A fall in oil prices should cause a reduction in transport and fuel costs for firms. Consumers who will also benefit from the lower prices of transport and fuel. The lower oil prices will effectively increase their disposable income and enable them to spend more on other goods

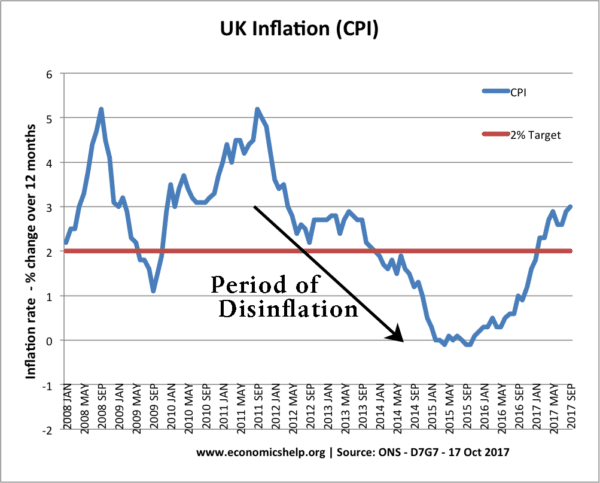

Because oil is the most traded commodity and has a significant bearing on global transport costs, it should lead to inflation and can lead to higher rates of economic growth.

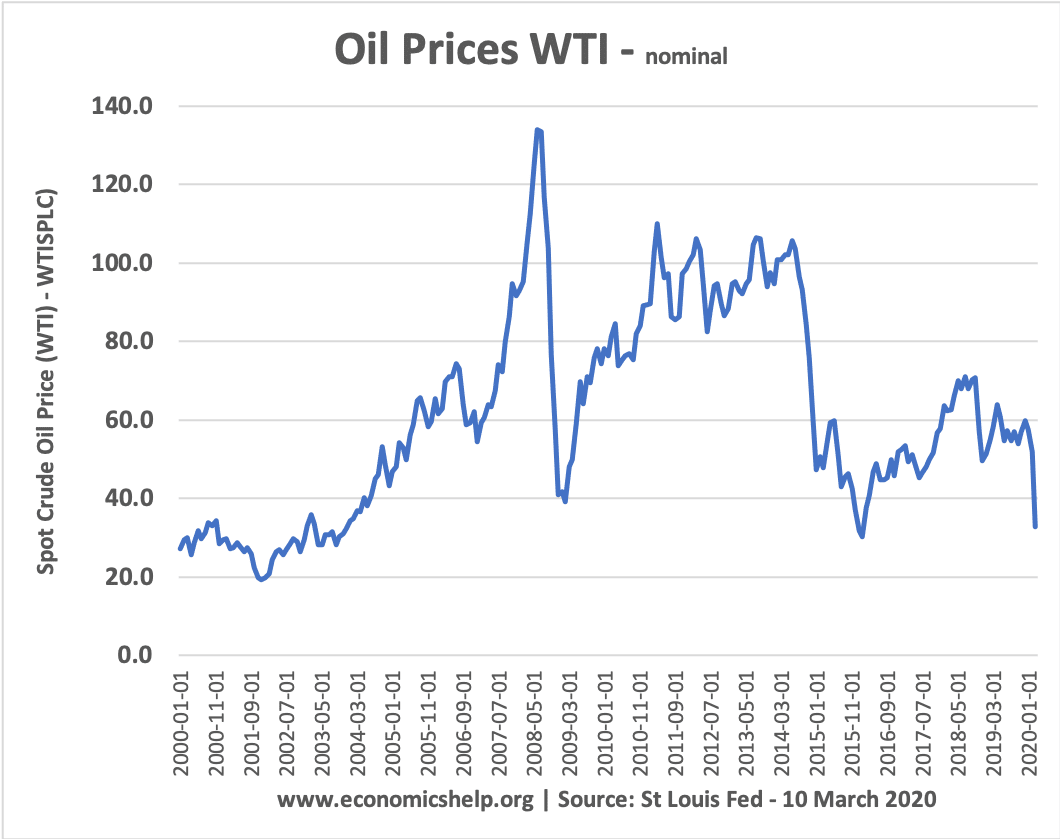

However, sometimes oil prices crash because there are fears of an economic recession. In this case, falling oil prices are not sufficient to increase economic growth because other factors keep growth low. Also, if oil prices fall sufficiently, it can cause some oil firms to go out of business and this causes a rise in bad debts. The crash in oil prices in 2020 is indicative of the economic recession and prices have fallen so far that many oil firms will be forced out of business, causing job losses and falling investment.

Also, falling oil prices will have differing effects depending on the country. Oil importing countries (e.g. Germany, Japan, India) will generally benefit from oil lower prices, but developing economies who rely on oil exports (e.g. Russia, Venezuela) could see a significant fall in export revenue.

Oil price fall 2020

The oil price fall in March-April 2020 has pushed oil to its lowest prices for many years. For a brief time in April 2020, Oil prices for WTI fell to negative prices. The above graph shows nominal prices and not adjusted for inflation.

Usually, a fall in oil prices would be greeted by consumers and firms due to the lower prices and costs. However, this fall is due to expectations of a sharp drop in travel and economic recession from the coronavirus. Therefore, there is little expectation that the lower oil prices will have any positive economic effect. If people cut back on travel, cheaper petrol doesn’t make much difference. If people see a fall in income because they are out of work, cheaper oil prices are only a small compensation.

More detail on lower oil prices

Products made from petroleum

Oil is a commodity used not just in petrol and diesel but many other products, such as

- Motor oil, plastics, clothes, solar panels, floor wax, ink, bearing grease and other 40 everyday products (Products made from petroleum)

- Therefore, many goods will see a marginal fall in cost of production when oil prices fall.

Impact of lower oil prices on oil consumers

Lower oil prices help to reduce the cost of living. In particular, if a household owns a car or uses other forms of transport reliant on oil. To a lesser extent, all goods should become cheaper due to lower transport costs.

This fall in the cost of living is especially important if real wage growth is low which has been the case in recent years. A fall in oil prices is effectively like a free tax cut. In theory, the fall in oil prices could lead to higher spending on other goods and services and add to real GDP.

Problem of Bad debts

In 2020, oil prices have fallen so far that the price of oil is selling for a lower price than the cost price for producers in US and Russia. Saudi Arabia has pushed the price below $30. But, this damages many oil firms have who borrowed to invest in new oil fields. This could lead to firms closing down and going bust.

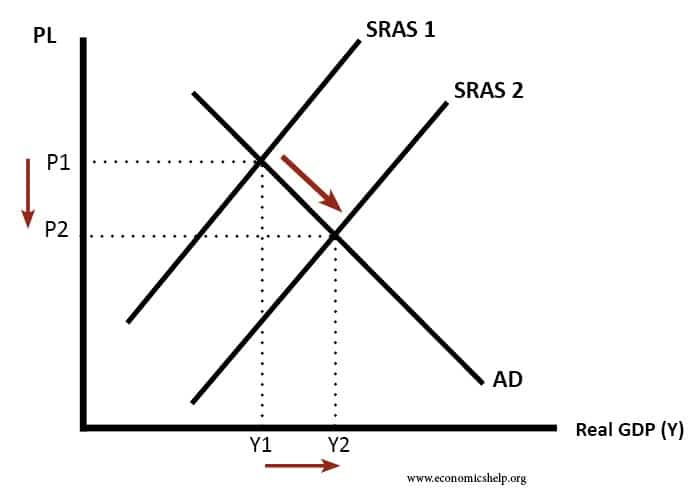

Macroeconomic impact of falling oil prices

- Lower inflation

- Higher output

This diagram shows that a fall in oil prices (and a fall in firms costs) will shift the short-run aggregate supply (SRAS) to the right, causing lower inflation and higher real GDP. (Some economists say on average a 10% fall in oil prices leads to a 0.1% increase in GDP (BBC article on falling oil prices)

3. Balance of payments

Oil importers will benefit from a falling oil price because the value of their oil imports will drop. This will reduce the current account deficit of oil importers; this is important for a country like India who imports 75% of oil consumption and currently has a large current account deficit. However, for oil exporters, a falling oil price will do the opposite reducing the value of their exports and causing lower trade surplus. The UK is currently a small net importer of oil, so will have a limited impact on UK current account.

Oil exporters

For oil exporters, a fall in oil price is damaging to the economy. Many oil-exporting countries rely on tax revenue from oil production to fund government spending. For example, Russia gains 70% of all tax revenues from oil and gas. Falling oil prices will lead to a government budget deficit, and will require either higher taxes or government spending cuts. Other oil exporters like Venezuela have relied in the past on oil revenues to fund generous social spending. A fall in oil prices could lead to a significant budget deficit and social problems.

Other oil exporters, such as Saudi Arabia and UAE have built up substantial foreign currency reserves; they can afford temporary falls in oil prices because they have substantial reserves.

Why falling oil prices is not enough for Europe?

Usually falling oil prices would be welcomed by oil importing countries. However, many are deeply fearful about prospects for the European and global economy.

Other economic impacts of lower oil prices

Reduced profitability for alternative energy sources. In recent years, there has been an incentive to invest in renewable energy and electric cars. A prolonged fall in oil prices will reduce this incentive and encourage firms and consumers to stick with oil.

Falling oil prices could delay investment into alternative ‘greener’ forms of energy, such as electric cars, and this could have negative consequences

Long-term falling oil prices could reverse the recent decline in-car use, leading to a steady increase in traffic congestion and environmental costs of petrol use. (see: post on case for increasing tax on petrol)

Evaluation

A few years ago, oil prices were rising through the roof, and many expected high oil prices to be the new norm. It is unlikely OPEC will want to tolerate low oil prices for too long. There is still a strong latent demand in Asia (India and China). The coronavirus could prove to be a very severe economic shock, which leads to a deep recession in 2020. However, it will not last – experts predict by 3-6 months, the worst should be over. This could cause a strong economic recovery and prices quickly bounce back.

Example – effect of falling oil prices on the Russian economy

The Russian economy is highly dependent on the oil and gas industry. The fall in oil prices caused a rapid devaluation in the Rouble and contributed to a recession.

See: article on Russian economic crisis.

Related pages

Consistent drop in oil price if continued will result in some new dynamic of global economy. Ever since the industrial revolution barring some short patches of time there has been no uncertainity on the oil demand and the economy was more or less driven by the extrapolation. This has been kind of auto pilot scenario as most of the journey has been without major hiccups. But now with the added scenarios of shale oil supply and the largest importer of oil -USA cease to be so anymore, another largst consumer China in slowdown mode, add to the fact that Iran, one of the top oil producer that was out of market due to embargo is all set to become active exporter soon, the global economy is badly nudged to spring out some new mode of economic vibration. Its just a matter of time. Only worry is that it should be complementing the existing economic set up and is not paradigm shift in any adverse manner.

Oil price may have collapsed down, yet petrol price in India remains the same, contrary to above observation.

If oil prices fall while demand for oil remains the same and nothing else in the economy changes, would gdp fall? After all the dollar amount of economic activity in the oil sector would be reduced by the amount of the reduction in the price of oil.

There will be fall in GDP of oil exporter countries definitely, but oil importers will have increased economic activity due to lower inflation and hence increase in GDP

please somebody should help me answer this. each time the price of petroleum(fuel) goes high in Nigeria they say its as a result of fall in the price of crude oil, but Nigeria is an exporter of crude oil and they dont refine crude oil, instead they buy already refined fuel or petrol from other countries. so how does the fall in price of crude oil affects the rise in price of fuel(petrol) in Nigeria?

Because your country did not have refinery, how could a country with abundance raw materials not have manufacturing plant to turn it into finish good. It cost your country more to bring in the finished product than what it generate on the export of raw materials. Hence, money coming in is less that what it pays out to bring in already processed good and the negative cost will have to be levied on the consumer

This is because Nigeria imports refined oil at a higher price than they export it. They are therefore making a loss and would need to sell the refined oil (fuel) at a much higher price to consumers (Nigerians) in order to make up for the budget deficit or make profit that contributes to government revenue.

Analyse the impact of falling prices on oil producing companies.

I dont think that this will continue for long.

If the price of oil keeps falling like this, most oil exporters would reduce output as they would not be interested in selling at such low rates.

Decrease in supply would lead to bounce back of the rates.

The fall of crude oil price in relation to production cost could make producing oil countries to consider reduction of their production quarter to boost demand is most likely.

I enjoy the write up

Oil prices have been rapidly decreasing in the world oil market during 2020. Oil prices also have been decreasing in Pakistan because of the fall in prices internationally. Starting from a price war led by two of the largest oil producers, Saudi Arabia and Russia to the collapse in demand due to Covid-19 related lockdowns around the globe, the market has seen such a low price that nobody has ever expected. Pakistan can get the benefit from reduction in oil prices which may help the manufacturers and exporters of the country to decrease their cost of production. Pakistan has to face some problems like deficit in amount of dollars that can help to lift cheap international stockpiles and build inventories as China did. Overall there is expectation of good impact of reduction in oil prices on the local producers.

Requirement:Being a student of economics identify and logically discuss which type of inflation will be affected due to fall in oil prices.

its a monopoly, even the oil become like buying chineese goods and selling them as european product in uk and the rest. if i am unable to producer as a country what the hell are the thinking buying making loss ,then sell, profit margins are low then, invest in LNG if you have or electric ,fund national projects of inventions and there are plenty of genious people . but government officials are all sheeps and they like to walk in group

Even after highs and lows in the oil prices, corona outbreak and then the Russia-Ukraine war, the Russian currency in now on its peak this year.

Nevertheless, oil prices have a major impact on the consumers around the world. I think governments have to make some more oil reserves so that we can have a better control over this situation.

I don’t think that this will continue for long.

If the price of oil keeps falling like this, most oil exporters would reduce output as they would not be interested in selling at such low rates.

Nevertheless, oil prices have a major impact on the consumers around the world. I think governments have to make some more oil reserves so that we can have a better control over this situation.

Nice Article Very helpfull for me.