Periods of high oil prices frequently lead to periods of recession shortly after. There are two main reasons for this.

- Higher oil prices reduce disposable income leading to lower spending.

- Higher oil prices push up inflation causing Central Banks to increase interest rates.

Oil prices and recession

With oil prices rising above $100 because of the conflict in Ukraine, there are fears high oil prices – combined with rising costs of living could lead to an economic slowdown later in the year.

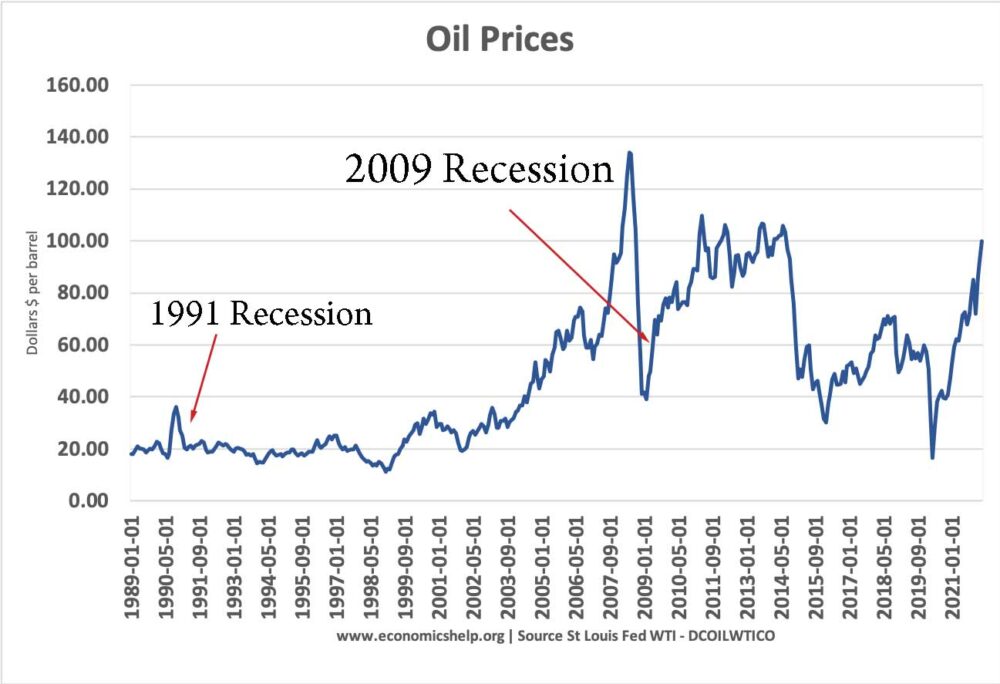

This graph shows two periods where high oil prices were shortly followed by a recession.

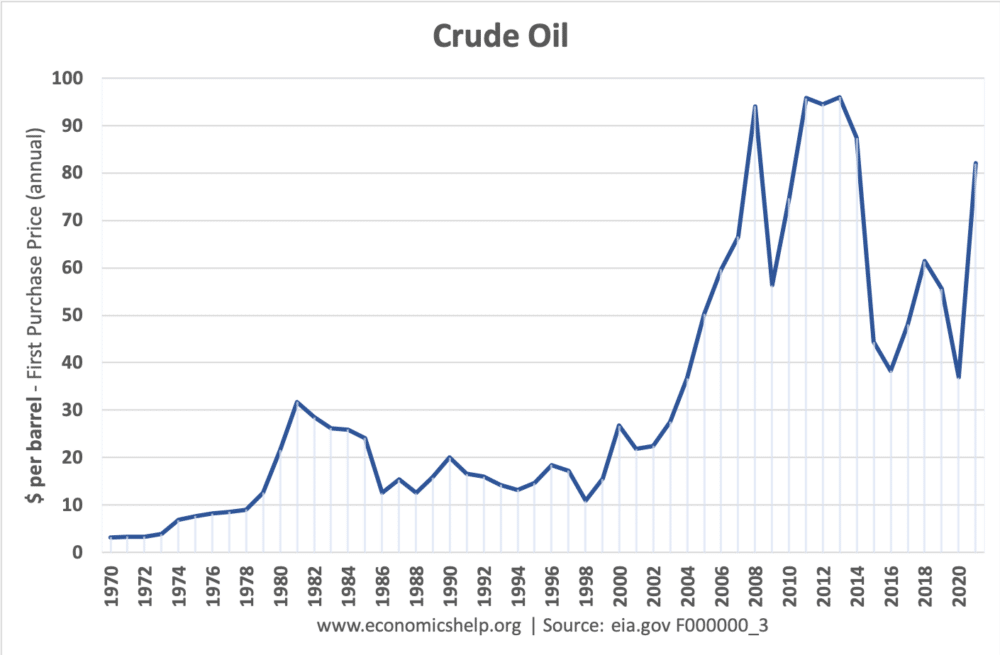

Oil prices and 1973-75 Recession

- 1973-75 after the first major oil price shock of 1974 when oil prices trebled.

- 1981-82 recession followed a sharp rise in oil prices

What explains the link between higher oil prices and recession?

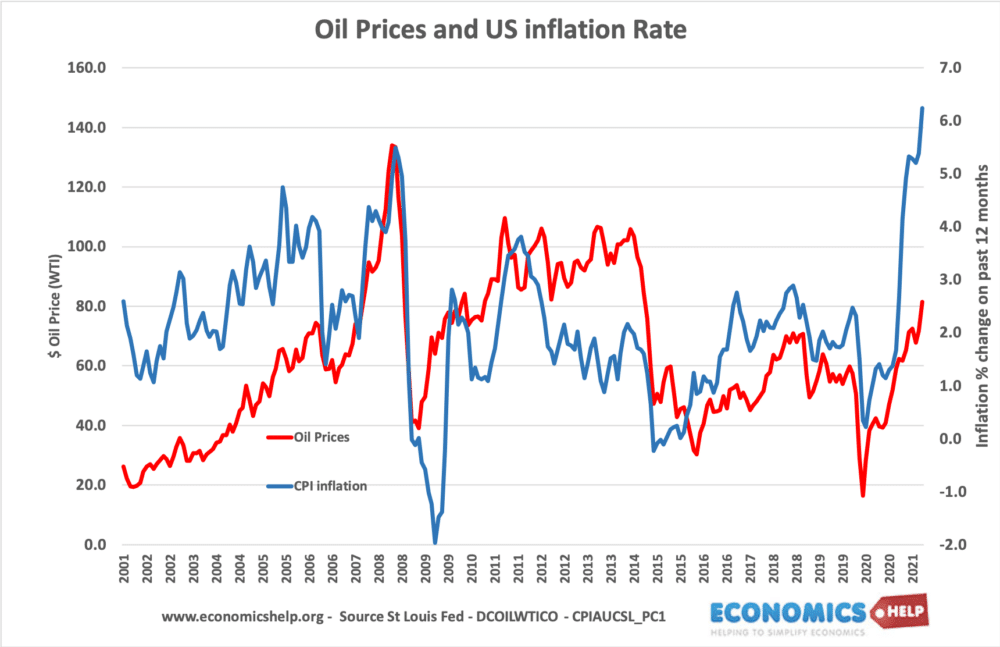

Rising oil prices have a significant impact on inflation. Higher oil prices cause a rise in the price of petrol, (gasoline) energy, and the cost of transporting all goods. Therefore indirectly all goods which are transported will see rising prices. There is a strong correlation between oil prices and inflation. – even though the world is less dependent on oil than in the 1970s.

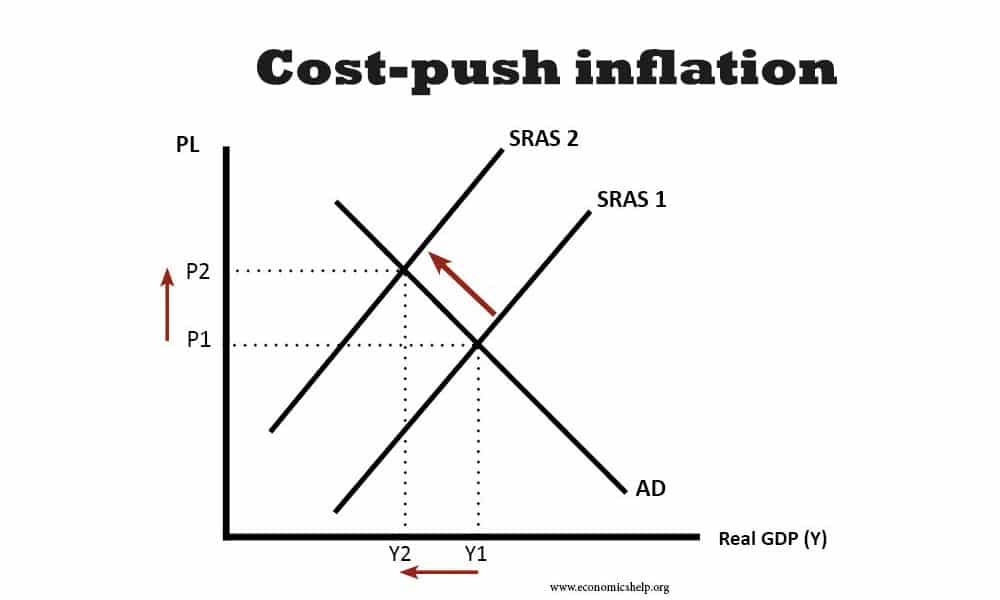

Lower disposable income for consumers. If oil prices are rising, consumers will face rising living costs and their disposable income will not go as far leading them to cut back on some purchases. We could say this cost-push inflation is the ‘worst’ kind of inflation. It is not like demand-pull inflation when consumers are causing inflation by high spending. With rising oil prices we get both higher prices and less demand, a situation which can lead to ‘stagflation‘

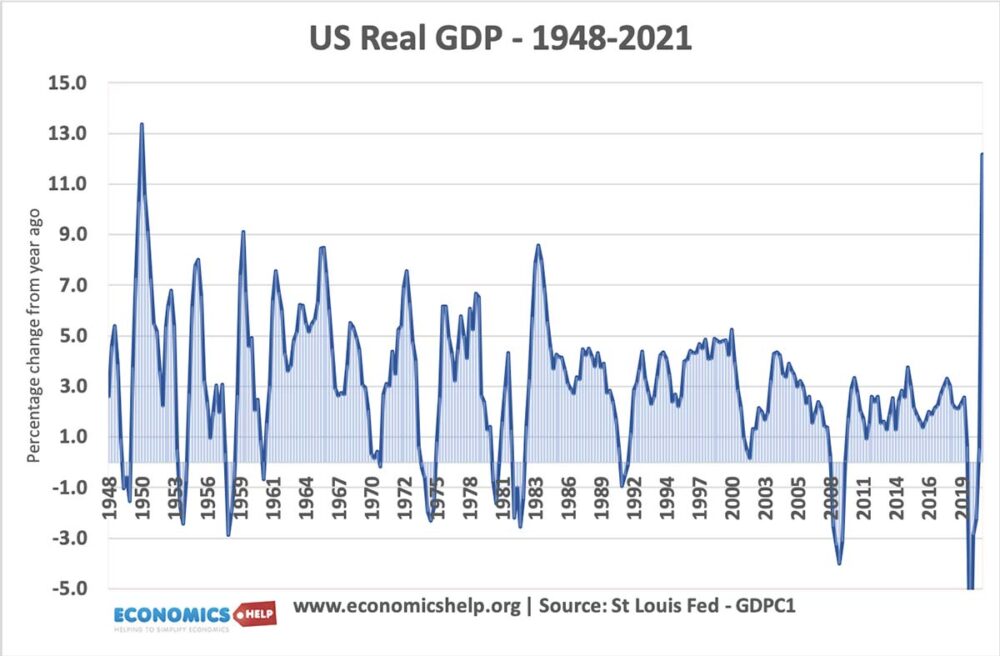

Higher oil prices cause short run aggregate supply (SRAS) to shift to the left causing both higher prices and lower real GDP.

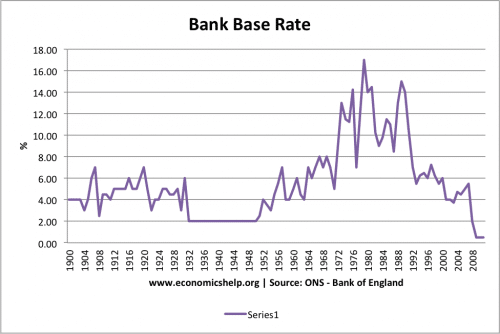

Upward pressure on interest rates. When inflation spikes due to cost-push inflation, it puts pressure on Central Banks to raise interest rates. Many Central Banks have a target of keeping inflation around 2%, but if oil prices are contributing towards inflation of 6%+, then the Central Bank may feel the need to raise interest rates.

Higher interest rates will slow down economic activity because higher rates increase the cost of borrowing and discourage spending and investment on credit. The problem is that consumers already face a squeeze on incomes from higher oil prices, therefore the increase in interest rates and increased cost of mortgage repayments has a double effect of reducing spending. For example in the 1970s, UK interest rates rose to 14% in response to high inflation. The inflation of the early 1980s led to interest rates peaking at 17% – both of these interest rates caused recession. (see also effect of higher interest rates)

When interest rates are this high, it tends to cause a major decline in spending, leading to recession.

Uncertainty. Often oil prices rise in response to some major event. For example, the Middle east conflict of 1973; Iran crisis 1979; Gulf War of 1991; Russia-Ukraine crisis 2022. Therefore, in addition to higher oil prices, businesses are responding to the greater political uncertainty and negative effects to trade. Therefore, businesses and consumers will not just respond to higher oil prices but the other strains on the world economy.

Higher oil prices do not always cause recession

- Higher oil prices do not always cause a recession. For example, after the financial crisis of 2009, oil prices recovered but on its own, this did not cause another recession.

- In 2021/22 oil prices increased due to the Covid recovery. Here oil prices were rising due to the strong economic recovery and therefore there is no reason that a recession would need to occur.

- The 2009 recession was not really caused by higher oil prices. The real reason was the credit crunch and breakdown of the financial system. Higher oil prices contributed a little to the fall in demand, but it was a very minor factor. Interestingly in 2008/09, interest rates were not increased despite higher inflation because the Central Banks were aware of the recessionary risks.

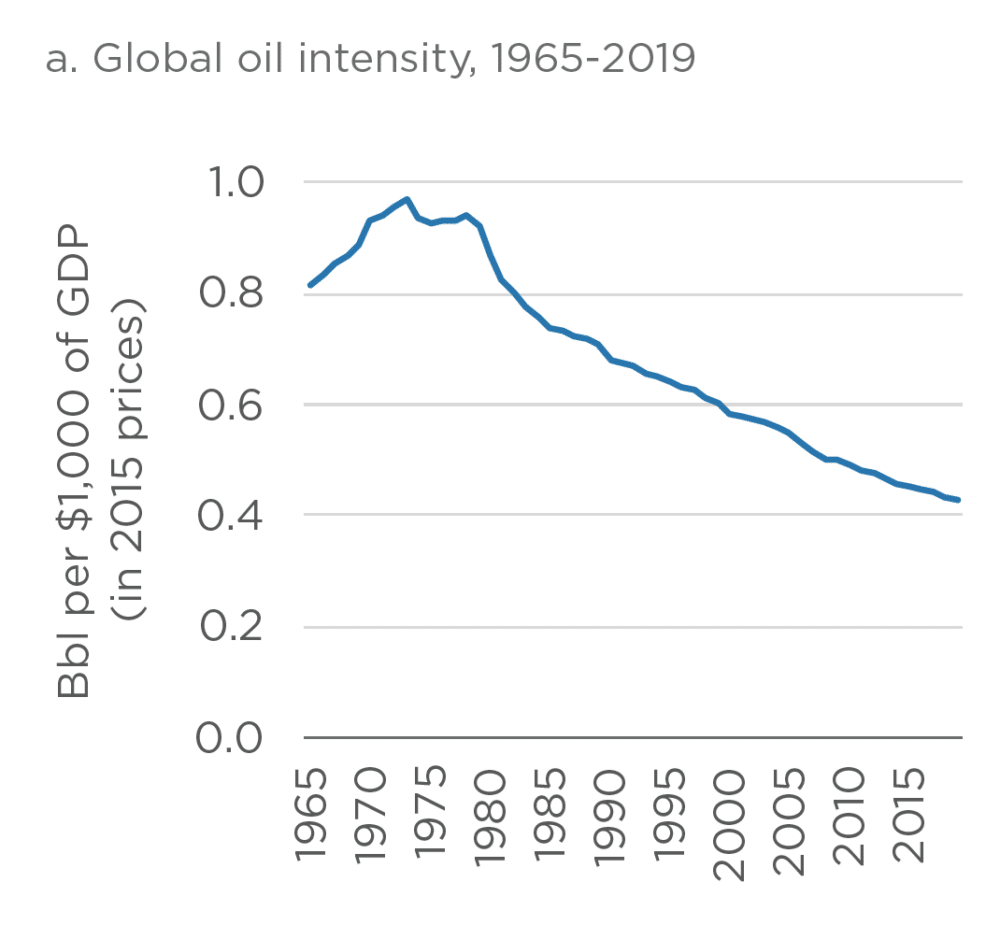

- Oil prices are becoming less significant to the world economy

www.oxfordeconomics.com/Global-Economic-Databank. Via Centre on Global energy policuy

Will higher oil prices of 2022 cause recession?

Before the Ukraine crisis, there was little prospect of higher oil prices, on their own, causing a recession. This is because there was a degree of spare capacity in the world economy as the economy recovered from Covid shut-downs. The higher oil prices were primarily a reflection of the economic recovery.

Interest rates were forecast to rise, but only in relatively small amounts. Also, the high inflation that is due to supply constraints from Covid should have started to ease as shipping companies readjust to the Covid shock.

However, the Ukraine crisis and strong set of sanctions on Russia adds a new element of uncertainty. It is not just higher oil prices that will push up inflation, but increased price of basic commodities, like wheat, corn, aluminium and potash fertilisers. All these commodities are exported by Russia or Ukraine and so supply will be reduced by the current conflict.

As a percentage of world GDP, the Russian and Ukrainian economy is small. (In terms of PPP, in 2020, Russian GDP is approx 3.3% (IMF) Nevertheless the sharp fall in trade and investment in Russia will affect confidence about foreign investment and trade when business see the potential costs of investing in emerging economies.

Another interesting factor is that demand for oil in the long-term may become more elastic as the oil price shock creates an additional incentive to move away from traditional fossil fuels and accelerate the transformation to more environmentally friendly energy sources.

Conclusion

On its own, higher oil prices do not cause a recession. However, if oil prices do cause substantial inflation it presents policymakers with a difficult dilemma – increase interest rates to reduce inflation and further reduce demand or leave interest rates unchanged and accept higher inflation. Although higher oil prices alone do not cause a recession, they can be a factor that makes it more likely.

Further reading

The price of oil fell on March 15 after spiking to its highest levels since 2008 as traders in the US and Europe sought to replace crude coming from Russia. The global energy market could be adjusting to the conflict in Ukraine. But if more countries join the US in banning Russian oil, prices will surge again, potentially to their highest point in decades, analysts say.

The good news is that the global economy has never been so insulated from high oil prices. Efficiency improvements and the shift in most countries away from burning oil in electric power plants mean that global GDP can grow without causing matching growth in oil demand. In other words, the global economy is using oil more efficiently than ever, which makes temporary price spikes more tolerable.

“Current oil prices are not an immediate cause for recession,” says Christof Rühl, a senior researcher at Columbia University’s Center on Global Energy Policy. “They’re volatile in the short term, but manageable in the long term.”

In 1978, just before that decade’s second oil crisis, the economy’s “oil intensity” peaked at 0.94 barrels needed to produce each $1,000 of global GDP, according to Rühl’s research. Today the figure is about half that.