When people talk of UK debt, they usually refer to government debt. This is debt the government has borrowed to finance budget deficits (when government spending is greater than taxation revenue) There is also external debt, which is the net amount the UK (private and public sector) owes abroad. This external debt is high (2011, £6,114bn over 400% of GDP) Though external debt is balanced by external assets.

(By 1914, the UK had paid off most of its debt from the Napoleonic Wars of the early nineteenth century. In 2000s, we had paid off most of the debt from WWI and WWII)

Most of UK government debt is held by domestic private sector investors (approx 70%). So when we talk about UK debt – it is slightly misleading. It is more like a family, where one family member gives money to another family member. It is merely moving money around the family rather than borrowing from abroad. The UK government is borrowing money from the domestic private sector. Paying off UK debt involves transferring money from general taxpayers to bondholders. It doesn’t actually change the amount of money in the economy.

What does paying off debt involve?

Government debt is financed by selling bonds. These can be short maturity (3 months to 30 years and in the case of First World War – unlimited). To pay off debt, the government could run a budget surplus with tax revenues greater than spending. With this surplus, the government would then purchase existing bonds back. Nevertheless, repurchasing the current level of debt (Aug 2022, UK public sector net debt was £2,427.5 bn or around 96.6%), it would take many years to complete.

Taxes to pay off debt

The UK could pay off its debt if it increased taxes and bought back government bonds. However, there may be some difficulties in raising the necessary money in a short period.

Problems with raising tax to pay off debt

- Also, higher taxes may create some disincentives to work or it may encourage the wealthy to move assets to other countries (tax havens) to avoid tax revenue.

- Another issue of paying off the debt is possible implications for aggregate demand and economic growth. A sharp rise in tax could lead to lower spending. Bondholders would gain more cash because their bonds are bought with tax revenue.

- But wealthy bondholders are unlikely to spend much of this extra cash – because they are interested in saving. Therefore, the net effect of trying to quickly reduce national debt would be to cause a fall in aggregate demand and lower economic growth and even recession. If the economy is growing quickly – with some inflationary pressure, then raising taxes would reduce inflationary pressure and growth would remain positive. But, if the economy was growing weakly then higher taxes could push the economy into recession.

Do bondholders want to be redeemed?

Another issue of UK debt is that there is a strong demand for buying government bonds. They are seen as a good investment and a secure way to save money. Despite low-interest rates, there has been a strong demand for buying government bonds – from the private sector, e.g. banks, pension funds, investment trusts. If the government paid off its debt and refunded all bondholders, it would be a little frustrating for these banks, pension funds, and investment trusts because they would have to find somewhere else to invest the money they would receive. To maintain a similar balanced portfolio, they would probably end up buying foreign government bonds, e.g. Eurobonds and US government bonds.

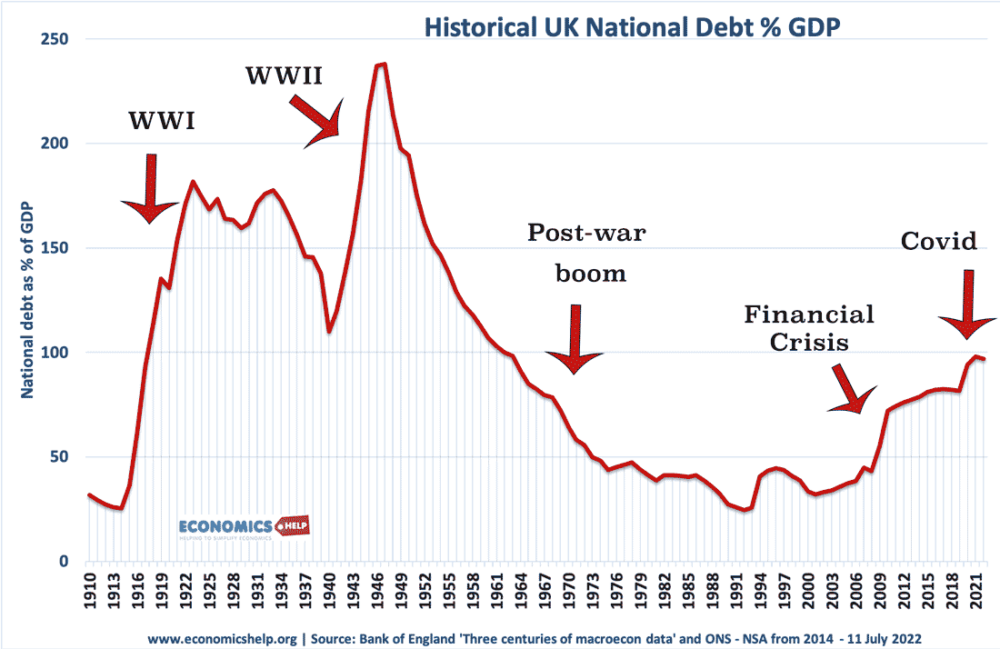

History of government debt

The history of national debt shows that we have been unable to pay off our debts since records began. There are few countries in the world with zero government borrowing. Perhaps a few super-rich oil countries have zero or minimal borrowing. UK borrowing fell sharply in the post-war period (due to strong economic growth) – there was no particular goal to pay off all debt.

The government still has some un-dated war bonds from the First World War. Bonds with no maturity date.

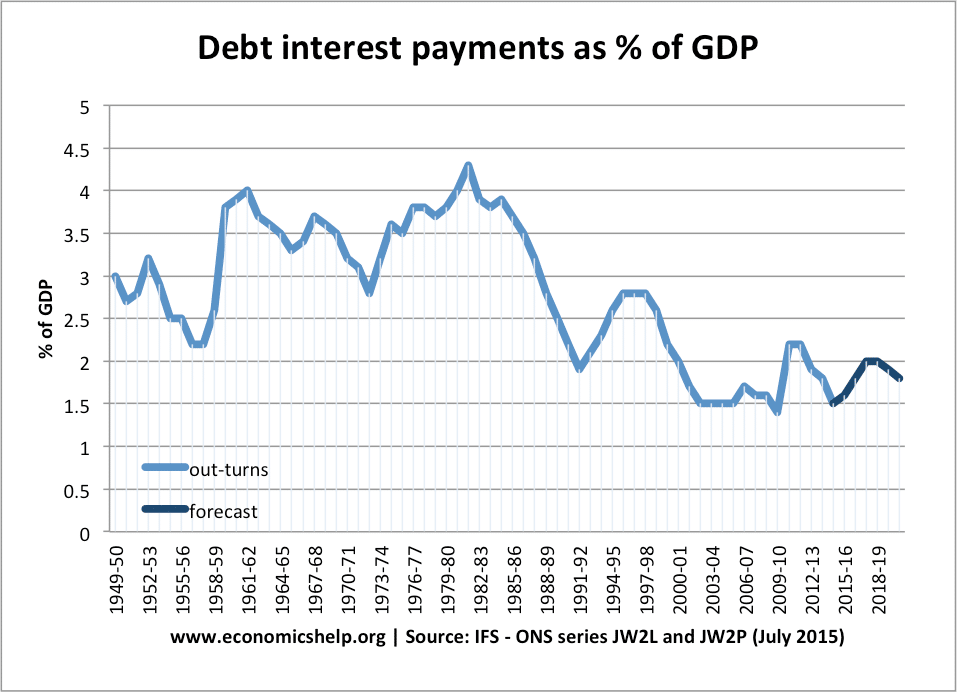

Can we afford to meet our debt interest repayments? Is debt sustainable?

A better question is how affordable is UK debt?

This shows the percentage of GDP which goes on debt interest payments. Since the 1970s, debt interest payments as % of GDP has fallen – even though debt has increased.

What could we sell to pay off our debts?

We sold our best assets in the 1980s during the government’s policy of privatisation. Many big firms like BT, BP, Electric companies, Water and Gas were sold (often at less than market price) to shareholders. These days the UK doesn’t have many assets left to sell.

Video on UK Debt

UK debt in context

Predicting debt for the next 50 years is difficult since we don’t know what kind of productivity improvements may come, e.g. continued gains in renewable energy may reduce the burden of higher oil and gas prices. Equally, the costs of environmental change could be worse.

Related

Hi, great posting here. However, I am still a little bit confuse. When we say government debt as a percentage of GDP, does that figure imply internal debt as a percentage of GDP or internal plus external debt as a percentage of GDP? Please help to clarify. Cheers

It implies the government’s debt – which is 70% held by internal investors and 30% of foreign investors.

This government debt held by foreigners is only a small portion of the other measure of external debt. External debt includes all private sector and public sector liabilities.

Is there a certain amount that government try to “pay back” a year by buying back bonds? Or, because we are still borrowing we don’t buy back bonds?

Also, how would the borrowed amount become too great to pay back? Is this what happened in Greece, and how would this moment come about for us?

If there was a bankruptcy/reset how would this affect the government/UK? Is it all fiat money now assets have been sold off – is this money borrowed through bonds, fictional before the transaction i.e. just “created” for that transaction? Why could the government therefore not do this themselves?

Thank you for your article by the way 🙂

Enjoyed reading it. i’m not an economist so it was very helpful.

Recently speaking to a retired businessman he said the Government debt would actually wipe itself out, is this possible? If so how?

Interesting, but. I understand the initial bail out of the financial Industry, to protect the Insurance and pension Industry.

But two things come to mind, 1] why separate public borrowing from the financial sector debt and 2] why did the % rate not return to historical norms

Why has the uk. Gov. Not invested in the huge oil & gas finds in Southern Ireland bringing advanced drilling technology. Boris Johnson proposed building a bridge from uk to Northern Ireland. This plan must come into operation. Using our Energy especially for our uk manufacturing industries would be a Number one WINNER. Forget the RIP OFF FOREIGN ENERGY IMPORT SUPPLY. Watching all Gov. MPS in discussion for the past 60 years was time waste for a solid future economy.To much time bickering and the never ending Covid party gate.The General public are stressed listening to all this debate. BOTH SIDES ARE ALL GUILTY. Do Good Plans for all. We all owe a million thanks to all involved in producing the Covid vaccine. It was a miracle moment . MILLIONS OF LIVES WOULD HAVE BEEN LOST.Yes mistakes were made very little was known about the Covid virus.I PHYLLIS DONAGHY PROPOSE THE HONOURABLE BORIS JOHNSON RECIEVE OVER DUE HONOUR.AND ALL THE SCIENENTS INVOLVED.HISTORY WAS MEDICALLY CREATED. To listen to all mps on both sides, the press, the horrible journalists insulting MR. BORIS JOHNSON day after day with all joining in. ITS A SAD TIME FOR ABUSING OUR LAW which is always fair. But not for Mr. B Johnson. I always enjoyed listening to both sides civil question debates. God in the disrespect shown it is not acceptable.There are many MPS. Not suitable for GOV. POSTS. I would put a new system in place for all.MP has to pass an EXAM for example To be appointed Transport Minister. And all ministers to pass exams. Local Elections can produce councillors not fit for purpose. Must be changed with extensive vetting and education qualifications and intense personal background vetting.Reprecenting the local and general public requires good qualifications and problem solveing and first call community ability in local planning. Local Councils must change to a new technology system.To cut crime, scams, drug dealing. Child sex abuse. Sex Trafficing by aliens coming into the uk, and safeguarding the benefit system.Also Redesigning each local Hospital System for A&E Dept.Cut out all admission to A&E for drug abusers Alcoholics,Dangerous Offenders. Domestic Abusers Public offenders to staff &Police.Requires a new independent medical & treatment for A&E and secure bed units with police and security built areas.Toilet Areas would be much wider and less private for security & medical observeation Special Staff Training Program for total protection in course of treatments This involves new inventive designed medical enforced controlled devices to protect Surgeons Doctors & Nursing Staff.The operations theatre would totally secure. This area would have its own private Lab. and all Blood testing Facilities.Ambulances must be designed to control and protect.No patient can be taken for granted at any time.All rules apply from the moment of patient interception.Restraining and breathing conditions would have immediate on going equipment to comfortably help the patient and staff under the health &Safety Act.Protecting the patients treatment before & after with on going procedures back to health.This Private Medical Building has no contact with normal A&E Hospital.There would be no contact with normal Hospital Procedures.All uk General Hospitals & NHS Homes must change their finiancial administration to implement a free up ongoing weekly operations costing budget.Saving time. Waste.Need for each operation. And operations classifications by surgeons.Complete Accountant Computer Technology SetUp.Those in our present administration in all hospitals lose time and money with a outdated present costing system. Perhaps their medical is limited.They have not all the finiancial knowledge for this vast ongoing daily budget. Meetings held to agree who is the next NHS Patient for operation surgery list.It’s like a lottery. First Data. All patients waiting waiting surgery times must be now updated. List waiting times. Classify all Surgical Operations in each group for the Selected Surgeon. Suggestion Every NHS Registered patient to pay an annual Registeration patient fee of £20 inclusive for all family. Single Adults £10 Each annually. Many options to help our present Gov. with backdated Covid debt.Millions forget this vast payment of public money to save their lives with a new vaccine.The Energy Crisis. The ukerine war. The boat refugees.And endless other expendures.This is not the time for Electioneering. It’s about planning not time wasting with speech disrespect for silly past goings on .You did this &that.Let me remind you years ago. What stupid talk.We ALL YES ALL want proper plans from both leaders & MPS and ACTION Sick of time wasting.The Working man &Woman are the economy of this wonderful UK.God Bless these workers.One Last Wish.Please Pay Our Doctors and Devoted Nurses of CULTURES.Thanks BYE Phyllis