- An assumption in classical economics is that firms seek to maximise profits.

- Profit = Total Revenue (TR) – Total Costs (TC).

- Therefore, profit maximisation occurs at the biggest gap between total revenue and total costs.

- A firm can maximise profits if it produces at an output where marginal revenue (MR) = marginal cost (MC)

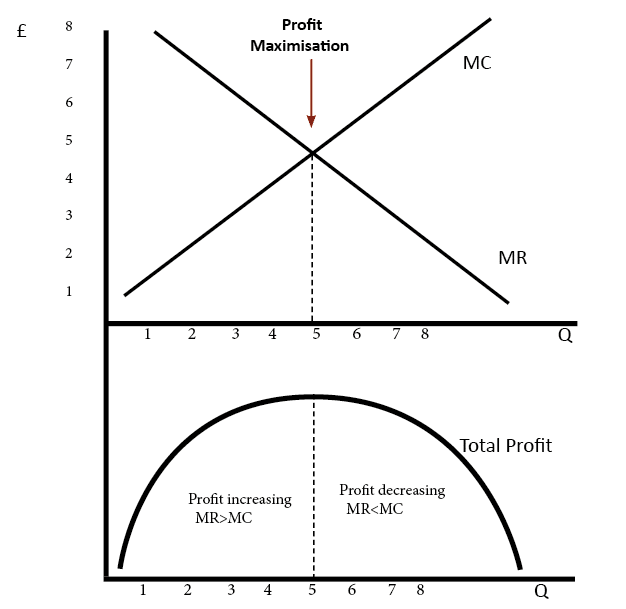

Diagram of Profit Maximisation

To understand this principle look at the above diagram.

- If the firm produces less than Output of 5, MR is greater than MC. Therefore, for this extra output, the firm is gaining more revenue than it is paying in costs, and total profit will increase.

- At an output of 4, MR is only just greater than MC; therefore, there is only a small increase in profit, but profit is still rising.

- However, after the output of 5, the marginal cost of the output is greater than the marginal revenue. This means the firm will see a fall in its profit level because the cost of these extra units is greater than revenue.

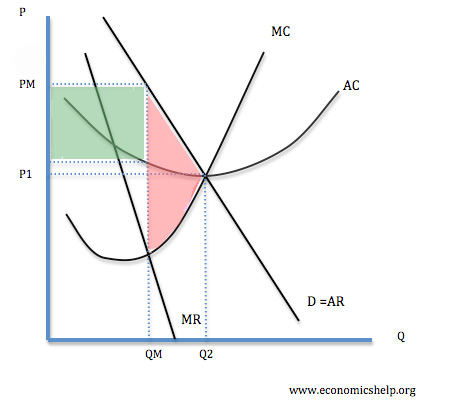

Profit maximisation for a monopoly

- In this diagram, the monopoly maximises profit where MR=MC – at Qm. This enables the firm to make supernormal profits (green area). Note, the firm could produce more and still make normal profit. But, to maximise profit, it involves setting a higher price and lower quantity than a competitive market.

- Note, the firm could produce more and still make a normal profit. But, to maximise profit, it involves setting a higher price and lower quantity than a competitive market.

- Therefore, in a monopoly profit maximisation involves selling a lower quantity and at a higher price. see also: Diagram of monopoly

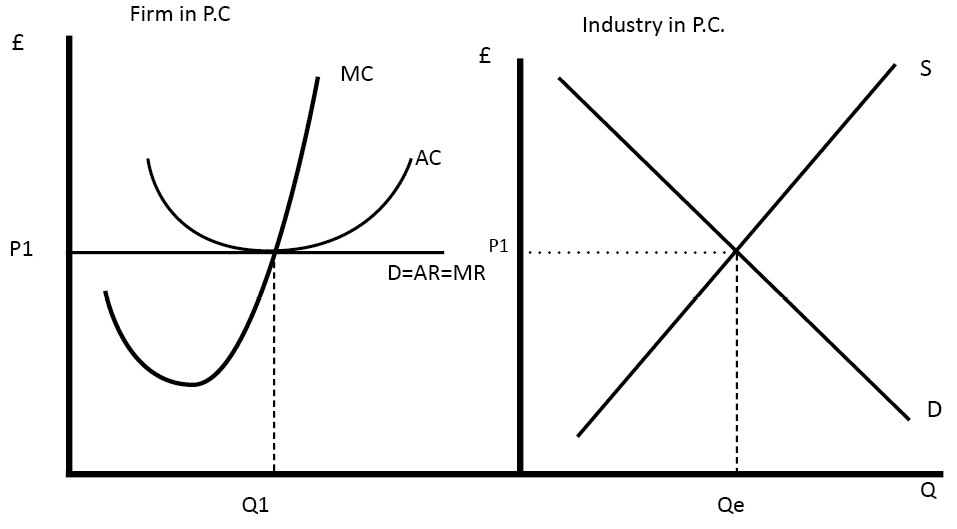

Profit Maximisation in Perfect Competition

In perfect competition, the same rule for profit maximisation still applies. The firm maximises profit where MR=MC (at Q1).

For a firm in perfect competition, demand is perfectly elastic, therefore MR=AR=D.

This gives a firm normal profit because at Q1, AR=AC.

Profit Maximisation in the Real World

Limitations of Profit Maximisation

- In the real world, it is not so easy to know exactly your marginal revenue and the marginal cost of last goods sold. For example, it is difficult for firms to know the price elasticity of demand for their good – which determines the MR.

- It also depends on how other firms react. If they increase the price, and other firms follow, demand may be inelastic. But, if they are the only firm to increase the price, demand will be elastic (see: kinked demand curve and game theory.

- However, firms can make a best estimation. Many firms may have to seek profit maximisation through trial and error. e.g. if they see increasing price leads to a smaller % fall in demand they will try to increase price as much as they can before demand becomes elastic

- It is difficult to isolate the effect of changing the price on demand. Demand may change due to many other factors apart from price.

- Firms may also have other objectives and considerations. For example, increasing the price to maximise profits in the short run could encourage more firms to enter the market; therefore firms may decide to make less than maximum profits and pursue a higher market share.

- Firms may also have other social objectives such as running the firm like a cooperative – to maximise the welfare of stakeholders (consumers, workers, suppliers) and not just the profit of owners.

- Profit satisficing. This occurs when there is a separation of ownership and control and where managers do enough to keep owners happy but then maximise other objectives such as enjoying work.

Related

Fantastic with its concise explanation

Very good. Helped me with my FDCR Business and Economics Application exam.

I have a question. Overridding objective of a companies?

Very good

if they increase prices above profit maximising equilibrium would they gain more profits????

No.

Since a firm’s ambition is to minimize cost and maximize profit what are the clear criteria for maximizing profit?

SIR! in reality can we make slope of average cost and average revenue equal as well constant?

how will this change in the long run

Hi what the difference between profit maximisation with TC, TR approach ? and MC=MR ?

It is good what will be the cause if MR is not equal to MC

I love study it is good

Hello Every one can someone help me on this question

QN

other things remaining the same, discuss how can a firm leverage the various market situations to maximize its goal of profit through its pricing policies

why do firms maximize total profit rather than profit per unit.