Summary

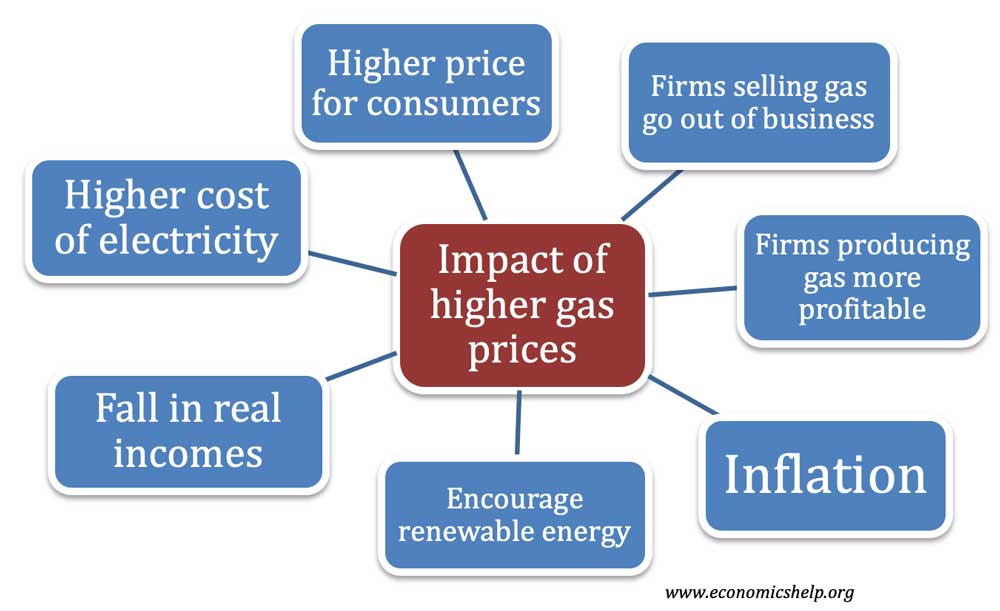

Natural gas is a key raw material for heating and electricity generation, therefore higher prices will significantly increase the cost of living, increase inflation and could slow down economic growth.

In the long term, higher gas prices will encourage consumers to find alternatives and firms to increase supply (e.g. fracking for natural gas), but any adjustment will take significant time.

Impact of higher gas prices

Cost of electricity. In the UK 43% of UK electricity is generated by burning natural gas (2016). Therefore, there is a direct correlation between increasing the price of natural gas and electricity. This is important because if people wanted to switch from gas central heating to electric central heating, they would find a similar rise in electric costs.

- In the long-term, higher gas prices will create an incentive to diversify electric generation away from gas-powered power stations. This could include extending the life of coal-burning power stations and/or encouraging renewable energy sources like wind, solar and tidal.

- Clearly, if countries switch to coal-based power stations, there is a large cost to the environment as burning coal creates more greenhouse gases than natural gas. But, if it encourages a switch to renewable energy there will be an environmental benefit. The problem is that renewable energies are often seasonal. In winter (when demand for gas is the highest) you can’t rely on solar power to generate electricity.

Energy companies go bust. In the UK 27 energy companies providing gas and electricity have gone bust due to soaring gas prices. The reason is that energy companies offer customers contracts to keep gas prices fixed at a certain level. This contract is based on stable gas prices. However, the unexpected rise in gas prices has meant that the companies have to buy gas at a higher cost than they sell it, meaning they are going to go bankrupt. In 2018, there were around 70 energy companies on the market, by March 2022, this has fallen to 30, and many expect more companies to go bankrupt as gas prices continue to rise faster than the price cap rises. In the long-term, this will lead to less competition and higher prices.

Energy producers more profitable. The flip side of this is that energy companies producing and selling gas will become much more profitable as they can sell at significantly higher prices but their costs are the same. For example, BP made $12.8bn profit in 2021 benefitting from rising oil and gas prices. (after making loss in 2020) But, this profit is before the record gas prices we are seeing in 2022. US energy producers ExxonMobil and Chevron reported net profits of $23bn and $15.6bn in 2021.

Consumers face record price increases. Higher gas and electricity prices will push up the cost of living for consumers. This comes at a time when other inflationary pressures are also causing an increase in the cost of living. The size of the energy bill increases could come as quite a shock as Energy UK predict a rise from £2,000 a year to nearer £3,000 by October.

Business cost increases

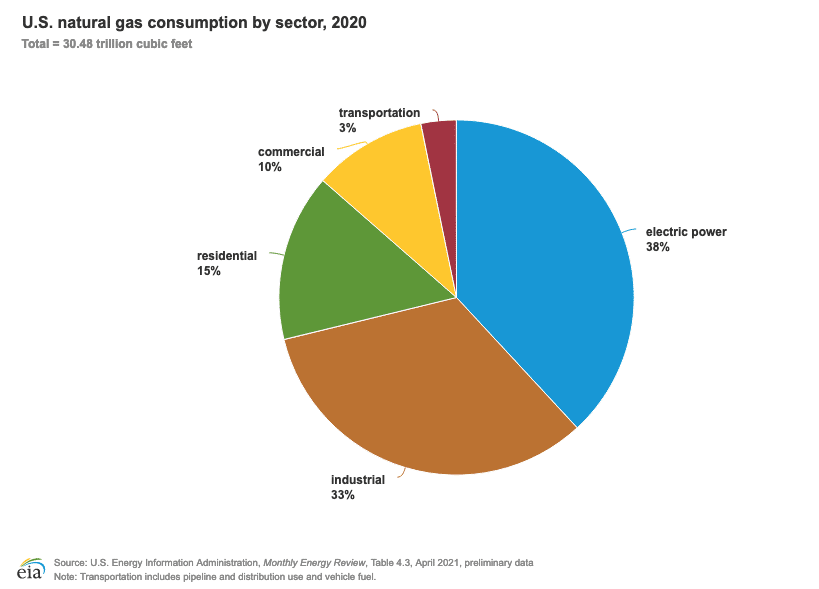

When we think of natural gas, we tend to think of our central heating, but residential use is only a part of overall gas consumption. The biggest consumer of gas is the industrial sector (33% in US), which use natural gas as an energy source in producing goods. Therefore, rising gas prices will also lead to an increase in input costs and there will be upward pressure on the prices of many goods which rely on gas and oil as raw materials.

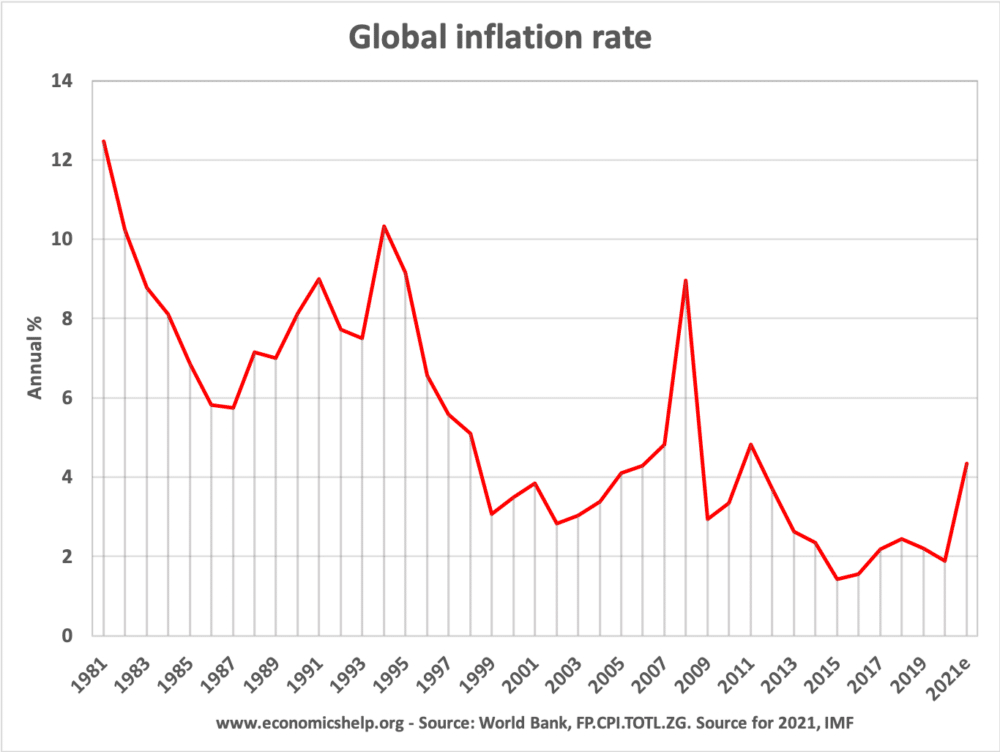

Inflationary pressures

After the Covid lockdown eased, there was a strong economic recovery with rising demand. However, supply constraints lingering from Covid led to bottlenecks in shipping, transport and supply chains. This puts upward pressure on prices leading to inflation. The rise in gas, oil and electricity prices will further increase inflationary pressure and the concern is that the high levels of inflation could change inflationary expectations. We have been used to low inflation for long-time, but continued price increases could cause inflation to be more embedded and then it becomes harder to reduce inflation in the future.

- Another side effect of higher gas prices and the inflationary pressures is that it will put more pressure on Central Banks to increase interest rates to reduce inflation.

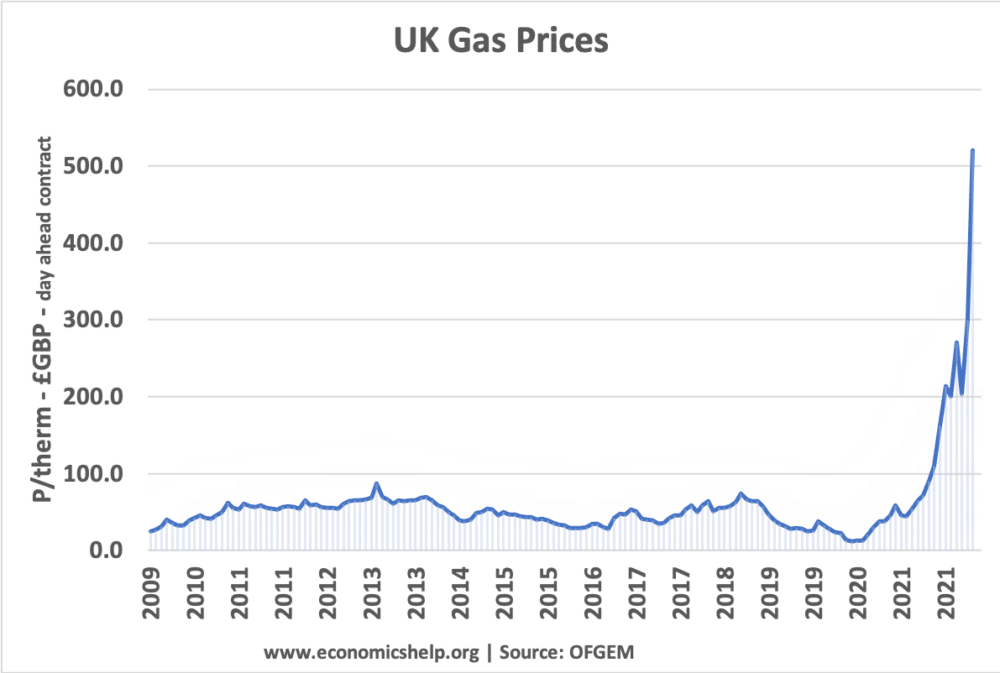

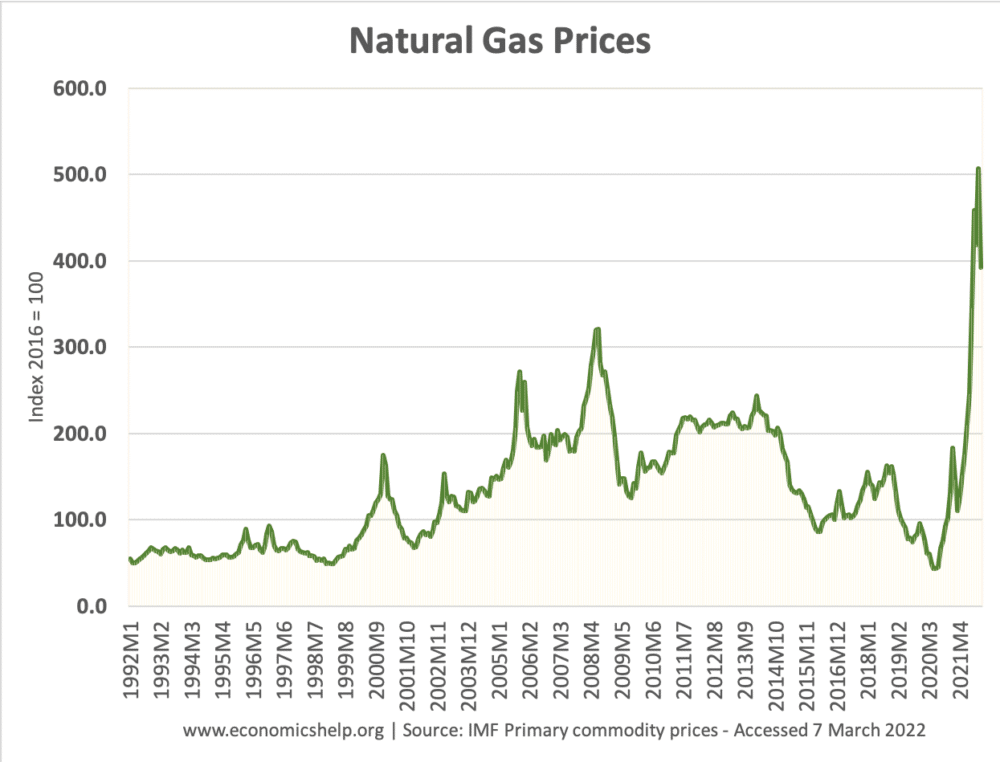

- However, it is worth pointing out that the gas price rises will not keep going forever, in 2023, we may see a fall in gas prices which will help reduce inflationary pressures. We tend to focus on newsworthy price increases but ignore the quieter fall in prices. For example, the last time there was a major increase in gas prices in 2008 – they didn’t last long.

Price surges tend to be temporary.

Stagflation/recession

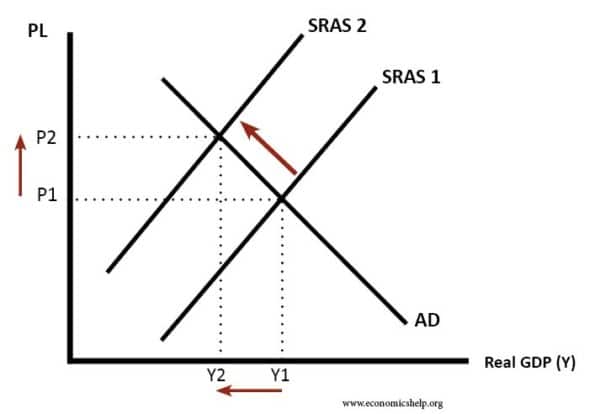

Higher gas prices increase costs of living and shift the short-run aggregate supply to the left, leading to higher prices and lower real GDP.

The rise in gas prices will reduce household disposable income. If households are paying an extra £1,000 a year, they will have to cut back spending in other areas (leisure, household goods, services). Other firms will see a fall in demand as disposable income is squeezed. This will lead to fall in consumer spending and hold back the economic recovery. If oil and gas prices continue to rise, it could be sufficient to cause recession.

Switching away from natural gas

The higher prices of natural gas act as a signal for consumers and firms to find alternative supplies. This incentive is heightened because of the geopolitical concerns about relying on Russian gas (which supplies around 17% of the world’s gas) It will encourage governments to encourage renewable energy sources like wind, solar and tidal energy, but it could also encourage governments to pursue nuclear energy and burn more coal-powered stations. Promoting renewable energies is the best for the environment but could take several years to fully replace gas.

Consumers have limited alternatives though because, the only real alternative to gas heating and cooking is electricity, which has been affected by rising price too. However, the rapid increases in price will encourage some consumers to reduce demand by turning down the Central heating thermometer and having colder houses.

Incentives to find new supplies of gas

There are still many potential sources of natural gas. For example, new methods of gas extraction like fracking could potentially unlock all of Europe’s natural gas needs. Fracking is controversial because of fears on local environment. After public pressure, fracking was halted in the UK, but if we get gas rationing and excessive prices, it could cause people to change their priorities and produce more natural gas. Energy companies are pressing for new permits to drill for natural gas in many locations.

Further reading