Readers Question: What is the impact of persistent national debt on economic growth?

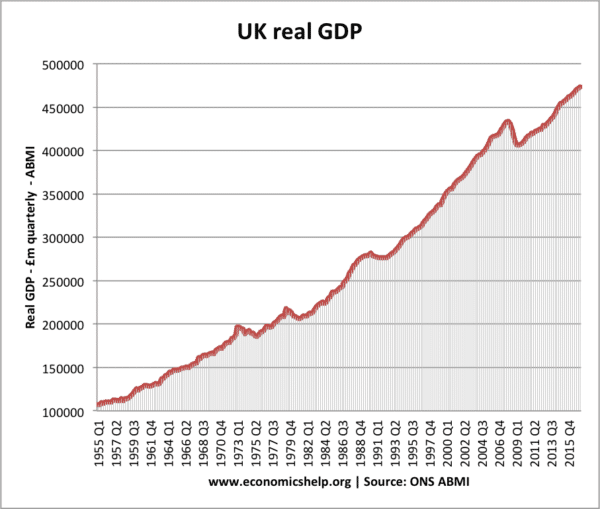

In summary, there is no obvious link between national (public sector) debt and levels of economic growth. Both UK and US finished the Second World War with high levels of national debt – but this did not prevent rapid economic growth in the 1950s and 1960s. High growth helped to reduce national debt as a % of GDP.

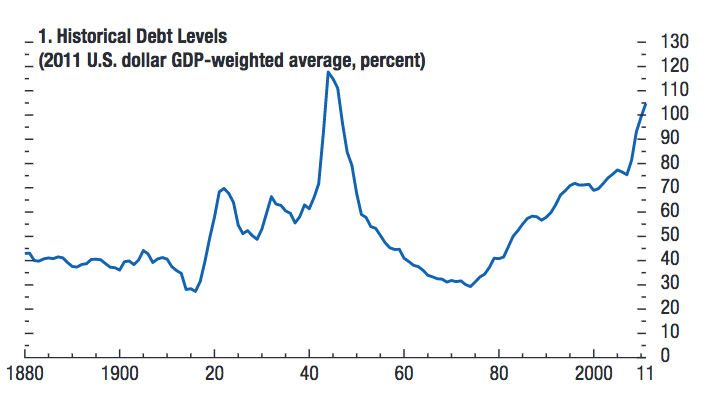

However, some free-market economists argue that above certain levels very high national debt can curtail economic growth because there is crowding out of the more efficient private sector. A controversial paper “Growth in a time of debt” 2010 by Carmen Reinhart, and Kenneth Rogoff, argued that GDP growth slows to a snail’s pace once government-debt levels exceed 90% of GDP. Though these findings have been challenged by other reports

Keynesians argue that in recessions – with falling private sector spending – government borrowing can provide an effective fiscal stimulus to increase growth rates in the short and medium term.

Another complication is that low growth and recession – causes rising national debt (fall in cyclical tax returns). High growth helps to reduce it (improved tax returns less spending on benefits)

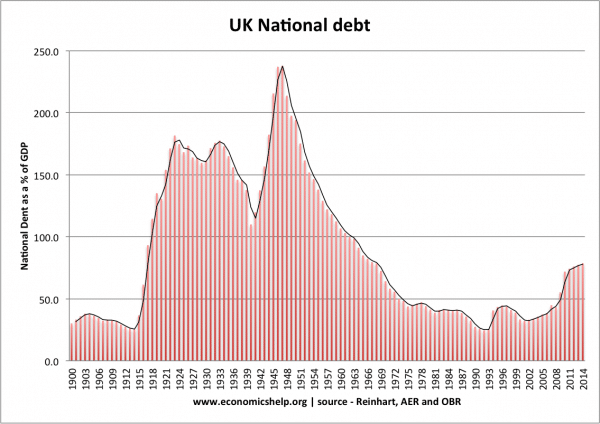

UK national debt

Periods of high debt – caused by World Wars and financial crisis.

High debt has not been a barrier to economic growth in the past. The period of the 1950s, when national debt was over 200% of GDP was not a barrier to the post-war economic boom.

Crowding out argument

If there is persistent government borrowing, then some economists argue crowding out is likely to occur. Crowding out occurs when higher government borrowing leads to lower private sector investment and spending. The argument is that the government borrow by selling bonds to the private sector. If the private sector buy government bonds then they have to less to spend in the private sector. Furthermore, government spending tends to be more inefficient than the private sector. Therefore, government debt can affect growth rates – especially if the economy is close to full capacity.

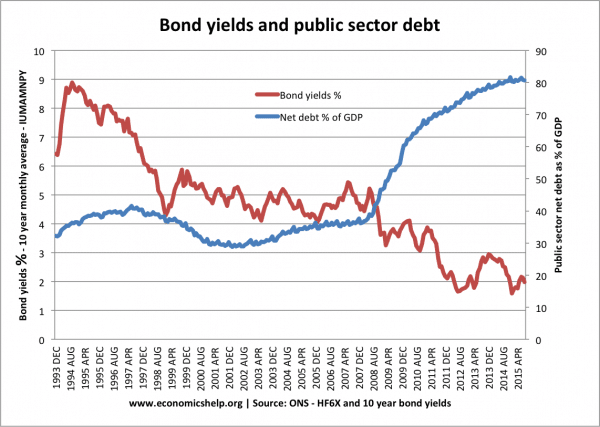

Crowding out due to higher interest rates

It is argued persistently high levels of government borrowing may lead to higher interest rates. This is because with high levels of debt – higher interest rates will be required to attract people to buy government debt. If interest rates do rise because of high government debt, this will make borrowing more expensive and reduce debt levels.

This occurred in the Eurozone between 2010-12, with liquidity shortages – higher debt caused bond yields to rise. However, after 2012 the ECB were more willing to provide liquidity and bond yields fell.

However, higher debt doesn’t necessarily cause higher bond yields. Bond yields are influenced by many factors other than the level of debt. For example, Between 2009 and 2016, UK national debt increased considerably, yet bond yields fell.

Bond yields fell because markets were keen to buy government bonds. Bond yields were also low because it was a period of weak economic growth.

High debt and future higher taxes and lower spending

The scale of UK government borrowing means that to reduce the debt burden, the government will have to increase taxes and/or cut spending over the next 3-4 years. These higher taxes and lower spending will have the affect of reducing UK economic growth and could even damage any economic recovery.

However, if fiscal policy is tight and reducing inflationary pressure in the economy, it can enable interest rates to stay lower and this expansionary monetary policy may offset the deflationary fiscal policy.

Keynesian view on debt

Government borrowing can act as an economic stimulus. The government is spending by borrowing from private sector and this can lead to injection into the circular flow.

In a recession, crowding out is unlikely to occur because there are unemployed resources. Keynes argued in a recession, government borrowing can help increase the rate of economic growth – because the government makes use of unused savings.

Why is Government borrowing?

If the government is borrowing to invest in public services like transport and education. It is possible, the government will increase productive capacity and enable a higher rate of economic growth. However, if the government borrowing is to finance transfer payments e.g. pensions and health care to an ageing population then there will be no boost to productive capacity from government borrowing, and the borrowing will be less sustainable

Another issue is whether high levels of debt will provide a constraint to future growth because of the forecast tax rises which will be necessary to reduce the debt burden to more manageable levels in the future. In the post-war period, growth helped reduce debt ratios.

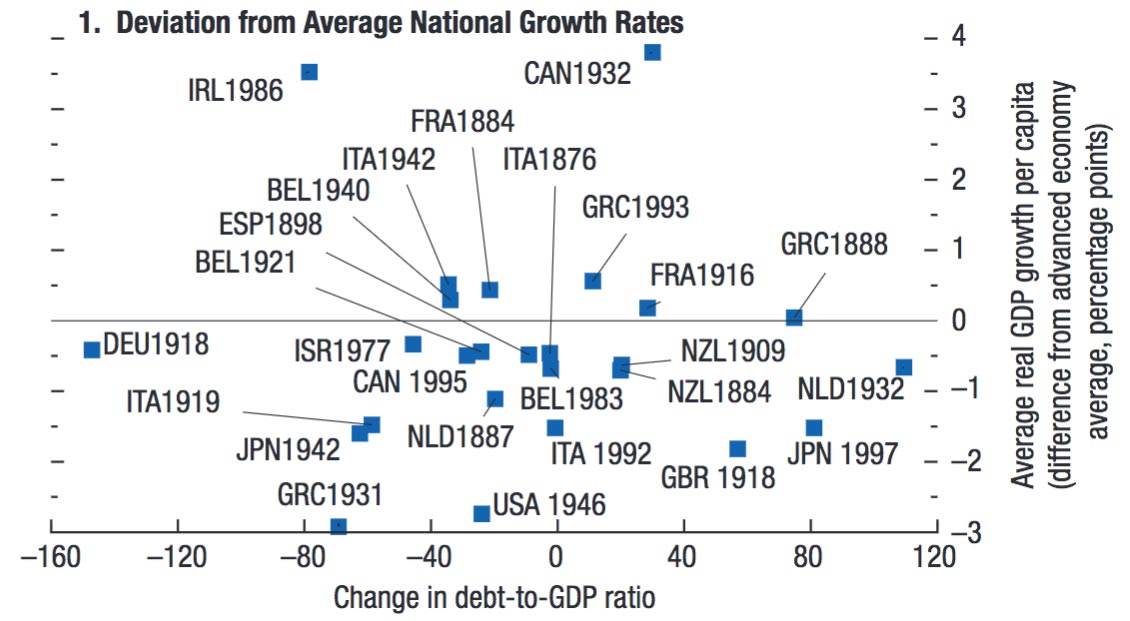

Studies on relationship between debt and growth

IMF

In fact, our subsequent analysis emphasizes that there are many factors that matter for a country’s growth and debt performance. Moreover, there is no single threshold for debt ratios that can delineate the “bad” from the “good.”

This article is very relevant to the macroeconomics I studied in my AP Economics class. This has a lot of information on aggregate demand and the impact of national debt and the policies that can be put to use. You have explained the implications of government borrowing very well. I have a clear insight into the concept of government borrowing and its impact on the economy.

This article talks about how government spending can increase aggregate demand, and is very interesting. This article also talks about contractionary fiscal policy and how it can reduce inflation. Expansionary monetary policy can help to counteract the fiscal policy.

Thanks,

Adit M.

“If government is borrowing to invest in public services like transport and education, it is possible, the government will increase productive capacity and enable a higher rate of economic growth.”

There is a flaw in this argument, as follows. Government spending on capital projects is much the same from year to year. Thus government might just as well pay for such projects out of income. And even if it doesn’t, it will still effectively pay for them out of income because every year it will have to repay capital sums borrowed years ago, and pay interest on sums not yet repaid.

Indeed, I argue in this paper that ALL government borrowing is a farce – it’s pointless:

http://mpra.ub.uni-muenchen.de/23785/

This article is misleading, actually. It claims to be talking about National Debt, but what it’s really talking about is Public Debt.

Public Debt is basically debt incurred by the Government that the citizens of the country are responsible for, which is all of it. A government has no money of its own, just its people’s.

Private Debt is the amount of money owed foreign investors by private citizens, basically like if GM takes out a loan from Chinese investors.

National Debt is the sum of both types of debt.

To some degree the logic in this article still holds true – that borrowing money for pleasure items (consumption) rather than for investing will lead to economic downfall in the future. But, please remember that this is an article about Public Debt when you read it, not about National Debt.

excellency article, i like it; i have improve my understanding capacity on this issue

I really enjoyed reading this article because it stresses the need for every government to avoid bad debts(debt to finance transfer payment) in favor of investment in capital goods