With house prices falling in the past 12 months, is it worth waiting to buy or is better just to bite the bullet and not worry about forecasts for interest rates and house prices?

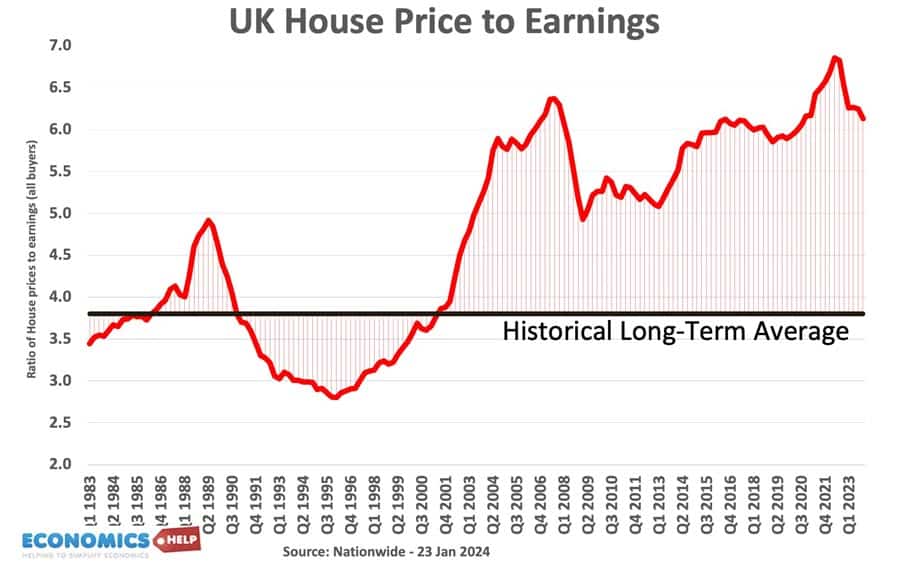

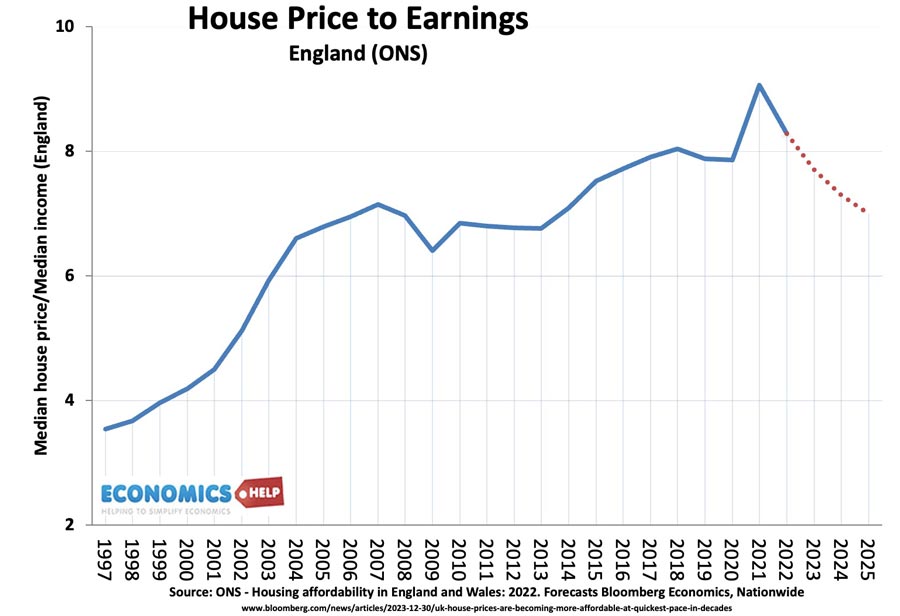

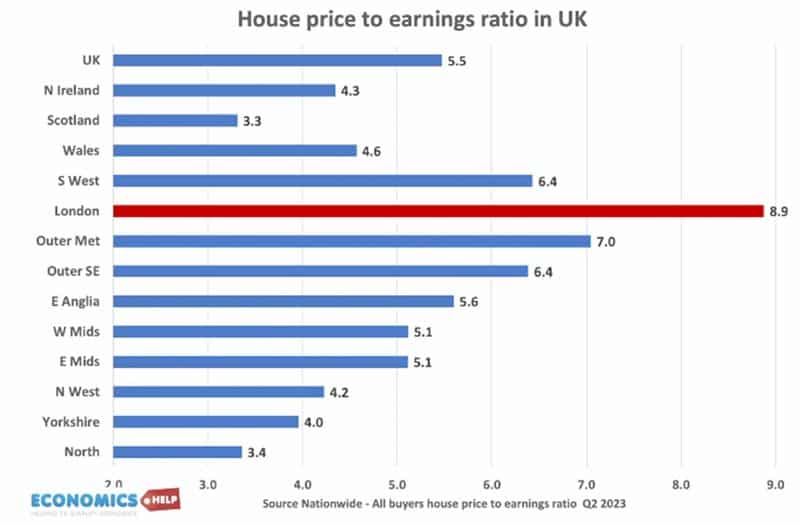

Despite modest falls, house price to incomes are still close record levels, and combined with higher interest rates and a weak economy, housing affordability will remain stretched throughout 2024. The good news is that even a conservative forecast by Bloomberg suggests, house price to income ratios will fall over the next 2 years.

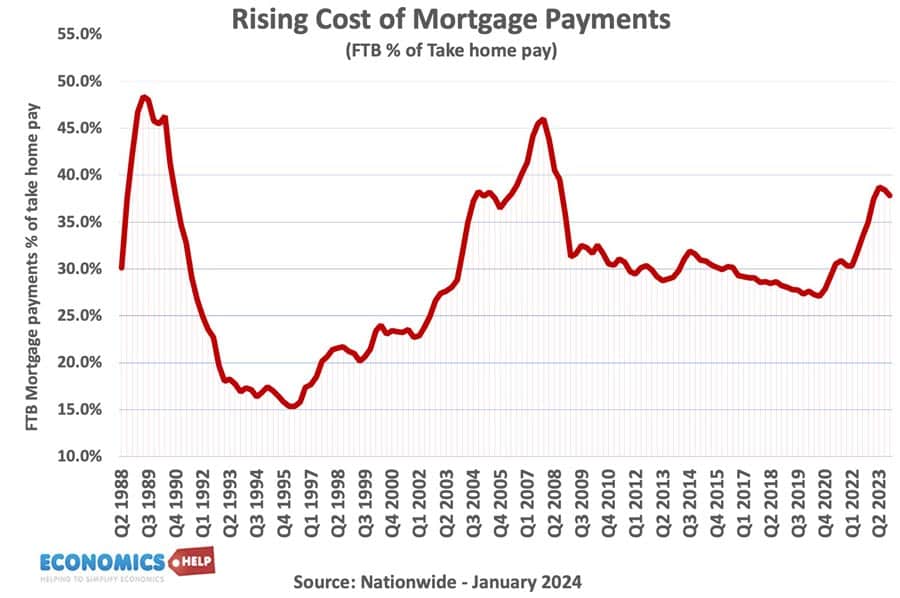

The past interest rate increases have seen mortgage payments as a share of disposable income rise to levels not seen since previous crashes, though it is worth noting, it is not quite as bad as 2009.

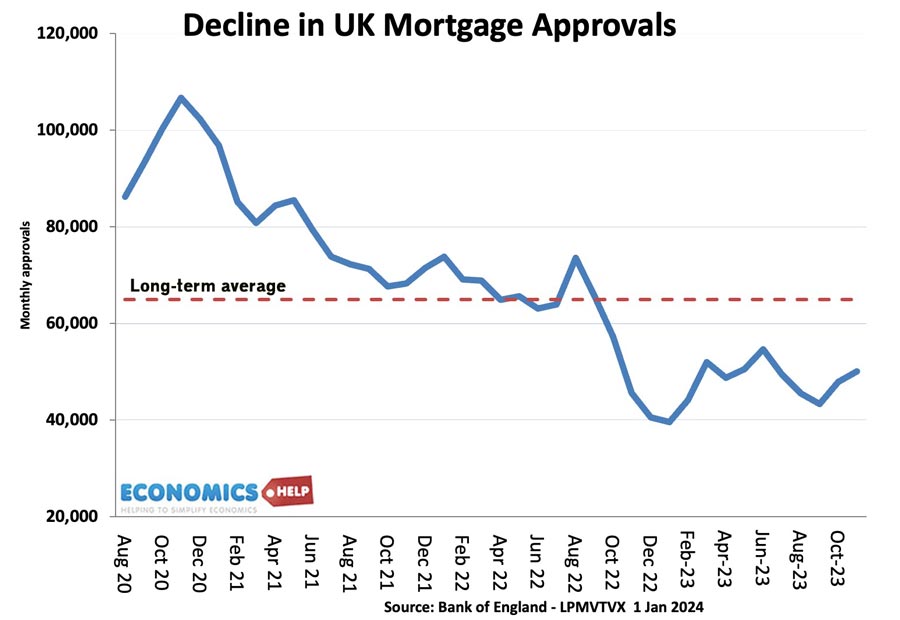

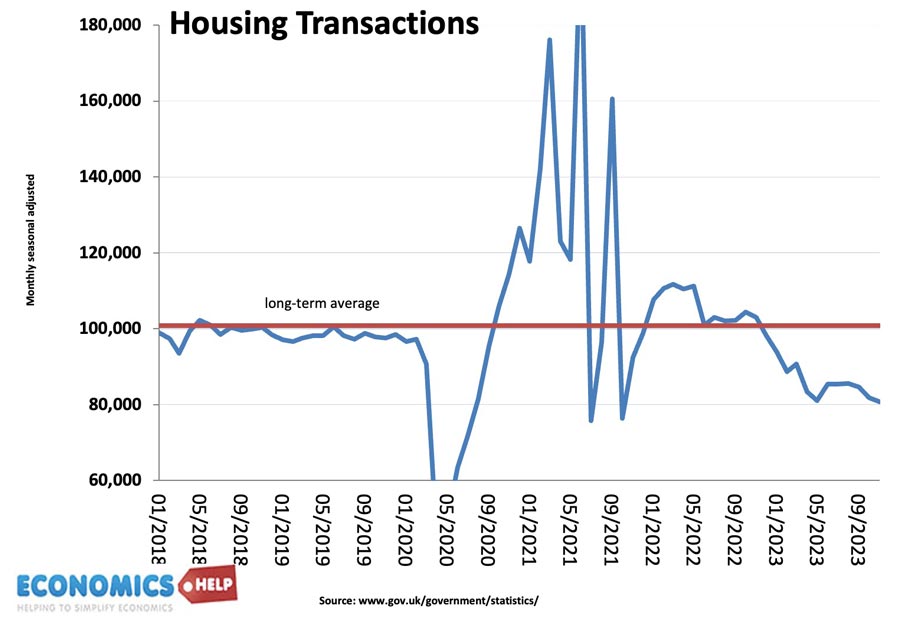

Higher rates have definitely had big effect leading led to fall in mortgage lending and lower transactions.

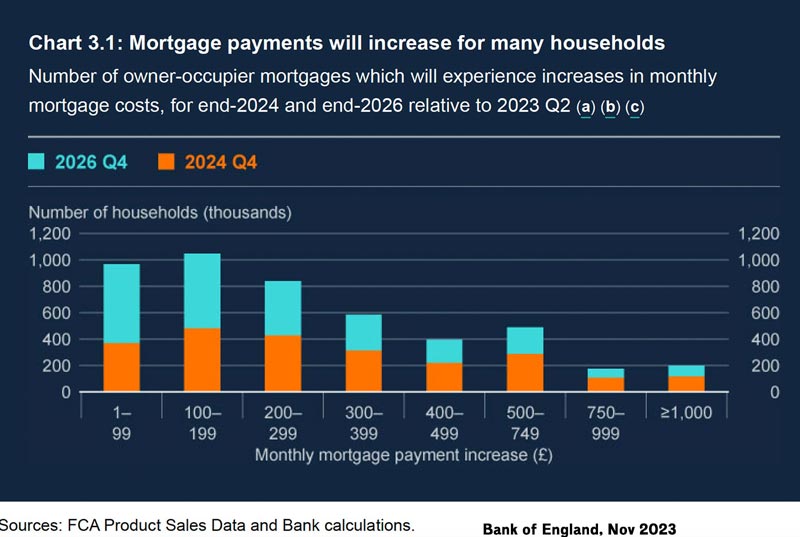

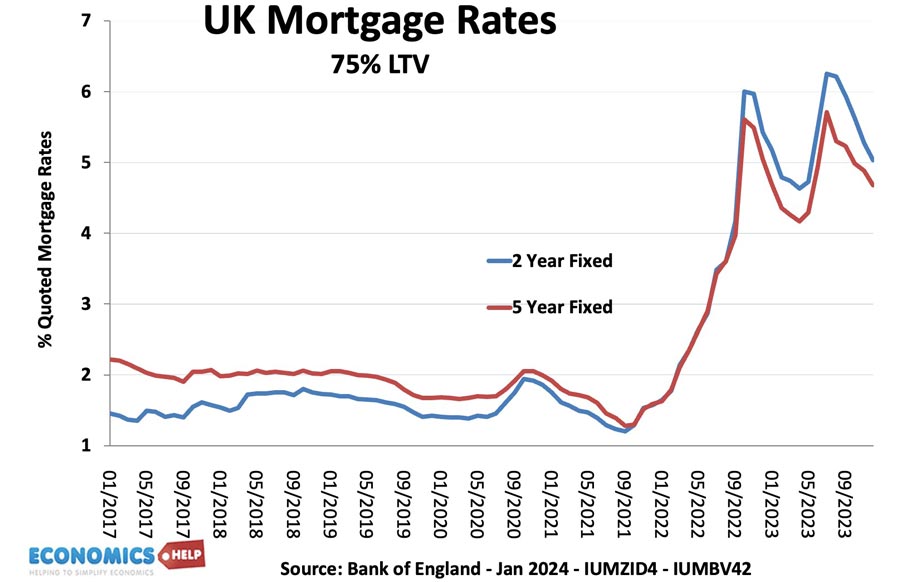

However, despite these interest rate rises, prices have not fallen as much as some predicted. There are three reasons. Firstly fixed rate mortgages have become more popular and so many households are insulated from the previous rises. But, this year around 1.5 million will remortgage to higher rates.

Already, mortgage losses have been rising, and a combination of higher rates and recession is likely to worsen that this year.

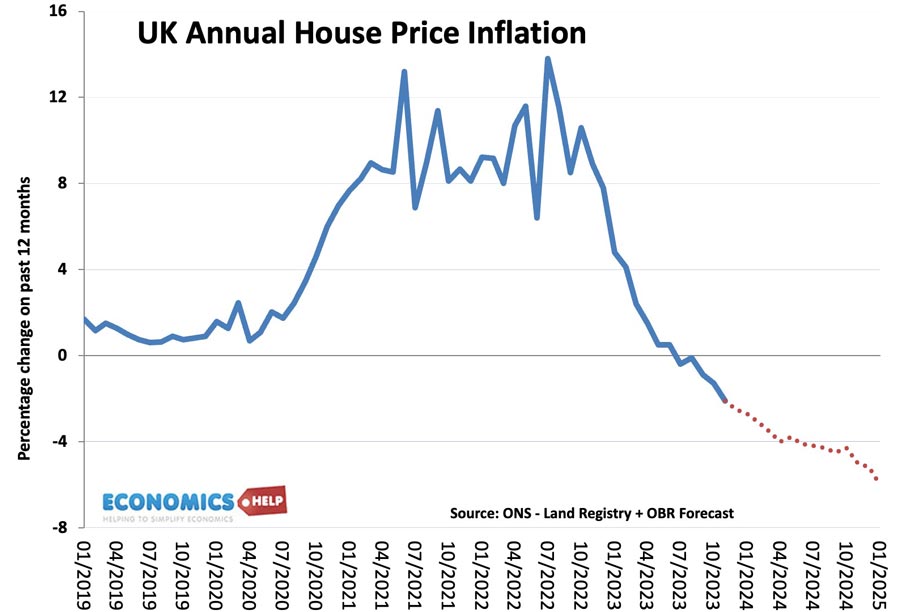

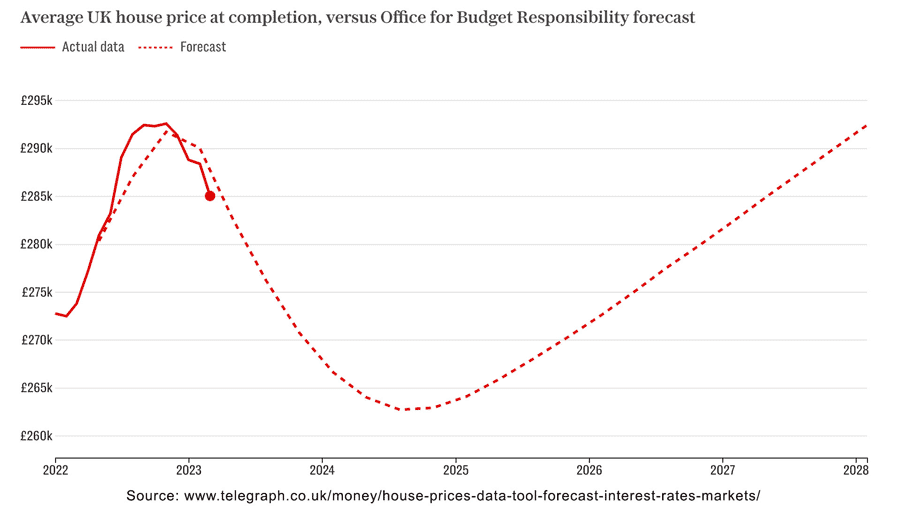

In recent months, there has been some minor reduction in mortgage rates offered by banks, which is good news for first time buyers, but it is still important to compare to 2022, when mortgage rates have still doubled. This is why the likes of the OBR predicted that house price will continue to fall into 2025 before slowly recovering.

Not everyone agrees with this forecast, but it suggests, at the very least, you don’t need to be in a rush to buy. Compared to previous falls, 2023 has been quite muted, either there is more to common or this time is different. Another reason house prices have held up so far is that mortgage lending criteria are stricter than pre-financial crash so fewer homebuyers have bad debt. Thirdly, the UK still faces a chronic shortage of housing, which is limiting buying options.

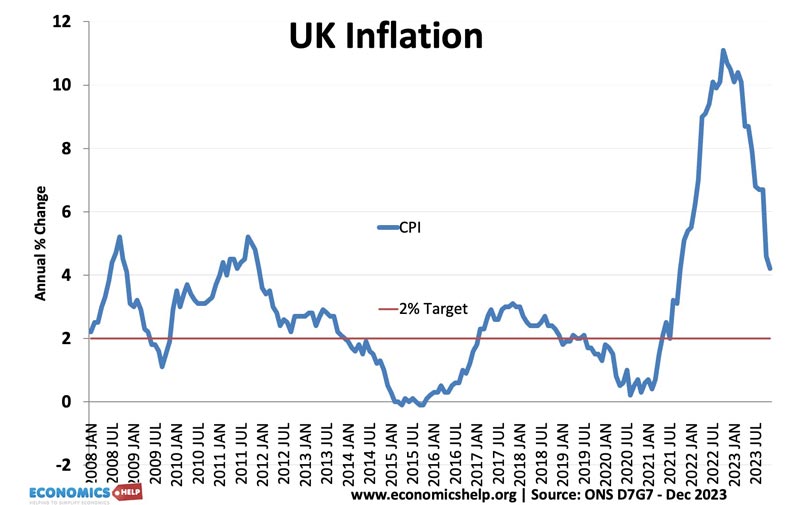

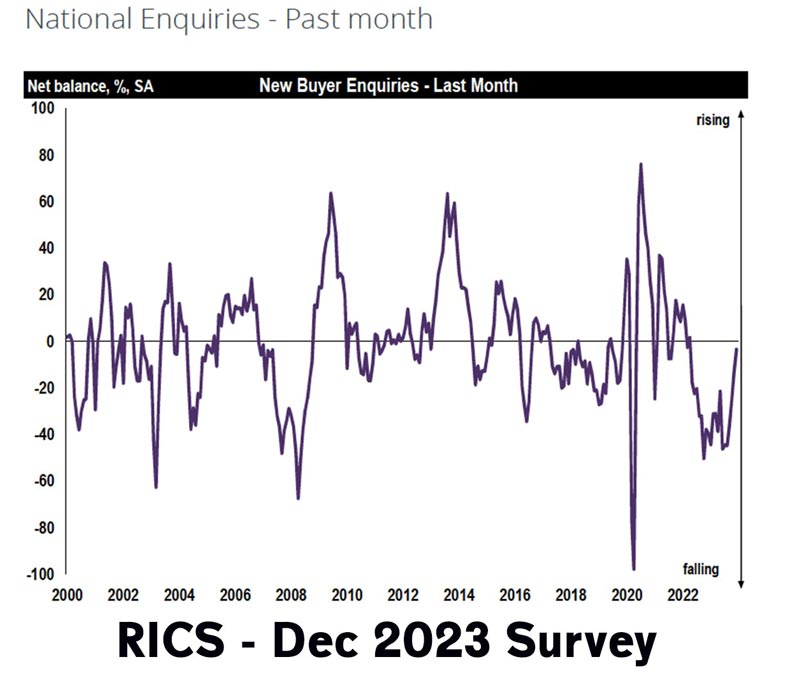

The good news on interest rates is that in the second half of 2023, inflation started to fall quicker than expected. After being an outlier, UK inflation started to reflect lower inflation trends around the world. The big drop in inflation in December, caused markets to price in four interest rate cuts by the end of the year. After a worrying decline in transactions in 2023, it led to a recent increase in buyer interest.

It was such a big drop in inflation that it caused Frank Knight to change its house price forecast from a 4% drop, to a 3% rise in 2024. However, if you are thinking of buying a house or even working as economic forecaster, I would advise not being too affected by monthly statistics. Last month, inflation unexpectedly rose to 4%, and suddenly people go from optimism to pessimism. My advice is don’t be blown off course by monthly news, people tend to over-react to monthly data.

Difficulties in buying

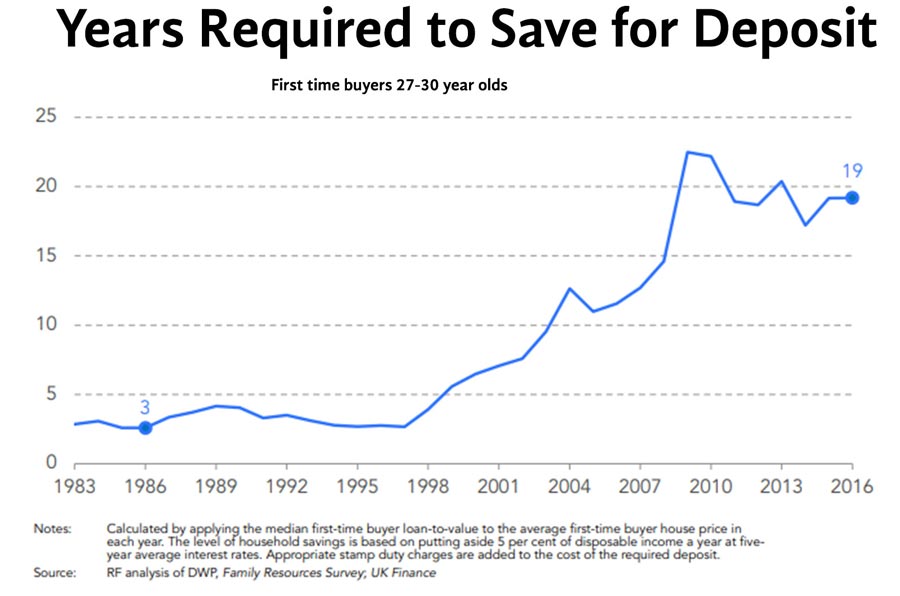

The big problem is that potential buyers still face tremendous difficulties in buying. Households in their late 20s, face 19 years of saving for a deposit. The combination of higher rates, plus requirements of banks to stress test higher mortgage rates, buyers are struggling to get a sufficiently big enough mortgage to buy. On top of these, we have a weakening economy.

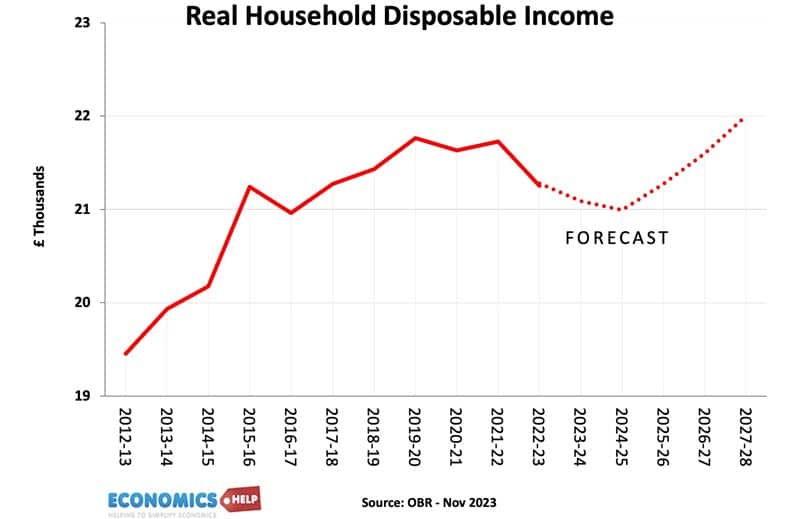

Real incomes have been battered by inflation, low productivity and a weak economy. The forecast is for continued weakness in real income growth for the next few years. There are early signs of the UK entering into recession, with a drastic fall in retail sales, just before Christmas. Any rise in unemployment and fear of unemployment will have a very negative effect on the housing market. Big housing crashes tend to occur in recessions. It’s not just interest rates but falling real wages and fear of unemployment that tend to hold back buyers. For those taking out a large mortgage, job security is an important factor, especially given the prospect of being left with negative equity. The problem is that as people remortgage and pay an extra £500 a month, there will be more squeezes on living standards to come.

One thing that might help the housing market, at least in the short-term is that with an upcoming election, the March budget is likely to provide tax cuts, and even promises of sticking plaster policies like a 99% mortgage. (this is not a good solution to Britain’s housing crisis, but if and when it is implemented, we would see first-time buyer demand increase.

Buying a house

Now as an economist I’m interested in economic forecasts, but for a potential homebuyer it’s not all about forecasts. If someone asked me the question – is it a good time to buy? The advice I would give is that if you are buying somewhere to live, then it is always worth considering, so long as you can afford it. If the alternative is paying market rents, which are probably close to mortgage payments anyway, you are at least starting to pay off mortgage debt. It will help when you reach retirement to own a home, rather than having to pay market rents.

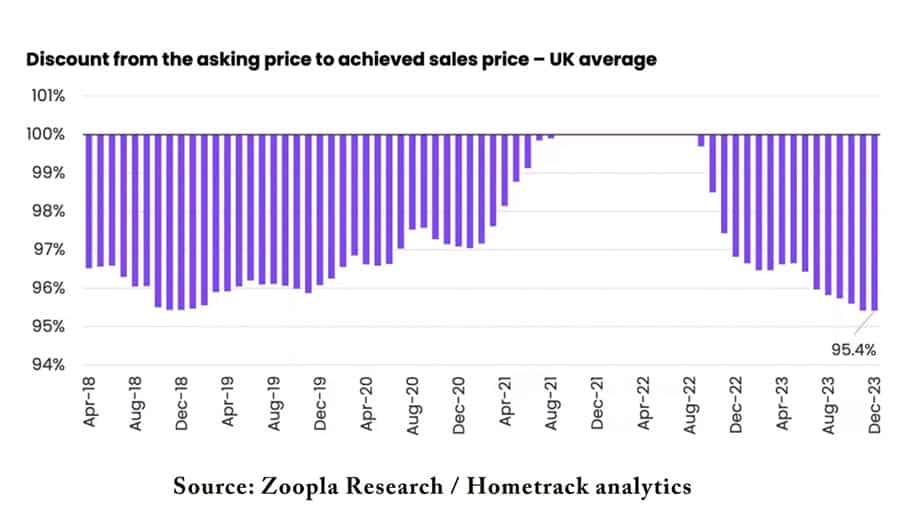

An important factor for any buyer is to know the state of the market. For example, Zoopla report an average 5% discount off the asking price to achieve the sales price. However, if we compare other data, we see even bigger discrepancies. According to Rightmove, the average asking price in Jan 2024 was £359,748. However, the average sold price that month, according to the ONS was £285,000 – 2% lower than the previous 12 months. Now the measures are not strictly comparable, ONS has a time delay, Rightmove doesn’t include all properties. But, for a buyer the chance of getting big discount is very important to bear in mind. Also, the New Year has seen many old listing deleted and relisted. A very useful tool is a Chrome extension property tracker, which can show you previous listings and how much price has been cut. There are some surprising cuts.

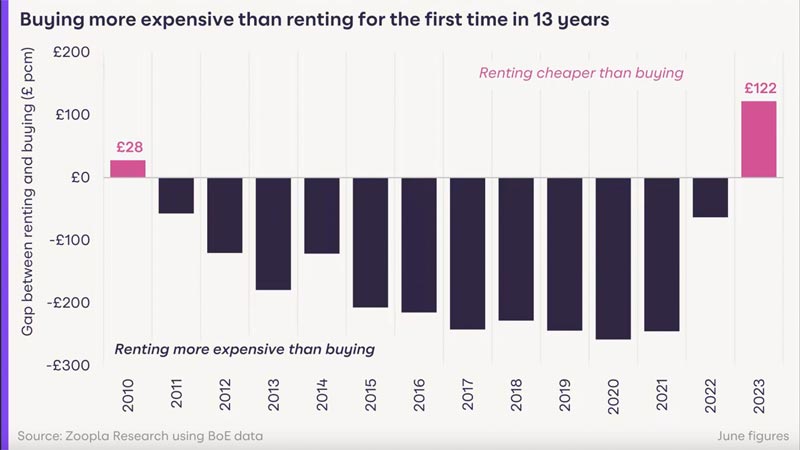

Rent vs Buying

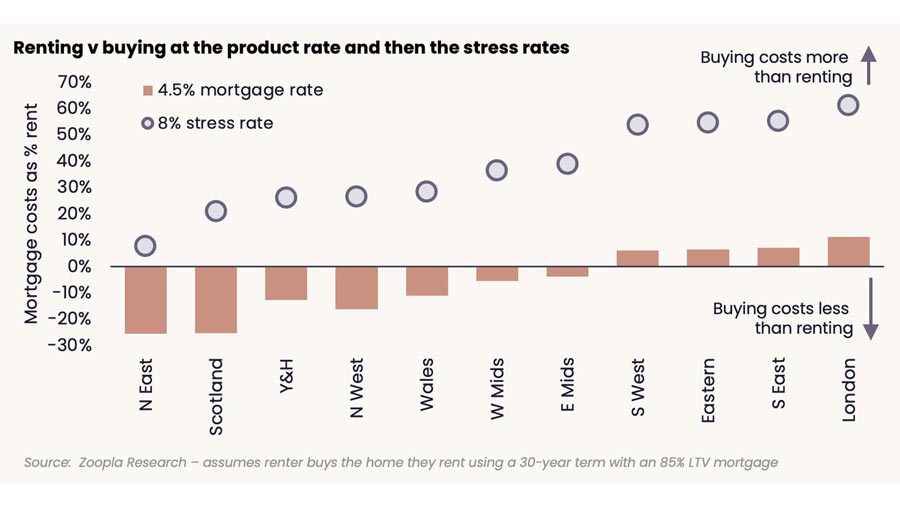

A crucial question for many first time buyers is the issue of renting. 2023 was the first year since 2010 when renting was actually cheaper than buying. This is because despite rising rents, mortgage payments have risen significantly. However, if we dig deeper, this effect is more pronounced in the south. In the north, it is still cheaper to buy than rent.

And this is always an important consideration with the housing market, house prices vary enormously by region. It is generally the south which has a greater shortage of supply, more over-valuation and are more susceptible to rising interest rates. If you’re able to work from home, there are many bargains in different parts of the country. Even within a region, prices can vary by district and even street.

However, even if you want to buy because it would be cheaper than renting with current stress test rules, you have to prove to the bank you can pay an extra 50% a month than what you are paying in rent. This is why many will be frustrated, they want to buy, but you can’t get a mortgage.

Buy to Let?

What about the prospect of buy to let? Does housing still provide a good investment? Last year, those who sold their houses made an average of over £100,000 profit on the initial sale price. But, looking forward, the prospect of similar capital gains looks much harder in the medium term because the ratio of house price to incomes has become stretched. Even with limited supply and a rise in the population, there is less scope for large house price growth in the next couple of years. In the short-term, the effect of higher rates and recession could see house price falls or at the very least stagnation.

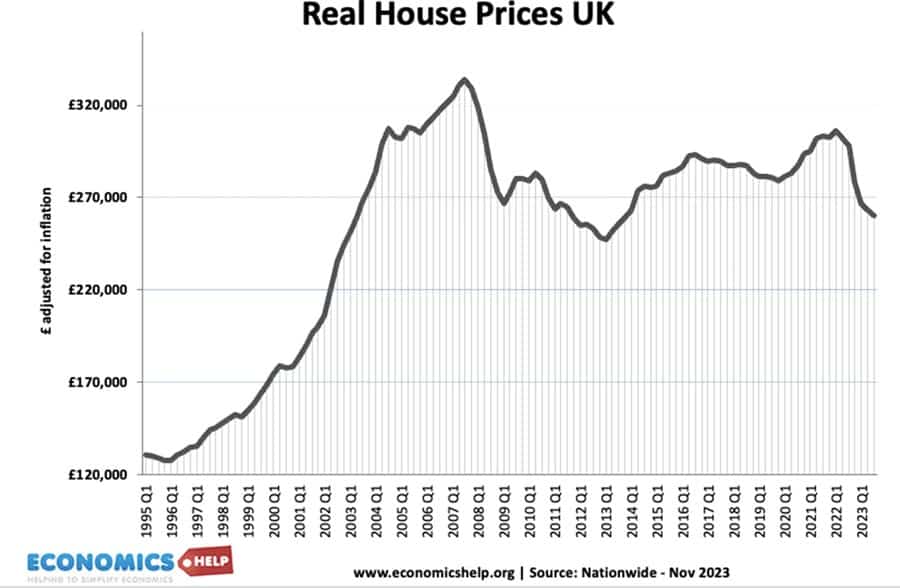

Real House Prices

And also it is very important to look at real house prices – that is adjusted for inflation. One reason nominal prices have not fallen more is that inflation and rising wages are reducing the real value of houses. Real house prices have fallen 22% since their 2007 peak and have fallen 15% since their Covid peak. Adjusting for inflation shows that housing is not necessarily the one-way bet it is often portrayed to be.

With higher interest rates, investors have also now many more attractive options for investment other than housing. Despite rising rents, rental yields are still relatively poor compared to the cost involved in buying. Combined with more government regulation, and higher taxes, many small private buy to let investors have sold up or considering it, with bigger investment firms stepping into the market. Why Landlords are selling up.

House Price Forecasts

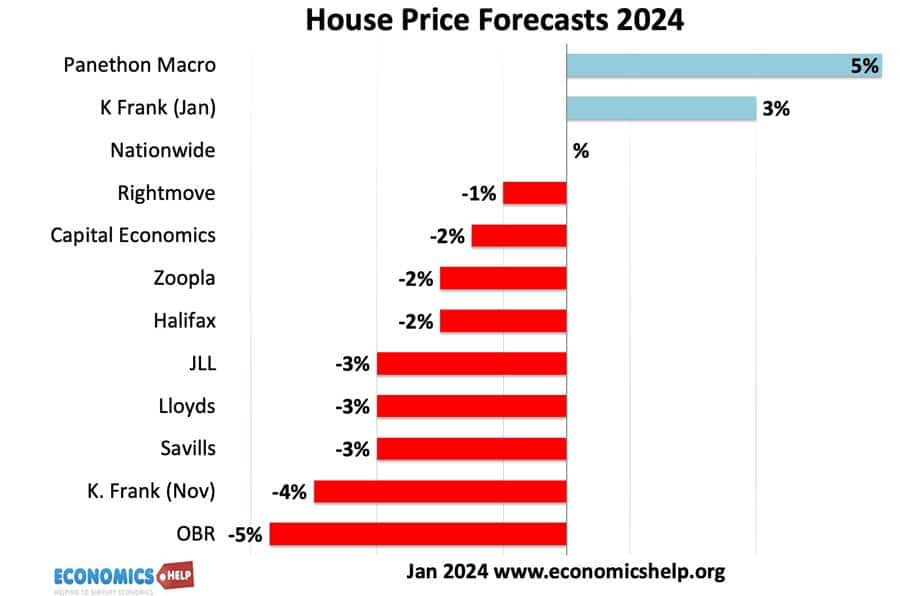

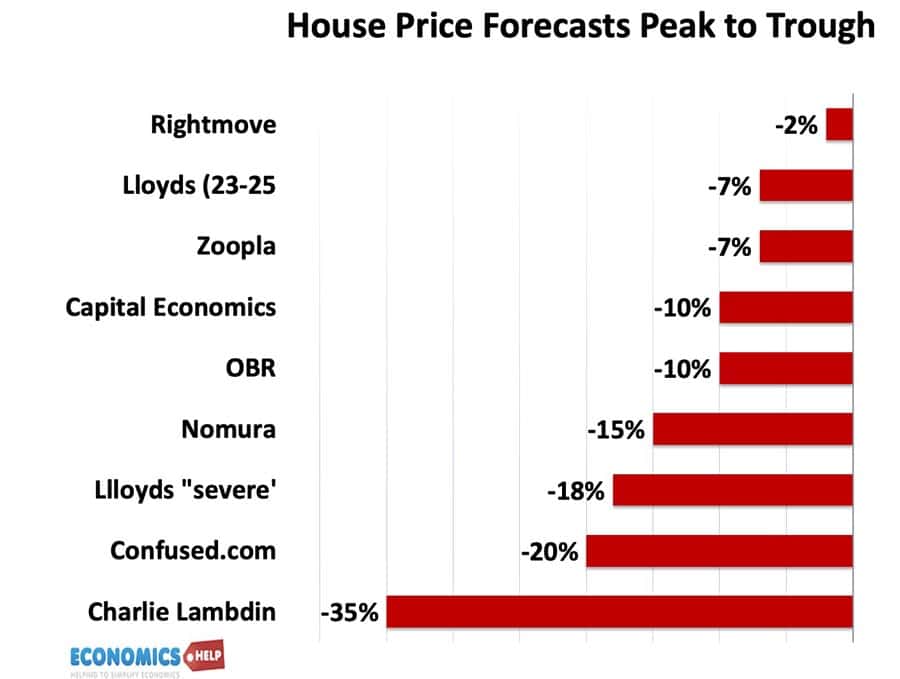

So what do people predict for house prices? In 2024, the consensus is small falls in prices or close to stagnation. The most pessimistic is the OBR with near 5% falls predicted for 2024. Some like Pantheon Macroeconomics predict a 5% rise. However, it is also important to look at a longer time frame. The housing market is slow to turn, in the mid 1990s, house prices didn’t fall until two years after interest rates started to rise. But, when they did fall, it took six years before prices started to consistently rise.

If we look at house price forecasts peak to trough, the most pessimistic is Charles Lambdin of Best Agent who has predicted 35% peak to trough. Lloyds predict a near 18% fall in a ‘severe’ scenario. It is worth bearing in mind, prices fell 20% in the past crashes. There are many similarities with previous crashes. On the one hand interest rates haven’t increased by as much, but because prices are much higher than the 90s, even small rate rises have bigger effects. House price-to-income ratios are actually higher than 2008 and early 90s. But, then mortgage payments as a share of income is not quite a bad. The market is also influenced by parental wealth which is stretching affordability. A key factor is the economy. Will we slip into deep recession or will tax cuts in March budget provide an unexpected lifeline?

But, to come back to the question is at a good time to buy? If I was renting, and I was able to get a sufficiently large mortgage to live where I wanted to live, I would take the chance. I would also be willing to get a longer term mortgage. When I first bought in 2005, I got a 43 year interest only mortgage – it was still more expensive than renting, but I got lucky with interest rates falling. House prices fell a few years later, but it doesn’t really matter if you live in the house.