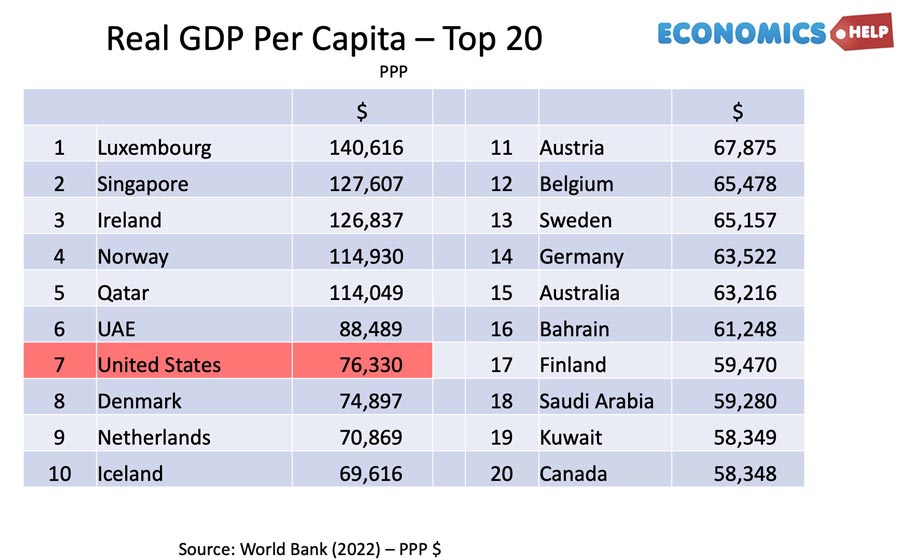

The US is one of the richest economies in the world – with the 7th highest real GDP per capita.

Not only that but the economy is booming with much higher rates of economic growth than elsewhere. However, in the real world, there is a disconnect, despite the undoubted wealth of America, many Americans feel poor – an economy rigged against them, living from paycheck to paycheck and worried they could be just one medical bill away from bankruptcy. How can an economy that is doing so well, be failing to give economic security to the majority of Americans?

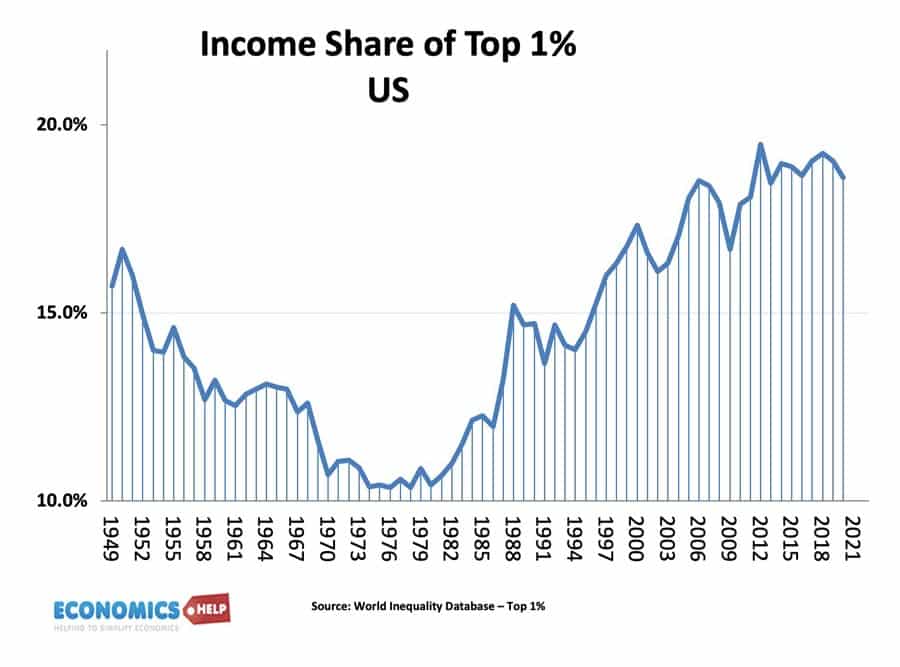

In the past few decades, America has become vastly more unequal.

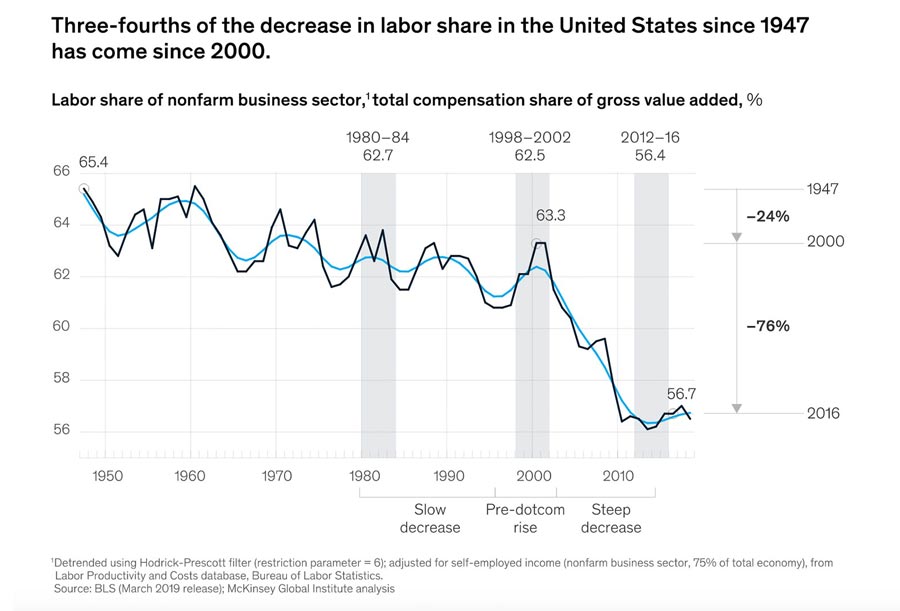

The labour share of income has fallen, and this decline has sped up in recent decades. But, it gets worse because whilst average workers have seen stagnating wages, the top 1% have seen an increase in income levels to levels last seen in the Gilded Age.

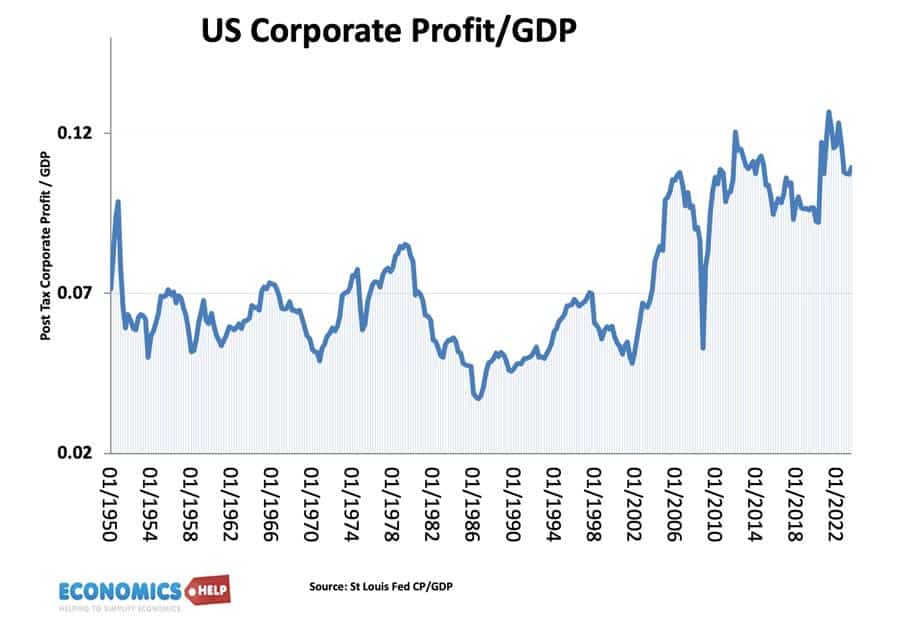

Whilst labour income share has fallen corporate profit has dramatically risen. It is not only a nominal increase, but corporate profit is taking a bigger share of GDP.

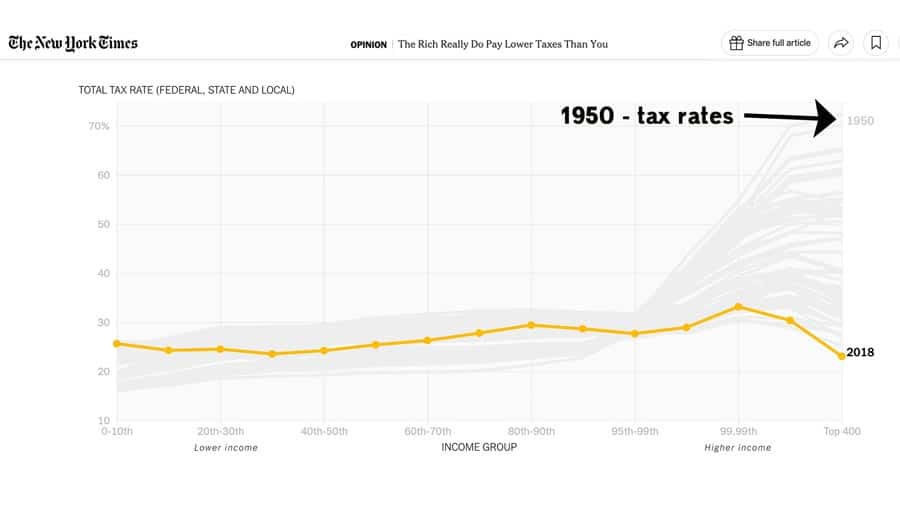

Yet, despite the success of corporate America, tax policy increasingly favours the rich. The large tax cuts of 2018, largely favoured businesses and high earners. According to the Tax Policy Centre the top 20% of Americans by income were projected to receive roughly 65% of the tax savings.

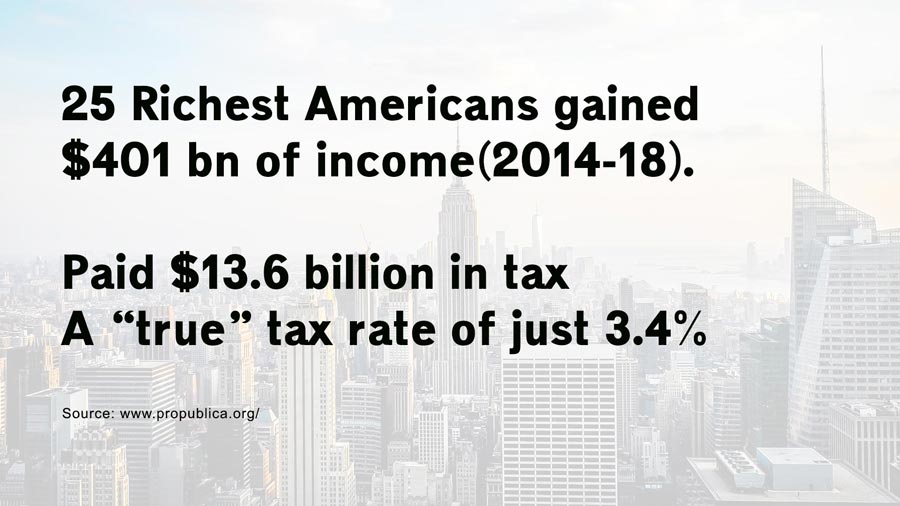

An irony of the American system is that it is often the lowest paid, who face the highest marginal rate of tax, with the super-wealthy paying the lowest average rates of tax. Research by the Whitehouse claims the richest 400 people in America paid a tax rate of 8.2%.

Propublic say if you include hidden income, it is closer to 4.2%. This happens because there are lower tax rates and exemptions for income from stocks, dividends and capital gains can be hidden. An ordinary worker is taxed directly, but for someone who can employ a creative accountant, there are many loopholes which companies and high earners can exploit. According to U.S. Treasury estimates, the top 1% of wealthy people underpay their taxes by $163 billion annually.

Whilst corporate America has significant lobbying power, the Federal Minimum Wage has seen a slow decline in relevance, falling in real terms, leading to less worker protection. It is also noticeable that the very low growth in wages since the mid-1970s corresponds with a decline in trade unions and worker protection. Individual states which have imposed higher rates have been able to increase wages without the anticipated rise in unemployment. But, even a minimum wage rate job of $15 an hour can be insufficient for the average worker. The cost of living has significantly increased with average households facing higher rents, insurance and health care premiums.

Tax and Health Care

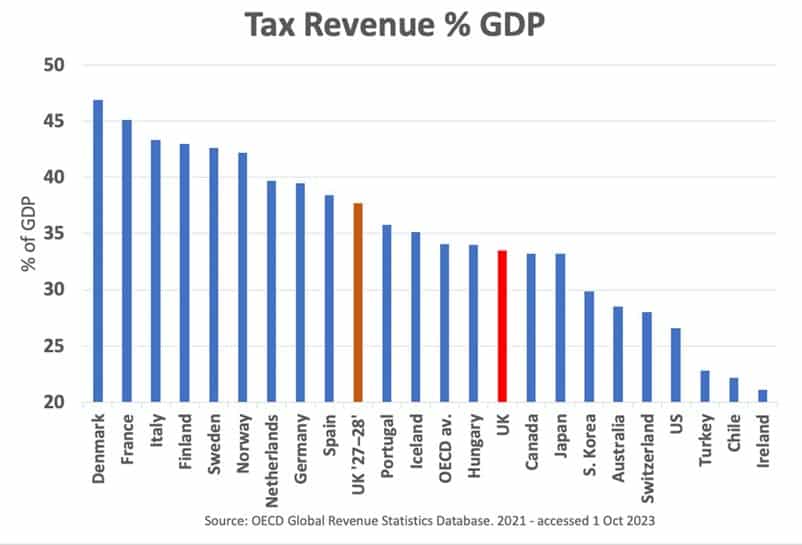

On the one hand, the US has one of the lowest tax rates as a share of GDP in the developed world, but this hides a hidden tax, the need to pay for private health insurance and out-of-pocket expenses.

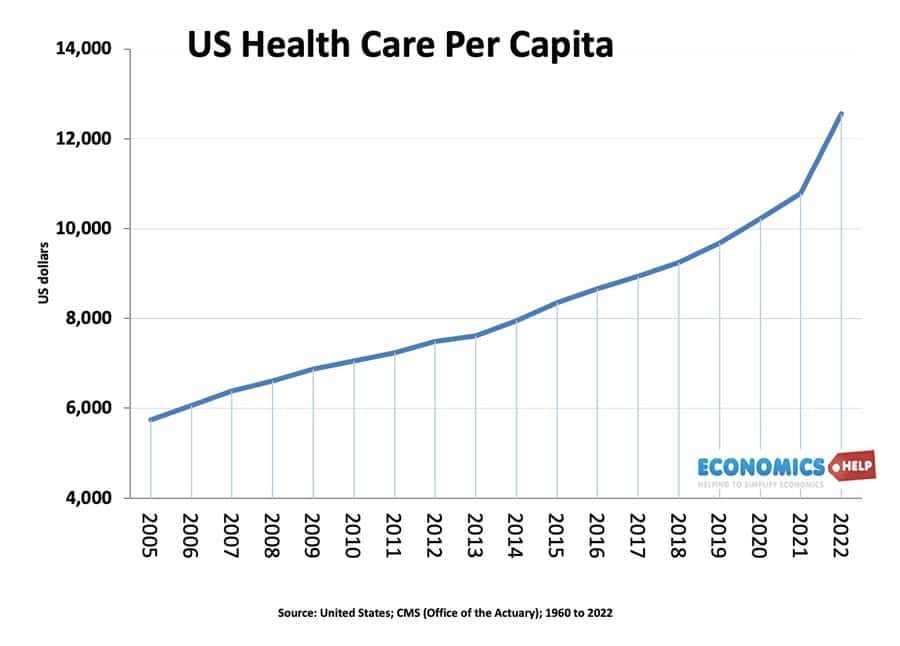

US Health care costs have risen drastically in recent years. Although the number of uninsured has fallen still 8% slipped through the net and is always at risk of health bankruptcy. Even basic health care plans can fail to meet all necessary expenses and this fear of sudden expenses is a reason many workers feel economic insecurity. Medical expenses directly cause 66.5% of bankruptcies, making it the leading cause of bankruptcy in America.

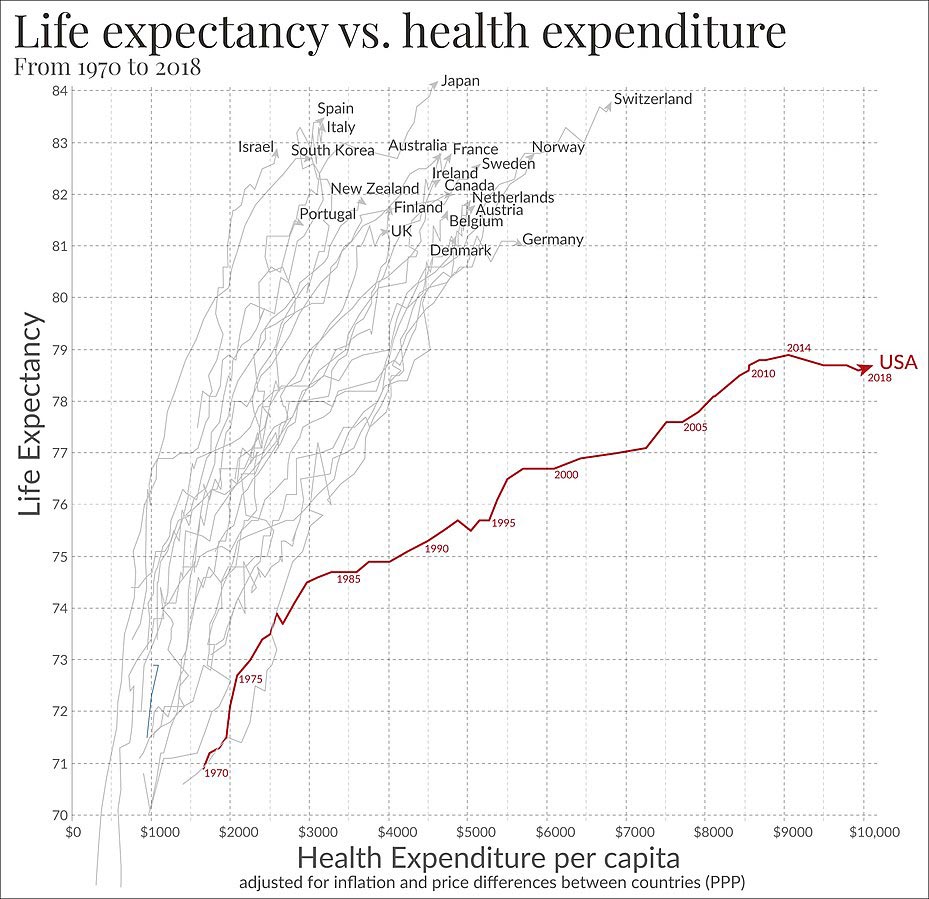

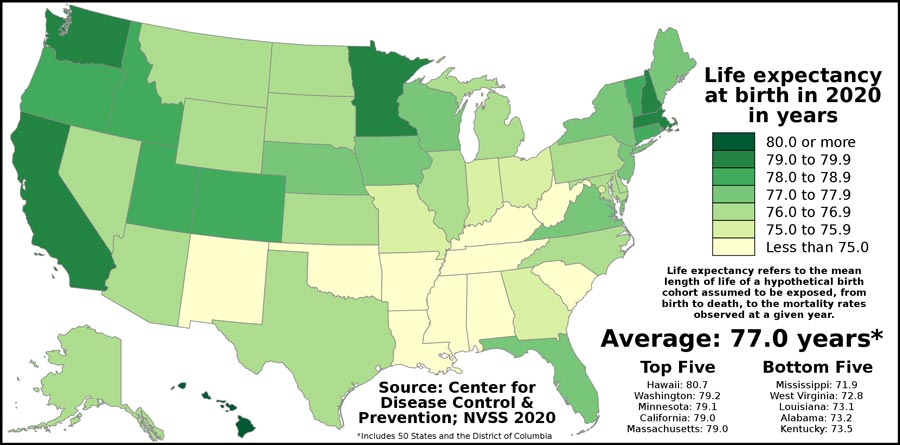

Healthcare costs are a major concern and expense. But, even though the US spends more on health care than other Western nations, the US still has seen a worrying decline in life expectancy. And this life expectancy also hides a growing inequality in outcomes.

Life expectancy in poorer states is significantly lower than in higher income states. In America is not just divided by income and wealth, but there is a growing inequality of health outcomes.

US Economic Boom

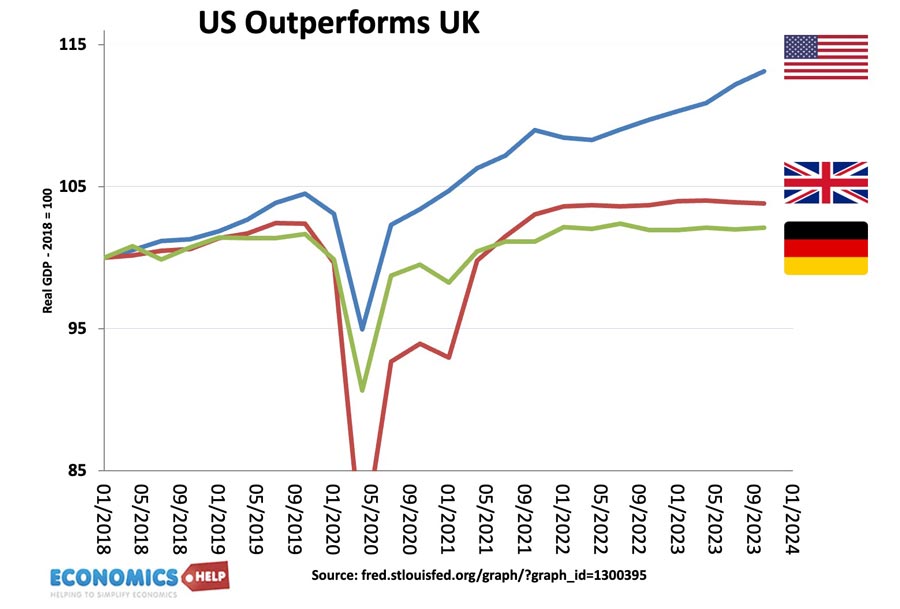

A while back I wrote about a booming US economy. Economic growth in the US really was 3.2% in the last quarter of 2023. And compared to the sclerotic UK economy, US growth is significantly higher. However, so far the increase in median wages, is still pretty modest.

A lot of the growth has been fuelled by falling savings, higher consumer borrowing, and also a growing government deficit. Even in work, many Americans are having to scrape to make ends meet. I have a good friend who lives in Chicago. He had a job for Whole Foods, recently bought by Amazon. He used to love the job, of chatting to consumers at the checkout, but under new management, he got sacked for spending too much time talking to consumers, rather than hitting efficiency targets. This raises two issues. Firstly, the US have a very poor safety net.

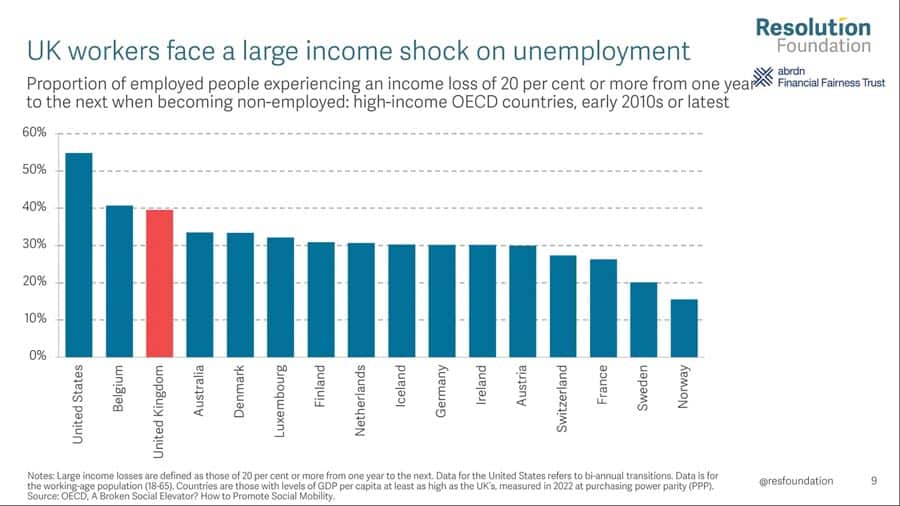

Compared to other countries, when an American is made unemployed, they see a much bigger drop in earnings than in Europe. European benefits are hardly generous, but they provide something of a cushion. But, in America, benefits have been squeezed meaning that should you lose your job and if you have no savings to fall back on, you could easily see yourself being evicted.

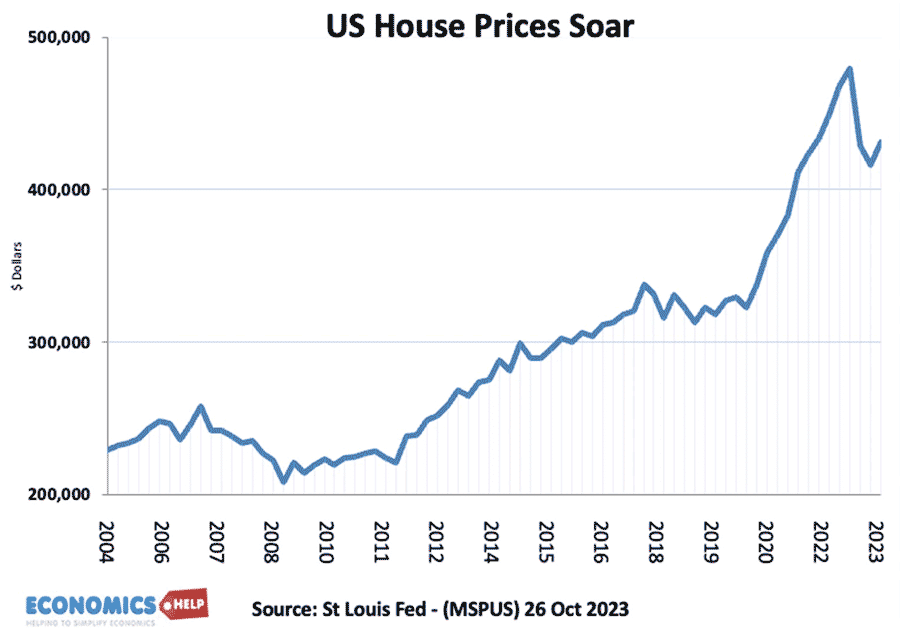

US house prices have soared in recent decades. Some owner owners and investors are sitting on large equity gains, but the consequence is that many people, especially the young are priced out of the market. Rents have also soared in the past few years. The shortage of housing in certain areas is causing an endemic of homelessness. It is a painful adjunct to the richest economy in the world, that homelessness is such a problem. Nearly half a million are affected by some form of homelessness, and in bigger cities like Los Angeles sleeping rough is becoming endemic.

Housing is also one aspect of wealth inequality, which shows an increasing gap in America. The top 10% of the population own an average of $6.5 million or 66% of wealth.

By contrast, the poorest half of the population has a wealth of only $50,000 or 2% of the total. It’s a big divide and wealth begets more wealth. Forbes reports that those who became billionaires last year inherited more than what they made through entrepreneurship. America has an increasing number of billionaires. 756 billionaires in 2023, compared to just 65 in 1990. The top three richest Americans have a combined wealth of $563 billion in 2022. And more than 1,000 ageing billionaires are expected to pass $5.2 trillion to their heirs over the next 20 to 30 years

Hours Worked

But going back to Amazon’s efficiency drive. There is another issue which affects living standards. When we compare real GDP per capita. US GDP per capita is much higher than say Germany.

But, Americans work much longer hours and have shorter holidays. If we adjust for hours worked, the outcome is very different, and Germany has a higher GDP per capita, per hour worked.

Americans have higher incomes, but do they have the time to enjoy it? There has been a worrying increase in the number of Americans with second jobs to make ends meet. Multiple job holders rose to over 8 million in Dec 2023. An all-time peak.

Related

External references

- Tax Policy Centre

- Whitehouse – average federal tax rate

- Our world in data

- Forbes – billionaires

- Medical bankruptcy stats