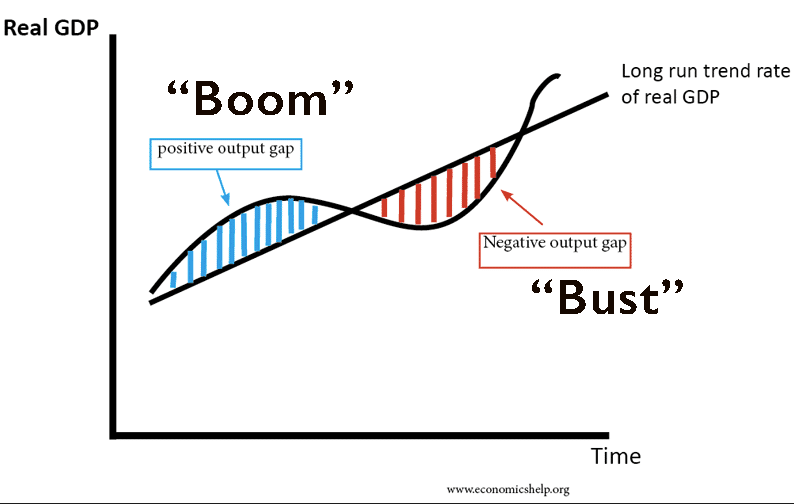

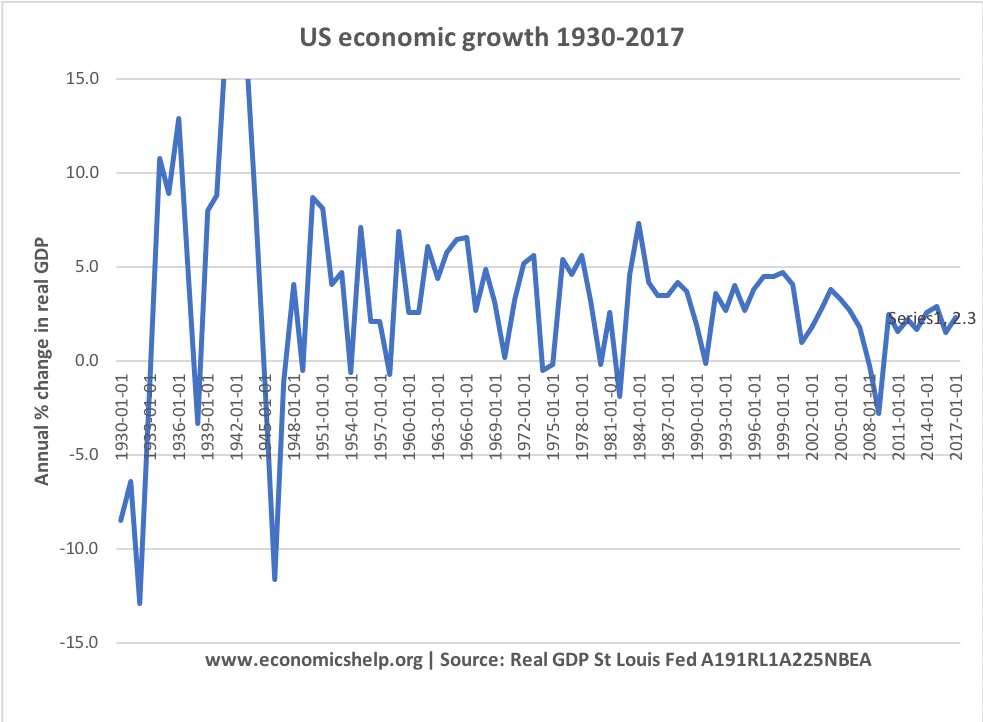

The economic cycle plays an important role in macroeconomics. Typically every 8-10 years, there is a recession (fall in output) or at least an economic downturn. Recessions tend to last for between six months and up to 2 or 3 years. But, even the deepest recession tends to end and the economy returns to a period of economic growth. However, there are time periods where the economic cycle seem to be less visible and economic growth seems to be more stable.

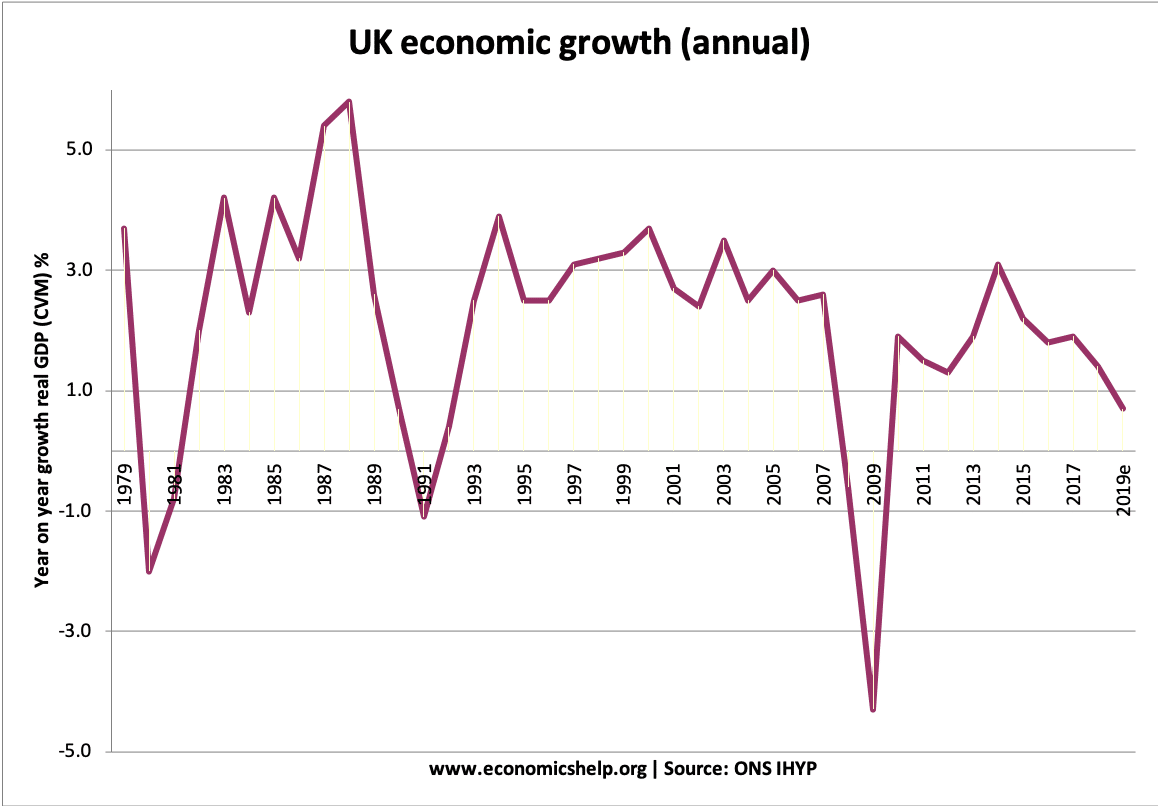

Evidence of boom and bust economic cycle

At various times, the economic cycle has been heightened by what is known as ‘boom and bust’ This refers to a period of rapid economic growth – usually associated with rising inflation. During this period of growth, unemployment falls. However, this growth usually proves to be unsustainable and when the economy runs out of steam, the high growth can turn quickly into a slowdown and then recession.

In the UK, economic activity has had a history of boom and bust economic cycles. Periods of high growth followed by a downturn or recession. For example, we had recessions in 1974, 1981, 1991.

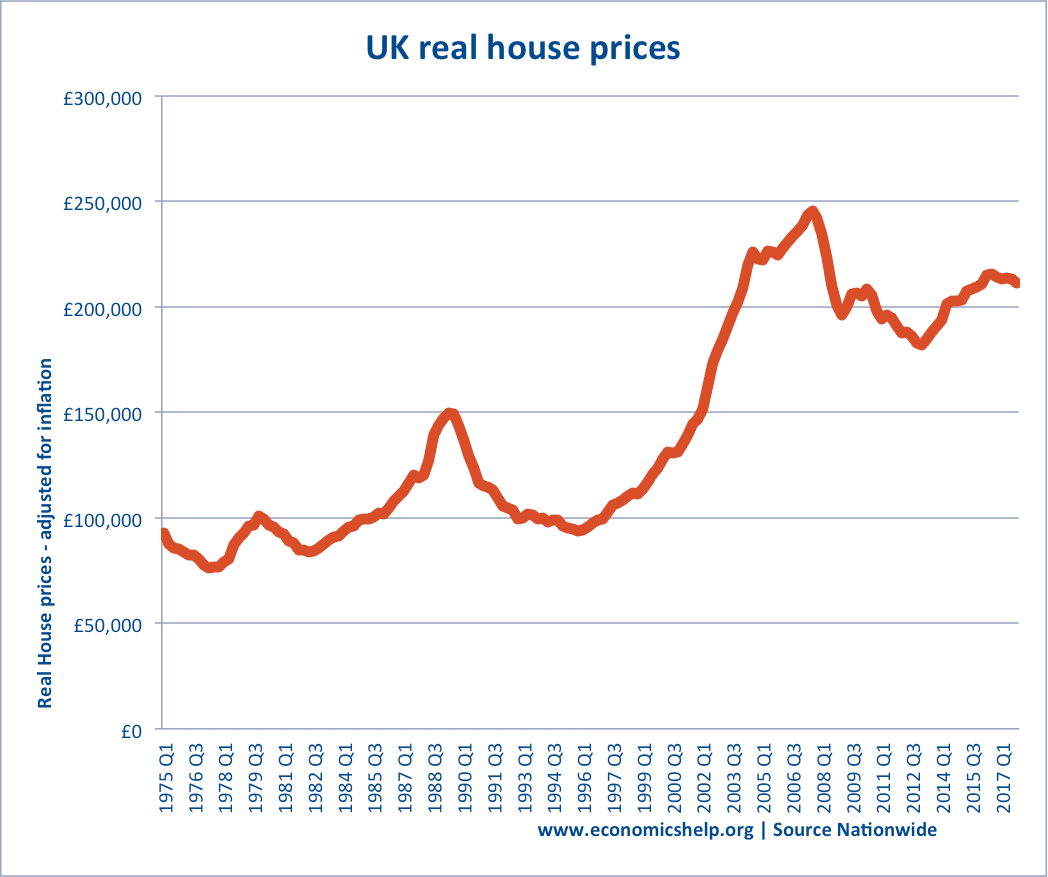

After the 1991 recession, we experienced a long period of economic expansion in which many hoped that the boom and bust cycle had been broken. From 1991 to 2007, we had a period of steady economic growth and low inflation. However, this apparent stability masked a boom and bust in house prices and credit. The credit boom and subsequent crunch caused the current recession and showed the economy is still subject to certain cyclical patterns.

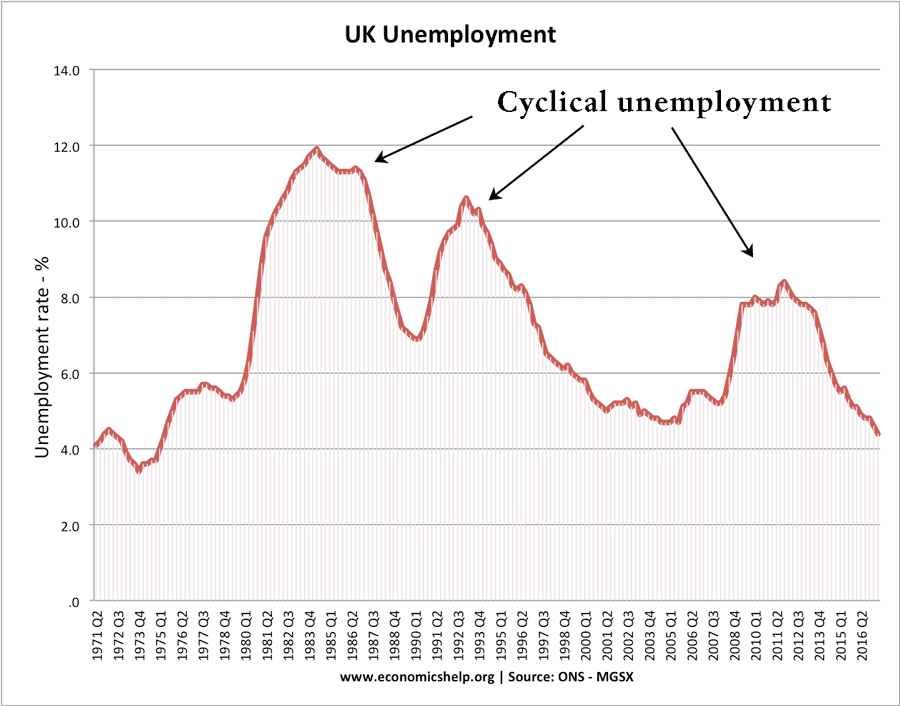

Cyclical unemployment

Unemployment is one factor that is closely related to the macro-economic cycle. During a period of high growth, firms will employ more workers, leading to lower unemployment. However, as soon as the economy slows down and enters recession, firms will cut back on hiring workers and lay people off. This will lead to a rise in cyclical (or demand-deficient) unemployment.

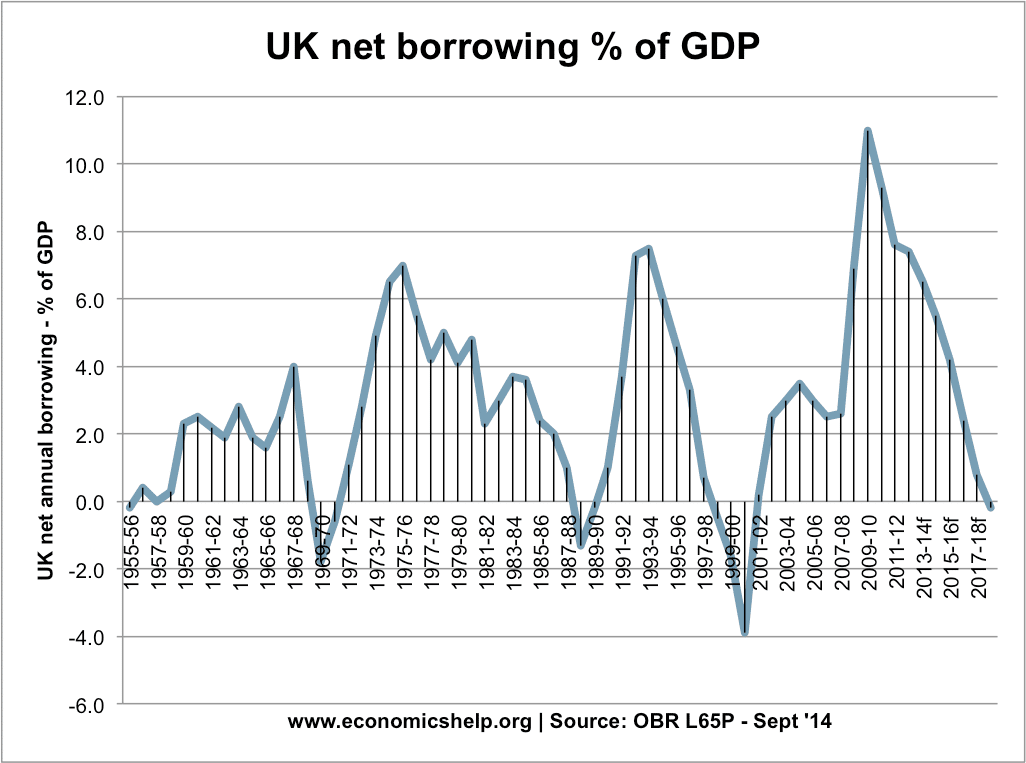

Cyclical government borrowing

During a period of high growth, tax receipts rise and spending on welfare benefits fall. This tends to cause an improvement in government finance. But, should the economy enter a recession, government borrowing will tend to rise.

Cyclical current account

For an economy like the UK and US, which is a net importer of consumer goods, the current account on the balance of payments often exhibits a cyclical behaviour. During a period of high growth, spending on imports increases causing a deterioration in the current account. During a recession, import spending falls and the current account improves.

Asset prices

Assets such as housing also have cycles, which often mirror the economic cycle. During a period of growth, the demand for buying a house will rise, pushing up prices. During a recession (especially if interest rates are high) then house prices tend to fall. The movement in house prices, can in turn, affect the economic cycle. When house prices rise, it creates a positive wealth effect that leads to higher consumer spending.

Other assets such as gold, government bonds and shares are less closely linked to the economic cycle. Gold may prove to be in higher demand during a period of high inflation or economic uncertainty. However, there is no hard and fast rule as the price of gold and shares may be influenced by speculation and market sentiment.

Limits of the economic cycle

Some economists, point out that whilst economies may have peaks and troughs, there is no reliable economic cycle. For example, the UK economy had an unbroken experience of positive economic growth from 1992 to 2007. It appeared the boom and bust cycle had ended. Between 2007 and 2020, there has been little evidence of economic boom in the global economy. Growth has been patchy and struggled to increase.

Other periods where there was little sign of economic cycles included

- Post-war German and Japan economy – steady unbroken growth during 1950s and 1960s.

- Chinese growth post 1980-2020. Fast unbroken growth as the economy catches up with western market economies.

Real business cycle theories

Real business cycle theories downplay the role of cyclical factors. They argue the economy is influenced by long-term supply side factors such as technological innovation and investment. If the rate of technological growth falls, it may cause a temporary fall in growth, but ultimately the economy is not dependent on fluctuations in demand. Real business cycle theories suggest that the economy is not inherently cyclical in nature. During a period of steady technological improvement – it could lead to a long-period of economic expansion without ups and downs.

Structural Unemployment. Unemployment has a cyclical element. In a recession, unemployment will rise. However, there are many factors other than the economic cycle. Some economists, especially free-market economists place greater emphasis on supply-side unemployment, such as frictional and structural unemployment. A rise in unemployment may not be due to ‘cyclical’ factors but a rise in the natural rate of unemployment.

Structural Current account.

The UK and US have often experienced a cyclical current account. However, other economies like China and Germany or more export-oriented. During a slowdown, they may continue to export to other countries and there are no signs of a change in the current account.

Counter-cyclical policies

The government and Central Bank can attempt to reduce the nature of the economic cycle. During high growth and inflation, the Central Bank can increase interest rates. This moderates demand and avoids rapid growth. In a recession, the Central Bank can cut interest rates to stimulate demand.

However, monetary policy itself could cause cyclical fluctuations, an increase in interest rates to reduce inflation could lead to an economic downturn and higher unemployment.

Cyclical economic activity in many different statistics from housing equity withdrawal, unemployment, consumer spending and economic growth.

Related