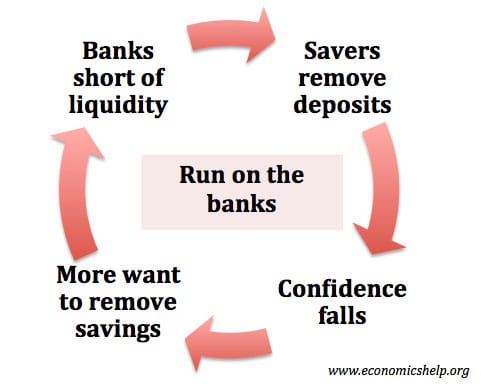

Bank run definition

A bank run occurs when there is a sudden demand to withdraw money from a bank, that the commercial bank struggles to meet. The first signs of ‘bank panic’ will encourage other depositors to also try and withdraw their savings, causing a further ‘run on the bank.’

In a bank run, investors are trying to get back their deposits before the bank goes out of business and depositors can no longer access their deposits.

A bank run occurs when savers become concerned about the liquidity of a bank and so seek to withdraw their savings and put it other assets, such as cash savings. When a bank receives multiple demands to withdraw money, it becomes unable to meet all the demands and has to call in loans, sell assets or impose restrictions on withdrawals.

The role of the Central Bank

An important role of a Central Bank is to provide liquidity to banks under stress and guarantee saving deposits. It is known as a ‘lender of last resort‘ This helps to reduce the panic about losing deposit and prevent bank runs. (Though there is a risk of creating moral hazard if bad banking decisions are safeguarded by government intervention.)

In the 1930s, the US banking system did not have a system of ‘lender of last resort’, and there were frequent bank runs which led to the collapse of 500 small to medium-sized banks.

Causes of a Bank Run

- When savers invest money in a bank. The bank doesn’t keep all the deposits in cash reserves. It is more profitable for a bank to lend a high percentage of deposits in the form of loans. It is lending money to homeowners and business, which allow the bank to make a profit on its deposits. If a bank had deposits of £1 billion, it might lend out £0.95 billion and keep only a reserve of £0.5bn (or 5% of deposits)

- If savers all demanded their cash at once, the bank wouldn’t be able to meet the demand for cash. It would have to call in loans or sell its assets. However, the bank relies on this not occurring. In normal circumstances, the bank can predict how much cash savers will need to withdraw.

- However, suppose the bank lent out money to a business, but there is a recession. Firms go out of business and its bank loans default. Also, if house prices fall and consumers can’t meet mortgage repayments, the banks will lose on its mortgage loans. In other words, the bank is losing money on its loan. Its balance sheet deteriorates, and its liabilities (deposits) could become greater than its assets (loans)

- If consumers hear bad economic news and news that a bank may be going out of business, then there is an incentive for consumers to withdraw their money before the bank does go out of business. When news spreads that other savers are withdrawing money, it creates a snowball effect and encourages other savers to also want to withdraw money.

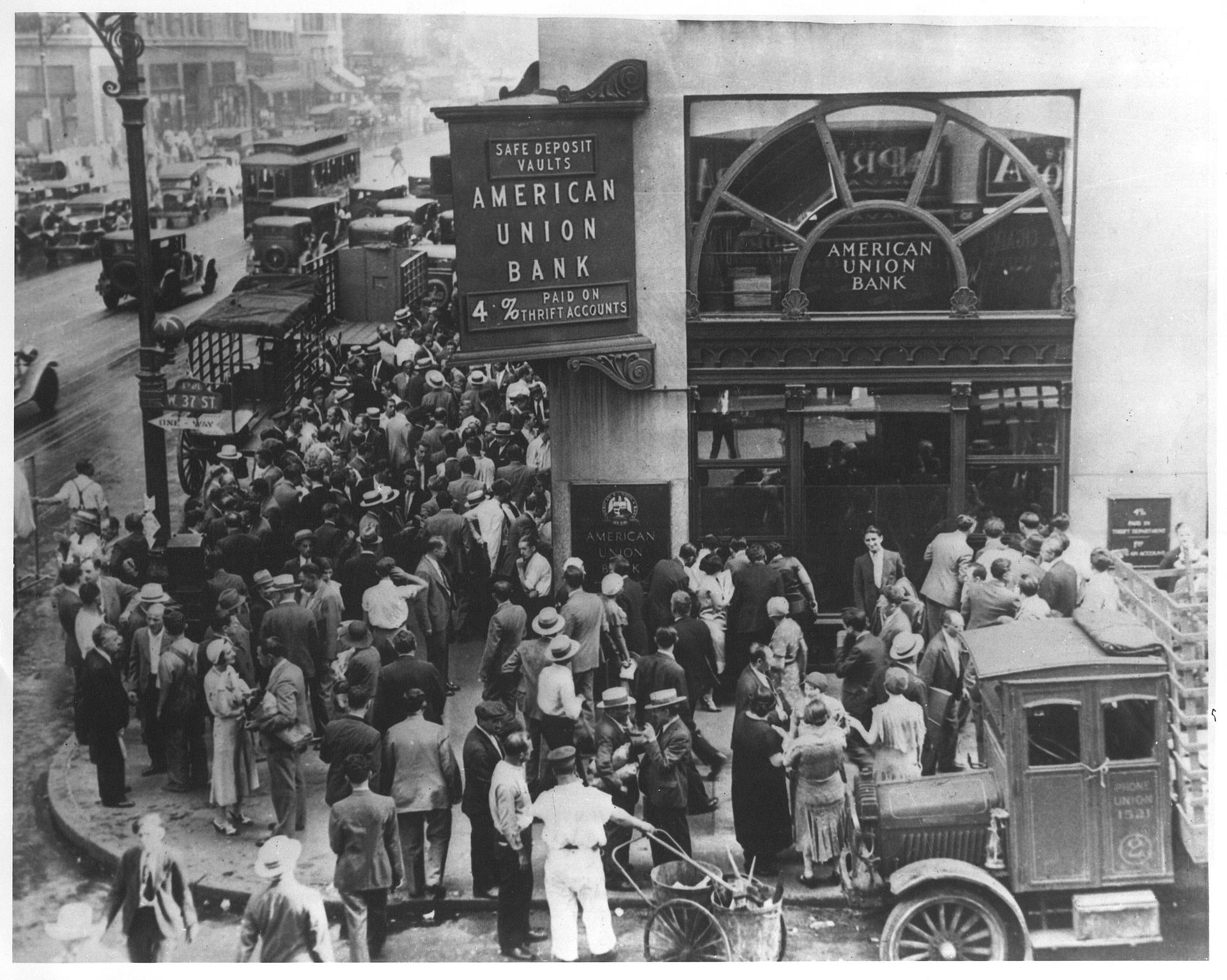

Bank runs of the 1930s

In the 1930s, the US saw numerous bank runs. The causes of this were:

- Growth in credit during the 1920s. For example, many consumers bought shares ‘on the margin,’ i.e. borrowed money to buy shares.

- There was no lender of last resort for commercial banks

- Banks were local and focused on a particular region. When a local business went under, everyone knew it would affect their local bank.

- The Wall Street Crash of 1929 caused stock market investors to lose money – especially those who bought on the margin. Many ‘paper millionaires became broke – owing more than they owed. This caused an increase in bank withdrawals.

- More seriously, banks also lost money from lending people money, which they now couldn’t pay back after the stock market fall.

- Agricultural recession. Throughout the 1920s, US agriculture was in recession with many farmers going out of business due to low prices and poor harvests.

- Great Depression. The economic panic caused consumers to cut back on spending and firms to cut back on investment. Economic growth and GDP fell sharply, leading to firms going bust and unemployment to rise.

- Regional banks saw a deterioration in their balance sheet. Their assets fell due to loan defaults and falling asset prices.

- Some regional banks started to struggle to meet the demand for withdrawals. This created a loss of confidence in the local, regional banks and investors became sensitive to news their bank would be next. Any negative news would create an incentive for people to rush to the bank and withdraw money before they went out of business.

Even the smallest negative news could cause problems. In Dec 1930, the New York Times reported a small merchant was advised by the Bank of the United States that his stock was a good investment. But, the merchant took this as a warning that the bank was refusing to sell his stock. The news spread like wildfire and within hours, 3,000 depositors had withdrawn $2 million. (Bank Run at History.com)

Consequences of Bank Run

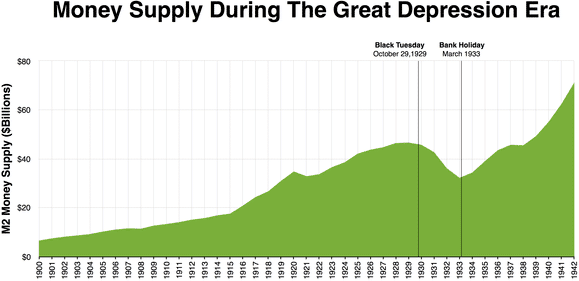

- The bank run had dire consequences for the US economy. People lost confidence in the banking system and so saved money in cash. Banks were starved of funds and unwilling to lend to business. Business investment dried up.

- The collapse in confidence also discouraged any big investment or spending plans.

- The bank collapses led to a fall in the money supply and a period of deflation. Deflation aggravated the real burden of debt, causing a further decline in real GDP.

US Real GDP in the 1930s

Bank Run Game Theory

If you have savings in a bank. Even if there is only a very small chance of the bank going bankrupt, there is a very strong incentive to make sure you are amongst the first to withdraw money – before the bank can’t return your deposits. If you wait, you risk losing everything. This is why bank runs create a panic and long queues. You lose nothing by being the first and risk-averse. You gain little by hoping the bank panic passes without consequence.

Bank run the UK – Northern Rock

Since Central Banks have played a more active role in securing deposits bank runs are less common. However, in the credit crunch of 2008, bank losses were very sharp and it created the circumstances of banks at risk of going under. The collapse of Lehman Brothers (an investment bank) was a shock and UK banks like Northern Rock were short of liquidity (they had been borrowing money to lend so were very short of liquidity. The Bank of England and the UK government had to explicitly state bank deposits would be secured.

Surprised there was no mention of fractional reserve banking?

Also would be great to hear thoughts on where the economy is heading following on from the long term debt cycle and Ray Dalio’s Latest book?

Classic finance. If the Fed would lower interest rates back to 0 – what would that mean? that they failed again and we need more QE? Seems likely…

When was a ‘lender of last resort’ system implemented into the US banking system?