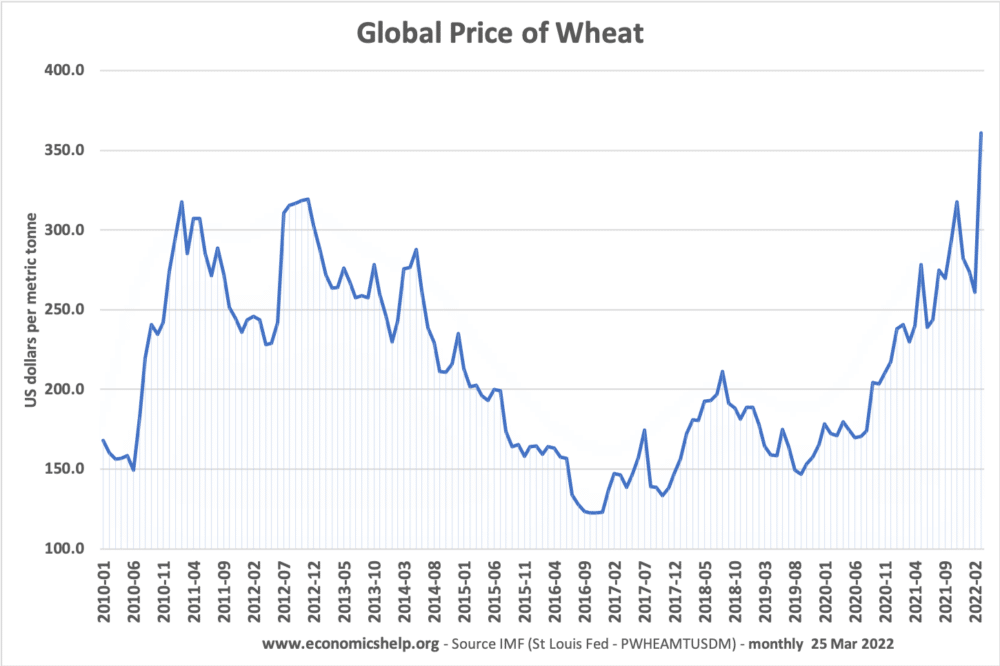

Higher wheat prices will have a significant impact on raising food prices and reducing living standards; it is feared it could cause widespread poverty and social unrest. The impact of higher wheat prices will be felt disproportionately by low-income consumers and major wheat importing countries, such as Egypt and Nigeria. This is because consumers on low income will spend a higher percentage of their income on food than higher-income consumers.

How much do higher wheat prices affect food prices?

Higher wheat prices will lead to higher prices of food in the shops. A variety of foods, such as bread, pasta, pastries and pizzas will all have higher costs of production and retailers will increase the price. The amount of the prices rises will depend upon how important wheat is to the final price and whether retailers and suppliers have stocks and future contracts to smooth out cost fluctuations. For example, a big pasta manufacturer may have developed large stocks of wheat and so a temporary rise in prices may not have an immediate effect on pasta prices. But, if the price rise is prolonged, they will need to pay more to buy future stocks and prices will invariably rise over the longer term.

A future contract is where buyers agree to buy wheat at a fixed price in the future. However, if the price rise is sustained then all future contracts will rise in price.

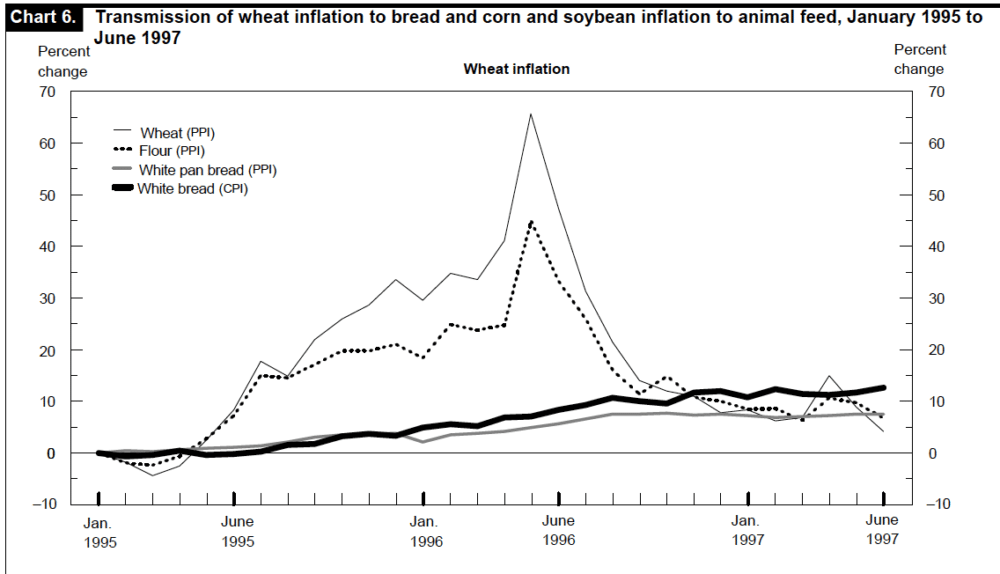

This is research from the Grain Price Shock of 1996. The actual inflation rate for wheat reached 65% in June 1996. At the time, white bread was rising by around 8%. Inflation for bread continued to rise until a year later, peaking at 12%. This shows that the price of bread will increase by a smaller percentage than the raw ingredient of wheat but also there is a delayed reaction. Food producers try to absorb some of the raw material costs until later. But, the spike in wheat prices had an effect for a couple of years.

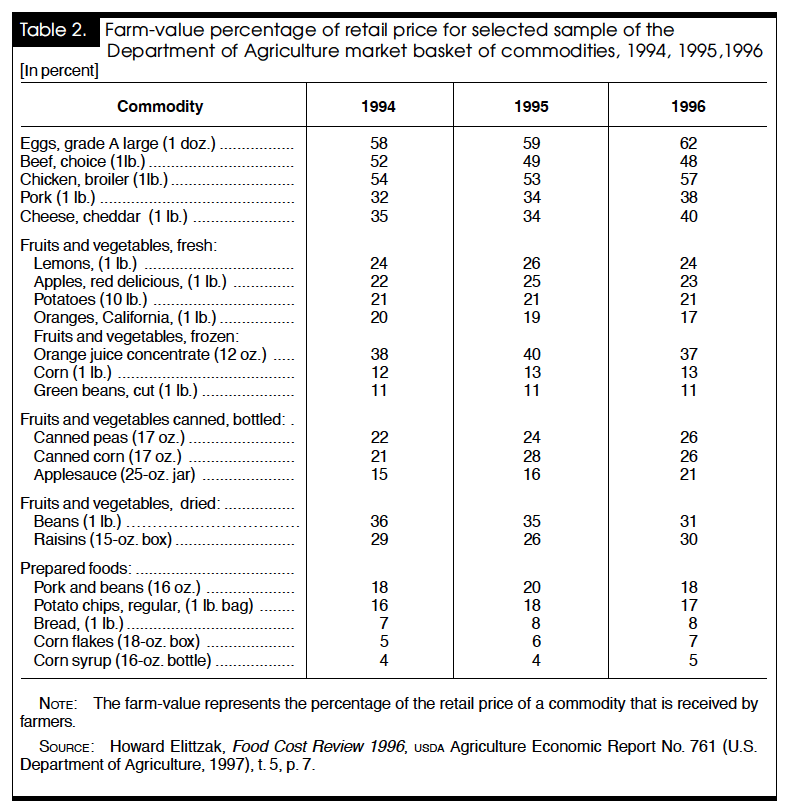

What percentage of the retail price is determined by raw material prices?

Monthly Labor Review August 1998.

This data shows the percentage of the retail price that is received by farmers. The highest ratio is eggs. With farmers receiving 62% of the final price. But, for a good like bread, farmers receive only 8% from the sale of raw materials. The rest of the price is composed of other costs, such as transport, baking, labour e.t.c. Therefore, this will explain why a rise in wheat prices will lead to a smaller percentage rise in bread prices.

Impact on growers and long-term supply

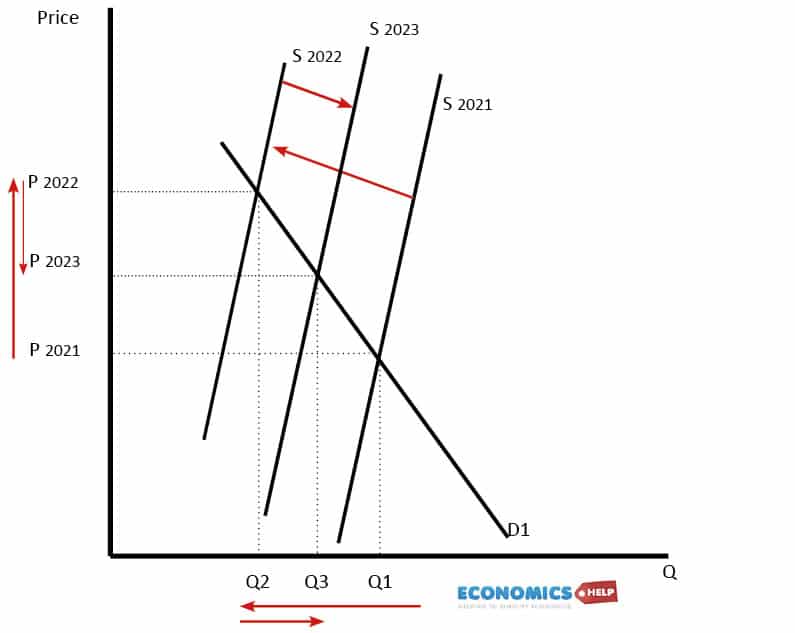

Farmers will be constantly looking at crop prices and deciding what to grow. If wheat prices rise relative to other food crops, then farmers around the world will respond by sowing more wheat and increasing their wheat supply. Wheat can be sown twice a year – autumn crop for spring harvest and spring crop for summer/autumn harvest. In response to higher prices of wheat in spring 2022 (due to oil prices and the Ukraine crisis) farmers around the world will be planting more wheat in response to the current crisis and in anticipation of higher prices.

In 2022, the supply of wheat falls, leading to a price rise from P 2021 to P 2022. But, this higher price acts as an incentive for farmers to grow more wheat; and so in 2023 (or earlier) the supply of wheat increases and the market price falls from P 2022 to P 2023. However, it is important to note the price of wheat does not just depend on the amount of wheat grown. 2021 saw record harvests of wheat and food, but the costs of production were rising because of higher oil prices – increasing cost of fertilisers and transport.

Because wheat can be grown in many countries around the world, there will be a significant response to a crisis or draught in one country. For example, Indian farmers may decide to grow more wheat than they traditionally would – reducing India’s demand for wheat imports. The main difficulty will be for countries, such as Egypt which does not have a good climate for the optimal growing of wheat. They will continue to rely on wheat imports and will face higher prices.

Impact of wheat prices on the global poor

In the west, a lot of attention is placed on oil prices as the world’s largest traded commodity. But, for lower-income countries, food prices are more important for determining poverty, malnutrition and even political stability.

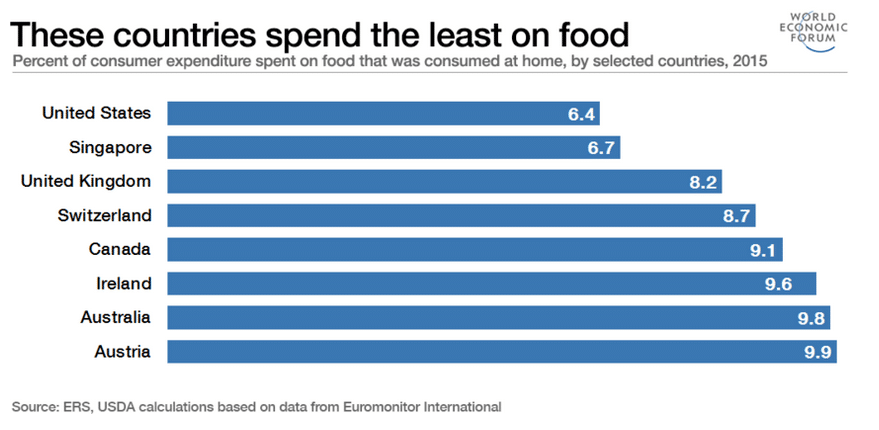

The percentage of household income that is spent on food varies from 6.4% in the United States to 56.4% in Nigeria. The implication is that any food price inflation will have a much bigger impact in Nigeria than in the US. Higher food prices combined with stagnant wages can mean consumers are unable to buy sufficient food. Rising food prices in 2011 were significant factors behind the political upheavals of 2011 in Libya and Egypt. Even in the US inequality can mean that some of the poorest households spend up to 40% of their household budget on food.

Further reading