Bank bailouts are back. But, why do governments go to such lengths to save banks who took risks, ignored regulations and made a loss? This title about bank failures destroying the economy is not actually linkbait title. I think it is fair to say, the US bank failures of 1930-33 really did destroy a good part of the US economy and cause widespread economic and social damage.

The Great Depression

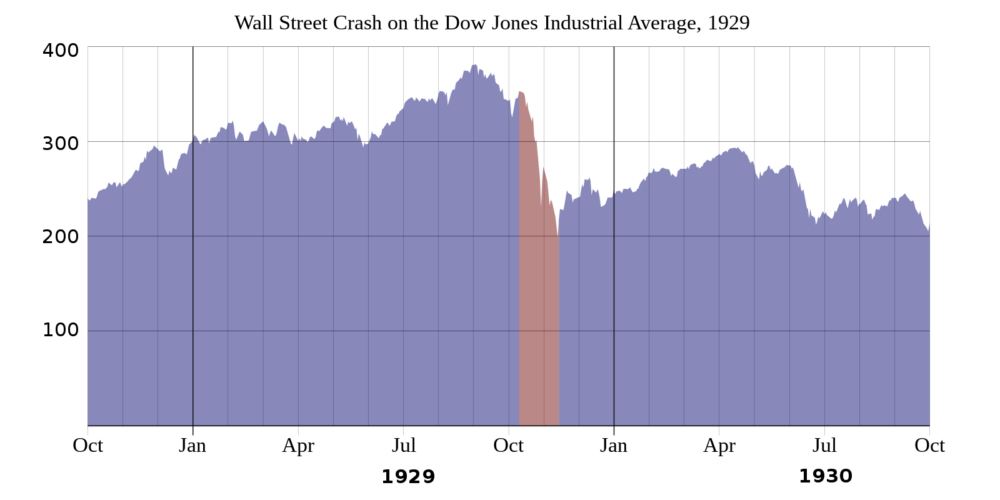

Let’s go back to 1930, the United States was in the midst of a severe recession, triggered by the Wall Street Crash of 1929.

But, there were no imminent signs of financial collapse or prolonged depression. But in December of 1930, the Bank of the United States faced a bank run. Now despite its magnificent name, the Bank of United States was a small local bank serving mainly immigrants in the Bronx and Brooklyn neighbourhoods of New York. The bank run started fairly innocuously, a customer claimed the bank had refused to sell shares it owned in the bank. As this rumour spread, bank customers started going to local branches to withdraw their deposits. The sight of people queuing, combined with the grim economic climate, soon snowballed into a full-scale panic. The New York Times reported a crowd of 20,000 people converging on local branches, and mounted police desperately trying to keep order.

The avalanche of withdrawal requests meant the bank couldn’t meet them. Many years later, it was actually proved the bank was actually solvent, but all its cash was tied up in long-term loans. The point is in those critical days, it didn’t have the cash reserves to meet the unexpected surge in withdrawals. But the news spread like wildfire – the bank has run out of money. People feared their life savings would be lost. If you see friends rushing to the bank to withdraw money – what is your rational response? Do you want to get in the line or risk losing your life deposits?

The pivotal moment of indecision

Now at this point, the great and good of the US banking system had a choice. The expectation was that the big beasts of US banking like J.P. Morgan would bail out the Bank of the United States, rather like his response to the 1907 banking crisis. But, for whatever reason, he refused to get involved. Some have claimed his antisemitism and anti-immigrant feeling may have played a role. The government did nothing. The decision was momentous. The news of a bank in New York going bust, soon spread throughout the country and local banks all over the country saw lines of customers desperate to claim their savings. Small and regional banks couldn’t cope with customers who were desperate to withdraw their deposits. It was often the same story as the United States bank – banks were solvent, but their liquidity was tied up in long-term loans.

The pressure deluged the system, and by 1933, 500 American banks had gone bust – destroyed by the feverish panic sweeping the nation, and no effective intervention by the government. But, it got worse, in an effort to meet demand for withdrawals, banks had to stop making new loans and try to recall existing ones. Business faced a credit crunch and lost their source of credit.

Impact of bank failure on the economy

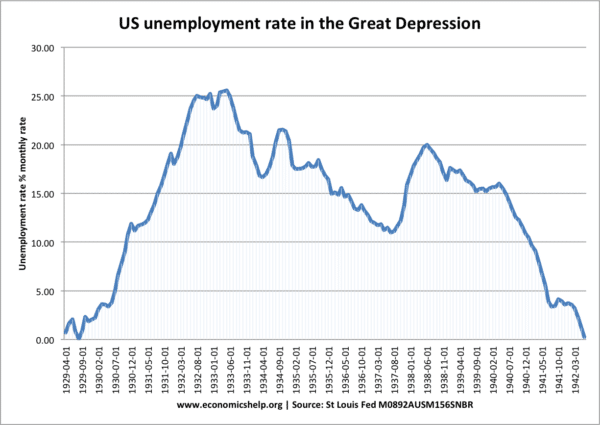

The impact on the economy was devastating. Unemployment rose from 4% in 1930 to 25% a few years later.

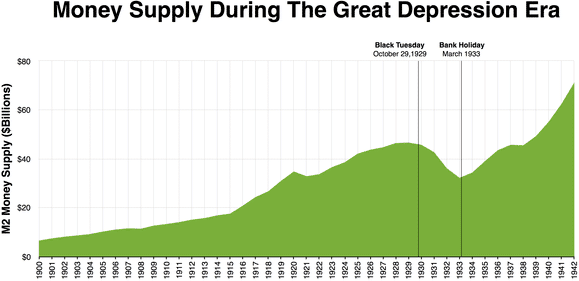

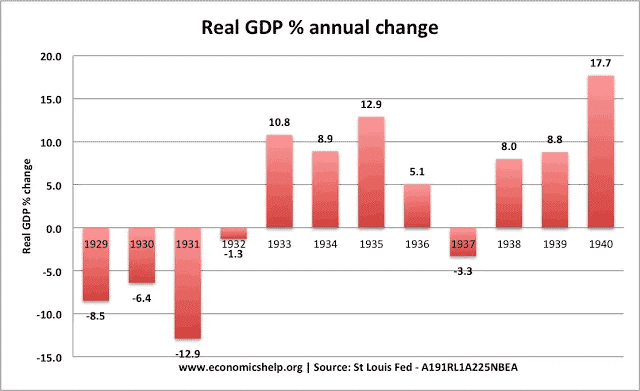

The money supply fell 20%, causing severe deflation. The contraction in real GDP was over 26%.

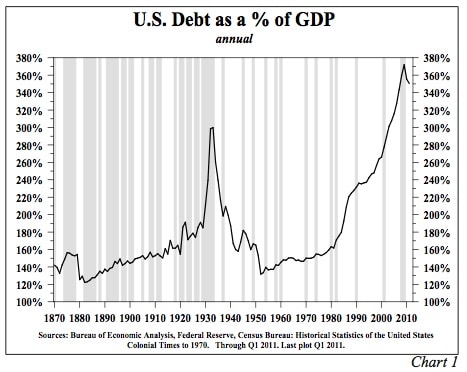

The deflation and fall in GDP caused a rise in the real value of debt and the total debt of the US (private + public) rose rapidly.

And the costs went beyond economic statistics, it caused mass unemployment at a time of very limited government support. Cities and rural areas became desolate areas with the unemployed forced to live in shanty towns like Hooverville on the edge of town. And of course, the surge in unemployment led to further declines in spending and growth, like a negative multiplier effect. Each decline in spending causing bigger falls in output.

The bailout of Silicon Valley

Fast forward 90 years, and you can begin to understand why the government-backed Federal agencies announced they would insure all depositors at the failed Silicon Valley bank. In this case, the bank was a victim of bad decisions, such as expecting interest rates to remain very low and a very narrow customer base. Not only that but Greg Becker, president of Silicon Valley Bank spent more than $500,000 on successfully lobbying Washington to exempt banks like his from federal regulation.

In fact, the Federal agencies only had to guarantee deposits of up to $250,000, but they decided to implement a full bailout for all investors, even on uninsured savings over $250,000. Many have been critical of this overly generous bailout, suggesting it sets a bad precedent and which will ultimately cost the taxpayer, through higher bank fees.

Moral hazard

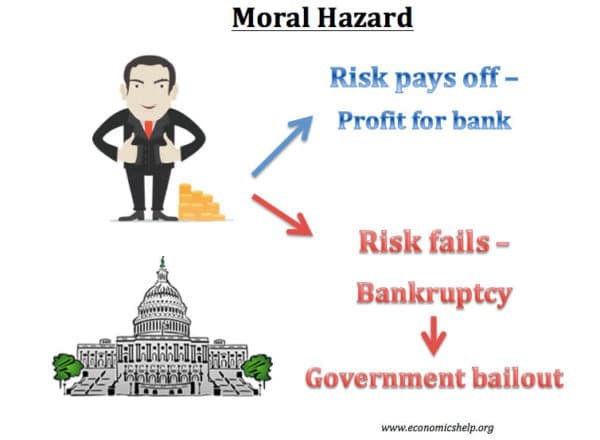

The problem is that bank runs give regulators a difficult choice. If they don’t do enough, there is a risk that panic spreads throughout the financial system – a contagious risk to other banks which might be vulnerable, but whilst each bailout may have a certain logic. It also creates a very problem of moral hazard.

Moral hazard is the concept that individuals are more likely to take bad decisions, when their risk is borne by others.

Silicon Valley bank was taking risks relying on a small number of venture capitalists in the high risk area of tech startups. In any other industry, if you fail and go bankrupt, that is it. You lose everything, and so of course you try to avoid this. But, bankers and bank customers know that because of the risk of contagion and bank panics, the government will step in. Heads we win, tail the taxpayer loses.

And each time, there is a generous bailout, it goes further to encourage risky bank practises. Not only that but there is the over-riding sense of unfairness. Why do we always bailout the very least deserving of all industries?

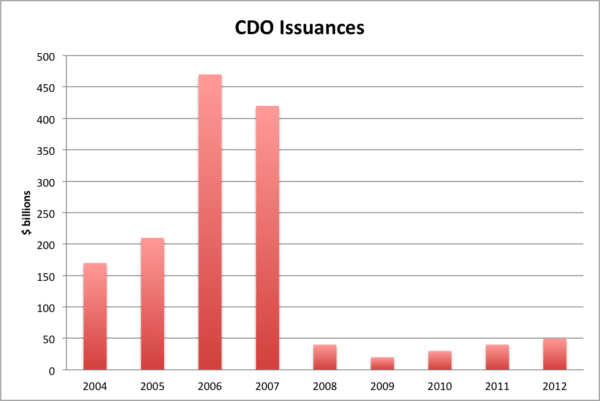

Bank failure of Lehman Brothers

However, whilst it is very tempting to let banks fail, that in itself carries risk. In September 2008, Lehman Brothers a bank specialising in sub-prime mortgage lending, was at risk of collapse. The Federal Reserve tried to negotiate a refinancing by other banks, but these failed and Lehman Brothers filed for bankruptcy – the largest in history at over $600 billion in assets. Its failure was such a shock it precipitated a financial panic and the mass withdrawal of funds from money markets, leading to the credit crunch and deep recession of 2008 and 2009.

It led to bank runs around the world. British banks like Northern Rock, RBS and Lloyds Banks all needed bailouts by the government The question policy makers may ask is how much shallower would the recession be if Lehman Brothers was saved?

Let them fail

In 2008, Iceland’s banks were very exposed by the banking crisis. Iceland’s external debt was more than 7 times the GDP of Iceland. The bank losses were so big, the Central Bank of Iceland found itself unable to act as a lender of last resort during the crisis. In the end three Icelandic banks were allowed to fail and millions of depositors outside Iceland lost their savings. Rather than bailout the banks, Iceland prosecuted its bankers for misuse of funds. Despite a few difficult years, the Icelandic economy recovered strongly and is much more balanced than before the financial crisis. It shows that you don’t necessarily have to bailout banks, but you can let them fail and make the bankers pay – it’s certainly a cautionary tale for wood-be Icelandic bankers. But, is this model applicable to the US? If Icelandic banks fail, it doesn’t cause global repercussions, but if Swiss and American banks failed the impact would be huge.

The difficult choice

The problem of a policymaker is that it looks bad to bailout undeserving banks. But, if you take the risk and let banks fail, there is always a fear it could go disastrously wrong. Who wants to be the person to allow a second great depression? The real problem comes back to regulation. If banks stick to regulation, then the banking system is safer.

Further reading