Definition of Buffer Stock Scheme

A buffer stock scheme is a government plan to stabilise prices in volatile markets. This requires intervention in buying and selling.

Prices for agricultural products are often volatile because:

- Supply can vary due to the weather.

- Demand is inelastic

- Supply is fixed in the short term

- See: Why are prices of agricultural goods volatile?

Buffer stock schemes aim to:

- Stabilise prices

- Ensure the supply of food

- Prevent farmers/producers going out of business because of a drop in prices.

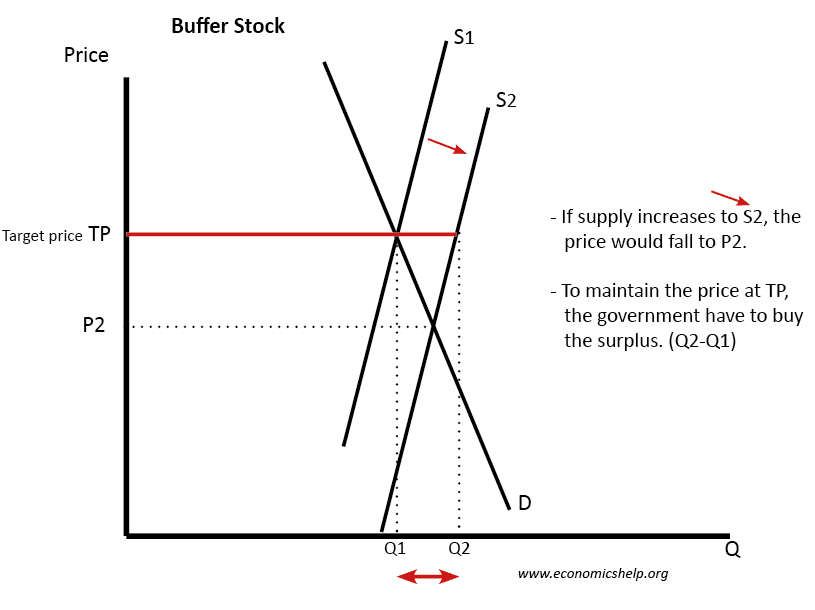

Diagram of Buffer Stock Scheme

If there is a very good harvest and supply increases to S2, the market price would fall to P2.

This price is below the target price (TP)

To maintain the price at TP, the government will need to buy the surplus stocks (Q2-Q1) and store the goods. This reduces supply on the market and effectively keeps prices at the target price.

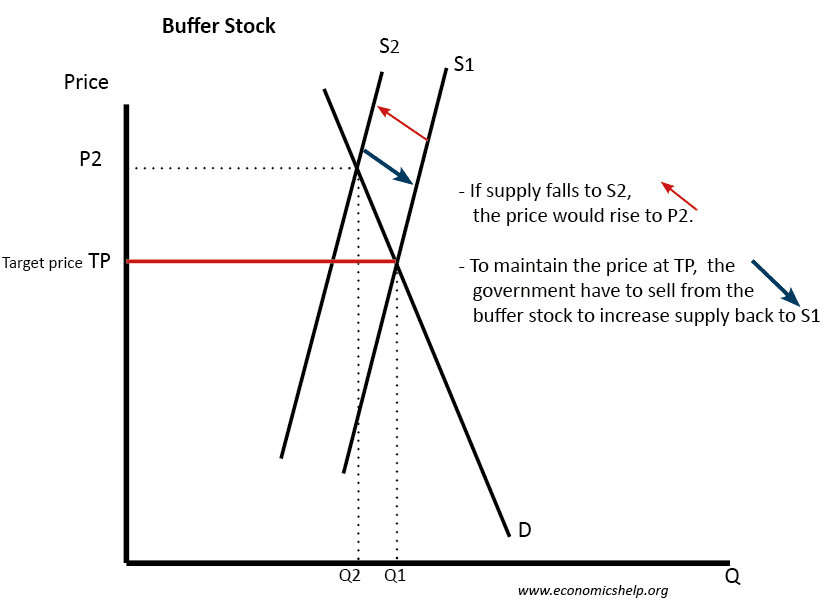

Buffer Stock with a shortage

In this case, there is a fall in supply. In a free market, the price would rise to P2 (above the target price)

To reduce prices back down to target price, the government need to sell goods from the buffer stock and effectively increase supply back to S1.

Advantages of buffer stocks

- Stable prices help maintain farmers incomes. A rapid drop in prices can make farmers go out of business, which leads to structural unemployment.

- Price stability encourages more investment in agriculture.

- Farming can have positive externalities e.g. helps rural communities. A drop in price could cause a negative multiplier effect within rural areas.

- Target prices help prevent excess prices for consumers and help reduce food inflation. This might be important for households living in poverty, who may struggle to pay high prices during years of shortage.

- It helps to maintain food supplies and avoid shortages.

- It is possible the government could make a profit from a buffer stock scheme. If it buys during a glut and sells during a shortage, it can make a profit.

Problems of buffer stocks

- Cost of buying excess supply could become quite high for the government and may require higher taxes.

- Minimum prices and buffer stocks could encourage oversupply as farmers know any surplus will be bought. It could even encourage excess use of chemicals to maximise yields because farmers know any excess supply can be sold – even if the market doesn’t want it.

- Government subsidy to farmers may encourage inefficiency amongst farmers. There may be less incentive to cut costs and respond to market pressures.

- Some goods cannot be stored in buffer stocks, e.g. fresh milk, meat e.t.c.

- Government agencies may have poor information e.g. what price to set, how much to buy? is there really a surplus? In practice, it can be difficult to know whether there is a surplus until later in the year.

- Administration costs of the scheme.

- Minimum prices for foodstuffs may require tariffs on imports.

- Globalised markets. Agriculture is a globalised market. If some countries form a buffer stock scheme and buy excess supply, they may find that other countries ‘free-ride’ on their efforts to keep prices high and undercut them.

- Are buffer stocks designed to help producers or consumers? Often agricultural buffer stocks are aimed at providing minimum prices and minimum incomes for farmers

Examples of Buffer Stocks

Genesis Wheat stores. In Genesis, Joseph stored wheat during the seven years of feast, so during the seven years of famine, he was able to distribute wheat from the stores.

“So he gathered all the food of these seven years which occurred in the land of Egypt and placed the food in the cities; he placed in every city the food from its own surrounding fields.” Genesis 41:48

Ever-normal granary

Established in the first century BC in China. The aim was to stabilise supply, buying grain in good years and distributing to regions suffering shortages. The idea was revived by Henry A. Wallace (a future adviser to Pres. Roosevelt) He took the idea from Chinese history and gave it this term. In 1929, the US implemented forms of agricultural intervention. From these 1930s schemes, government support for agriculture has grown and proven difficult to take away.

EU Common Agricultural Policy

The CAP included minimum prices for many foodstuffs. As a result, it encouraged over-supply. The European Union were forced to buy the surplus. This surplus was stored in huge barns and warehouses. (known as butter mountains, wine lakes, grain mountains)

The scheme was largely a failure because it became very expensive to keep buying the surplus. There was never any real shortage. In the end, the EU had to start implementing quotas to limit excess supply. CAP was slowly reformed to reduce the target minimum prices.

1970 Wool Floor Price Scheme Australia

This aimed to stabilise the price of wool. The advantage is that wool is easy to store. In years of high supply, the government would buy and store the excess wool. In times of shortage, the government would release wool from the stores.

The scheme was abandoned as it primarily became about the government buying wool. There was a period of declining demand, and the scheme merely encouraged farmers to keep producing wool – rather than respond to changing market signals.

International Cocoa Organization (ICCO)

In 2017, the Ivory Coast and Ghana planned to revive a buffer stock scheme for cocoa. The Ivory Coast and Ghana control over 60% of the world’s supply. In 2017, they face the prospect of a global surplus of 371,000 tonnes – which will lead to plummeting prices and less export revenue.

The Ivory Coast chief of staff to trade minister – Narcisse Sepy Yessoh said:

“Must we continue on this path, flooding the market with beans in abundance and driving down prices to the detriment of our economies and people? We don’t think so,”

The Ivory Coast plans to build warehouses with the capacity to store 250,000 tonnes of cocoa. One paper suggested that periods of buffer stock intervention were relatively successful in stabilising farm incomes. (Commodity buffer stock redux: The role of the International Cocoa Organization in prices and incomes 2011. Link Raymond Swaray)

Related