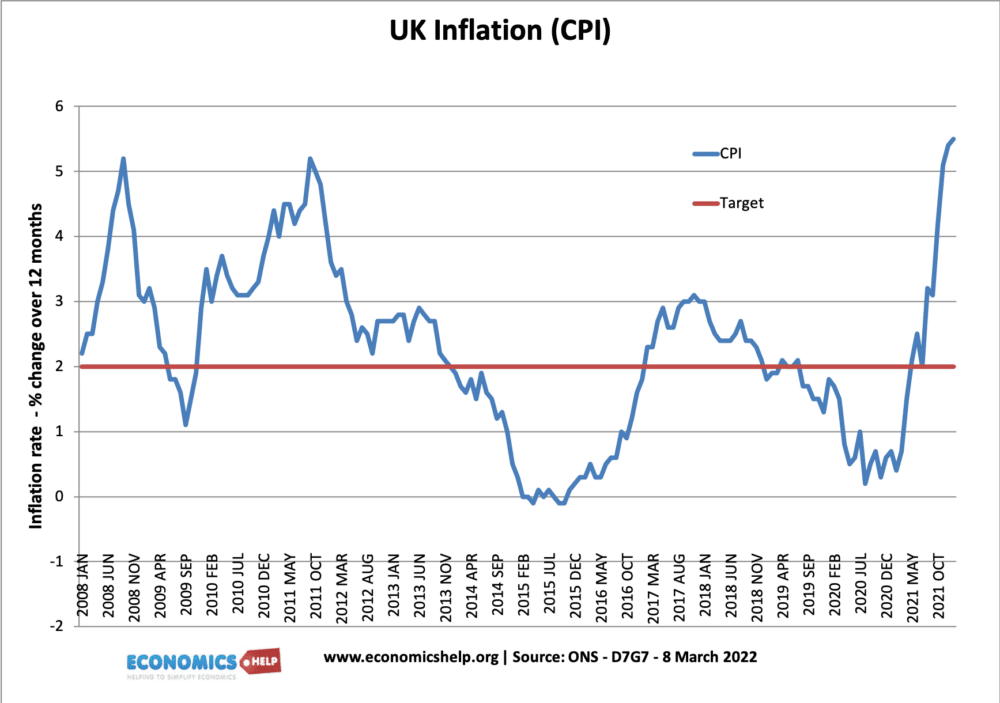

Inflation measures how much the price of goods and services have increased over a period of time; and will have a significant impact on changes in the cost of living.

An inflation rate of 5% means that on average the typical household basket of goods (e.g. food, TVs) and services (haircut, restaurant meal) is 5% more expensive than the previous 12 months.

The higher the rate of inflation the more the cost of living will be increasing.

Cost of living

Inflation determines changes in the cost of living. But inflation isn’t the only factor affecting your actual cost of living – the money you have to pay every month. As well as the change in the price of goods and services, a key factor is how expensive is it to live in a particular area; this will depend on factors such as taxes, healthcare, transport and the cost of renting/buying a house. For example, in cities like London and New York, the cost of living is very high because of expensive housing. Even if inflation was very low for a few years, it would do little to reduce the cost of living in that particular city.

When we look at the cost of living, it is important to bear in mind factors like

- Interest rates – determines the cost of mortgages and other borrowing costs.

- Average house price/rents. Depending on supply and demand-side factors.

- Necessary spending on transport.

- Healthcare costs

- Taxes.

For example, during the Covid pandemic in 2020, if people worked from home rather than take an expensive commute, their cost of living would fall because they no longer need to pay for transport.

If there is global warming, the cost of living in cold countries will decrease (less need for heating), but it might increase the cost of living in hot countries because they need to spend more on air-conditioning.

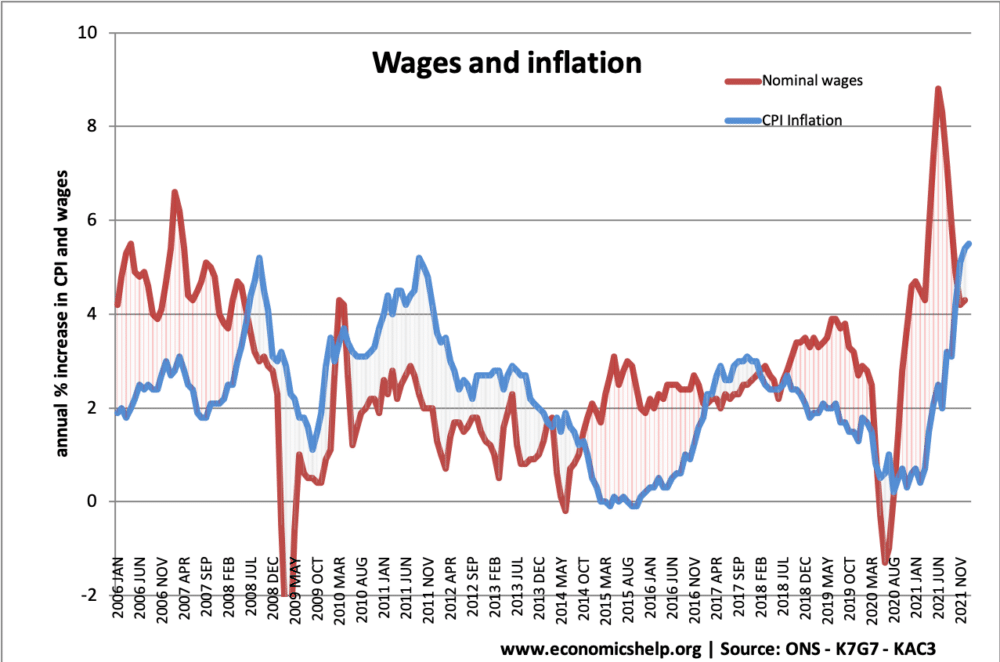

Inflation and real wages

An important factor for households is the inflation rate compared with their income. For example, if we have an inflation rate of 5%, but average incomes are increasing by 8%, the real income will increase by +3%. Therefore, even though inflation has increased prices, the important thing is that we have more income to be able to afford the higher cost of living.

However, if the inflation rate is higher than nominal wage growth, then households will be worse off. Their living standards will fall and with higher prices, they will not be able to buy as much as previously. Suppose the inflation rate is 5%, but your pension or wage only increases by 1.5%, then your real income will fall by 3.5%

Why cost of living may rise more than inflation

Some households may experience a rise in living costs that are higher than the official inflation rate. How is this possible?

Inflation measures the average price change for the average household. However, your spending may not be typical. For example, if you have a low income, you may spend a higher percentage of your income on basic food items, fuel and rent. Therefore, if the price of these essentials are rising faster than inflation, then your cost of living could easily be rising faster than the official inflation rate.

Correspondingly a consumer who spends a high percentage of their income on services and electronic goods may see a rise in the cost of living less than average incomes.

In 2022 the cost of living has been rising much faster for basic essentials. For example, food campaigner Jack Monroe pointed out how between 2021 and 2022, basic foods increased much more significantly than the official rate of inflation. Some examples of higher inflation for basic food items.

- The cheapest rice 1kg cost 45p now it’s £1 for 500g. (+344%)

- Curry sauce was 30p, now it’s 89p. (+196%)

- A bag of small apples was 59p and is now 89p. (+ 50%)

In response, the ONS has said they will try to measure more items in the future. This is particularly important because if wages and benefits rise with headline inflation 5% – low-income consumers facing 50% increases in food prices will become worse off.

It could also work the other way, there may be times when basic food items and fuel prices are rising more slowly than the average inflation rate.

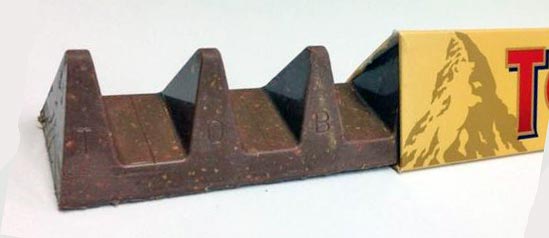

Shrinkflation

Inflation isn’t the only factor that might affect your cost of living. Shrinkflation is when firms keep prices the same but reduce the size of products. If you need to buy the same quantity as before, you will end up spending more. A similar concept is skimpflation when firms reduce the standard of service.

Further reading

- The relationship between oil prices and inflation

- Who are the winners and losers from inflation?

- Causes of Inflation

- Costs of Inflation

- Calculating the cost of living.