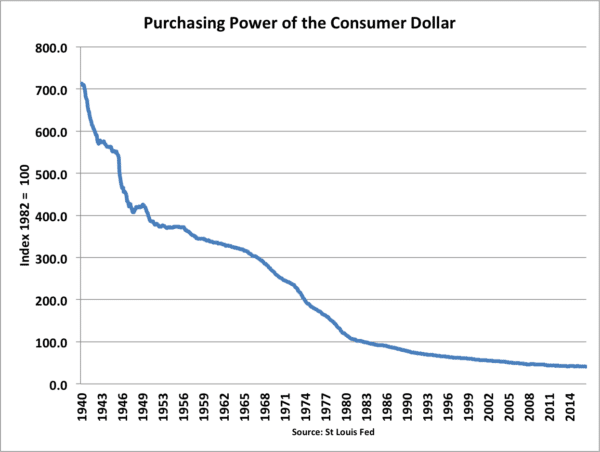

Inflation is a continuous rise in the price level. Inflation means the value of money will fall and purchase relatively fewer goods than previously.

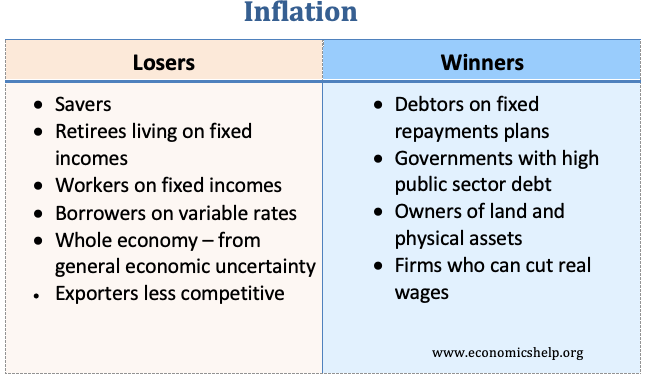

In summary:

- Inflation will hurt those who keep cash savings and workers with fixed wages.

- Inflation will benefit those with large debts who, with rising prices, find it easier to pay back their debts

Video

Losers from inflation

Savers. Traditionally savers lose from inflation. If prices rise, the value of money falls, and the real value of savings declines. For example, in periods of hyperinflation, people who had saved all their life could see the value of their savings wiped out because, with higher prices, their savings are effectively worthless.

Inflation and Savings

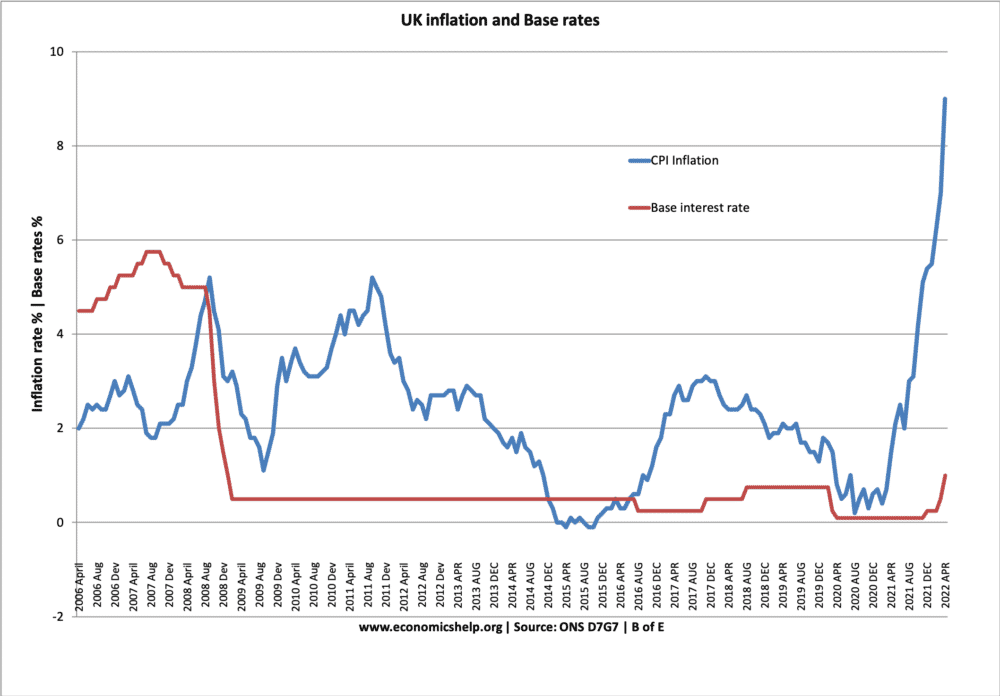

- Savers can be protected from inflation if they can gain an interest rate higher than the rate of inflation. For example, if inflation is 5%, but banks are giving an interest rate of 7%, then those who save in a bank will still see a real rise in the value of their savings.

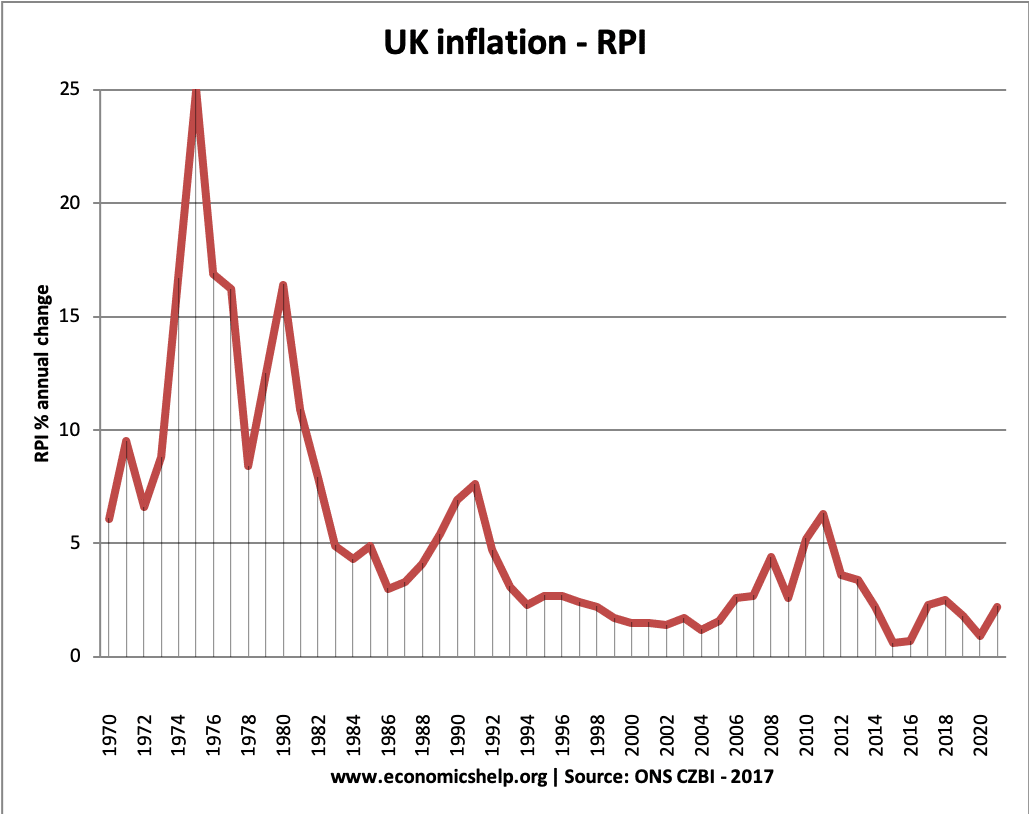

Savers are much more likely to lose out if we get both high inflation and low-interest rates. For example, in the aftermath of the 2008 credit crisis, inflation rose to 5% (due to cost-push factors) but, interest rates were cut to 0.5%. Therefore, savers lost out during this period.

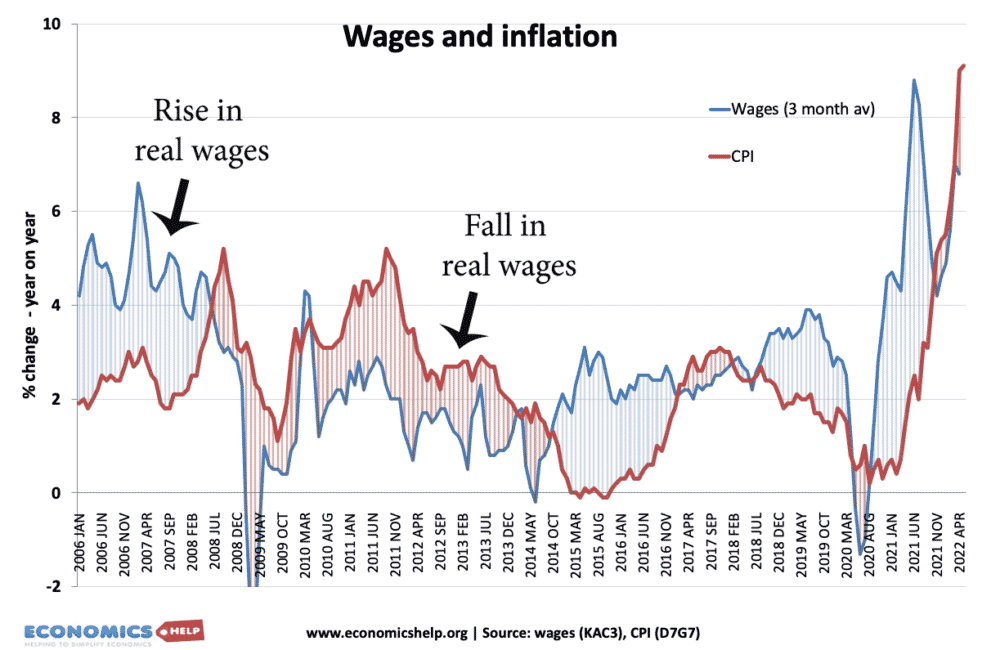

Workers on fixed-wage contracts

Another potential losers from inflation are workers who are stuck on fixed-wage contracts. Suppose that workers have a wage freeze and then inflation is 5%. It means at the end of the year, their wages purchase 5% less than at the start of the year.

In the period 2008-14, CPI inflation was above nominal wage rises – causing a decline in real wages.

Even though inflation was relatively low (by UK historical standards) – it left many workers with a fall in real wages.

- Inflation may particularly harm workers in non-unionised jobs, where workers have less bargaining power to demand higher nominal wages to keep up with rising inflation.

- This period of negative real wages will particularly harm those who are living close to the poverty line. Those on higher incomes will be able to absorb a fall in real wages. Even a modest increase in prices can make it more difficult to purchase goods and services. The UK saw a rise in the use of food banks in the period 2009-17.

- In the 1970s, the UK had inflation of over 20%, but wages rose to keep pace with rising inflation, therefore workers continued to have real wage increases. In fact, rising wages was a cause of inflation in the 1970s.

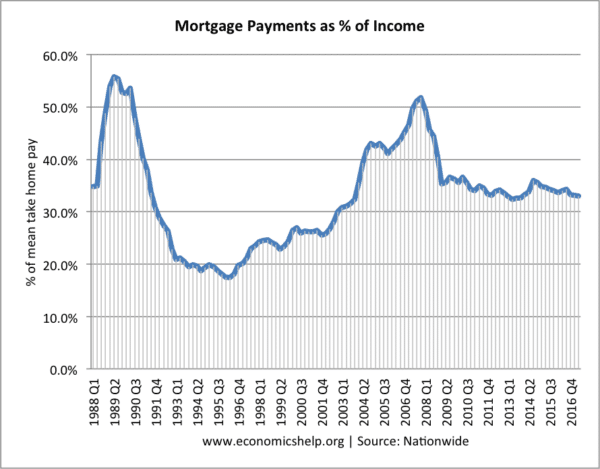

Borrowers on variable mortgage rates

A rise in inflation can cause the government/central bank to increase interest rates. This will lead to a higher borrowing rate. Therefore mortgage owners who have variable mortgage rates can see significant rises in their mortgage payments.

In the late 1980s, the UK experienced an economic boom, economic growth was high, but inflation increased close to 10% – as a result of the overheating economy, the government increased interest rates. This saw a rapid rise in mortgage costs – which were largely unexpected. Many homeowners found they couldn’t afford higher mortgage payments and so defaulted on mortgage payments.

The high inflation of the 1980s indirectly caused mortgage payments to rise and many to lose their home.

- However, higher inflation doesn’t necessarily lead to higher interest rates. Post-2008 recession, there was cost-push inflation, but the Bank of England didn’t raise rates (they felt inflation would be temporary). Therefore, mortgage owners saw a fall in their variable rates and mortgage payments as a percentage of income fell.

General economic confidence

If inflation is high and variable, it creates uncertainty for both consumers, banks and companies. There is a reluctance to invest and this can lead to lower economic growth and less job availability. Therefore, in the long-term, higher inflation is associated with a deterioration in economic prospects.

Exporters

If UK inflation is higher than our competitors, then UK goods will become less competitive and exporters will see a decline in demand and struggle to sell their goods.

Winners from inflation

Business/household with high debt

High rates of inflation can make it easier to pay back outstanding debt. Businesses will be able to increase prices to consumers and use the extra revenue to pay outstanding debts.

- However, if a bank borrowed at a variable mortgage rate from a bank. Then if inflation rises and the bank increase interest rates, this will increase the cost of debt repayments.

Governments with debt

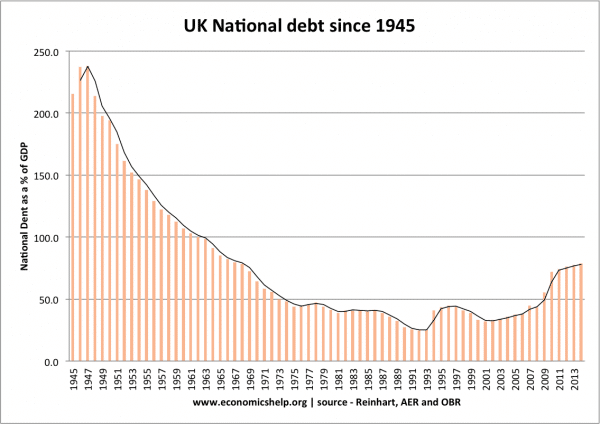

Inflation can make it easier for the government to reduce the real value of its debt (public debt as a % of GDP)

This is especially true if inflation is higher than expected. For example in the 1960s, markets expected low inflation so the government were able to sell government bonds at low rates of interest rates. However, in the 1970s, inflation was higher than expected – and higher than the bond yield on a government bond. Therefore owners of the bonds saw a fall in the real value of their bond, whilst the government saw a fall in the real value of its debt.

In the 1970s, unexpected inflation (from oil price shock) helped to reduce government’s debt burden in various countries such as the US.

Between 1945 and 1991, the nominal value of government debt rose, but inflation and economic growth helped the value of national debt to fall as a percentage of GDP.

Landowners/Owners of physical assets

In a period of hyperinflation, those with savings can see a rapid fall in the real value of their savings. However, those who own physical assets tend to be protected. Physical wealth – such as land, factories and machines will retain its value.

In periods, of hyperinflation, there is often increased demand for assets, such as gold and silver. Gold cannot be subject to the same inflationary pressures as paper money as it cannot be printed.

However, it is worth bearing in mind, that in a period of inflation, buying gold is not guaranteed to increase in real value. This is because the price of gold can also be subject to speculative pressures. For example, the price of gold spiked in 1980 and then fell afterwards.

However, in periods of hyperinflation, holding gold is a way to protect real wealth in a way money is not.

Banks and mortgage companies

In periods of negative real interest rates, it tends to increase profit margins for banks With base rates close to zero and very low saving rates, lending rates are higher than saving rates.

Anecdotal evidence

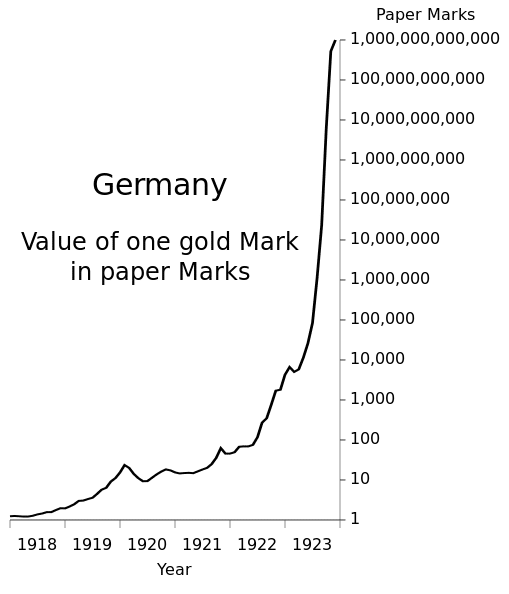

A good example of extreme inflation is Germany in the period 1922-24, the inflation rate reached astronomical figures.

Middle-class workers who had put a lifetime of savings into their pension fund found that in 1924, the pension fund was worthless. After working for 40 years, one middle-class clerk cashed his retirement fund and used it to buy a cup of coffee.

In this hyperinflation, it led to great fear, uncertainty and confusion. People responded by trying to buy anything physical – like buttons, cloth – anything that might hold value better than money.

However, not everyone suffered as much. Farmers did well because the price of food continued to rise. Business that had borrowed large sums found that their debts had effectively disappeared due to inflation reducing the real value of debt. These businesses could buy up over firms who had gone out of business due to the costs of inflation.

Those who owned land or physical assets were able to maintain their wealth.

This kind of very high inflation creates significant grievance as inflation can appear like an unfair way to redistribute wealth from savers to borrowers.

Further reading

Nice and simple explanation

Great explanation. To better understand economy it is important to understand more about inflation and how inflation works.

Thank you

Thanks for the clear explanation and discussion. Jim W

At times of high inflation, one needs to be an asset owner in order to protect themselves from the brutal effects of inflation. Value and dividend-paying stocks can work here.

Thanks you sir

This analysis is sloppy. You need to distinguish stable inflation from variable inflation, and you need to distinguish low inflation from high (or hyper-) inflation.

You talk about the downsides of “inflation”, but almost all the negatives you mention are actually consequences of variable inflation, or unexpected inflation, or high/hyper-inflation. You don’t properly analyze the common case of low, stable inflation (e.g. a central bank with a 1-2% annual inflation target). With low, stable inflation, almost all of the negatives you mention don’t happen.

You have a sentence (or word) here and there that shows that you’re aware of this distinction. But the overall impression that a typical reader would get from your article is highly misleading. To give a proper accounting for the effects of inflation, you would also need a section on the effects (or lack thereof!) of low, stable inflation. (In particular, you should be sure to study the Fisher Effect: nominal interest rates adjust to inflation, with the result that real interest rates are unchanged.)

I would be interested in any additional readings on inflation/hyperinflation that you might suggest including any that you may have authored. Thank you.

One group that benefits from high inflation figures are people who have future pension investments ties into inflation indexes. Yes I pay more for my living expenses at this point of time, but I have more invested in pensions and the high inflation will benefit me more than the measly pay increase and high living expenses I have at this point of time. Also I have no mortgage, so the value of my home is going up..sunk cost though.