There are a few different reasons firms may put up prices, but in each case, a business will weigh up the pros and cons.

Potential reasons for increasing prices

- An increase in costs of production.

- A general increase in the price level (inflation)

- Competitors are increasing the price.

- Firms believe demand has become more price inelastic, e.g stronger brand loyalty

- Firms getting close to a shortage/selling out, so increase price in response to the rising demand.

- Seasonal factors, e.g. tourist outlets increase price during the peak tourist season.

Increased costs

The easiest factor for determining price increases is an increase in costs. Firms may adopt a form of cost-plus pricing.

- If a good costs $10 to make, it may need a profit margin of say $5 and so the good will retail for $15.

- If the costs of production rise to $11, then a simple calculation is to increase the price to $16.

If labour costs increased 10%, and labour costs were 50% of a firm’s costs, then you might expect an increase in the price of 5% due to higher wages.

However, a rise in costs may not lead to a direct rise in prices. Firstly, if the firm feels the rise in costs is likely to be temporary or short-term, then it may absorb the higher costs and avoid irritating consumers by increasing prices. For example, if oil prices rise, there is a logic for train and bus companies to increase prices. However, the companies would face the significant menu and transaction costs of changing prices. Therefore, they will try to keep prices the same for at least one year. Only at the end of the year, would they change prices depending on oil prices. Some firms may take future contracts out on oil prices as a way to insulate themselves from varying costs.

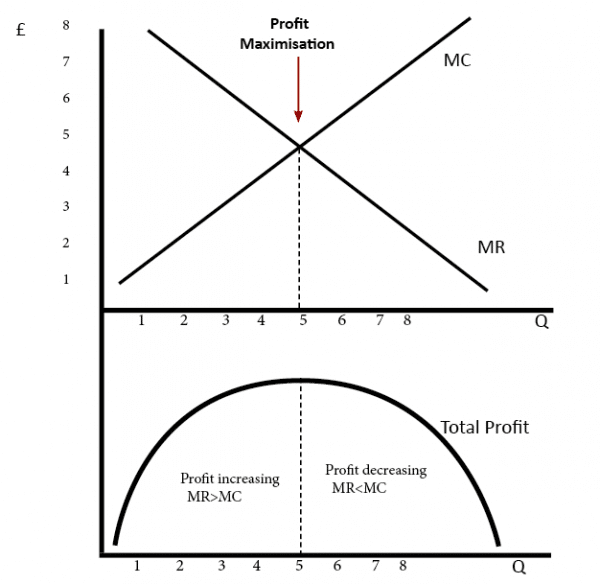

Profit maximisation

In economics, we can see a firm maximises profit by setting a price where Marginal revenue (MR) = marginal cost (MC). Therefore, increasing prices will be directly related to changes in MR or MC.

In theory, a rise in marginal revenue or fall in marginal cost would lead to higher prices. However, in the real world, firms are unlikely to have access to such precise data and may prefer to use ‘rules of thumb’ in setting prices.

Inflation

In a period of inflation, firms will typically increase prices at a similar rate to inflation. If the inflation rate rises to 5%, then it will be easier for a firm to also increase prices at 5%. However, within an economy, there can be different rates of inflation within different sectors. For example, whilst food and drink may rise 7%, electronic goods could be falling in price. The inflation rate is only a rough guide and most firms will not directly look at inflation, but focus on cost rises within their own sector. Some goods are closely linked to the inflation rate like train fares and bus fares. In the annual review, the inflation rate will be a starting point to decide annual fare increases (though of course train companies may increase prices by more.)

Competitors

For most firms facing a degree of competition, the actions of their competitors will have a big bearing on their price decisions. If a market leader, such as Tescos or Virgin Media increases the price, then it becomes a temptation for rival firms to increase the price by a similar amount. However, it depends on the objectives of firms. If the objective is profit maximisation, then they are more likely to respond by increase prices at a similar amount to competitors. However, they may prefer to seek sales maximisation – and an increase in market share.

If Tesco increased the price of groceries then rivals like Lidl and Aldi may continue to keep prices the same because they are more interested in gaining market share from Tesco. For many years, Amazon pursued a strategy not of profit maximisation but market penetration – seeking to keep prices as low as possible to gain market share. Therefore, if book retailers increased prices, Amazon would pay little attention.

Elasticity of demand

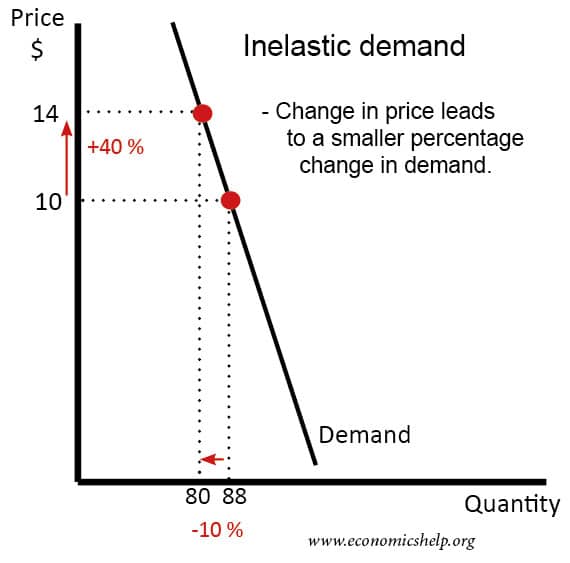

A key factor in determining whether to increase price is elasticity of demand. If demand is price inelastic, then an increase in price will cause a smaller percentage fall in demand, and the firm will see an increase in revenue and rise in profits.

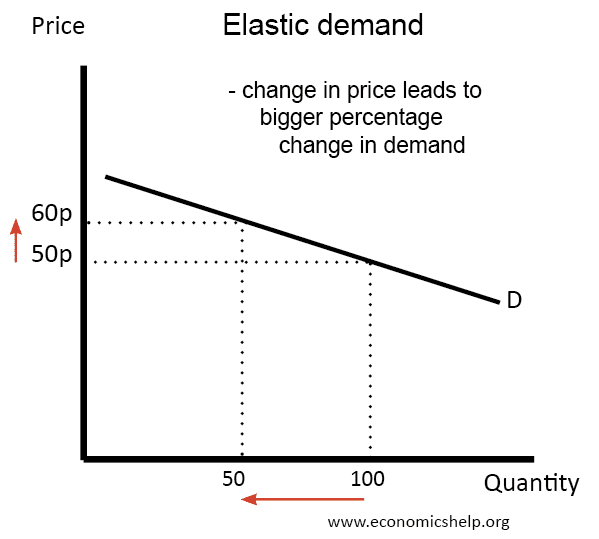

If demand is price elastic, then an increase in price will cause a bigger percentage fall in demand; the firm will see a fall in revenue.

If demand is price elastic, the firm will have little incentive to increase the price because revenue will fall. (If the firm sell less, it will have lower costs – so if demand is only just price elastic, increasing prices may still increase profits because fall in costs is greater than fall in revenue)

If a firm became more popular or develops stronger brand loyalty, then it may be in a better position to increase price as demand will become more price inelastic. For example, if a clothing brand cultivates a popular brand image, then consumers will be willing to pay higher prices for the sense of getting a ‘premium’ brand. For a retailer like Primark, who specialise in low-cost clothing, consumers will be much more price sensitive and it will be difficult for Primark to increase price above the rate of inflation. For a strong brand like Versace, Prada, Gucci, it will be much easier to increase prices.

Apple has been very successful at increasing the price of its latest iPhone. They have achieved this by bringing out models with more features combined with their strong brand loyalty. This is a combination of improving the quality of the product, but also successful brand loyalty.

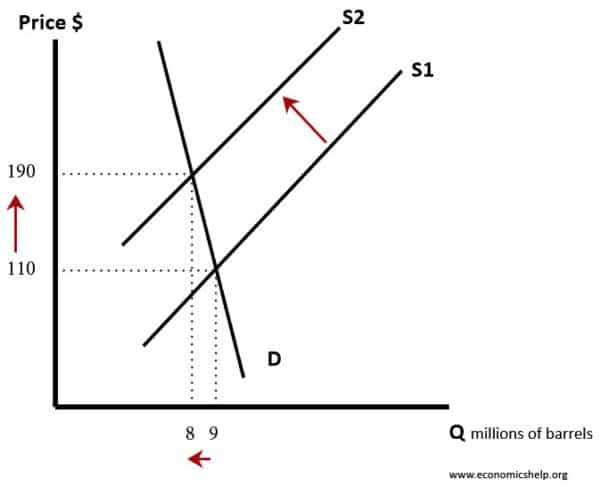

Shortage

If a firm is running out of stock, then one response is simply to increase the price. The higher price rations the demand and gives the firm time to deal with the shortage.

However, there might be occasions, where firms do not want to increase the price – even though market equilibrium has increased. For example, Uber use surge pricing – when demand rises, the price of taxis can increase a lot. However, in some cases, after a disaster or terrorist attack, the price of Uber’s went through the roof. This created bad publicity as it seemed Uber were profiting from people’s misfortune. After some bad publicity, they decided to cap price increases. This is an example of why firms may be wise not to always follow market forces.

Similarly, theatres or football clubs may decide to keep prices lower than market equilibrium to avoid giving sense they are becoming ‘elitist’ but make the service/good affordable to ordinary fans.

Seasonal factors

In certain time periods, it makes more sense for firms to increase price. The price of holiday cottages is much higher during the summer holidays. It is a type of price discrimination setting different prices to different groups of consumers. There are different forms of price discrimination which can encourage a firm to set higher prices for some groups of consumers.

Related