Oil prices tend to be volatile for a few reasons.

- Demand varies with the economic cycle.

- Changes in the price of oil can be magnified by speculators who buy forward contracts

- Supply is quite inelastic in the short-term. Therefore, a small change in demand can have a significant impact on the price.

Firms and consumers often face having to adjust to oil price changes – either rapidly rising prices or rapidly falling prices. Their response will depend on the magnitude of change and also how long the price change is likely to last. For oil-exporting countries, especially in emerging markets, adjusting to oil price shocks can be quite challenging and painful.

Adjusting to higher oil prices

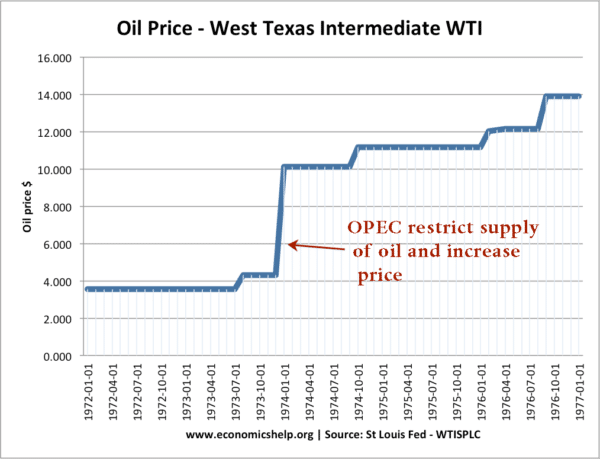

- The classic case of an oil price shock was in 1973 when oil prices tripled within the space of a few days. It was a genuine shock to western economies who had grown accustomed to cheap oil. In the short-term higher oil prices caused

- A fall in demand for oil and related products. For example, demand for travelling by car fell.

- Transport costs rose, leading to cost-push inflation. This led to workers demanding higher wages. In the 1970s, unions were quite successful in gaining higher wages and combined with rising oil prices was a factor in causing significant inflation.

- A rise in demand for alternatives/substitutes. Increased demand for walking, cycling and public transport.

- In the short-term the fall in demand for oil is quite inelastic. People have the commitment to get to work and so when the price rises, it is hard to adjust. Therefore consumers tend to keep paying the higher prices, but the longer the price increase lasts, the greater the incentive to find alternative and cut reliance on oil

In the long-term, it is easier for firms and consumers to adjust.

- The higher price of oil makes transport more expensive so consumers give a higher weighting to fuel efficiency. This encouraged firms to prioritise cars which could boast good fuel efficiency (over the ‘gas guzzlers or the ’50s and ’60s’)

- In recent times, high oil prices have spurred investment in hybrid cars and alternative sources of fuel.

- Producers also adjust by seeking to increase supply. A higher oil price makes oil production more profitable and can spur investment in more remote areas. After the oil price shocks of the 1970s, it became profitable to produce oil in more inaccessible areas, such as Russia, Antarctic, The North Sea. Therefore, over time, OPECs dominance of the oil market fell.

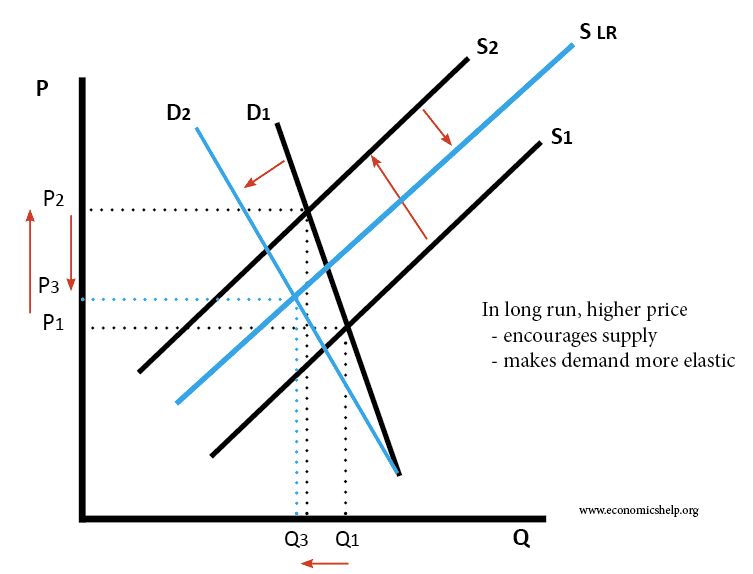

Adjusting to oil shock in the short-term and long-term.

- Initially, supply falls from S1 to S2. This causes the price to rise to P2 and demand to fall.

However, in the long-term

- Demand becomes more elastic (sensitive to change in prices) demand shifts to D2

- The high price acts as an incentive for firms to increase the supply of oil. Therefore, in long-run, supply increases from S2 to S LR.

- Therefore, in long-run, the rise in oil prices can be mitigated and fall back closer to the original. This is what happened after the 1970s oil shock.

Adjusting to lower oil prices

Adjusting to lower prices leads to similar issues. For consumers, there is little adjustment needed. They primarily benefit from lower prices and it creates less incentive to use alternative forms of transport such as trains.

- Producers and oil-exporting countries can find it more difficult to adjust to the fall in prices.

- In the short-term, producers will cut back on investment and drilling, especially in more expensive areas of oil production. If the fall in oil prices proves more long-term, they will need to consider closing down operations.

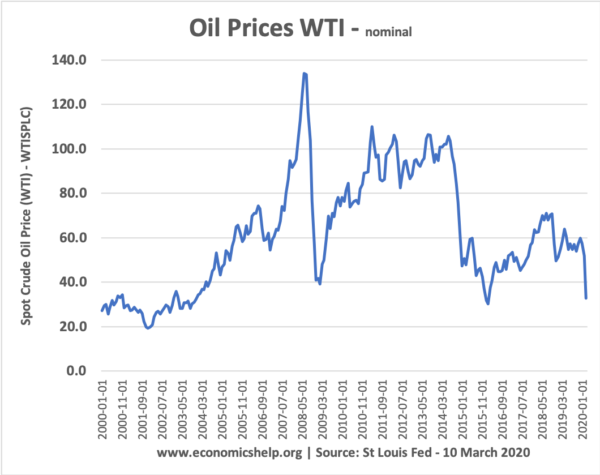

- In 2020, the fall in demand for oil was so severe, futures contract on oil became negative. This is because just storing oil has costs involved. There was so much surplus, people with forward contracts were paying others to take delivery of oil and deal with costs of storing.

- The fall in oil prices in 2020 has led to oil prices falling below the break-even cost price of producing. Oil firms face a twin problem – over-supply and a fall in demand. Usually, firms would respond to a fall in oil prices by temporarily accepting loss, borrowing and hope that oil prices rebound. However, the depth of the 2020 recession may make this difficult and many oil producers may be forced to move out of the industry altogether. Oil produces in relatively high cost areas will be the hardest hit.

How do oil-exporting countries adjust?

The issue of volatile oil prices is more difficult for economies which rely on oil revenues for a significant part of GDP. In good times, higher oil prices may encourage countries to save surplus and/or invest in the diversification of the economy. Norway invested in a national pension fund. Qatar and UAE have tried to diversify the economy away from purely fossil fuels. But for many countries, the temptation is to use oil revenues for current spending.

A rapid fall in oil prices can be very difficult to adjust to. For emerging economies like Russia, Iran and Venezuela a sudden fall in oil price will lead to a fall in government tax revenue, a fall in GDP and a fall in foreign currency earnings. This can even lead to capital flight – if investors become concerned about the viability of the economy.

With falling oil prices, government tax revenues will fall so there will be fewer funds to invest in diversification. For example, with falling oil prices in 2020, Russia also saw an outflow of investors selling Russian bonds – making it more expensive for the government to borrow – at a time when there is a greater need for government borrowing.

One side-effect of a rapid fall in oil prices is that it will tend to cause fall in the exchange rate of oil producers. For example, in early March the Russian Ruble fell 20% due to the collapse in oil prices. A fall in the exchange rate should, in theory, provide a boost in the competitiveness of Russian exporters. In the long-term, it should help rebalance the economy away from oil and towards manufacturing and agricultural exports. However, in practice, this adjustment can take time. To develop manufacturing industries takes time and investment. Investment funds may be in short supply when the economy is doing badly. Also, if oil prices fall due to global recession, it is hard to find new export markets with consumer demand weak.

Related