- Monetary policy involves using interest rates and other monetary tools to influence the levels of consumer spending and aggregate demand (AD). In particular monetary policy aims to stabilise the economic cycle – keep inflation low and avoid recessions.

Aim of monetary policy

- Low inflation. UK target is CPI 2% +/-1. Low inflation is considered an important factor in enabling higher investment in the long-term.

- Stable economic growth. Monetary policy is also concerned with maintaining a sustainable rate of economic growth and keeping unemployment low.

How monetary policy works

- UK monetary policy is set by the Monetary Policy Committee (MPC) of the Bank of England.

- They are independent in setting interest rates but have to try and meet the government’s inflation target.

- The Bank of England set the base rate. This is the rate commercial banks borrow from the Bank of England.

- Changing the base rate tends to influence all interest rates in the economy – from saving rates to mortgage and lending rates

- More details on how the Bank of England set the interest rates

How MPC set interest rates

The Bank of England studies inflationary trends in the economy. This involves looking at a range of economic variables such as:

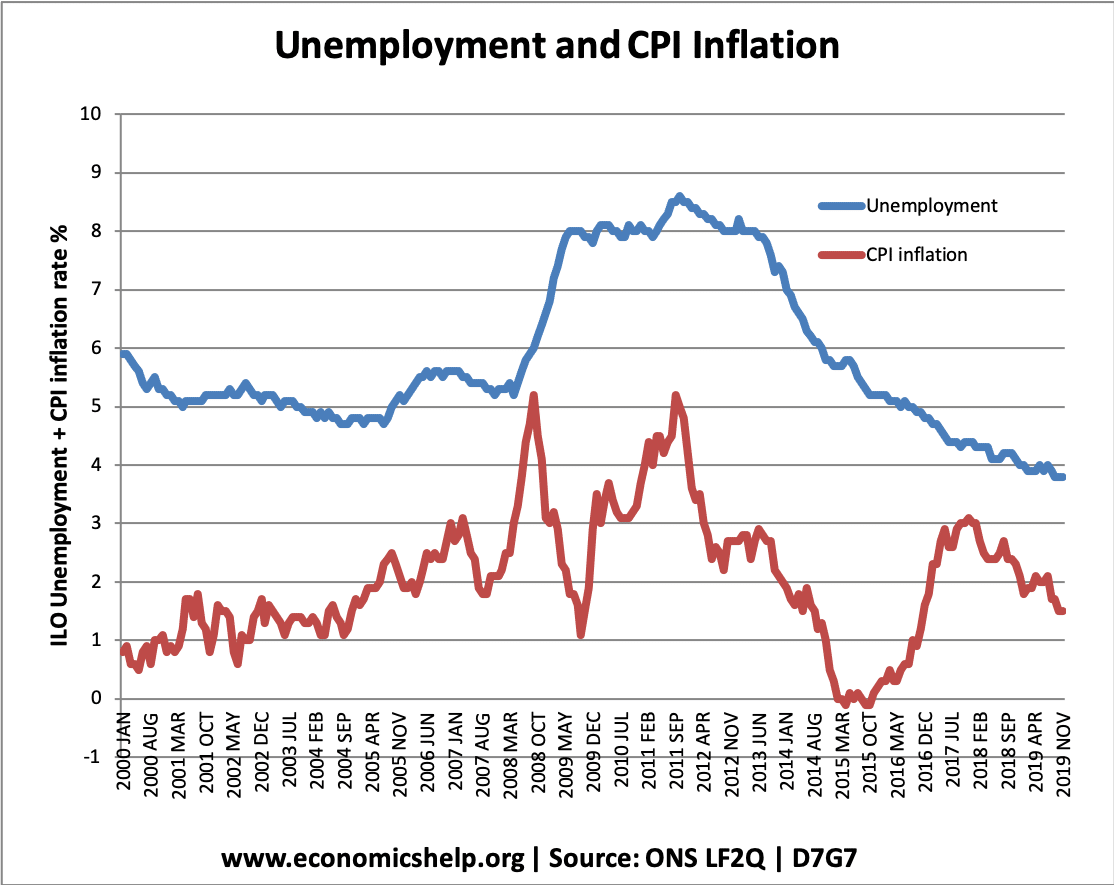

- Unemployment, consumer confidence, spare capacity in the economy, exchange rate index, house prices, economic growth

From these statistics, the Bank of England decides whether inflation is likely to rise or fall.

- If they expect higher inflation and higher growth, they will tend to increase interest rates.

- If they expect lower growth and a fall in the inflation rate, they will tend to cut interest rates.

Other aspects of monetary policy – Quantitative easing

During the credit crunch of 2008-09, the Bank of England also used Quantitative Easing as a part of monetary policy. This involves creating money electronically to buy assets (such as government bonds from banks). It is hoped by buying illiquid assets there will be an increase in the money supply and avoid deflationary pressures.

Loose monetary policy

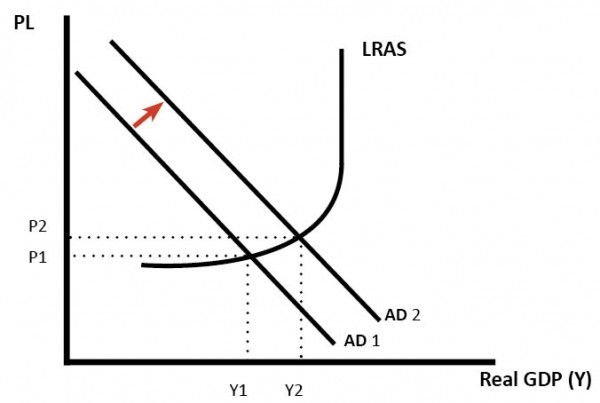

If the Bank of England anticipates inflation falling below the government’s target of 2% and economic growth is sluggish, or the economy is facing a recession. They are likely to cut interest rates.

Lower interest rates, in theory, should stimulate economic activity. This is because lower interest rates reduce borrowing costs. This increases the disposable income of consumers with mortgage interest payments and should encourage spending.

see: Effect of cutting interest rates

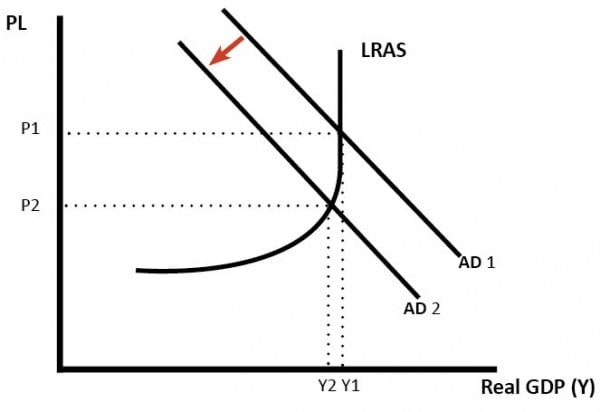

Tight monetary policy

If the Bank feels the economy is growing too quickly and inflation is expected to exceed the government’s target, then they are likely to increase interest rates to reduce the rate of economic growth and reduce inflationary pressures.

In this case, a rise in interest rates causes a fall in consumer spending and investment leading to lower inflation.

See: Effects of Raising Interest Rates in the UK

UK Monetary Policy

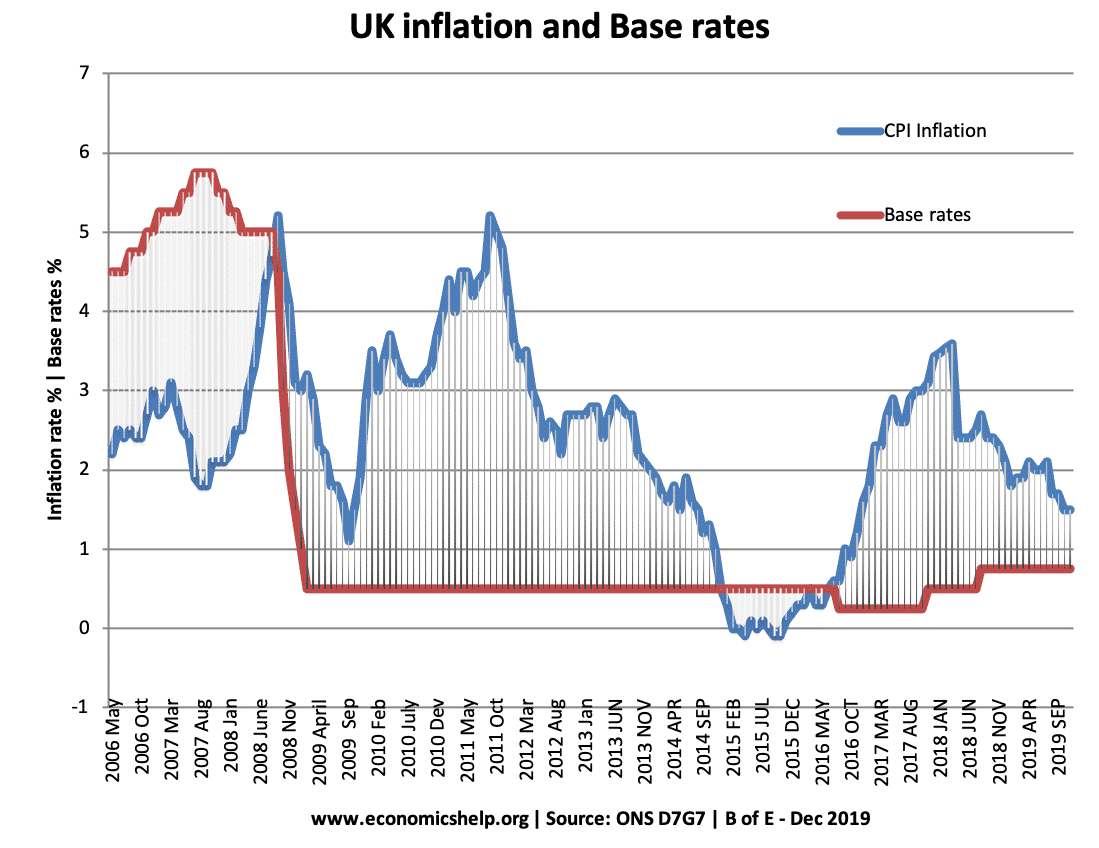

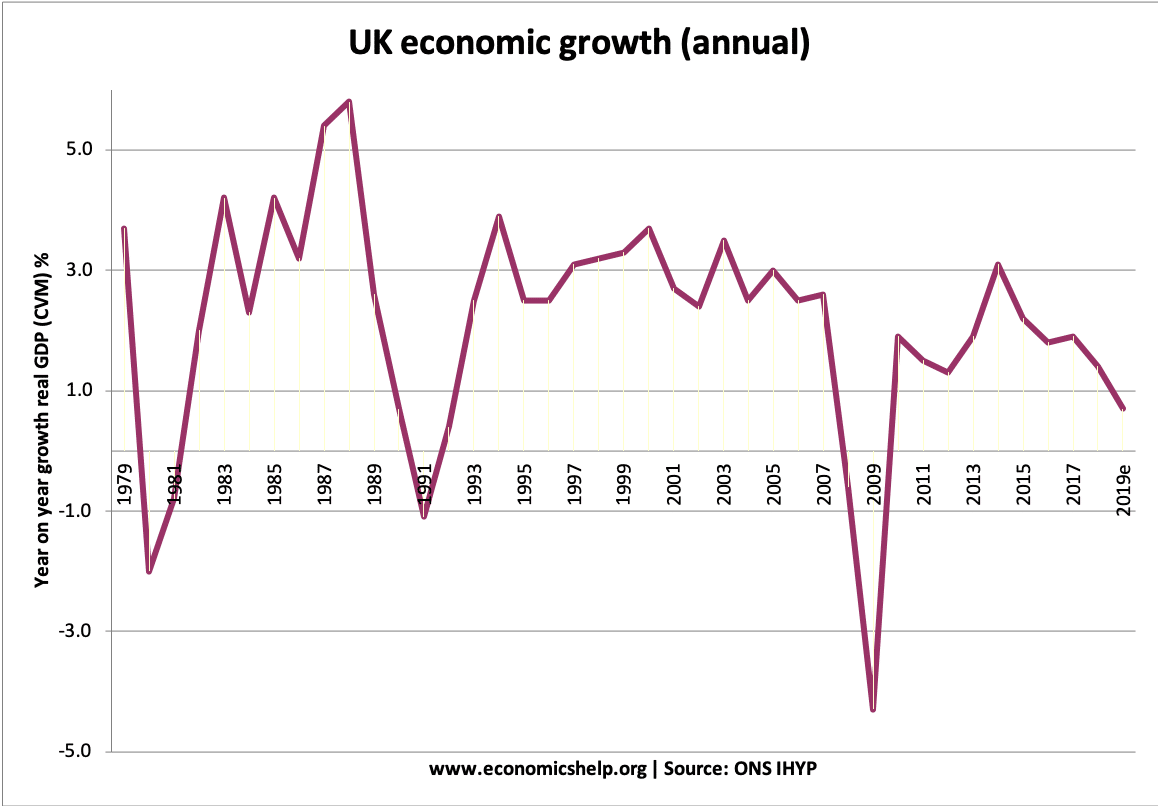

In 2008/09, the economy went into deep recession. This led the Bank of England to cut interest rates from 5% to 0.5%.

An evaluation of UK monetary policy

1997-2007

In the period 1997-2007, monetary policy effectively kept economic growth and inflation stable. This was because cost-push inflation was low and the independent Bank of England was successful in preventing growth exceeding the long-run trend rate.

However, in the great moderation, despite low inflation, there were imbalances in the economy – such as rising house prices and boom in credit. This shows the limit of monetary policy in preventing a credit bubble.

2007-2011

Between 2007 and 2011, monetary policy became much more difficult. This was because of:

Cost-push inflation and recession. In 2008 and 2011, the UK experienced a rise in CPI inflation to over 5%. (see: cost push inflation) Yet, at the same time, economic growth was very low or negative. This present the Bank of England with a difficulty. On the one hand, inflation is above their target so they should consider raising interest rates. However, with a depressed economy, the economy needs the opposite.

Liquidity Trap. In 2008, the economy was in a liquidity trap. Cutting interest rates to zero, failed to boost spending and economic growth. Therefore, the Bank of England were forced to pursue quantitative easing.

Difficulties of monetary policy

Some limitations of monetary policy include:

- Liquidity Trap – This occurs when a cut in interest rates fail to stimulate economic activity. e.g. because of low confidence or banks don’t want to pass base rate cut onto consumers.

- Difficult to control many objectives with one tool – interest rates. For example, a rise in oil prices causes cost-push inflation and lower growth. The Bank could increase interest rates to reduce inflation, but, it would cause economic growth to fall as well. In 2009, inflation rose to rising oil prices, but the economy was also in recession; the Bank decided to ‘allow’ the temporary inflation and concentrate on economic recovery.

- Changing interest rates affects the exchange rate. Tight monetary policy causes an appreciation in the exchange rate which will make exports less competitive.

- Interest rates may affect some parts of the economy more than others. e.g. higher interest rates increase the disposable income of people with savings. But, could cause homeowners to be unable to afford their mortgages.

- Time lags – If the Bank of England change base rates, it can take up to 18 months for the effects to filter through the economy. For example, if people have a two-year fixed mortgage, they will not notice until they remortgage. This means the Bank needs to predict future inflation so that they can change interest rates in anticipation.

See also: