There are many costs associated with inflation; the volatility and uncertainty can lead to lower levels of investment and lower economic growth. For individuals, inflation can lead to a fall in the value of their savings and redistribute income in society from savers to lenders and those with assets. At extreme levels, inflation can destabilise society and destroy confidence in the economic system.

“Lenin is said to have declared that the best way to destroy the capitalist system was to debauch the currency. By a continuing process of inflation governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens.” – John Maynard Keynes, (1919) “The Economic Consequences of the Peace” Chapter VI, pp. 235-236.

Most countries target low inflation – usually around an inflation rate of 2%

Explaining the costs of inflation

1. Reduced international competitiveness

If a country has a relatively higher inflation rate than its trading partners, then its exports will become less competitive, leading to a fall in exports and a deterioration in the UK current account. This is particularly a problem for a country in a fixed exchange rate. For example, countries in the Euro, such as Greece, Ireland and Spain experienced higher inflation than northern Eurozone, leading to record current account deficits (over 10% of GDP in 2007. The uncompetitiveness also caused a fall in economic growth

- However, if a country is in a floating exchange rate – then the high inflation can be offset by a depreciation in the currency. Though this still has an economic cost as it is a decline in the terms of trade and more expensive imports.

2. Confusion and uncertainty

When inflation is high, people are more uncertain about what to spend their money on. Also, when inflation is high, firms are usually less willing to invest – because they are uncertain about future prices, profits and costs. This uncertainty and confusion can lead to lower rates of economic growth over the long term. This is one of the main concerns about high inflation rates. Countries with low and stable inflation rates – tend to have improved economic performance over countries with higher inflation.

3. Boom and bust economic cycles

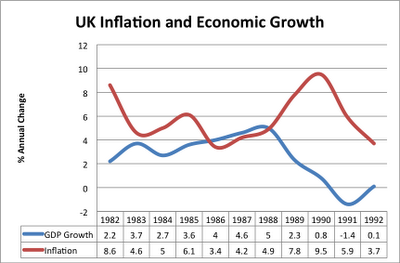

High inflationary growth is unsustainable and is usually followed by a recession. By keeping inflation low, it enables a long period of sustainable economic growth. For example, in the UK in the period 1992-2007, low inflation helped economic growth to be more stable – than the previous boom and bust cycles.

In the late 1980s, the UK enjoyed rapid economic growth. However, this led to a rise in inflation. This inflationary growth proved unsustainable, and in 1991 the economy entered a deep recession with negative economic growth. See: Lawson Boom

4. Menu costs

This is the cost of changing price lists. When inflation is high, prices need frequently changing which incurs a cost.

- However, modern technology has helped to reduce this cost.

5. Shoe leather costs

To save on losing interest in a bank people will hold less cash and make more trips to the bank.

6. Income redistribution

Inflation will typically make borrowers better off and lenders worse off. Inflation reduces the value of savings, especially if the savings are in the form of cash or bank account with a very low-interest rate. Inflation tends to hit older people more. Often retired people rely on the interest from savings. High inflation can reduce the real value of their saving and real incomes.

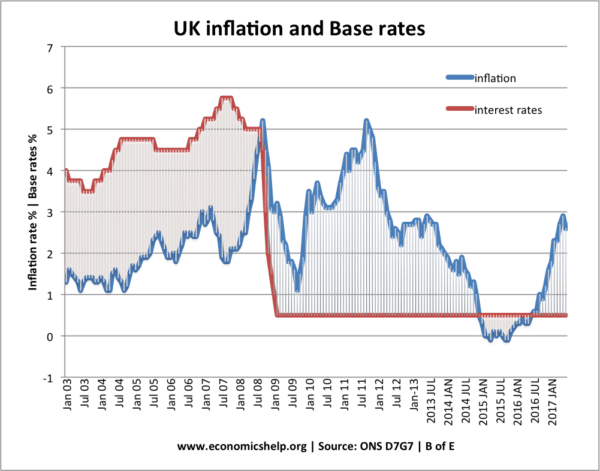

- However, it does depend on the real rate of interest. e.g. if a saver gets a higher rate of interest than the inflation rate, they will not lose out. This occurred in the period from 2003 to 2008. However, from 2008 to 2015, the inflation rate is higher than interest rates – and so savers were losing out in this period.

7. Cost of reducing inflation

High inflation is deemed unacceptable therefore governments / Central Bank feel it is best to reduce it. This will involve higher interest rates to reduce spending and investment. This reduction in Aggregate Demand (AD) will lead to a decline in economic growth and unemployment. Inflation is reduced, but there is a cost to other macro-economic objectives. Therefore, it is better to keep inflation low and avoid later more costly efforts to reduce it.

8. Fiscal drag

The amount of tax we pay increases if there is inflation. This is because with rising wages more people will slip into the top income tax brackets. See: Fiscal Drag

9. Falling real incomes

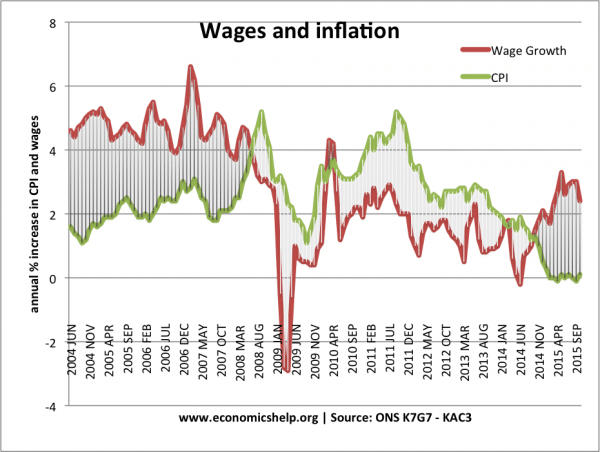

In periods of nominal wage restraint, even a small increase in inflation can lead to a fall in real wages. For example, in the period 2010-17, the UK experience pay restraint – especially amongst public sector workers, with wages limited by 1% a year. However, with inflation at 2-4% – it meant workers saw a fall in real wages

Graph sowing Inflation higher than wage growth 2010-2015 (falling real wages)

10. Bondholders lose out

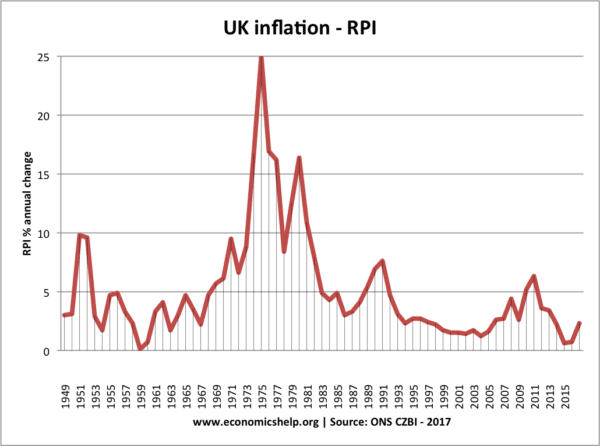

In the 1970s, many investors expected low inflation. Therefore they bought government bonds with interest rates of around 6%. With low inflation of 3-4%, they gain from buying government bonds. However, in the 1970s, inflation was much higher than expected and higher than the nominal interest rate. Therefore, bondholders saw a fall in the real value of their bonds. This made it easier for the government to pay back their debt, but it means investors lose out. Also, it makes investors less willing to purchase government bonds in the future.

UK inflation post-war. Inflation of the 1970s created instability and led to a decline in the value of savings.

Hyperinflation costs

- In periods of extreme inflation (e.g. inflation rates over 100%) inflation undermines basic economic confidence and can destroy usual economic activity. With periods of hyperinflation, people lose all confidence in money and try to spend as soon as they receive it.

- In countries with hyperinflation, we often see a ‘barter economy’ emerge with consumers exchanging goods for services – as money becomes worthless. The diagram above is from Germany in 1923 when hyperinflation made money worthless. There are stories of people using a wheelbarrow to carry around money. When they stopped outside a shop, the money was left but the wheelbarrow stolen!

- During hyperinflation, the cost of dealing with rising prices can become extreme. With prices rising by up to 100% a day – as soon as people get paid, they have to go out and spend it. In some cases, workers needed paying twice a day.

- During hyperinflation, there is also a very rapid redistribution of income – because interest rates cannot keep up with the rising prices. It tends to hit the middle-class savers the most. The only sections of society insulated from hyperinflation are those who own physical assets or debtors who see the real value of debts wiped out.

- Anticipated and unanticipated inflation

- If inflation is unanticipated (e.g. people expect a lower inflation rate), then the costs will be more serious than if the inflation rate was expected. It is unanticipated inflation that can negatively impact on a firm’s costs.

- Low inflation is often seen as harmless or even beneficial because it allows prices to adjust more easily

Further reading