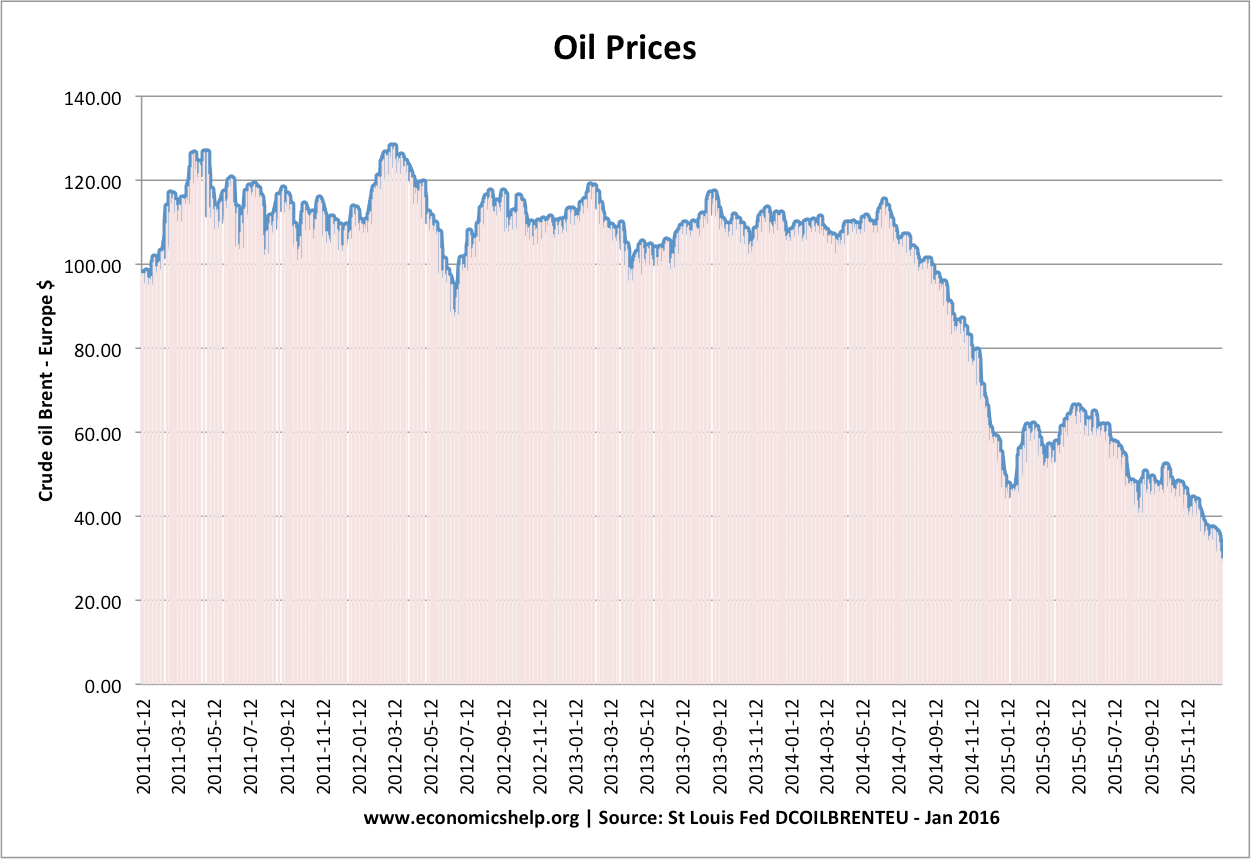

Effect of falling oil prices

A fall in oil prices should cause a reduction in transport and fuel costs for firms. Consumers who will also benefit from the lower prices of transport and fuel. The lower oil prices will effectively increase their disposable income and enable them to spend more on other goods Because oil is the most traded commodity …