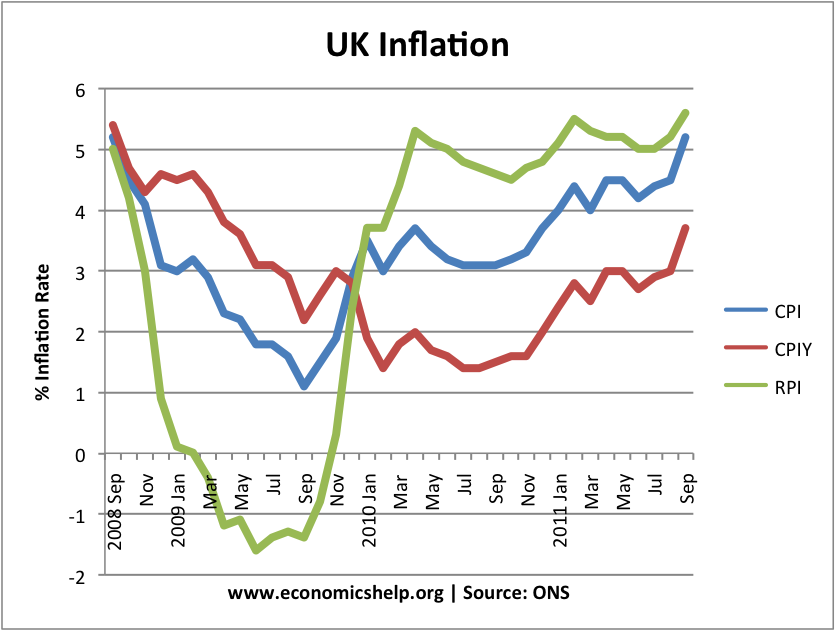

In September 2011, CPI inflation rose to 5.2%, well above the government’s inflation target of 2%. RPI inflation is even higher at 5.6%

Why have the Bank of England kept interest rates at 0.5% despite this increase in inflation? Should we not be more concerned about inflation?

Price indices and inflation ONS

Reasons To be Concerned

- Falling Real Wages as inflation is above wage increases

- Decline in Value of Savings because inflation is higher than interest rates.

- Inflation can create uncertainty and confusion leading to lower investment levels

- Some may fear that this temporary inflation may increase inflationary expectations leading to higher wages and permanently higher inflation.

Reasons Not To Worry

- If we exclude taxes (CPIY), inflation is lower at 3.5%

- Excluding more volatile energy prices ‘core inflation’ is even lower.

- Also, UK inflation has been increased by the effects of devaluation which increases our import prices.

- With unemployment rising to over 2.7 million, there is little if any wage inflation. The Bank will see wage inflation as a much better guide to underlying inflation than this temporary CPI and RPI factor.

- Basically, the current rate of inflation is due to many temporary factors (taxes, devaluation, energy prices). The Bank of England calculate that next year, these temporary factors will expire, causing a rapid drop in the inflation rate.

- To reduce inflation closer to target would be damaging for prospects of economic growth. It would lead to an even higher unemployment rate.

This inflation rate is not good, but to religiously target inflation of 2%, could be to risk a very severe recession and in 2012, we could end up with deflation.

Related

In capatalist Amerika, Bank Robs you.

http://narwhaler.com/in-capitalist-america-bank-robs-you-bIe3lI