Debt is one of the oldest financial instruments, but is it good or bad?

To some debt is a sinful way of living beyond your means. Debt is an instrument which increases inequality and can cause economic hardship because of the fixed repayment costs. Furthermore, others point to debt as one of the main causes behind unsustainable financial bubbles and bust.

Debt can get a bad press, but at the same time, most people will take on some form of debt during their lifetime. Debt enables people to survive university (smooth income over your life cycle). Debt also enables individuals to purchase a house and firms to invest. Debt is a crucial element behind economic growth and economic activity.

So is debt good or bad. Or does it depend on the type of debt?

Debt as a good thing

Redistribution of money in the economy. One way of seeing debt is as a way to reallocate money to more productive areas of the economy. Suppose one person is currently short of money, and another person has a surplus (excess saving). Debt is a means for the person with excess savings to lend to those in need of money. Without the instrument of debt, there would be more infrequent imbalances of money and it would constrain economic activity. In theory, debt doesn’t lead to a loss of money. For every liability, there is an equivalent asset. For every borrower there is a lender.

Debt is mutually beneficial. Debt contracts should be pareto efficient in that both parties become better off as a result. The lender gains interest on his loan. The borrower gains money when he needs it and can use it for a more productive process.

Investment. Without the instrument of debt, it would be very difficult for firms and individuals to invest in increasing capacity. The early railways were built by the private sector and they required companies to take on substantial debts (usually in form of shares) to be able to build the railways before the firms started to gain income.

Mortgage debt. Without mortgage debt, most people would never be able to buy a house because it is so expensive compared to income. A mortgage loan enables the purchase to be spread over 30 years. Although it means you pay more interest, it is a better investment than paying rent.

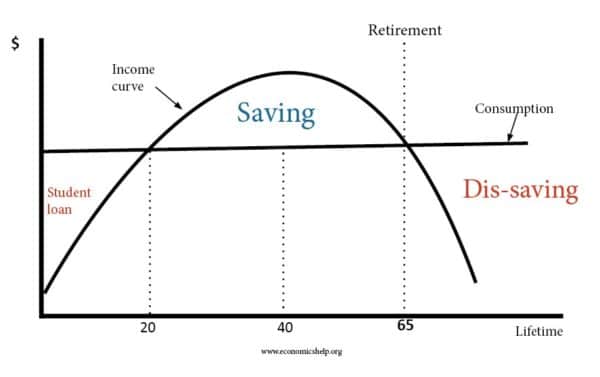

Income Life cycle. Most people will find their income varies considerably over their lifetime.

- As a student, you have outgoings and little income, therefore, you need to borrow. However, getting a qualification is an investment in your future earning power and it also helps the economy become more productive.

- 21-65, you are working and building up savings. But, may still need to take on debt to buy a house / car.

- 65+ You have accumulate savings over your life time. You are a net saver.

Debt is a way to smooth income over your life cycle. Without debt, you would have less opportunities when young.

Problems with debt

1. Debt cycle. If people use debt to buy goods, then firms will see a rise in demand, and this will cause higher GDP. Therefore, we get both higher debt and higher GDP. However, if firms borrow to buy assets, such as shares or houses, then we get a rise in asset prices, but this doesn’t increase GDP. Instead, debt can be an instrument for causing an asset bubble. Rising asset prices can encourage more people to take on more debt and buy more assets. This contributes to the asset bubble and financial instability.

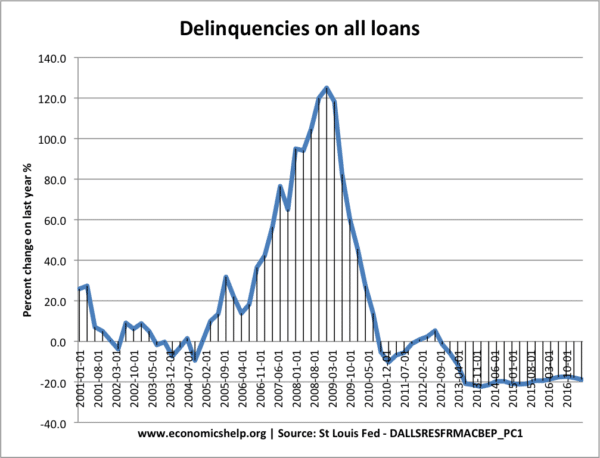

In the early 2000s, mortgages were sold aggressively encouraging everyone to take out a mortgage. However, many took a mortgage who later couldn’t pay the monthly mortgage payments – causing a rise in mortgage delinquencies, home repossessions and the credit crunch.

In a boom, if house prices rise because people are borrowing to get a mortgage, it can encourage others to borrow even more to get a house before prices rise further.

2. Interest rate costs for low-income groups. Those on low-incomes are most at risk of suffering financially from debt. Those with low-income and poor credit history get the worst deals for borrowing. Banks charge higher rates of interest – even for small sums. If borrowers miss payments, they can be charged high fees. The combination of high interest and charges means that debt causes a fall in disposable income of those who have highest debts.

3. Debt interest spiral. A problem of debt is that those in difficult financial situations are forced to borrow and take on debt. However, the debt interest payments then make it difficult to ever pay off the debt. Under some plans, borrowers may make a monthly payment that goes to mostly the debt interest and does nothing to reduce the capital burden. Therefore, debt becomes a millstone to keep low-income people in debt for long periods of time.

4. Debt of developing economies. This is also true on an international level. During the early 1980s, developing economies were encouraged to borrow money at low interest rates to fund investment. However, as interest rates rose, the debt interest took a high percentage of foreign currency earnings. Rather than helping to boost economic development, debt held the countries back.

Related