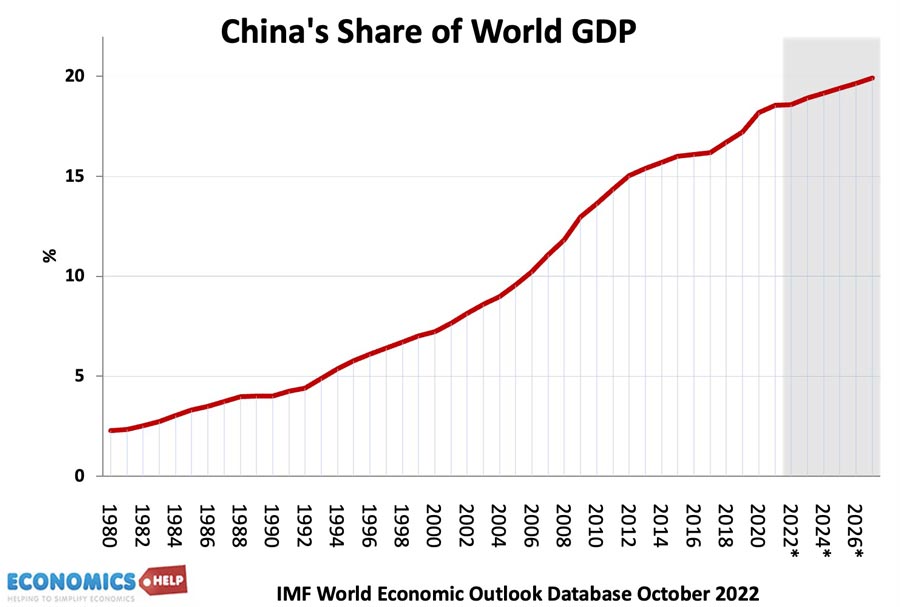

For three decades, the Chinese economy boomed, transforming itself into the world manufacturing hub.

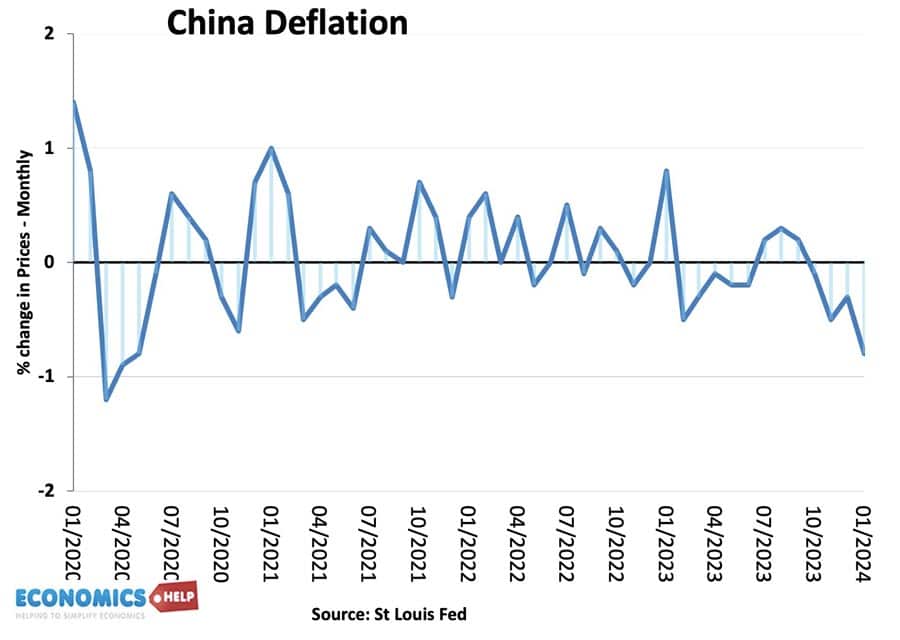

Up to 70% of suppliers on Amazon rely on Chinese supply chains. Buy any electric good and it’s likely to say ‘Made in China’. But, the Chinese economy is in crisis. A property collapse has seen prices fall and flats remain unfinished. Combined with Covid lockdowns and political meddling, Chinese consumers have lost confidence and reduced spending. There has been a decline in savings, falling wages and rising youth unemployment. The result has been deflation with prices falling throughout 2023. Now whilst, there are significant benefits to lower prices, the response of the Chinese government to subsidise manufacturing is ramping up trade tensions and making it difficult for European manufacturers.

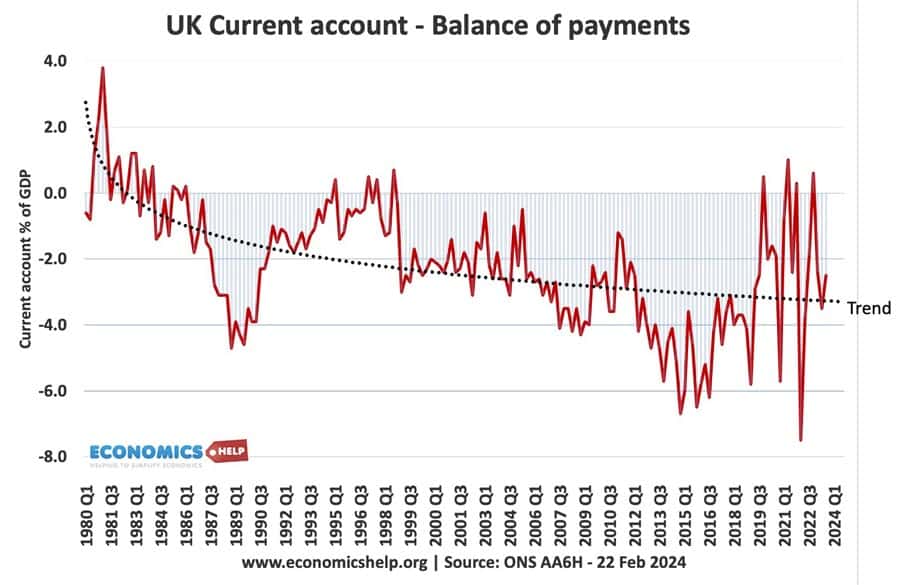

In the boom years, China grew at up to 10% a year. Manufacturing production soared as Chinese firms undercut more expensive Western production. It was a significant cause of the decline in UK and US manufacturing only very specific firms can compete with low-cost Chinese production. On the positive side, UK consumers benefited from lower prices and cheap manufactured goods helped to keep inflation low. But, by running a current account deficit, there was a concern the UK economy was becoming unbalanced, relying on Chinese capital flows to finance the deficit. Last year, the UK ran a £26bn deficit in goods and services with China. But with China’s deflation, this is likely to worsen.

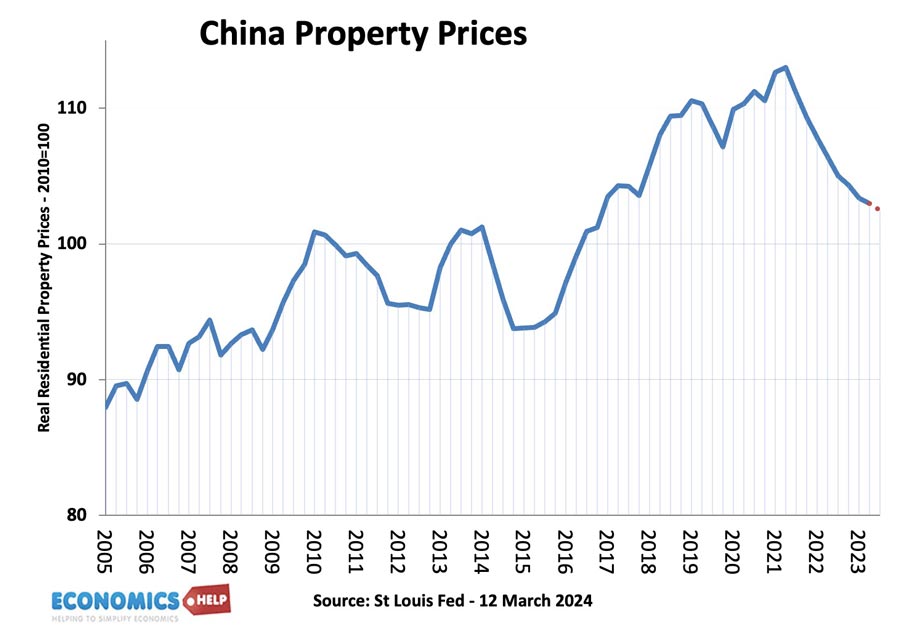

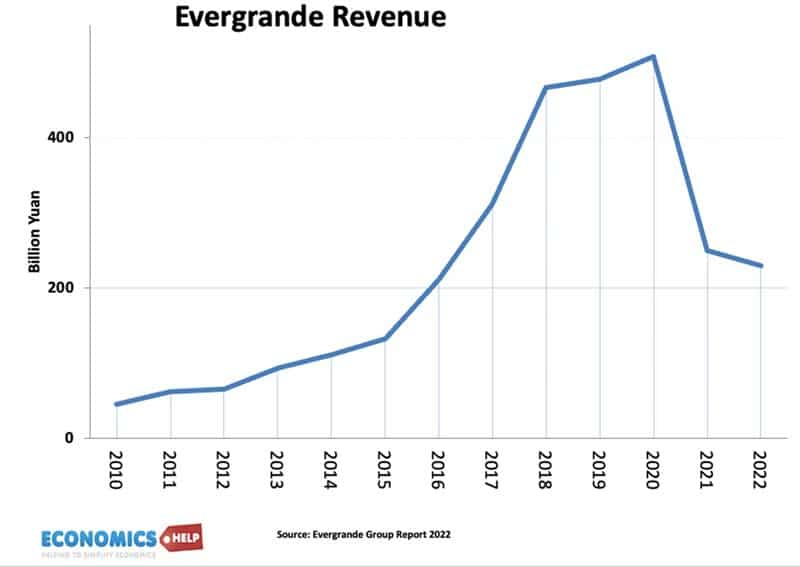

In the boom years, China saw an explosion in apartment building. But, developers got greedy and started to sell houses before they had been built. Many Chinese households invested in housing but lost everything when property developers collapsed. It has led to ghost towns across China, bad debts and a loss of confidence. Big developers like Evergrande have seen their share price crater as their business model was exposed to be built on unsound footings.

Property used to account for 25% of the Chinese economy, but this source of growth is going into reverse. The truth is house prices should have fallen much further, but they are artificially being kept high by local authorities fearful of the impact of a crash in prices. On top of this, Covid lockdowns in China were the strictest in the world. It harmed investment and confidence. The Chinese government has increasingly become authoritarian, clamping down on entrepreneurs, which has created a fear of taking risks. The Chinese economic slowdown has also led to a decline in demand for Western luxury brands, for example, Aston Martin, Rolls-Royce or Burberry.

Last year China experienced deflation, which means prices are falling. After our struggles with inflation, this might seem like a good thing. But, deflation can be very damaging. China will be looking over its shoulder at Japan, which saw a property crash in the 1980s, and then two decades of deflation and low economic growth. The problem is that deflation in China is accompanied by lower salaries for office workers and growing youth unemployment. When prices and wages are falling, the real value of debt rises, and consumers lose the confidence to spend. This is likely to harm Chinese economic growth and therefore, lead to lower global growth. Given the weakness of the UK and European economies, this negative shock could further harm our economy.

But, the biggest issue is that given the real problems in the property sector, the Chinese government are aggressively promoting Chinese manufacturing, in particular new green technologies which are seeing rapid growth. Europe claims that this means China is effectively pursuing protectionist policies of unfair subsidies. For example, electric battery makers were offered subsidies that could account for more than 50 per cent of the cost of the product. The result is a flood of cheap imports, which will harm European and US manufacturing. European car firms have already seen a big decline in market share to Chinese electric vehicles. But continued state support will see further competitive advantage. Last year, China experienced a record trade surplus of $823 billion with the rest of the world.

But, the UK already has concerns about an economy too reliant on consumer spending and running a persistent trade deficit. It is argued that countries that run large current account deficits tend to require large fiscal deficits to provide economic support. China’s deflation and continued support of manufacturing could make this even worse.

How does this affect a British householder?

On the one hand, low cost Chinese exports give a short-term benefit to consumers who can buy electric vehicles or solar panels more cheaply. There’s no doubt that without Chinese manufacturing, it would be more expensive to install solar panels. But, continued subsidies amount to unfair competition making it very difficult for UK and European firms to become established and competitive. It doesn’t help that the US has already pursued a similar industrial strategy of subsidising green technology. It means that any firm wanting to invest in a new battery factory can demand a very hefty subsidy from the government to locate in a country. The UK is expected to pay around £500mn in subsidies to Tata Group to support a £4bn battery factory in the UK. Supporting new industries has got very expensive.

However, there is one very welcome benefit of Chinese deflation. Manufactured goods prices are falling around 3.5% and Bloomberg reported Chinese export prices fell 9.2% last year. This leads to lower inflation in the west, and helps to reduce inflationary pressures. Also, China’s economic slowdown has been a key factor in reducing commodity price inflation, such as cheaper oil. This has also helped bring down inflation in the West. This kind of positive inflation shock will be very welcome by the Bank of England, which would like help in reducing inflation without pushing the economy further into recession.

China and Europe have very different economic models. Europe relies on the private sector, in China the economy is more state-directed. But, it means that the UK and Europe may need to consider more seriously protectionist measures to limit the flooding of markets with cheap manufactured goods like solar panels which will damage domestic industry. But, the problem is that any trade war, will itself have negative consequences. Placing tariffs on solar panels or electric vehicles will just make it more difficult for consumers and the economy to transition to a greener economy. It could also hit UK brands like Jaguar and Range Rover who currently have niche exports to China. When the US placed tariffs on Chinese exports, China retaliated by restricting gallium and germanium, two metals used in chip making which it has a chokehold. A final point is that with the proceeds of a large current account surplus, China has bought trillions of US debt and to a lesser extent UK debt. Around 25% of UK debt is foreign-owned and China is thought to be the biggest buyer. But, a trade war and efforts to restore from China, have seen a decline in China’s willingness to buy UK and US bonds.

Whilst China experienced a real property crisis, should we worry about something similar in the UK – check out this video for prospects for UK housing prices in 2024.

Related

External sources