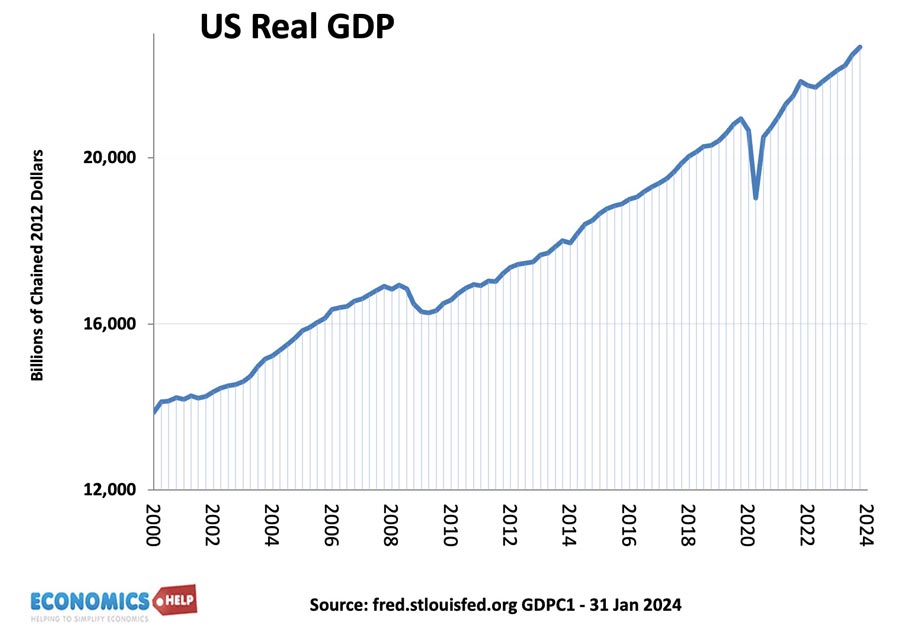

The US economy is currently booming with economic growth of over 3%, record employment figures and core inflation falling to 2%.

It has been labelled the Goldilocks economy – everything is appearing to go well, but last year, there was no shortage of forecasts predicting the imminent demise of the US economy.

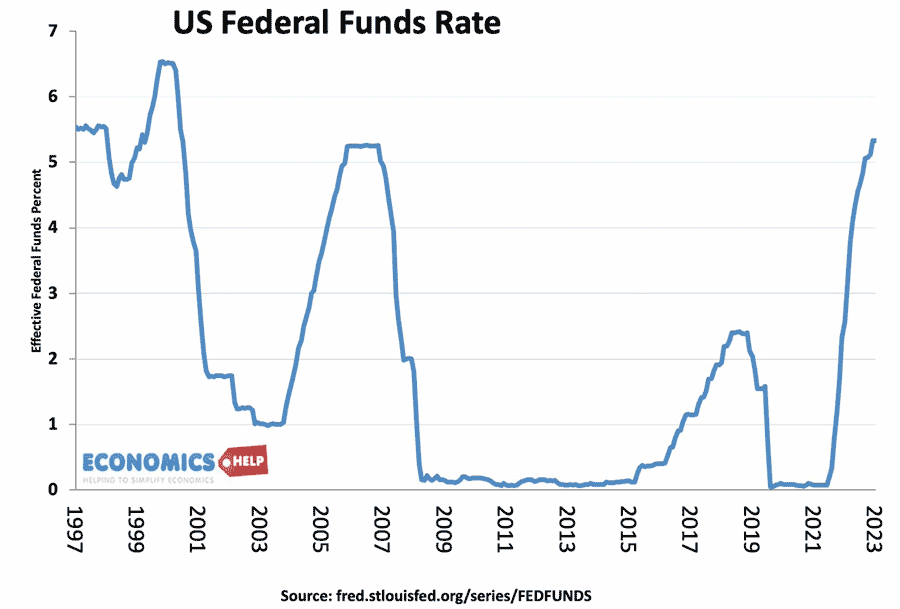

High inflation and the Fed’s rapid increase in interest rates, seemed a perfect storm for a recession. Larry Summers claimed that to bring inflation down would require 7% unemployment. But, come November will this low-inflationary growth be maintained or will the long-predicted recession finally arrive? There are seven factors which put the US economy at Risk of a downturn.

Why has US economy done better than expected?

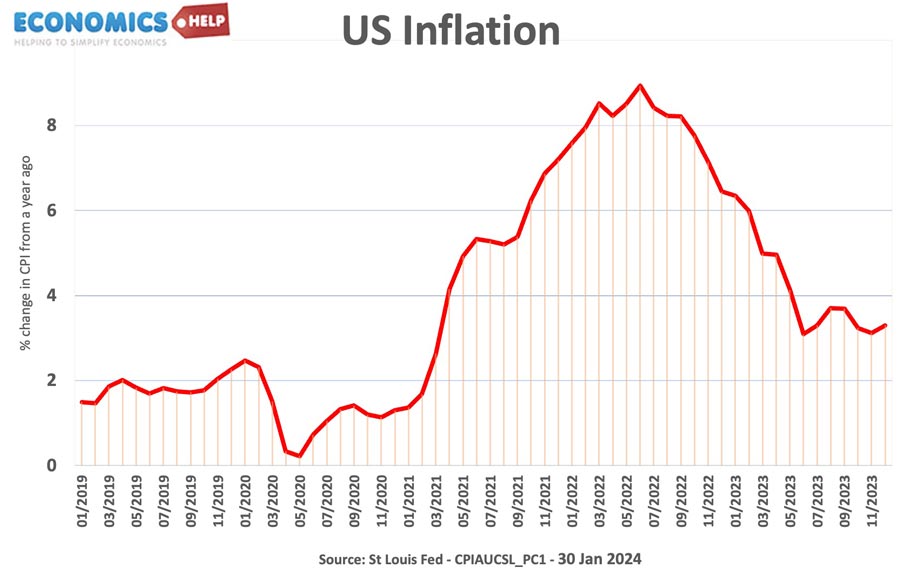

In 2022, the US economy was hit by unexpectedly high inflation. Covid disruptions to supply chains, higher oil prices and a post-pandemic surge in demand. But, in 2023, we saw a sharp drop in oil prices and covid disruptions eased. The result was an almost effortless reduction in inflation. Costs fell and household finances finally started to improve

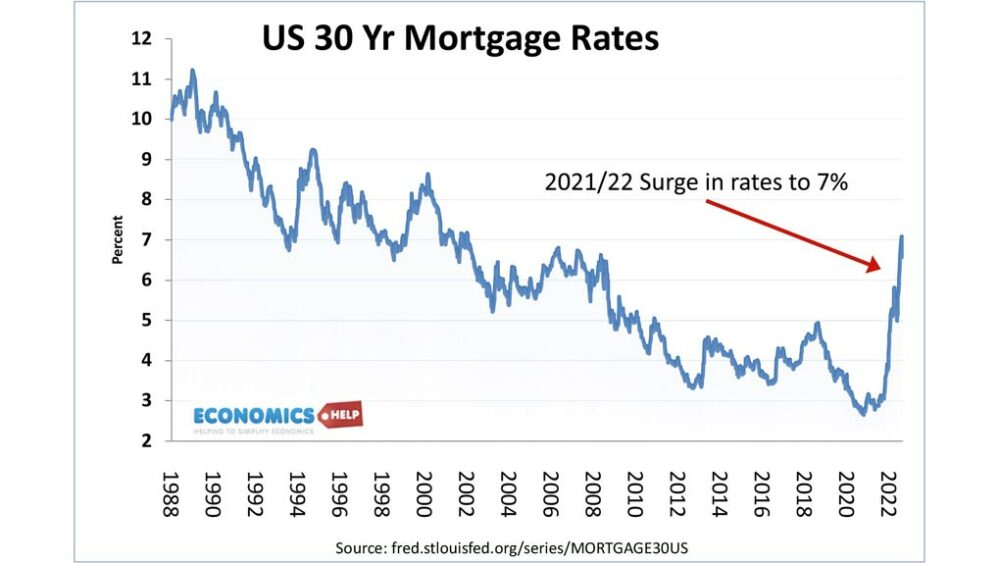

Now, usually, a rise in interest rates from 2 to 5% would be expected to make households worse off and precipitate a recession, but since the credit crunch, households have moved to 30-year mortgages, so many households have been insulated from the rise in rates. It has caused a stagnant housing market with people not able to move, trapped in their house because they need to keep their original mortgage deal. But, it meant there wasn’t the same squeeze on living standards as previous interest rate rises.

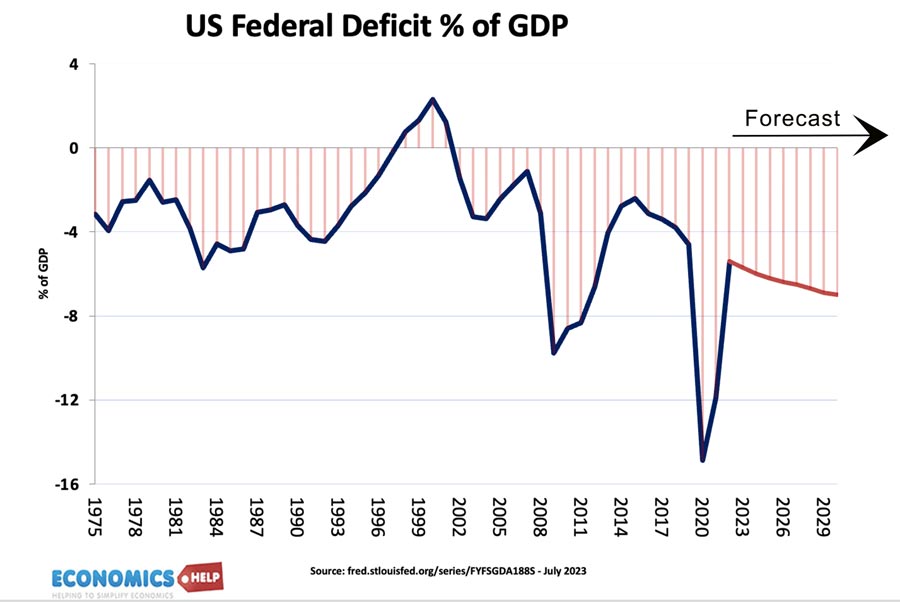

The second big factor behind the strength of the US economy is that whilst monetary policy has tightened, the government have continued to stimulate demand and investment through an ambitious inflation reduction Act. It is ironic it was called an inflation reduction act, when really it was about Green energy subsidies. The result has been to cause a surge in manufacturing investment, boost employment and provide a stimulus to the economy. The consequence is a worrying rise in government borrowing. The budget deficit has increased and is forecast to keep rising. The rise in borrowing would be even worse, but Medicare costs have not increased by as much as predicted. Partly due to falling US life expectancy.

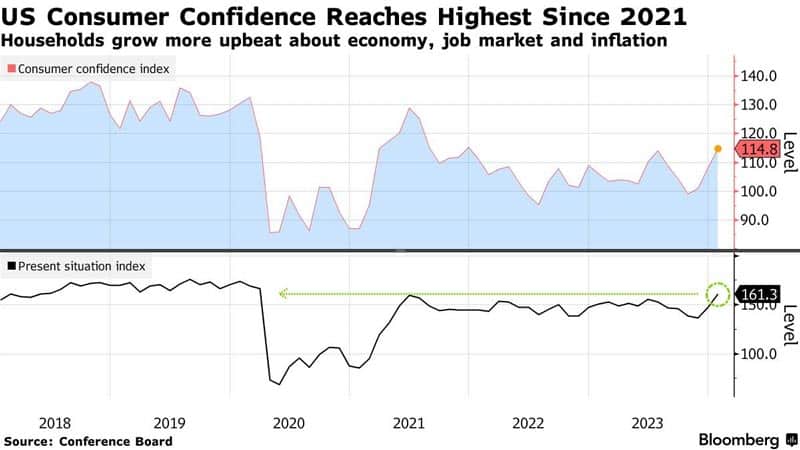

Finally, US consumer confidence is improving. In early 2023, US consumers were very pessimistic about the wider economy, despite theoretically good economic statistics. The reason was despite falling inflation, consumers were still adjusting to the 25% increase in the price level. When I was in US last year, I was shocked at how food prices had doubled since I was there last. But, with inflation continuing to fall, consumers are now more positive. And the good news is that very recent inflation trends are even better than 12 months ago. The outlook for inflation in the next 12 months is good. It even gives the Fed the scope to consider interest rate cuts in the coming year.

What could go Wrong for US Economy?

This paints a fairly optimistic picture but there are seven warning signals.

Firstly, the US has a two speed economy. Despite strong economic growth, low income households are still struggling with real wages only marginally higher than pre-pandemic. The cost of living still bites and 61% of Americans still live pay check to pay check. For example, in America, car insurance has soared 37% since Jan 2020. A combination of shift to more expensive SUVs, higher interest rates and the increased technology of cars, all cause an unwelcome increase in costs.

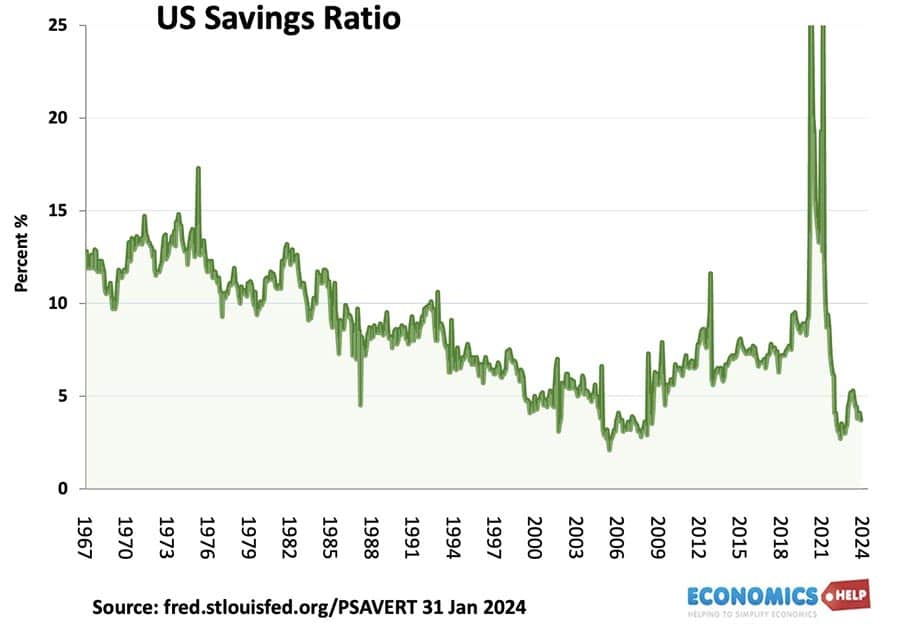

Secondly, American households have survived recent cost of living crisis by running down savings. It has fallen to 3.7% one of the lowest rates in post-war period. There is little room for manoeuvre left.

Thirdly, the large rise in interest rates is still to be felt in the economy. Interest rates have a time lag, but in 2024, the impact of higher borrowing costs will be increasingly felt. US house prices are significantly overvalued with price to income ratios near record levels. Higher mortgage rates could in theory bring down prices as first time buyers are priced out. Falling house prices would hit household wealth and consumer confidence.

Fourthly, the lessons of the 2022 inflation shock should not be forgotten so quickly. All it takes is for another geo-political shock to cause a rise in oil prices. Saudi Arabia is wanting to drive oil prices higher, it is only weak Chinese and European demand that is keeping prices low. The turmoil in the middle-east could easily escalate causing a surge in oil prices and a return of a devastating oil price shock.

Fifthly, the American economy has become reliant on expansionary fiscal policy and high government borrowing. But, this is unsustainable in the long-term. From a Keynesian perspective, a period of high growth should be a period of reducing borrowing rather than federal debt of 6% of GDP. Fitch report how total government borrowing reached 9% of GDP in 2023 – worsened by higher debt interest payments. Partisan brinkmanship leaves open scope for a government shutdown later in year. The only good news is that the strong growth is causing better than expected tax revenues.

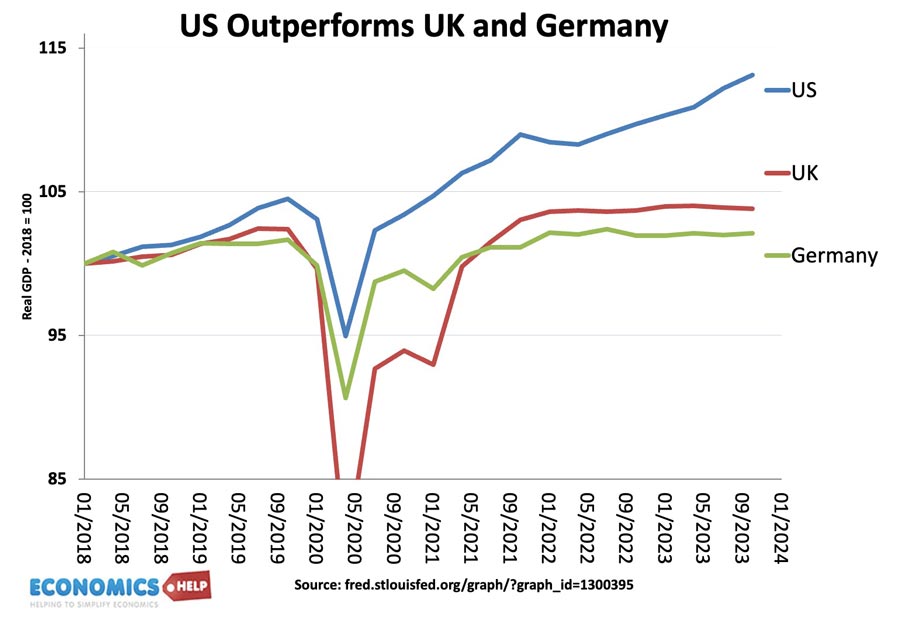

Sixthly, the US economy is leaving behind other economies. European economies are struggling, barely escaping recession. China faces a property crisis and weak economic growth, with a period of inflation. Added to the geo-political uncertainty, low global growth will hurt the US economy throughout the next year.

What do experts predict? The stakes couldn’t be higher. Should the economy be doing well and it will favour the incumbent president. But, should we see a recession or a resurgence in inflation, it could be fatal for the chances of President Biden.

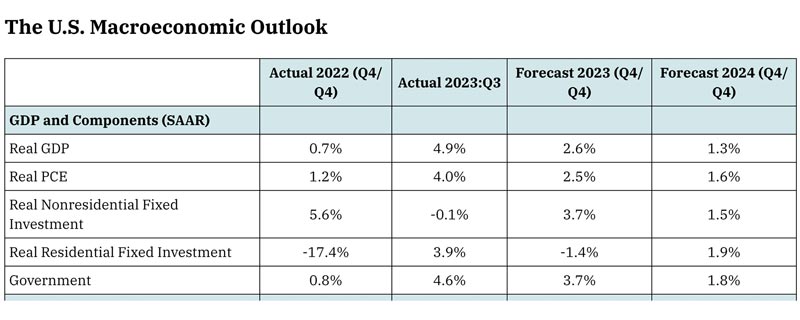

J.P.Morgan predict growth of only 0.7%. St Louis Fed report a survey of professional forecasters predict economic growth of 1.8% by the fourth quarter of 2024. But, inflation should continue to fall. There will be a slight uptick in unemployment, but still close to full employment of 4.2%

This forecast was made in Nov 2023, but already growth in last quarter exceeded forecasters. Forecasting has been a difficult job in recent years. Don’t forget many predicted recession in 2023, but the US had growth of nearly 3%.

Economies have a certain momentum effect. The past growth will continue to boost investment and spending throughout the year. However, there is limited growth for a further surge in spending. Saving rates have fallen and the economy is closer to balancing supply and demand. In the absence of an unexpected supply shock, inflation should continue to fall slowly and remain close to the government’s target. So there is a a good chance the main economic figures will be relatively good in November 2023. But, it is worth bearing in mind, the past few years have shown, that people’s perceptions of the economy may only weakly correlate to what is happening. The inflation shock took time to absorb. Why is the US booming but Germany entering recession. A big factor is that whilst the US runs a deficit, Germany is pursuing austerity.

Related