Bottlenecks refer to the situation where firms are unable to meet demand because of delays, shortages and lack of spare capacity. Bottlenecks can occur from a spike in demand or disruptions to supply. They can lead to higher prices, inflation, shortages of goods and even lower economic growth.

For many years, we have grown accustomed to very efficient supply chains, which led to a wide range of goods seemingly effortlessly transported across the globe to meet consumer demand. It is one of those things that when working well, we don’t notice but take for granted. The invisible hand of the market was doing its job, but in recent months a range of external factors have tested the reliability of global supply chains.

Causes of supply bottlenecks in 2021/22

- Covid lockdowns causing falls in manufacturing and shipping. Governmental response to Covid has often led to lockdowns where normal economic activity is disrupted and factories closed. This was especially an issue in China, with many large manufacturing bases being closed. Even into 2022, China is still using economic lockdowns to deal with a resurgence in Covid cases. This means the usual production of electronics and goods is delayed, leading to long lead times for production.

- Demand surge. During the pandemic, many consumers cut back on spending and accumulated savings as they worked from home. When the pandemic ended there was a surge in demand, especially for durable goods such as electronics. However, the same goods in demand were in shortage of supply. The IMF estimate that global demand outpaced global supply fell between 0.5 and 1.0 percentage points in 2021.

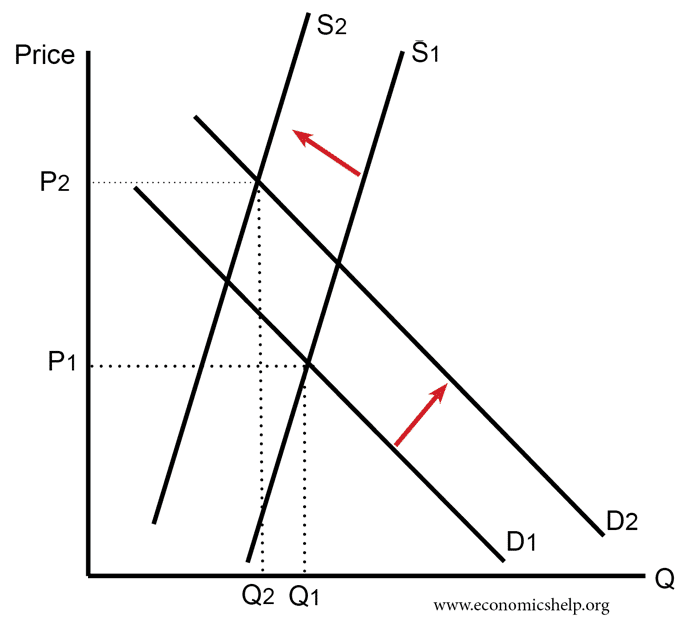

- Supply is inelastic in the short-term. The difficulty is that temporary rises in price and demand cannot necessarily translate into increased supply. Supply is not perfectly elastic, especially when manufacturing firms have bottlenecks themselves.

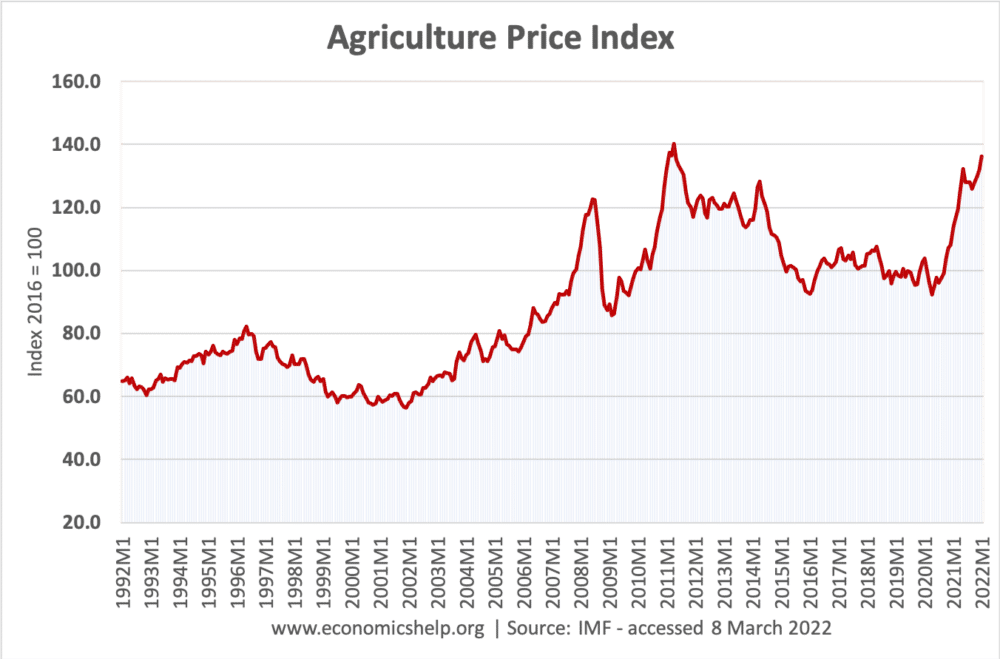

- Rise in price of commodities. The rise in demand for finished goods has also put upward pressure on demand for commodities. A range of commodities from food to fuel has seen higher prices. This rise in input prices has put further pressure on final consumer prices. The rise in fuel prices post-covid has been further exacerbated by the war in Ukraine which threatens to limit the supply of oil and gas from Russia and neighbouring countries.

Impact of bottlenecks

Higher prices

With demand outstripping supply, we have seen prices pushed upwards, contributing to a global uptick in inflation.

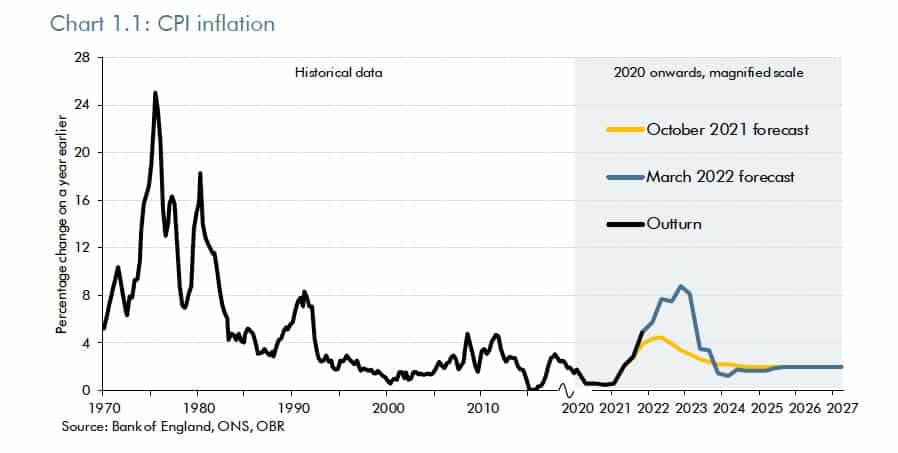

For example, due primarily due to supply bottlenecks, inflation in the US has hit 7.5% (January 2022). The UK is experiencing high inflation and is forecast to peak at over 8% by the end of the year.

High inflation is not just an issue for advanced economies, inflation is accelerating across the globe.

Delays and rationing of goods. The bottlenecks have been particularly felt in shipping, which has proved quite inelastic in responding to increased demand. Before the Covid pandemic, it took 55 days to ship freight from China to Europe. By March 2022, this had increased to 110 days. For firms who rely on ‘just in time’ management, this increased delay has meant they are unable to fulfil orders. Retailers of bikes, cars, furniture and electronics are unable to meet consumer demand and consumers are having to wait many months to get their products. For example, many bicycle retailers are reporting a 365 day wait for an ordered bike to arrive. Even when firms can arrange to ship, the costs have risen up to sixfold. Very few industries have been unaffected by supply bottlenecks. Often it is just a few key components that cause production to be halted. With automobile production, it is the bottleneck of electronic systems which have held firms back. In the bicycle industry, firms can produce their own frames, but components such as gears, are heavily reliant on one firm, Shimano based in Japan.

Higher food prices

Whilst electronic goods are not necessities, food prices have increased for related reasons – higher input costs, and supply constraints. This is likely to have more effect on causing poverty, especially in the developing world.

For example, see: Impact of higher wheat prices

Monetary policy and interest rates

The cost-push inflation we are seeing is difficult to deal with. The only real option to reduce inflation is for Central Banks to change monetary policy. For example, Central Banks could increase interest rates to slow down the economy and reduce demand. However, this is a difficult balancing act because higher interest rates could easily cause a marked slowdown in growth that turns into a recession. Part of the inflation is strong demand, but a bigger part is cost-push factors. Therefore, this means the Central Banks have a difficult job. They want to reduce inflation, but not at the expense of creating a recession and the corresponding rise in unemployment.

Nevertheless, interest rates are likely to rise in 2022. For example, experts predict US interest rates of 2% by spring 2023. But, these interest rates will still be low by historical standards.

Impact of inflation

The cost-push inflation is likely to have serious adverse consequences – especially for those savers and workers not protected by high-interest rates and rising nominal wages. If interest rates only rise to 2%, and we see inflation peak at around 8%, that will lead to a fall in the real value of nominal assets. This can lead to redistribution from savers to borrowers. (see inflation tax) Pensioners and workers who are unable to get index-linked benefits and wages will also experience a fall in real income.

Will inflation expectations become embedded

The big question about the surge in inflation is whether it will prove temporary or lead to prolonged higher inflation like in the 1970s and early 1980s. At the moment, medium-term inflationary expectations are still low, with workers and firms expecting inflation to fall back in 2023. But, if workers get used to inflation, they may become in a position to demand contracts that have higher nominal wage growth and this will lead to rising inflation expectations and the ‘temporary’ inflation will become more permanent. In this scenario, it will prove more difficult to reduce inflation in the future. At the moment, the most likely scenario is inflation will fall because we are not yet seeing the wage push pressures of the 1970s and early 80s.

Relocation of supply

The supply side shock of 2021/22 plus the geopolitical events of Russia’s shocking invasion of Ukraine will make many businesses re-evaluate their long-term plans. The crisis shows the difficulty of relying on supply chains from across the world that may not share the same political values. Europe will seek to divest from Russian energy. But already there are signs that western companies are becoming more reluctant to commit to long-term investment in China. If China is more unreliable than we thought, do firms want to risk being caught out like they were with Russian sanctions?

Further reading