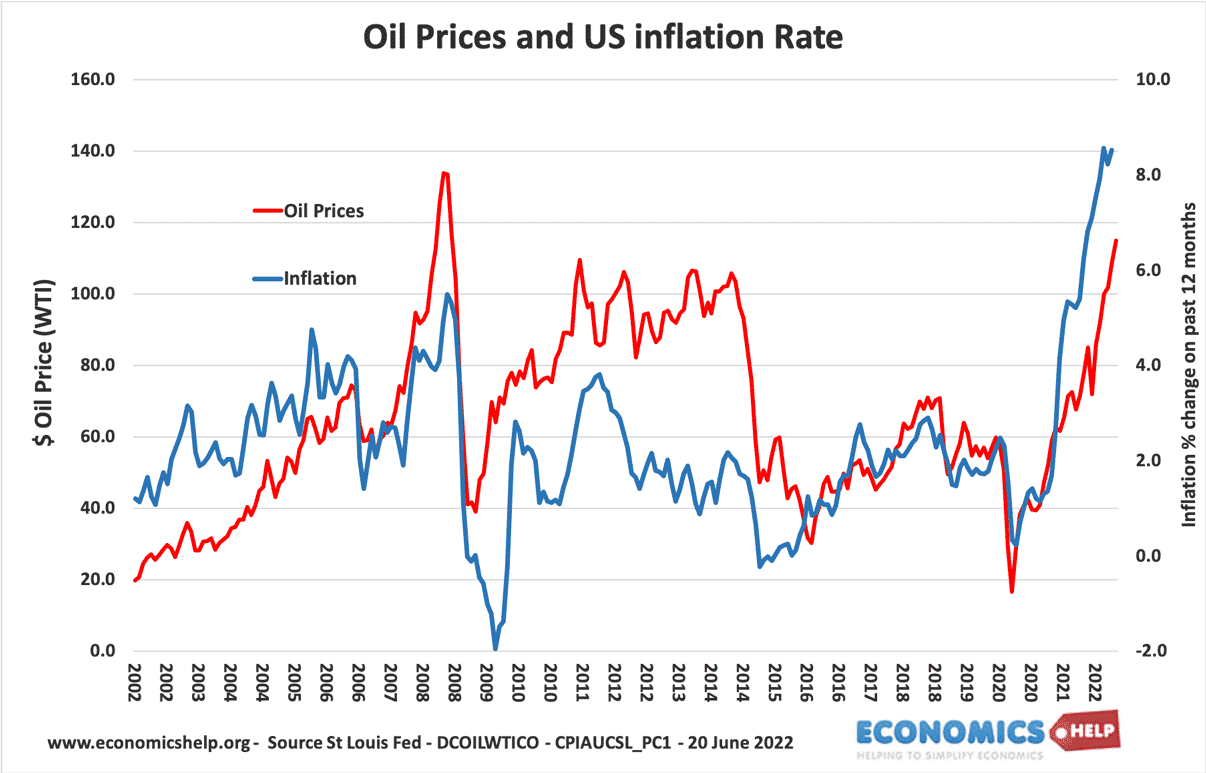

Just as post-Covid supply chain problems were starting to be resolved, the Russian invasion of Ukraine, caused a further supply shock, causing a surge in oil, gas, energy and food prices. It made those initial problems much worse. At the start of wars, the price of oil typically surges as countries seek to buy more, at the same time, supply was restricted because of Russian sanctions.

We can see a strong link between oil prices and inflation. This is a graph for the US, but it is a similar situation in the UK. UK consumers have seen a dramatic increase in petrol prices from 145.6p per litre in Jan 2022, to 195p per litre in July 2022. This was caused, not just by rising oil prices, but also rising profit margins, as petrol retailers have taken advantage of the rising oil prices, to increase their mark-up.

The Russian invasion and blockade of Ukraine has also caused a global shortage of wheat, sunflower oil and maize, causing serious cost-push inflation around the world.

Profit-push inflation

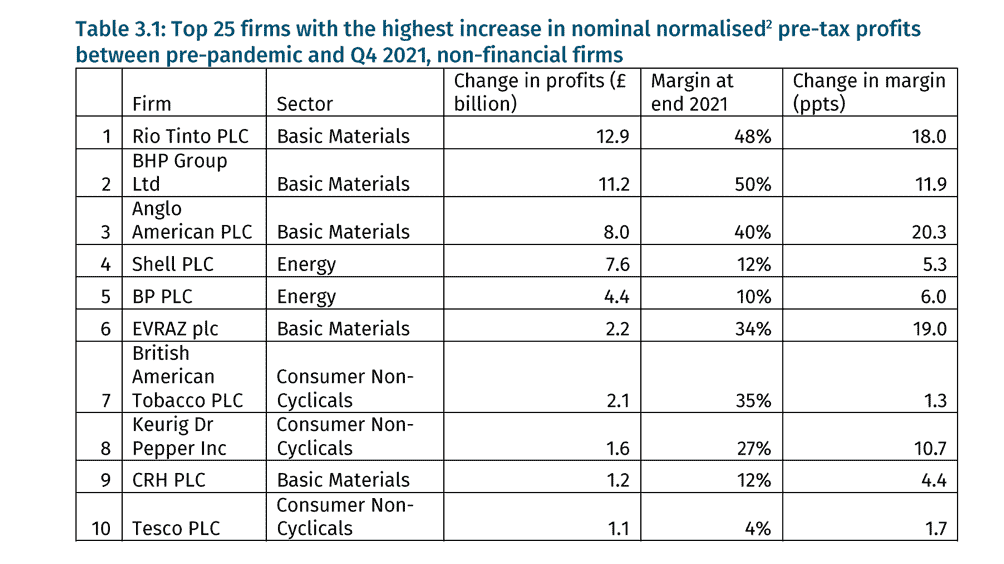

There is an old adage that a period of high inflation is always a good time for firms with market power to increase their profit margins. Research by the IPPR found

“corporate profits in the UK have increased by 34% since the onset of the Covid-19 pandemic, 90% of those increases made by the top 25 multinationals.”

A worrying trend is that in recent decades many markets have seen an increase in market concentration. (therefore less competition) This decrease in competition is matched by a rise in the profitability of many companies. UK’s Competition and Markets Authority (2022) has found that markups (a measure of profitability) in UK companies have increased by 75 per cent over the last two decades. (link)

The result is that profit-push inflation is another factor behind rising prices. It is particularly striking that whilst energy prices rise to record highs for householders, big energy companies like BP and Shell have posted record profits. For example, in the first three months of 2022, BP’s profits more than doubled to $6.2bn (£5bn.)

UK worse off

Inflation is a global phenomenon with high inflation in the US, and Europe (though still low in parts of Asia). However, given the low growth rate, UK inflation is really quite high. This is partly due to the effect of Brexit. In particular, the depreciation in the value of the Pound has had the effect of rising import prices. Also, Brexit has raised the cost of doing business with Europe and contributed to the low productivity growth.

Long-term problems

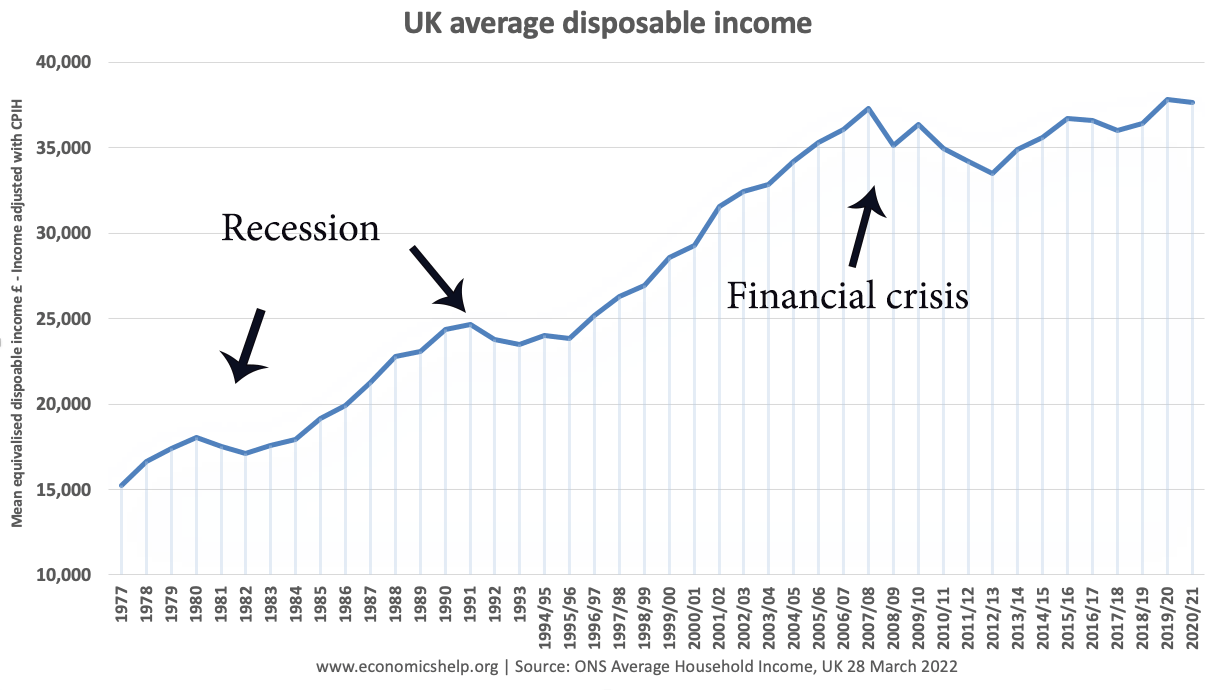

Whilst, the Ukraine war and record 9% inflation (highest since the 1980s) have magnified the cost of living crisis, it is not the sole cause. Ever since the great recession of 2009, the UK has experienced low productivity growth and feeble economic growth.

In this climate of poor productivity, it is very difficult to enable significant growth in real wages and real incomes. The poor productivity has also put pressure on the government’s financial position, requiring a rise in the tax burden to finance public services. Yet, whilst taxes have risen, there remains under-investment in the public sector, and an unwillingness to increase public sector pay and state welfare payments.

At the current state of the economic cycle, with poor economic growth, tax rises (higher NI, freezing of thresholds) have further reduced disposable income, but the chancellor felt they were needed given the large post-Covid deficit.

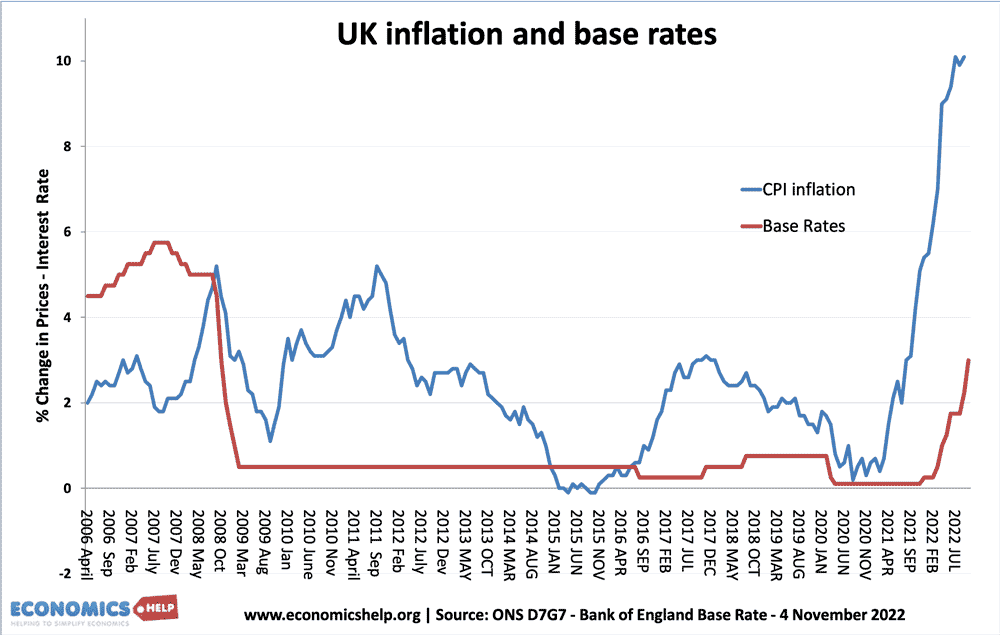

Interest rates

Since 2009, interest rates have been close to zero. A sign of secular stagnation, weak growth and a reluctance for the private sector to invest. Low-interest rates have been used to try and promote economic growth. However, with inflation rising to 10%, Central Banks are starting to increase interest rates. Although they are still low by historical standards, even a small increase in interest rates will have a big effect on borrowers and mortgage owners who have become accustomed to ultra-low rates. Higher interest rates will increasingly have an effect on the cost of living in the coming months.

Inequality

Another issue with the cost of living crisis is that the effect on low-income groups is proportionately greater. The Bank of England reports

“The share of income spent on taxes and such essential spending varies greatly… – for households in the lowest income decile, it accounts for around 90% of their income, relative to around 45% for households in the highest income decile. ” July 2022

The high share of income spent on essentials, means they have much less room for manoeuvre. Also, it is these essential goods, (food, energy, heating) that has seen the biggest increase in prices, meaning the cost of living crisis is having a bigger effect on the most vulnerable.

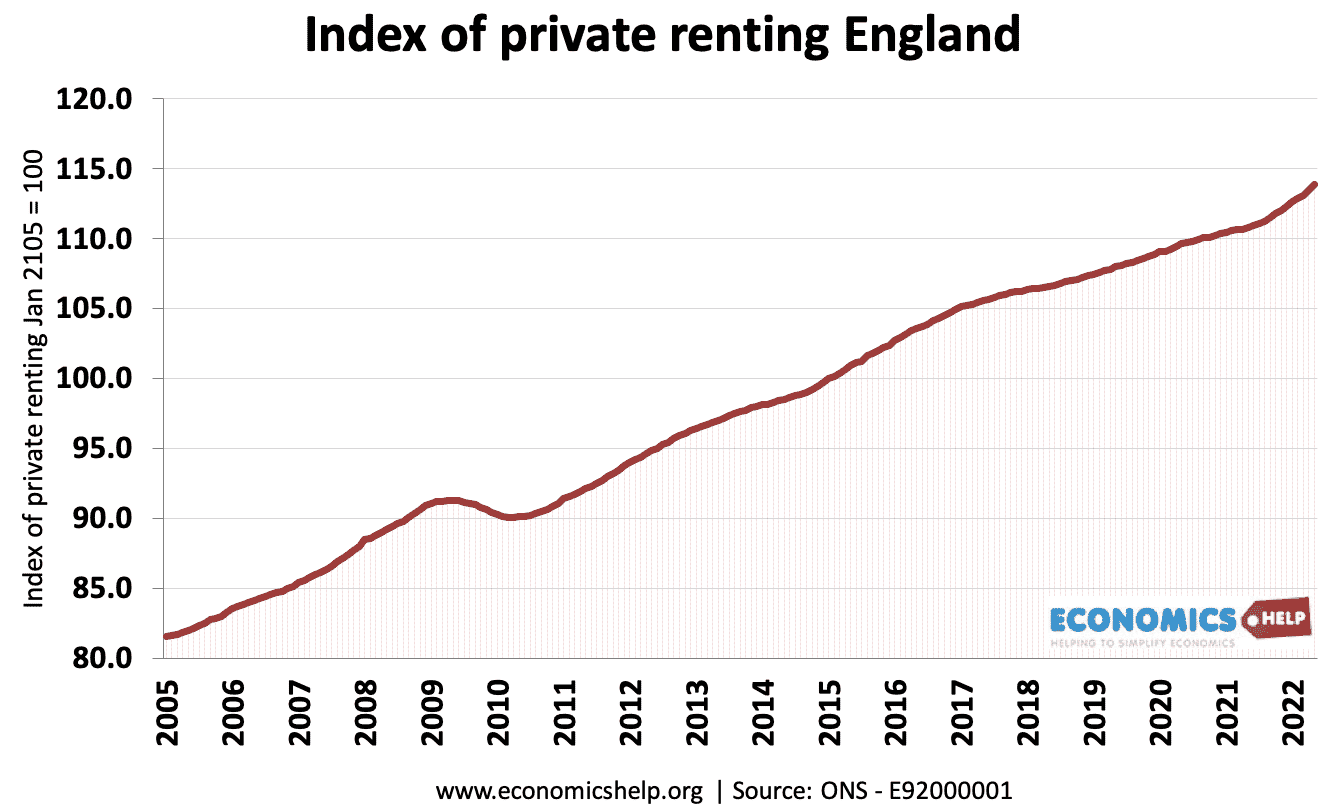

Housing costs

Between 2005 and 2022, the cost of private renting in England has increased nearly 40%

Another long-term structural problem in the UK economy (and others around the world) is the above-inflation rise in house prices and rental prices. Rising house prices have been driven by two main factors. Insufficient supply compared to rising demand, and the environment of ultra-low interest rates, which makes the mortgage costs relatively cheap to buy a house. These two factors have pushed up house prices, meaning first-time buyers face higher mortgage payments as a share of their income. For those unable to get on the property ladder, rents have been rising consistently. The average cost of renting a property in the UK is now £1,060 a month (£1,752 in greater London) statista

Any good news on cost of living Crisis?

- In the past few weeks, oil price rises have gone into reverse. Whilst the geo-political situation is uncertain. There is a long tradition of oil prices rising to great fanfare, then quietly falling. This should feed into lower petrol prices soon. The news on gas prices and electricity is less promising, with energy bills set to soar in Europe this winter.

- Inflation is good for tax revenues. Inflation leads to higher tax revenues and (is a secret way for improving the nation’s finances). Expect big tax cuts in the UK. Although the long-term situation is dire, you can expect a pre-election giveaway.

2021 saw real wage growth as nominal wages rebounded sharply after Covid pandemic. It is unclear whether this real wage growth can return. Recent months have seen more falls in real wages

Further reading

Thank You! This single page has made more sense than anything else I’ve read on the cost of living crisis.

Cheer Laurie

I second what the first post says. It seems Britain will soon be seeing protests to make the Poll Tax riots seem like small fry……oh wait…..your right to protest has already been curtailed by this government.

It is noticeable that profit in basic materials has increased more than in other sectors. If they are largely essential materials and demand is inelastic, a small restriction on supply will lead to large increases in prices and so also to profits…total revenue may increase significantly as (variable) costs decrease. Is that “profit push” or supply shortage, a form of cost-push, inflation? (Increased scarcity increases opportunity cost).

This is a very good and clear analysis. Thank you.

Thank you – this has helped me a lot. Coherent and understandable!

quite an expaination