Wheat is the fifth most commonly traded commodity after oil, coffee, gas and gold. It accounts for approximately 21% of the world’s food and the gross world trade in wheat is greater than all other crops combined. Wheat is a key ingredient of bread, flour, and pasta, and is also used in the production of whiskey and beer.

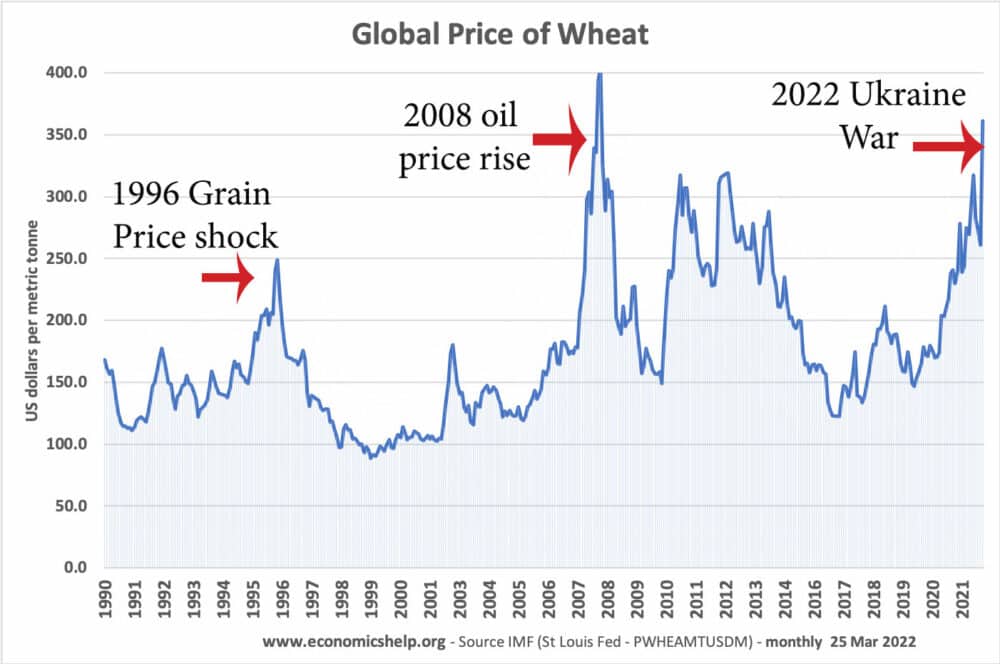

Source: St Louis Fed (recent months, market data)

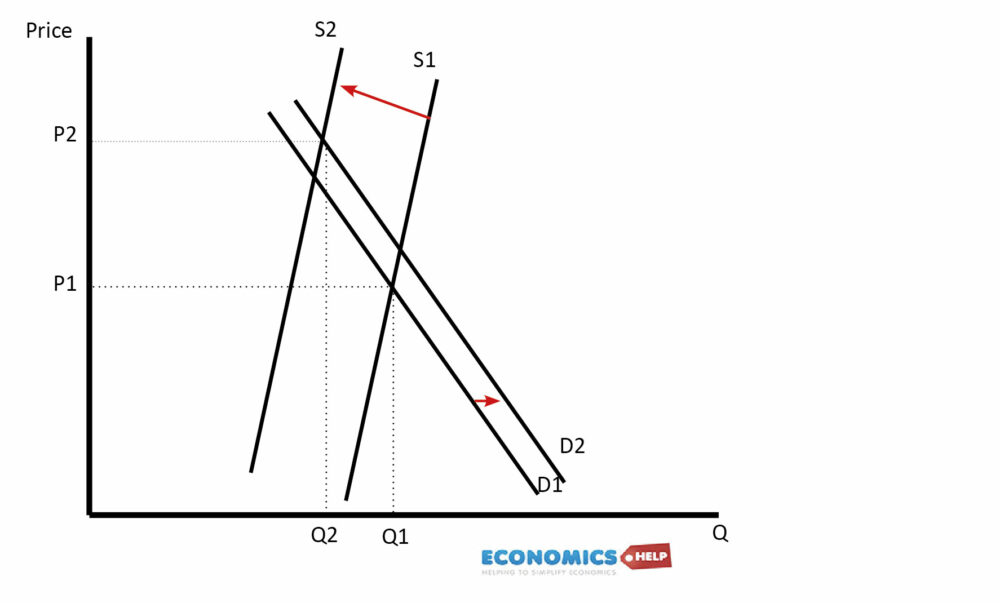

The price of wheat is determined by supply and demand factors, in particular the price of oil, global population, income growth, price of substitutes and climate factors affecting the supply.

In recent months, the conflict in Ukraine (which produces around 10% of the global supply) has pushed up wheat prices and prices could continue to rise due to the negative effect on supply surrounding the conflict.

Main factors affecting wheat prices

Supply side factors

1. Oil prices

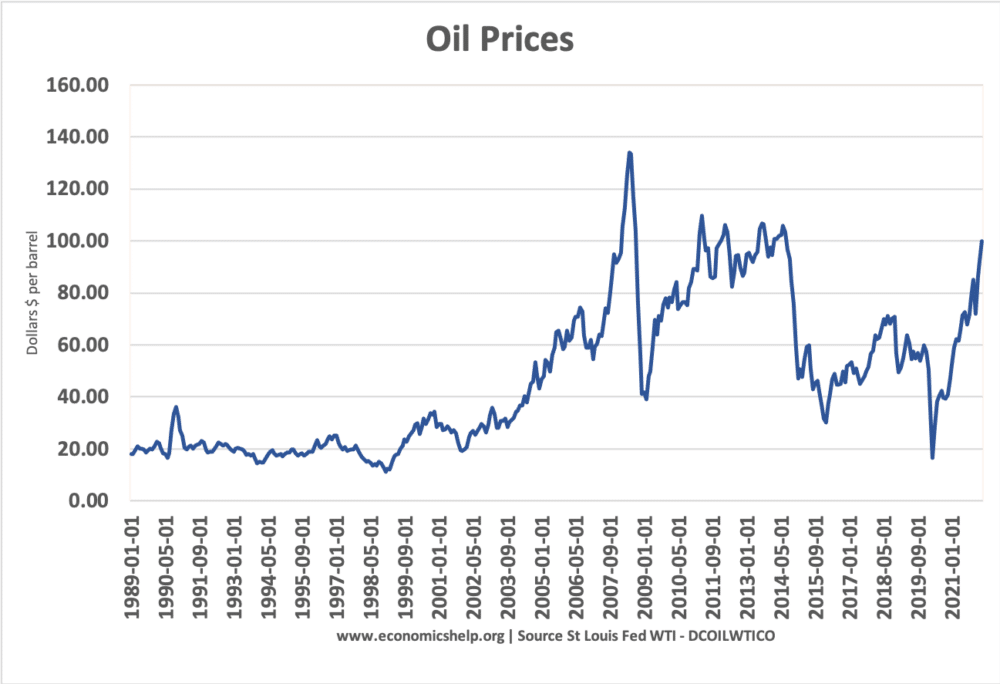

There is a close link between oil prices and wheat prices for two reasons. Firstly, oil is an important input cost. Higher oil prices will increase the cost of farmers using machinery like tractors. Higher energy prices increase the cost of making fertilizers – which use substantial energy to make. It will also directly affect the cost of transporting wheat around the world. The lowest wheat price in 1998 was also the lowest oil price. The peaks in oil prices in 2008 and 2011 were also related to higher wheat prices.

A second link is due to the demand for biofuels. When oil prices rise, there is greater demand for growing crops for biofuels such as corn, rapeseed and soybeans. This switch to biofuel crops will limit the supply of wheat for food and this fall in supply will push up prices.

2. Productivity of land

In the post-war period, the supply of wheat grew significantly partly because more land was used for growing wheat but primarily because of the increased productivity of farmers. This comes from the use of fertilizers and pesticides which can increase yields. Also, increased centralisation of farms can lead to economies of scale with farmers growing wheat on a much larger scale than previously. A key factor is how much more productivity growth farmers will be able to get in the future. There is the possibility for new innovations (such as controversial GM crops) to increase supply, but also climate factors and loss of soil fertility could cause supply problems in the future.

3. Climate factors

Wheat is a crop that depends on favourable weather conditions. It is one of the most versatile crops being able to grow in a wide variety of locations, but still extremes of weather, such as excess heat, cold and lack of rain, will cause a fall in supply as farmers see diminished crops. For example, in 1996, we see a spike in wheat prices which was related to bad weather, especially in the American mid-west. A bad winter and drought led to damaged crops, causing a fall in production and a rise in price. The rise in price was exacerbated by bigger falls in corn production and strong foreign demand.

4. Geo-political factors

The Russian invasion of Ukraine 2022 will have a major impact on the supply of wheat because Ukraine, Russia and other former countries of the Soviet Union are major producers. In 2019, 8.9% of the world’s wheat exports were grown in Ukraine, 14% in Russia – meaning nearly a quarter of world exports come from the two countries (Our World in Data). The conflict in Ukraine has disrupted supply and sanctions on Russia also affect the supply they will put on the world market.

5. How much wheat is planted?

Farmers have a choice of crops to plant. If farmers expect high prices of wheat, this will encourage more planting now and greater supply next year. If farmers expect low prices, they will cut back production and in the next year, supply could be less. Therefore, farmers can respond to market signals, but there is a delay of one growing season. This explains why supply can be relatively inelastic in the very short term (though some wheat can be stored to act as a buffer) The cobweb theory suggests the price of commodities can be unstable because of delay in reacting to market signals.

6. Government intervention

Because wheat is such a sensitive commodity, especially in developing economies where it greatly affects living standards, governments may intervene to affect the price. The government may subsidise the wheat price to enable food to remain affordable. However, artificially lowering the price will cause a further rise in demand and put more pressure on global prices. Alternatively, the government may impose tariffs on the import of wheat of finished wheat products like pasta. This will make wheat more expensive in countries with higher tariffs.

Demand side factors

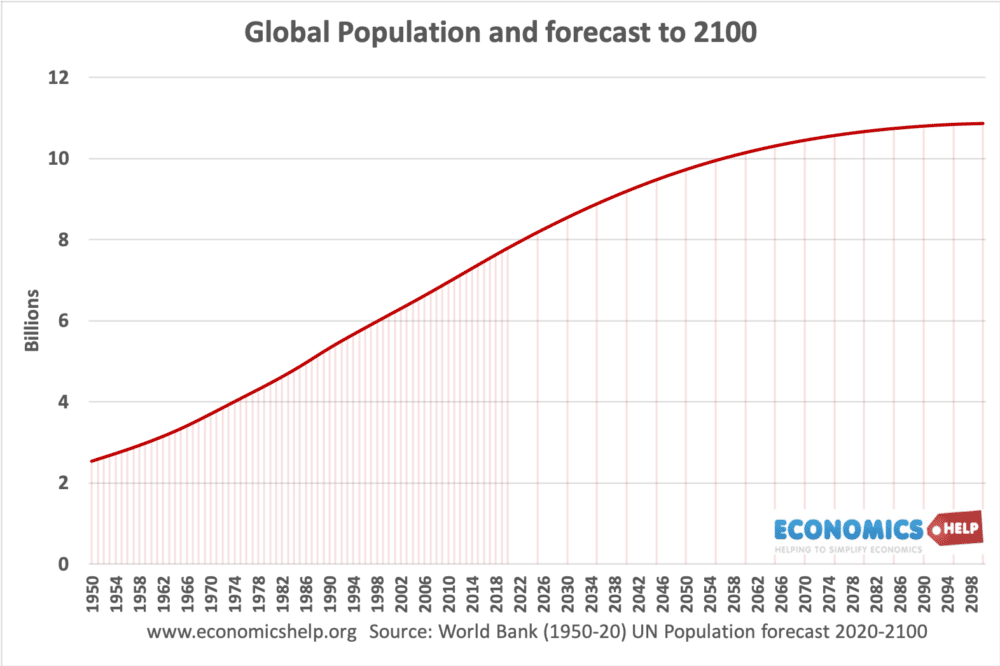

1. Population growth

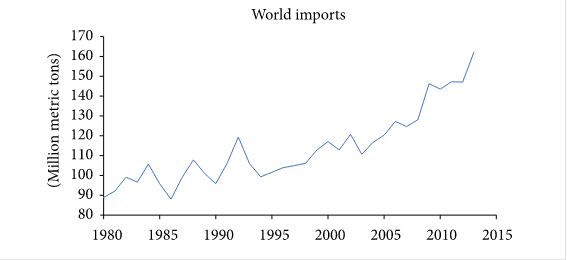

A growing world population will lead to higher demand for wheat. There is a strong link between population growth and rising demand for wheat with average demand for wheat growing 1.6% annually between 1980-2010.

2. Income growth in developing world

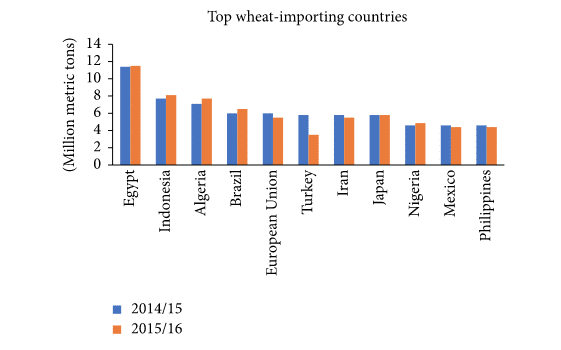

Higher economic growth, especially in the developing world is a key factor pushing up the demand for wheat. The biggest importers of wheat are in Africa and South East Asia

Source: USDA, Foreign Agricultural Service, June 2015, via Doi.org

Rise in world imports of wheat show the growing global demand.

A rise in income can also lead to higher meat and dairy production (these foods tend to be income elastic). This can indirectly increase the price of wheat as it is grown for use in animal feeds rather than selling for human consumption.

3. Substitution effect

Wheat has several fairly close substitutes. As an alternative source of carbohydrates, consumers can purchase rice, corn, soy and rye. If these crops increase in price, then the demand for wheat will rise too, causing higher prices. If general food prices fall, this will reduce the pressure on demand for wheat so prices will fall too.

4. Value of US Dollar

The wheat price is dominated in dollars. Therefore a rise in the US dollar will increase the price that other countries will have to effectively pay for wheat. For example, if the Egyptian currency fell sharply against the dollar, the effective price Egyptians have to pay will rise because of the higher costs of buying wheat in dollars.

5. Speculation

Wheat prices can be affected by investor speculation. If investors feel the wheat price is likely to increase, they may buy wheat now and store it – in anticipation of rising prices. The large rise in wheat prices 2010-12, is partly attributed to investor speculation.

Further reading