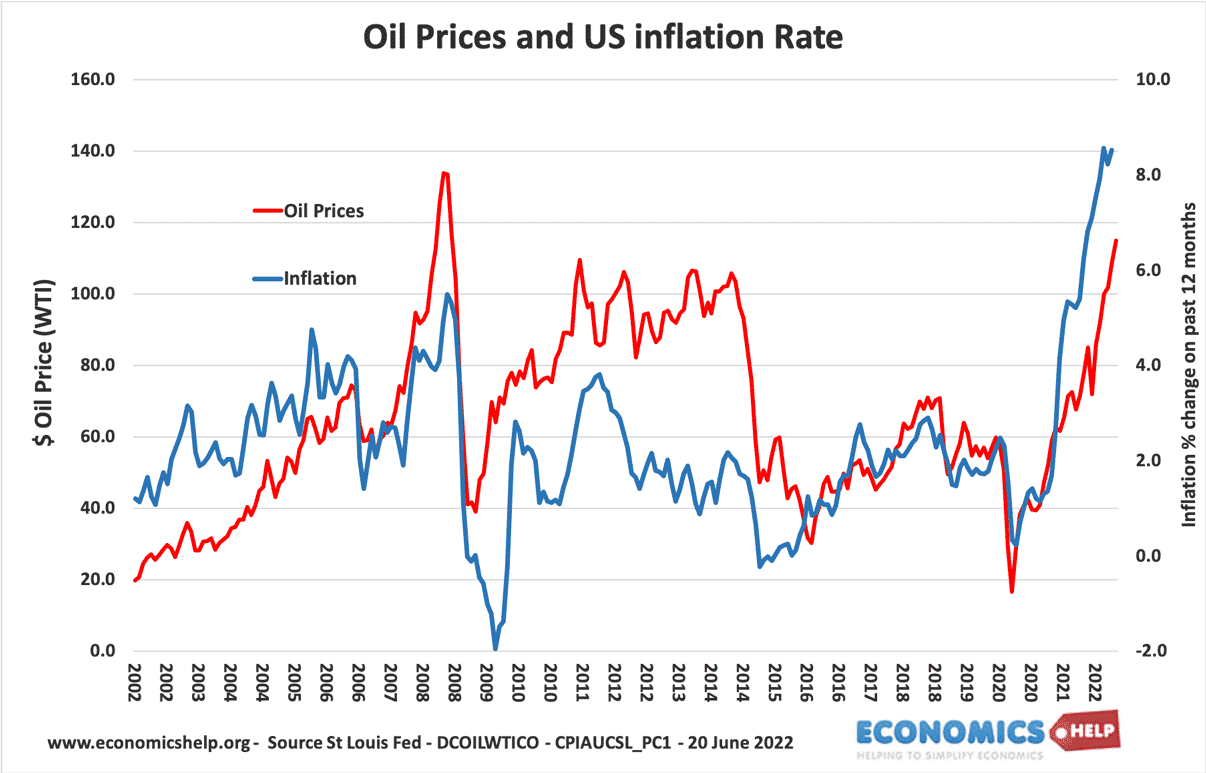

Oil prices have a significant effect on the consumer price index, though the correlation between oil prices and inflation is less direct than it used to be in the 1970s. St Louis Fed estimates a correlation of 0.27 between changes in the oil price and inflation. In other words, a sustained 10% rise in oil prices may cause the consumer price index to rise 2.7%. (Does oil drive inflation? 2018)

There is a stronger correlation between oil prices and producer prices. The producer price index measures the average selling price from domestic producers and is more closely linked to the input costs, such as oil prices.

What causes the link between oil prices and inflation?

Oil is a raw commodity in many goods, such as

- Petrol (gasoline) and diesel

- Jet fuel

- Plastics

- Petro-chemicals

- Asphalt

- Cosmetics

- Propane cooking gas

Therefore as oil prices rise, the cost of producing these goods rises.

The biggest use of oil is transportation (66%). Therefore, when oil prices rise, all goods which are transported will be affected by higher transport costs.

Also, if producer prices rise due to higher oil prices, it can also lead to knock-on effects, for example, a higher price of petrol may encourage workers to seek higher wages. Rising oil prices may increase inflation expectations.

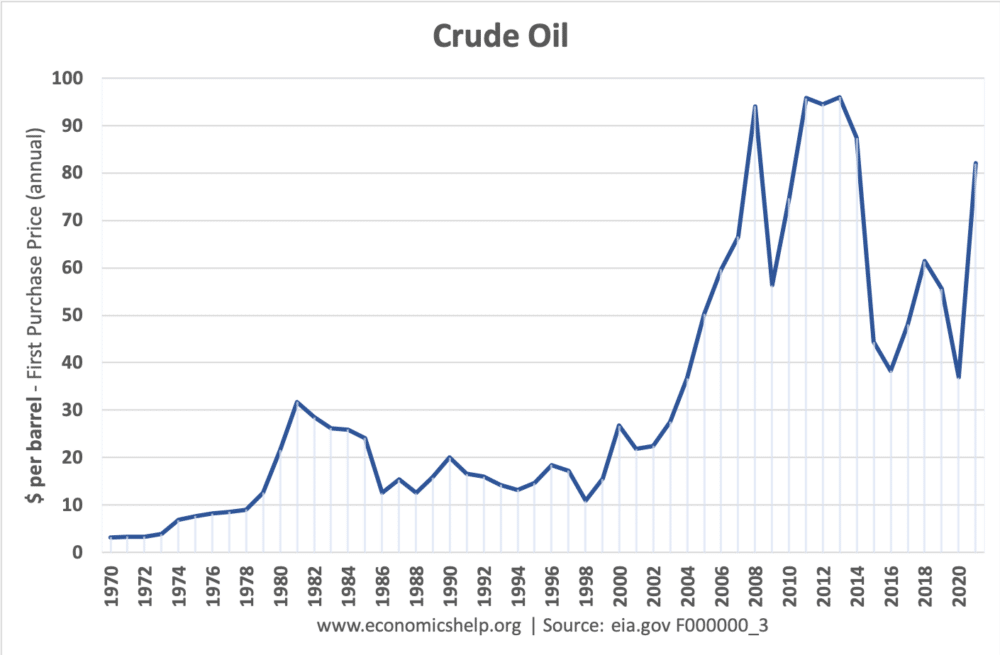

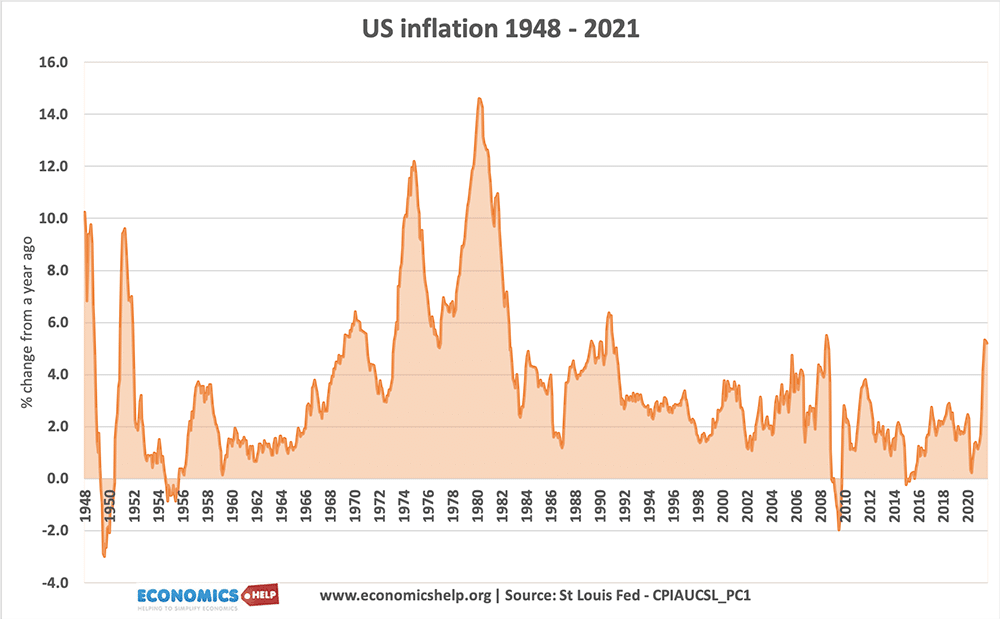

1970s Inflation

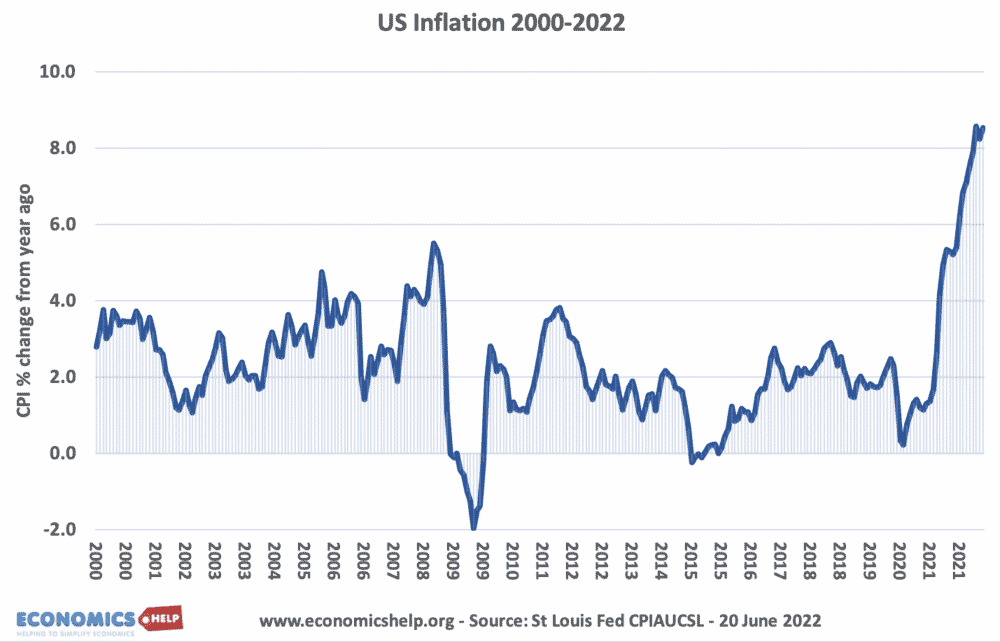

In the 1970s, oil prices rose from $3 in early 1973 to $30 by the end of 1979. This was a period of high inflation across the world, with the UK, US and Europe experiencing double-digit inflation – much higher than the others. The inflation was also unusual, in that, mostly inflation had been subdued in the post-war period (with the exceptions of very brief spikes in the 1950s)

In the 1970s, you could argue that rising oil price was not the only cause of inflation. In addition, wage growth was strong (partly due to powerful unions) So when prices start rising due to higher oil prices, the response of rising wages, made the inflation more permanent. But, although this is true, oil prices were the main reason for igniting inflation in the first place.

In the run-up to the first gulf war in 1992. Oil prices doubled from $16 (June 1990) to $36 in October 1990. But, in this period, CPI inflation did not take off. The oil price shock was absorbed with little inflationary pressure.

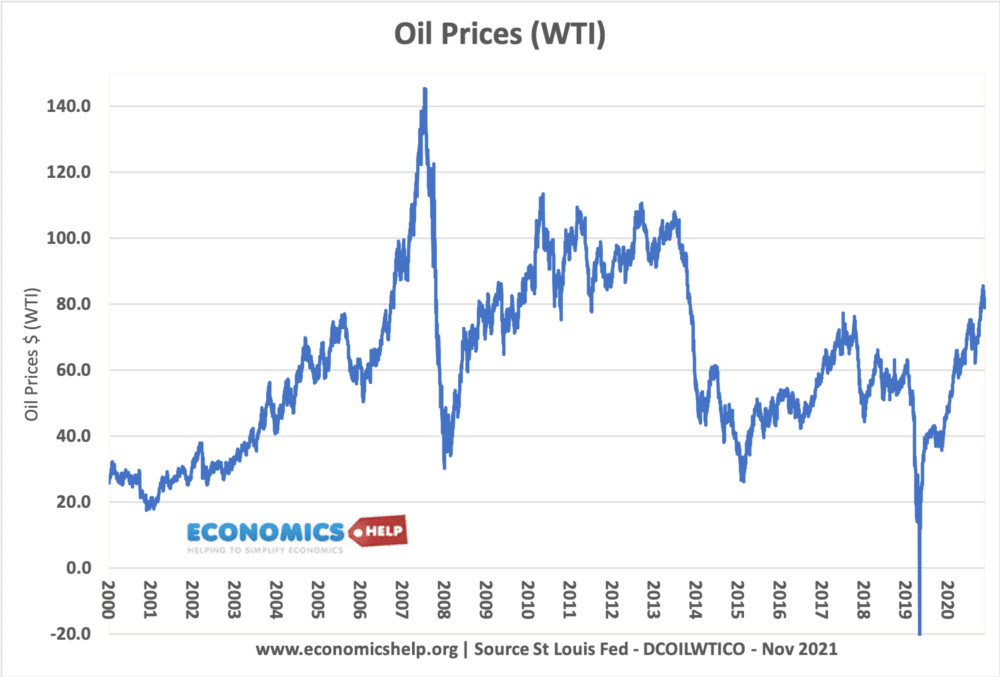

2008 oil price shock

From January 2007 to June 2008 oil prices rose from $54 to $144 in less than 18 months. It did cause inflation, but only inflation of 5% – quite small compared to the size of the sustained rise in oil prices. Interestingly as oil prices collapsed in the credit crunch of 2008, CPI inflation fell into negative territory for the first time in decades.

2021

Since recovering from the Covid-induced economic downturn, oil prices surged from (briefly) negative prices of WTI to over $80 in Nov 2021. It led to US inflation of 6.2% (October 2021) Again, it is a significant rise in inflation, though still lagging, the dramatic turnaround in oil prices. Also, the inflation of late 2021 can also be attributed to other supply-side shocks, such as a shortage of shipping and containers.

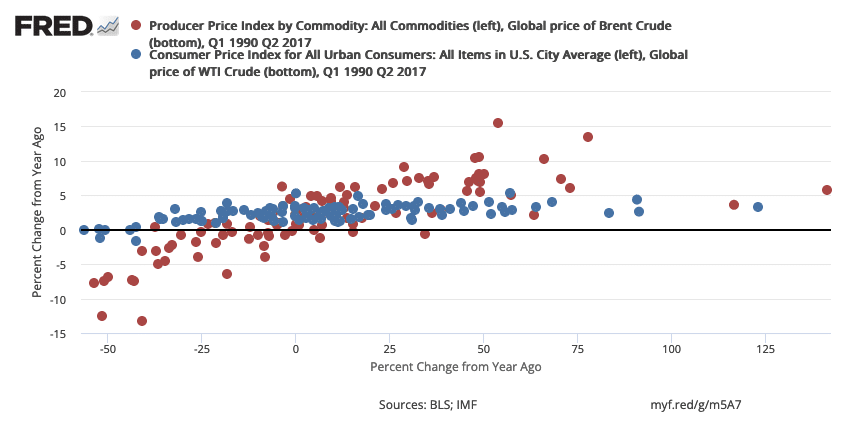

Relationship between oil price changes and consumer/producer price changes

This graph plots the producer price index and consumer price index against the global price of Brent Crude oil.

- There is a fairly strong relationship between changes in oil prices and changes in producer prices. As we would expect

- The relationship between oil prices and consumer prices is much weaker, with only a marginal correlation between changing oil prices and consumer prices.

Why isn’t the link between oil prices and consumer prices stronger?

- Roughly 66% of economic output and consumption is in the form of services (retail, insurance, hospitality). For this sector, oil prices only play a small role. If oil prices rise, it is unlikely to lead to a higher price of haircuts.

- Economies are reducing their dependency on oil. In the early 1970s when oil was cheap, there was no reason not to drive a big ‘gaz guzzler’ which went through a lot of gas(petrol).

- Since the 1970s, engines have become more fuel-efficient and we have seen the rise of alternative forms of energy.

- Firms can absorb some of the cost increases. If a firm experiences a 10% rise in costs, due to higher oil prices, it doesn’t mean it will pass this onto consumers in the form of 10% higher prices. In a competitive market, firms may agree to a lower profit margin and avoid irritating consumers through higher prices. Equally, when there is a fall in oil prices, firms are slow to cut prices – they regain their former profit margins.

- Forward contracts. Transport firms don’t just buy oil when they need it. They may insulate themselves from volatile prices by buying future contracts.

- When oil prices were negative in 2021, this was due to the costs of storing oil (there was such a glut, firms didn’t want to take more deliveries of oil because of storage costs). But, the actual price paid for by consumers was significantly higher.

- Oil prices are an important factor in determining inflation. A very significant rise in oil prices will feed through into higher inflation. However, there are many other factors affecting inflation, apart from oil – notably, wage growth, confidence, spare capacity in the economy, rate of growth. Therefore, even if oil prices rise, it might be outweighed by other factors.

Related

Hi Tejvan,

Can you update the Oil Price vs US Inflation chart at the top? It’s very much relevant today. I’d love to see the latest. I have most of the raw data but that chart really sums up the relationship.

Updated June 20, 2022

https://www.economicshelp.org/blog/167245/economics/the-relationship-between-oil-prices-and-inflation/