The economic cycle plays an important role in determining the level of government borrowing, especially in the short run. Essentially, higher economic growth leads to lower government borrowing, but a recession will increase government borrowing.

Over the past few years (2008-12) – the idea that an economic downturn increases government borrowing is probably one of my most repeated sentences on this blog.

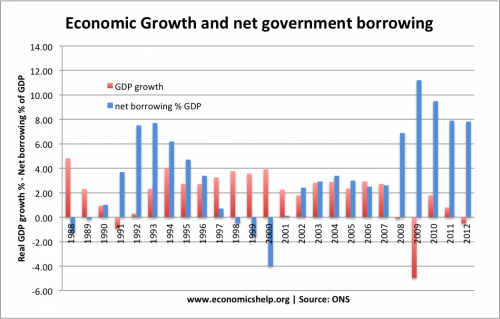

- At the end of the 1980s boom, the UK ran a small budget surplus (negative net borrowing).

- The recession of 1991 caused a sharp swing in the budget deficit, with net borrowing rising to nearly 8% of GDP.

- The long period of economic expansion 1993-2001 saw a fall in net borrowing.

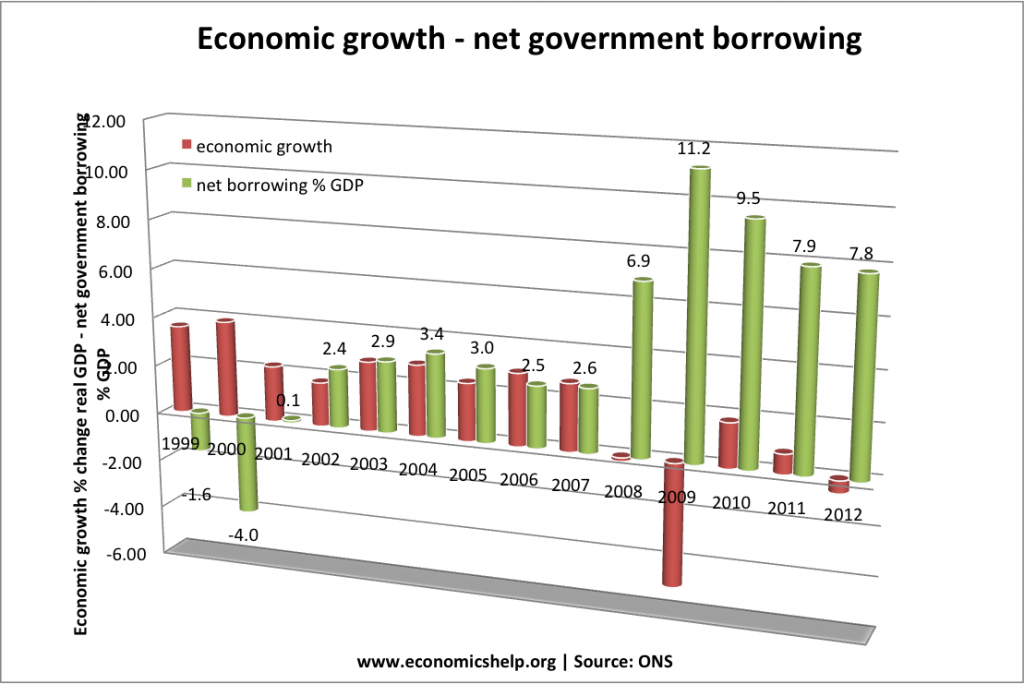

- The recession of 2008/09 saw record levels of government borrowing with net government borrowing increasing to over 10% of GDP

- The economic cycle isn’t the only factor affecting the level of government borrowing. For example, net borrowing increased 2002-2007 because the government increased government spending – despite the positive economic growth.

Recent Years since 1999

Why does government borrowing increase in a recession?

1. Tax receipts fall

Even if tax rates stay the same, negative economic growth, will lead to lower tax revenues. For example:

- People spend less. Therefore, VAT receipts and excise duties on alcohol, petrol will decrease.

- Lower earnings. Lower wages will lead to lower income tax receipts and lower NI contributions. In particular, a recession may see a fall in high paying bonuses, which would attract the top rate of income tax 45%. Also, if people are made unemployed, they will pay zero income tax.

- Lower corporation tax. Firms earn less profit and so, therefore, corporation tax receipts fall.

- Falling house prices and a lower number of transactions. This will lead to lower stamp duty. Fewer houses are sold and also the value falls.

2. Government spending

In a recession, the government will tend to spend more on automatic fiscal stabilisers. For example:

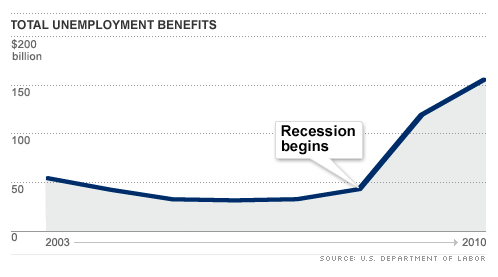

- Unemployment benefits. Higher unemployment will mean the government have to pay more unemployment benefits

- Income support / universal credit. As well as spending more on unemployment benefits, the government will have to spend more on related means-tested welfare payments, such as child support, income support / universal credit.

Example of cost of unemployment benefit spending in US

Cost of unemployment benefits $319 so far in US. CNN money

3. Fiscal policy

In a recession, the government may decide to pursue counter-cyclical fiscal policy. For example, in 2009, we had a cut in the rate of VAT to try and increase consumer spending or the government may decide to spend more.

Cyclical deficit

The cyclical deficit refers to the level of government borrowing directly attributable to a recession.

Structural deficit

This refers to the underlying level of government borrowing – even if we ignore cyclical factors, such as temporarily depressed level of tax receipts.

Cyclically adjusted deficit

This refers to a measure of government borrowing adjusted for the economic downturn. This cyclically-adjusted deficit would be less volatile.

However, it can be difficult to evaluate how much borrowing is cyclical. For example, unemployment may lead to a permanent loss of output, which leads to future lost tax revenues. Many underestimated the depth of this great recession and so borrowing has fallen at a slower rate than expected.

Evaluation

The impact on tax revenues will depend on several factors. For example, in the boom years, the Irish economy was heavily dependent on property taxes. When the property market collapsed, the Irish government saw a significant fall in tax revenues.

- In 2007, total tax revenue was €69,677 million.

- In 2011, tax revenue had fallen to €55,415 million

- That is a 20% fall in nominal tax revenues between 2007 and 2011. (Irish borrowing)

By contrast, tax receipts from VAT are generally more stable and less cyclical because consumer spending is less volatile than buying houses.

The UK was hard hit by the 2009 recession because it hit the financial sector more than usual. The finance sector generally has the highest wages and contributed significant income tax and corporation tax revenues in the boom years. When the recession hit the financial sector, there was a considerable loss of income tax and corporation tax revenues.

Related

Note on stats:

- The figures for GDP growth are for a calendar year, e.g. 2008

- The figures for government borrowing are for the tax year 2008/09.

- For the sake of simplicity I merged the tax year 2008/09 with the calender 2008.

- It’s slightly inaccurate, but the general trend is correct

On the other hand it’s a complete and total myth that government ACTUALLY NEEDS to increase borrowing in a recession or to impart stimulus. It’s a myth constantly repeated by Tory politicians. And Labour politicians repeat the myth, because they’re as clueless as Tory politicians.

Keynes, Milton Friedman and numerous other economists pointed out long ago that the government / central bank machine can perfectly well print money as an alternative to borrowing the stuff.

Indeed you have to be raving bonkers to borrow something which you can produce yourself for free.