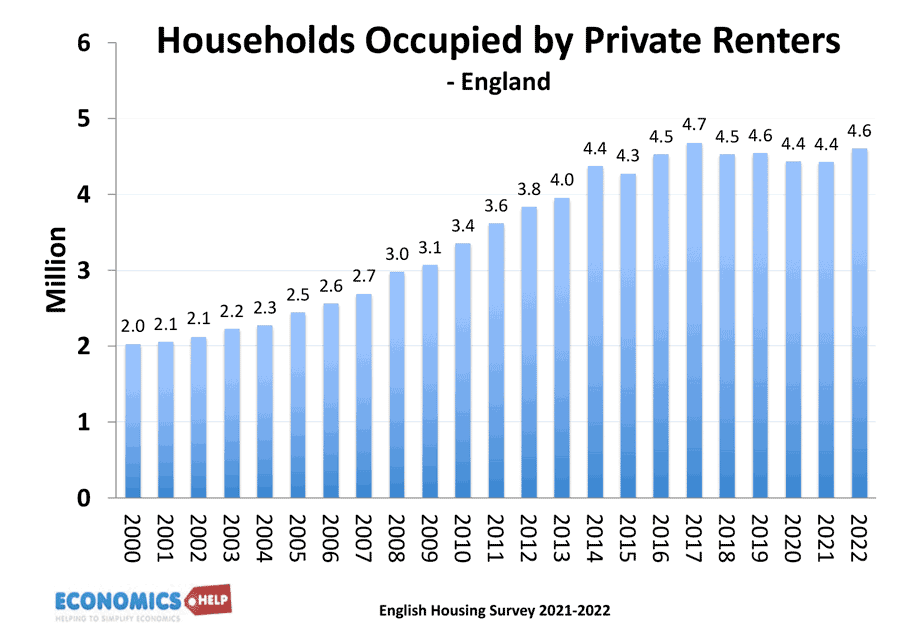

For the past eight years there has been a net exodus of landlords from the private rental market – tighter regulations, tax changes and now the double whammy of inflation and rising interest rates is leading to a shortage of rental properties, just as the market needs more. In the past 20 years, the number of households in the private rented sector in England has more than doubled from 2 million to over 4 million.

Why are landlords fed up with the private rental market at a time of rapidly rising demand and higher rents? Have recent regulations and proposed new laws gone too far and does more need to be done to improve the supply of rented accommodation?

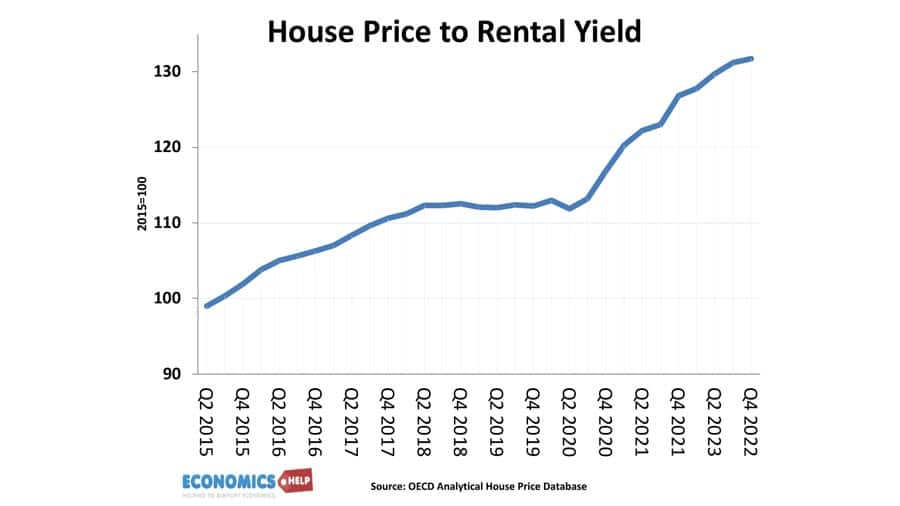

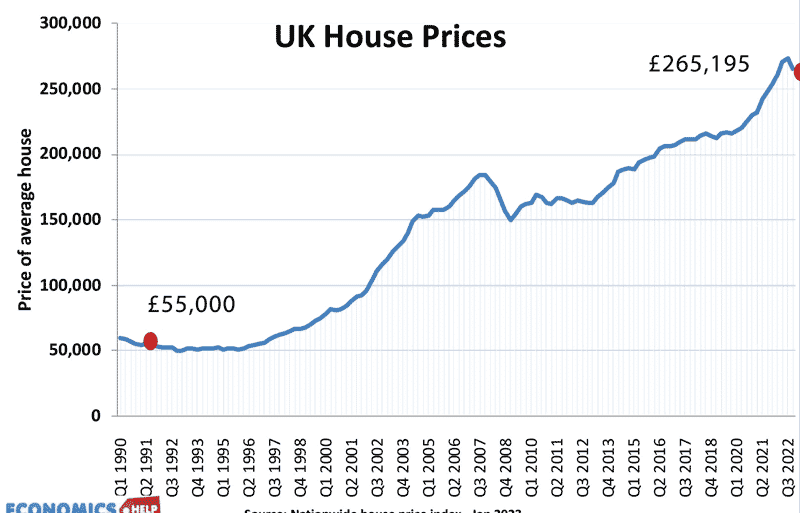

The past rise in house prices were great for property owners, but the ratio of house price to rental yields is now near an all time high, making it less attractive.

According to Hamptons in 2022, landlords sold 35,000 more properties than they bought. Landlords accounted for 12% of purchases and 16% of sales. The National Residential Landlords association claim landlord confidence has plummeted this year – with landlords citing short-term pressures of higher interest rates, and proposed new legislation.

Back in 2014, George Osborne introduced changes to reduce tax privileges enjoyed by buy-to-let investors. This included reducing tax relief on buy-to-let mortgages and a new stamp duty surcharge on buying additional properties followed. And since 2014, we can see a trend of landlords selling more than buying. However, it is new proposed legislation which is causing many to think twice about the sector. This year, Michael Gove, the secretary of state for levelling up, plans to strengthen tenants’ rights with greater regulation, including scrapping section 21 “no-fault” evictions.

For landlords this is a major change in the market. Landlords claim section 21 evictions are primarily used to evict tenants who have stopped paying. Pressure groups for renters claim they can be misused to unfairly evict tenants. However, whatever the reason, the concern of landlords is that the new process of removing non-paying tenants is expected to be expensive and a long drawn out procedure through over-worked courts, which makes letting less attractive. Also, another proposed change is the end of fixed term contracts, which means tenants have the right to leave after a short-time. But, this could be a loss for landlords who incur the costs of marketing, inventory, paperwork, and letting fees but are then soon left without tenants.

On top of this, there are more regulations surrounding the rental market. Each legislation has a logic for improving conditions of housing, but in a time of high inflation, meeting these criteria can be increasingly costly. For example, by 2025 landlords will have to meet an energy grade of C before they can let out their homes or face £30,000 fine. However, nearly 56% of UK homes do not meet this criteria and for landlords with old Victorian housing, the cost of renovation may make it unprofitable to let.

Some landlords claim they face a “war of attrition” with new legislation effectively rent control by the backdoor. It doesn’t help that nationally landlords don’t have the best of reputations and so politically there is relatively few votes in supporting landlord interests. And it is understandable there is considerable sympathy for renters, who are facing really great financial pressures. Those on low incomes in expensive areas are facing rent as a share of income reaching over 50%. And this is a situation exacerbated by falling real wages and high inflation. But, these same living costs are making the industry less attractive to landlords. 80% of landlords say inflation has significantly increased the cost of maintenance, which is a higher cost and another factor reducing the profitability of the sector. As well as high maintenance costs, inflation reduces the real value of houses as well.

Other costs and regulations brought in recent years include

- Deposit protection schemes.

- Mortgage interest disallowance,

- Removal of wear and tear allowance,

- Stricter energy performance and HMO licenses.

And coming soon will be

- Removing fixed term tenancies

- Removal of section 21 notices

- Enabling tenants to keep pets.

The new regulations and tax changes all have a logic and could benefit the rental sector in the long-term in raising standards, but the problem is that if landlords face higher costs and regulations, it can have the unintended effect of reducing supply. This will affect renters as much as landlords. Given the rise in costs, many landlords have a financial pressure to increase rents. For landlords considering selling, past and future legislation is one the biggest reasons given.

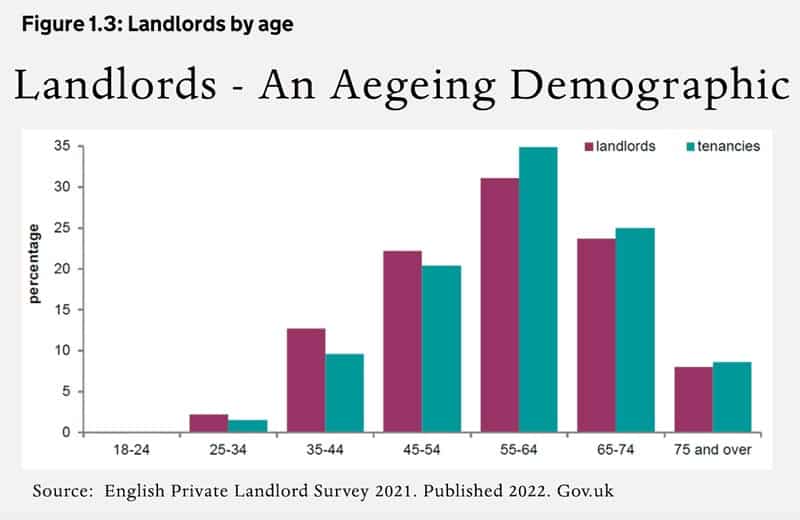

Another concern about the private rented sector is that it is dominated by an older generation of landlords. Over 60% of landlords are over 55 years old. It is striking how many landlords view becoming a landlord as a good investment for a pension. Despite some high-profile young landlord influencers on Tik Tok, Young landlords are not replacing the ageing profile. For many young potential landlords the difficulties of getting on the property ladder are just as hard as for first time buyer because of high prices and cost of living pressures.

Interest rates

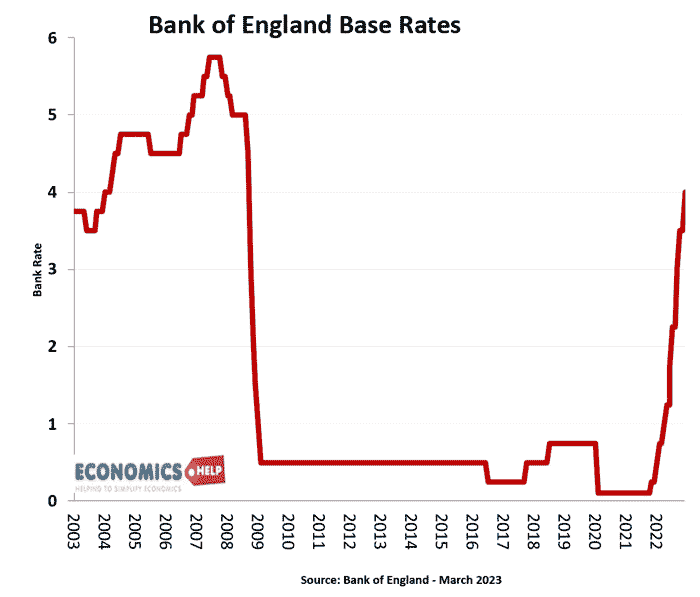

The difficult circumstances of the buy-to-let market have been exacerbated by rising interest rates. Around 59% of landlords have at least one property financed by a buy-to-let mortgage. For landlords with an interest-only mortgage, the effect of rising interest rates are more of a burden than a conventional repayment mortgage.

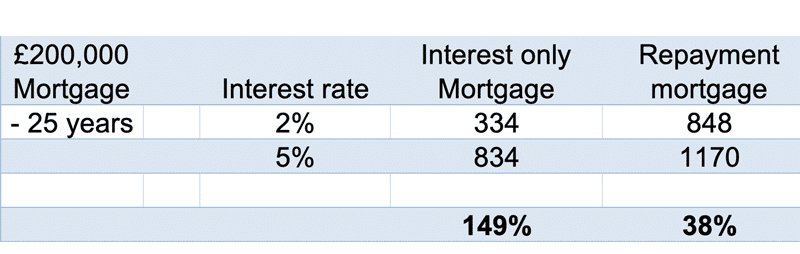

For example, an increase in interest rates from 2% to 5% increases the monthly payments of an interest-only mortgage by 149% but only 38% for a standard repayment mortgage. According to the National Residential Landlords association – at base rates of 5% half of landlords claim it would make it unprofitable. The business model of the past 13 years has been premised on ultra-low rates, and it is a shock they have increased so much.

Landlords are stress tested to make sure rental incomes are 125% higher than mortgage payments. Rising interest rates mean rents have to rise to meet stress test. It is unsurprising that we are seeing rising rents as landlords want to meet costs or maintain the profit margin of their business model. Yet overall rental yields are substantially lower than previous decades.

Another aspect of the buy to let market is capital gains. In the past decade, capital gains were the most profitable part of the business. Hamptons report the average landlord in England and Wales sold their buy-to-let last year for £91,270 more than they paid for it, having owned the property for just under 10 years. After the payment of capital gains tax, stamp duty and income tax, the average higher-rate taxpaying landlord made a total net return of £105,500, or 56%, over 10 years. This represents a 225% return on the initial investment – 39% of this total gain came from rental income, with 61% from capital growth. This shows that in a booming property market, buy to let can be a very good investment.

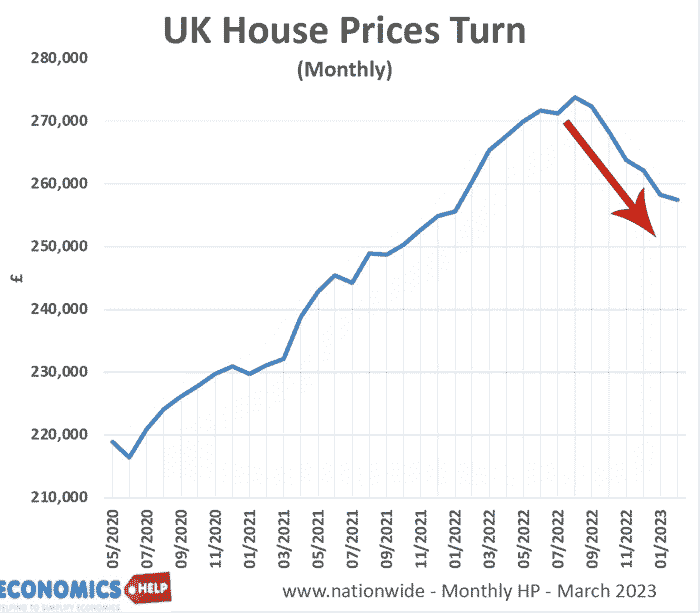

However, with house prices having temporarily peaked – the scope for large capital gains seems to be a long way off. House price to rents are at record highs and as we have looked at in previous videos, House price-to-income ratios in the UK are also close to all-time highs too. The last time price-to-income ratios were close to nine times was in the nineteenth century. Combined with rising interest rates and weak economic growth, house prices have started to fall.

The average higher-rate taxpaying landlord in Great Britain made around £41,000 in profit from rental income on one property over the last 10 years. Meanwhile the average lower rate taxpayer made a £66,460 profit.

If it wasn’t for capital gains tax providing an incentive to hold onto the property, more landlords may take the opportunity to sell. But, if plans to increase capital gains tax further, the National Residental landlords association claim upto 50% would consider selling.

It is worth bearing in mind the private rented sector has a huge range of landlords. This vary from big companies and wealthy individuals who buy with cash and are not affected by interest rates. It also includes smaller landlords who do buy on a mortgage. The huge range of tenants and landlords means it is possible to find numerous examples of nightmare tenants and slum landlords. But, landlords definitely suffer from a poor reputation. Perhaps the idea of earning passive income from earning wealth has never sat easily with many. Of course, some landlords will say, it is a mistake to think of letting as ‘passive’ income. In fact, it can become a full-time job improving and managing properties.

But, what is clear in the short-term at least, there is a wide range of pressures on landlords that are leading to a shortage of lets – just at a time, when we need more rental properties. This is bad news for both landlords and also renters. Solutions to the issue could involve government subsidy for home insulation. It is a social benefit and investment for whole economy. Secondly, if the private sector can’t provide sufficient rented accommodation, there is need for more government building.

On a personal level, I rented for several years before buying. One landlord kicked me out a few days before Christmas, The next landlord was great, five happy years. I also have some experience with being a landlord myself, letting out a room. All I can say is I know what it is like to have tenants who don’t want to pay!

Further reading

Excellent review, thank you very much.

Even though it puts one off considering a buy-to-let investment in the foreseeable future.