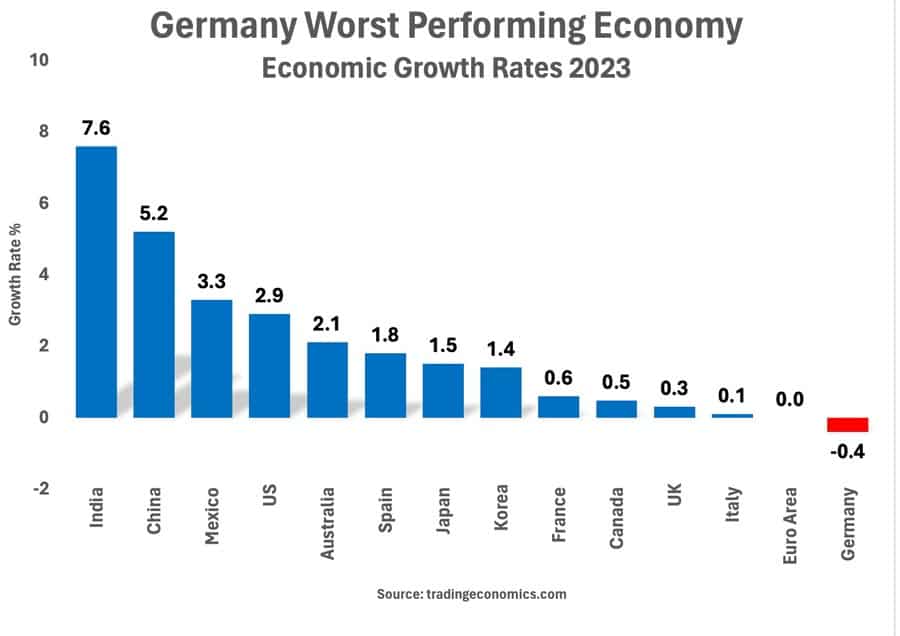

Last year, Germany was the worst-performing major economy in the world. Real wages have fallen, confidence plummeted and workers are protesting.

Relative growth rates

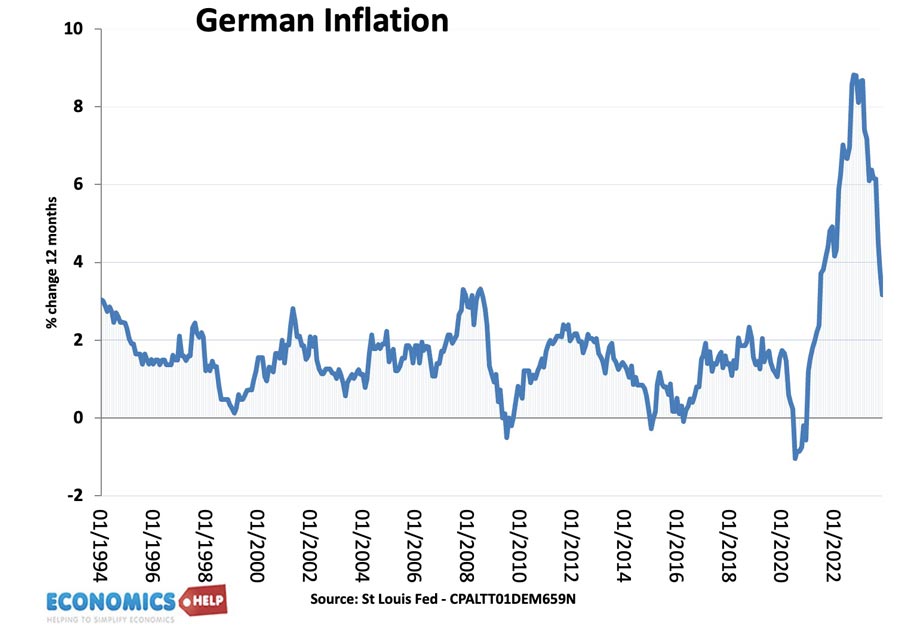

The only thing increasing is the cost of living, with Germany experiencing the highest inflation in the post-war period.

For decades, it wasn’t like this the German economy was seen as an economic miracle or Wirtschaftswunder. Its rapid growth and industrial sector the envy of the world. But, 2023 has seen a temporary crisis highlight long-term structural issues of under-investment, an ageing population and a reliance on Russia and China. Is Germany’s much-vaunted economic model at risk of implosion or will the economy be able to shrug off these temporary difficulties?

News

I have a new Youtube Channel “Economics Help Global” – I would appreciate if you could subscribe and help the channel get going. My existing channel will focus on UK Economy.

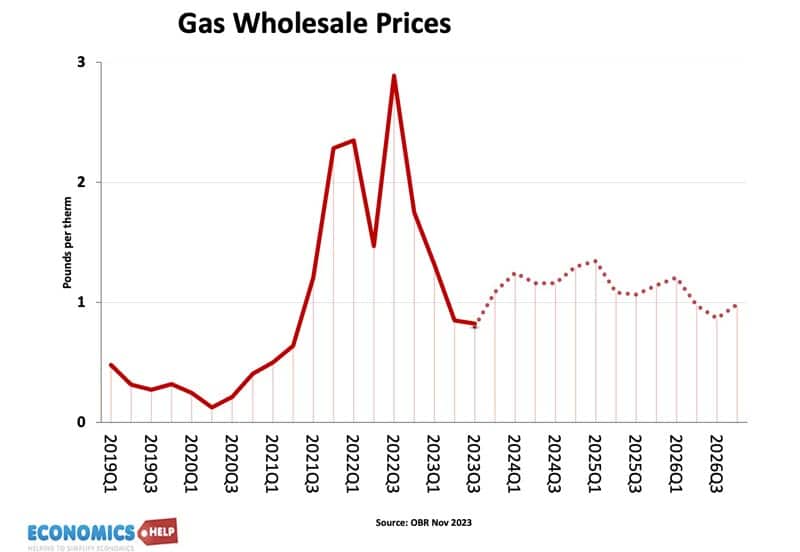

In fairness to Germany, the past few years have thrown a number of real economic shocks, which may have devastated a weaker economy. No country was more reliant on cheap Russian gas than Germany. After the Fukishma nuclear disaster of 2011, Germany closed all nuclear plants and placed their faith in Russian gas. Germany’s industrial giants demanded cheap energy and it was hoped that such a large trade deal would encourage Russia to move closer to European democracy.

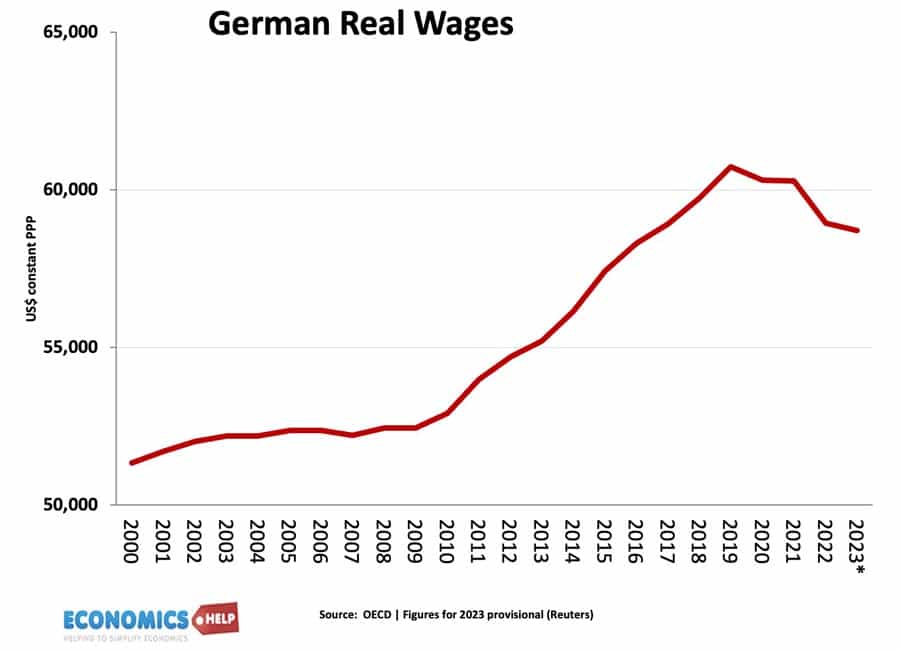

But the dramatic disruption to gas supplies in 2022, caused prices to soar and industry fretted about having to halt production. Faced with imminent disaster the government mobilised to conserve energy demand and import liquid gas. It was actually a great achievement, but the cost was higher gas prices and much larger government borrowing. The energy price increases have caused a rare surge in inflation, causing a loss in both business and consumer confidence. And in 2024, more problems are in store with construction workers demanding 20% pay rises. The loss of real wages in the past two years have caused rare industrial disputes with farmers and train drivers going on strike. The German reputation for reliability and efficiency is under strain. And there is no easy solution. Like much of Europe, Germany has suffered a fall in the birth rate, an ageing population and a shortage of workers, which could see more wage rises and inflationary pressures in the coming year.

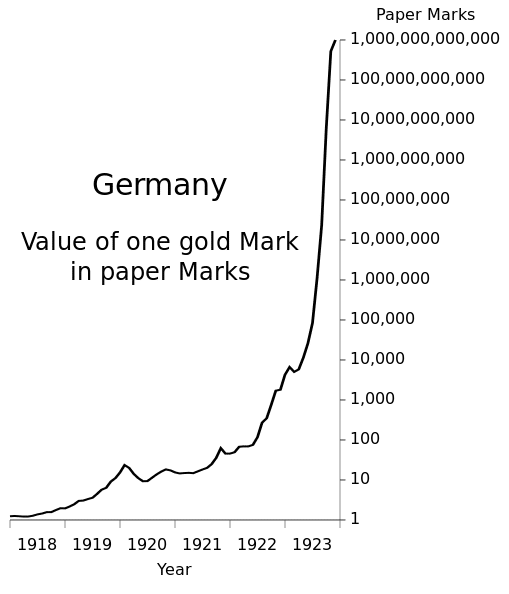

100 years ago to the day, the German economy was experiencing a traumatic period of hyper-inflation, with workers carrying wheelbarrows full of money to deal with runaway inflation and a worthless currency. The shock of inflation and its role in the demise of democracy still reverberates in the German psyche today.

Another key element in the Germany psyche is a dislike of government debt. So strong is the fear and dislike of higher debt, that in 2009, the government passed a constitutional amendment limiting the amount of debt a government could borrow. The problem is that in the crisis of 2023, government spending soared to deal with covid and the effects of the Ukraine war. When the government wanted to maintain spending commitments, the court struck in down as unconstitutional. The result is that the government is forced into austerity at exactly the time when the government need to do exactly the opposite. As countries in southern Europe might be able to tell Germany, austerity is never popular. Farmers are in revolt over higher taxes, and workers striking over falls in real pay. But, the real problem is that with the private sector in retreat, cuts in government spending are worsening the decline in demand and growth.

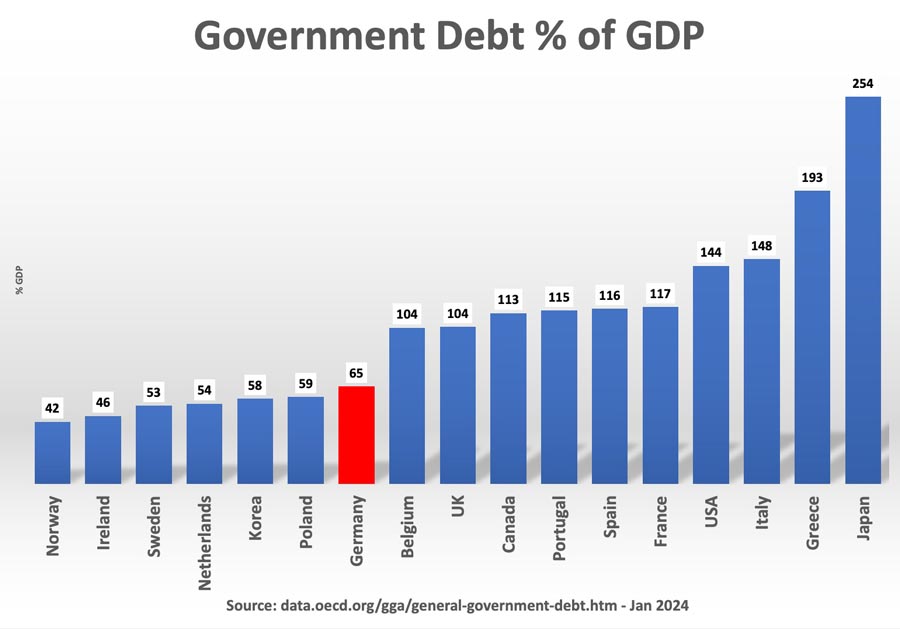

Misplaced Debt Concerns

If any country can afford to borrow more, it is Germany, German bond yields are one of the lowest in the world due to strong demand and a stellar reputation. German debt as a share of GDP, is much lower than similar countries. Germany can and should be willing to borrow more to face these temporary crisis. Germany can afford investment in public infrastructure which has fallen behind in recent years. Germany is facing self-imposed austerity and recession, which is completely unnecessary. The problem is that to change the debt brake rule, would require a 2/3 majority in parliament

Structural German Economic Problems

However, the German crisis is much more than these temporary headwinds, German industry fears it is being left behind by a fast changing global economy and when times were good times, they failed to invest. The once much-vaunted German car-industry is struggling to move into the electric car market. Germany’s great competitive advantage was always in high-tech mechanical engineering. But electric cars need software as much as any engineering. The result is that Germany is rapidly losing ground to Chinese car firms and American firms like Tesla. Exports to China have fallen, hurt by both the slowing Chinese economy and a declining competitive advantage. Brexit, which disrupted exports to the lucrative UK market has not helped. German car makers such as VW still retain a strong brand image, but it was tainted by the diesel emissions scandal, which saw sales in America fall. Industrialists worry that German car makers could face a Nokia or Blackberry moment. A once dominant industry becoming complacent and then suddenly and quietly overtaken by new firms like Tesla and Chinese start ups.

This may sound something of an exaggeration, German car firms are still in good health. In 2022, Volkswagen was the largest car firm in the world and still saw sales of €156bn in the first half of 2023. They still have time to catch up with switch to electric. However, past success is no guarantee of future success. And should the car industry suffer, it would have a major negative effect on some of the poorest regions in Germany, which rely on the car industry.

However, away from the German car-industry, there is a growing realisation Germany has lagged behind in key technological changes. It has fallen behind in the adoption of digital technology, even as the government have to cut spending on digitisation services. Germany ranks only 23 in digital competitiveness and many government services are still in the paper era.

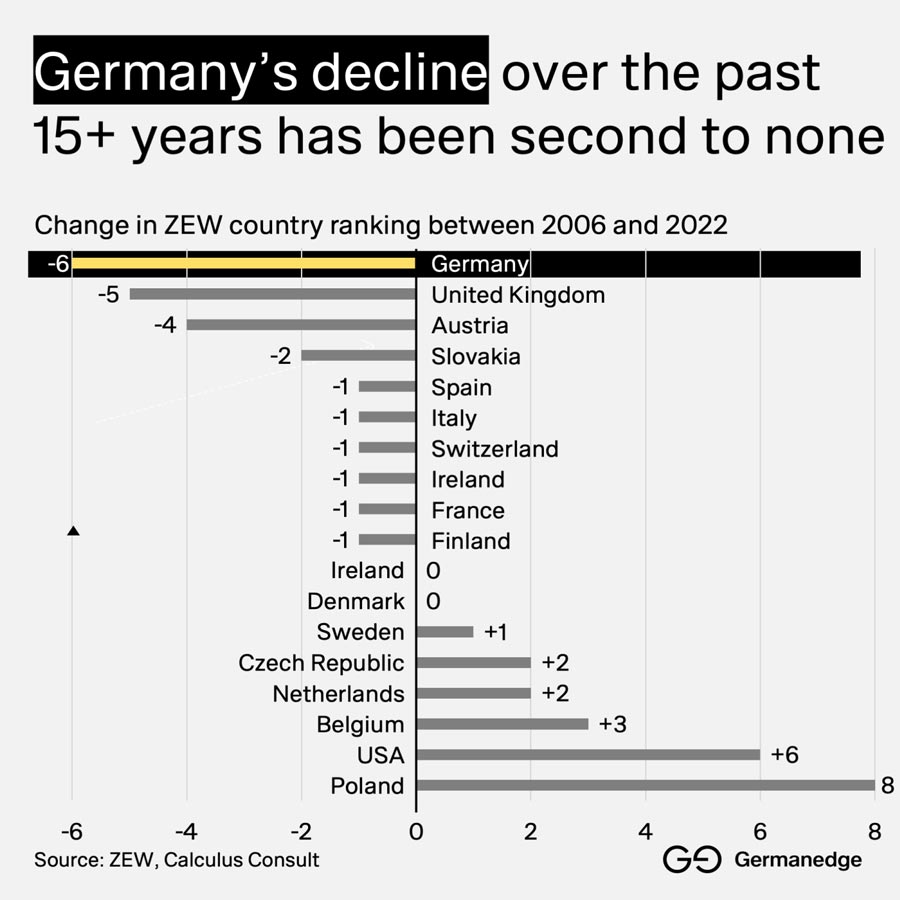

German industry complains of an excessive regulatory burden. The economist reports, it takes 120 days for a German firm to receive an operating license. Italy and Greece, hardly bastions of free enterprise take 40 days. Construction permits take 50% longer than the OECD average and as a result, Germany has become less attractive as a business location. It has suffered the biggest falls in attractiveness in the past 15 years.

Impact of Green Subsidies

Germany and the rest of Europe have also been impacted by President Biden’s Inflation Reduction Act, which was a huge expansion of subsidies for green technology. It means to keep up, Europe is forced to follow suit with big subsidies to attract the new technology, but given German’s self-imposed budget constraints, it has less room for manoeuvre than it would like. Germany is also one of the most exposed economies to China with strong interlinks between the two economies. A hard decoupling would cost 5% of German GDP, equivalent to another Covid shock.

Euro

Even the Euro is not proving as smooth as the German economy would want. In the initial decades, Germany had lower inflation and gained increased competitiveness from the single currency. It led to a huge current account surplus. But, in the recent crisis, the tables have been turned with Germany facing the highest inflation and lowest growth. There is a risk monetary policy could be too tight for Europe’s biggest economy. There is certainly no easy devaluation, which could have happened in the past.

Too Early To Write off Germany

However, despite all these headwinds and they are very real, it is important not to lose sight of the underlying strengths of the German economy. Living standards are amongst the highest in the world, it has a strong industrial base, a well-educated workforce and strong institutions. The recent crisis could be a trigger to pursue much-needed reforms. German economy faced a bigger challenge during reunification in the early 1990s when the economy struggled, and just as people talked about Germany being the weakest economy in Europe, it rebounded. It would take a brave forecast to write off the German economy, but the challenges of 2024 are very real, and an unusual shock for an economy which has used to being one of the world’s strongest performers being the worst.

Source

https://www.linkedin.com/pulse/germanys-digital-lag-uncomfortable-reality-check-von-stengel

https://www.economist.com/finance-and-economics/2023/08/17/the-german-economy-from-european-leader-to-laggard

https://www.economist.com/business/2023/07/31/what-if-germany-stopped-making-cars

https://www.linkedin.com/pulse/germanys-digital-lag-uncomfortable-reality-check-von-stengel

Ireland – The Hidden Cost of Living in the World’s Richest Country

- How Wealth Broke Society